DKB Visa card

DKB customers will be ecstatic about their absolutely free Visa card and the opportunity to withdraw money worldwide, even in foreign currencies, without any fees.

Once you start to look into the details, you will start recommending this card to everyone and wonder ‘Why didn’t I get this sooner?’

This page summarizes the 11 most important and useful functions of the DKB Visa card. You can gladly comment at the end of the page if you have something to add or have any questions. but beforehand …

… this is what DKB customers love most:

- completely free Visa card (no annual fee, no hidden costs!)

- all cash withdrawals are free of charge at home and abroad

- the customer call center is available 24 hours a day in case of problems

1. Free Visa card

The DKB Visa card is only available in the free version. It is an automatic part of the “DKB Cash” offer. It is a combination of an internet checking account and Visa card. Optional DKB offers such as custody account or financing can also be added.

DKB Cash can be used as anything from a “home bank on the internet” (the bank’s slogan since 2014) to a secondary account/card for travel or saving purposes. No matter how you use it, it is always free!

2. Withdraw money worldwide at no cost!

Since the DKB does not have its own branches and isn’t connected to any ATMs, all Visa-certified ATMs are available to you, and you can even withdraw cash at no cost.

Every withdrawal with the DKB Visa card is free of charge!

Don’t be bothered by notifications of fees for foreign customers (on the ATM itself or on the screen). For every cash withdrawal, there are two transactions that happen in the background: first, the withdrawal of an amount of cash and second, the fee for the withdrawal.

You will see the first transaction on your credit card statement, but not the second. You don’t need to pass this on to the DKB, it automatically takes care of it.

Tip: If you withdraw money in a foreign currency with your DKB Visa card while abroad, it simultaneously saves you the expense of a currency exchange. When withdrawing cash from ATMs in a foreign currency, the DKB doesn’t charge any handling fees or additional fees on top of the exchange rate. These two articles expand on the advantages in detail:

- DKB Visa card in foreign assignment (German)

- This is how you can check DKBs current exchange rates (German)

With the DKB Visa card, you save yourself fees for withdrawal as well as fees for a currency exchange when abroad. In some countries, ATMs try to trick you, but if you know about this special portal, you’re well armed. Here’s an article about rip-offs at Polish ATMs (German) (applies to all except Polish cards at cash withdrawal).

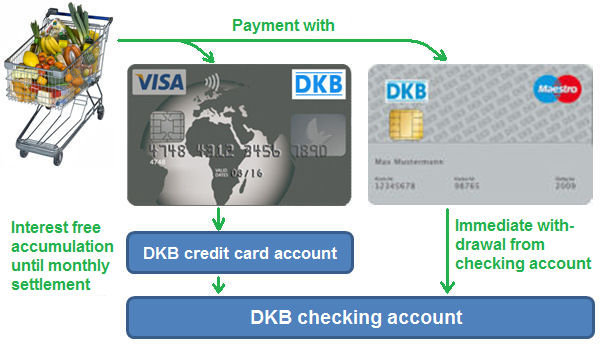

4. Payment with interest advantage

The DKB Visa card is a “real” credit card. The difference to a debit card (V Pay or Maestro Card = second card that you receive when you open an account with the DKB) is that payments aren’t booked directly from your checking account, but rather are gathered on the credit card account.

Because of this, the account balance can slip into the red. That’s good and the way it’s supposed to be, because the DKB never charges interest on credit. You are interest free while in credit!

This is true until the 20th or 22nd of that month (if the 20th is a weekend or holiday, the following business day applies). Then the credit card balance is paid from your DKB checking account. If your checking account doesn’t have a high enough balance for this, the bank charges overdraft interest but never expensive credit card interest rates like the ones from regular credit card companies.

From the customer’s perspective it’s smart to pay primarily with your Visa. By the way: cash withdrawals are also interest-free until the monthly billing. That’s like free credit!

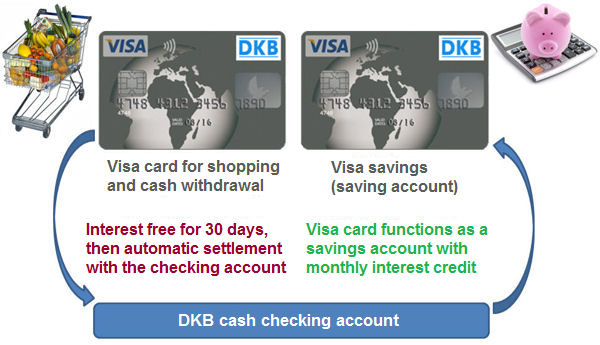

5. Saving with an interest rate advantage

You can use the DKB Visa card as a savings card (modern savings account), because the DKB gives you a good interest rate on the savings on your card. You can find the current interest rate here: https://www.dkb.de/privatkunden/dkb-cash/produktinfo/dkb-cash-vm-tagesgeld-verzinsung/index.html.

The interest is credited monthly, which means you can look forward to a small compound interest effect.

Even though it hardly makes any sense to use a savings card for payments (except if you’ve saved for a trip), I still recommend that you ask the DKB to issue you a second Visa card. Every cash withdrawal or payment immediately reduces your savings!

The second Visa card is free, as well. You use one to spend money and let it go into the red, interest-free, for up to one month and use the other to save. Here, the balance will earn interest every day that is credited at the end of the month. Isn’t that clever?

I’ll write an article to better describe how to apply for a second DKB Visa card soon, and insert the link here.

… DKB’s excellent terms are optimally utilized with 2 Visa cards!

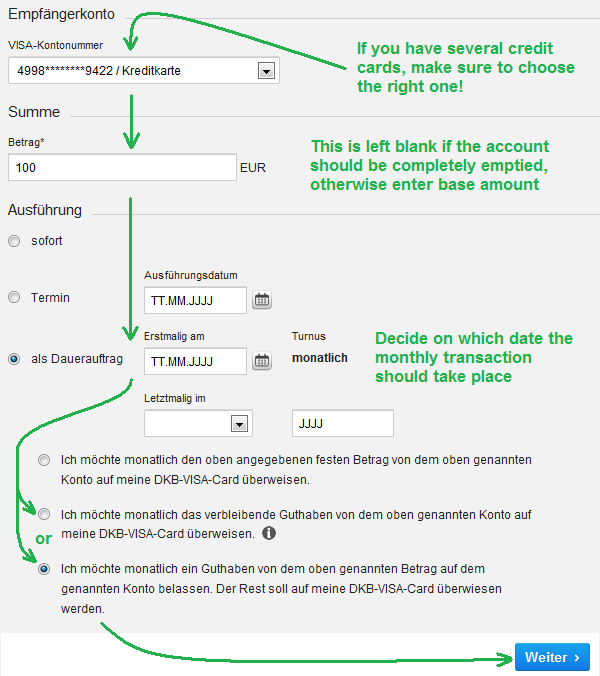

6. Smart saving with the “account clean up” function

Banks profit very well when working with a notable sum of money that an account holder leaves on his checking account, as banks usually don’t pay any interest at all or only low interest in case of the DKB for money on checking accounts.

It doesn’t have to be that way. Get the earnings on your account! The DKB offers a useful function for this in their online banking system. It’s called DKB Visa saving.

For saving purposes, you can have the remaining balance on your checking account automatically deposited to your Visa card. This is usually one day before your income is deposited. Alternatively you can set a basic sum, so that only everything above this limit gets transferred – this makes sense if unexpected withdrawals occur.

This automatic deposit is easy to set up and can be adjusted at any time. People who put this idea into practice will automatically become more wealthy!

You can set up this function in your online banking account here: Finanzstatus (financial status) ⇒ Zahlungsaufträge (payment orders) ⇒ Visa-Sparen (Visa Save) ⇒ Neuer Visa-Sparauftrag (new Visa Save task).

7. Having an emergency Visa card sent to you while abroad

You are traveling – maybe even out of the country – and your credit card gets lost or stolen. What now? Of course you report the loss to have the card blocked first. (You can find the telephone number to do just that here: Emergency card or even emergency money while abroad (German)). But still, you might be stuck in a foreign country without enough money.

That’s not how it is for DKB customers, though. Within 48 hours, you will receive an emergency Visa card at no cost. This card is valid for 6 months, or until you have a regular replacement card, allowing you to comfortably resume your travels.

I’ll also post the link to an article here soon that goes into more detail about this topic.

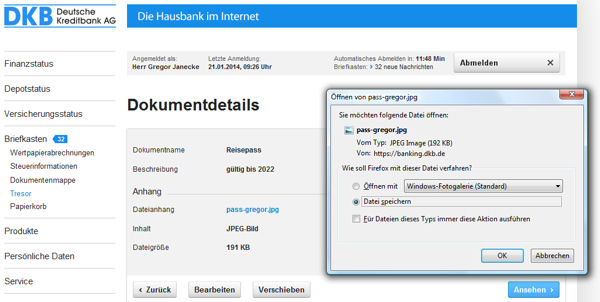

8. Free online safe (save files on the bank’s backup server)

If you have been robbed while traveling, it’s likely you’ve lost more than just your Visa card. Germany’s Federal Foreign Office recommends that you always make copies of your passport and other IDs and bring them with you as well. This makes it much easier to verify your identity and issue the replacement of the lost documents.

However, I have never felt very comfortable carrying important documents around with me while traveling. 99.9 percent of the time you don’t end up needing them and drag them around with you for no reason.

Thanks to the DKB, you don’t need to take the documents with you. You can find the option to upload up to 40 megabytes in files to the bank’s server by clicking on the menu Briefkasten (mail box) ⇒ Tresor (safe). These files are kept very secure and can only be seen by logging into your online banking account.

If I actually do lose my passport (you can also upload the insurance document of your international health insurance, international driver’s license, etc.), I just find a secure computer – for example, one in the German consulate – log into my DKB online banking account and print out a scanned copy.

The copy of my passport is kept safe with DKB, and I’m still able to access it through my online banking account anywhere where there’s an internet connection.

9. “City Cashback” (discounts through use of DKB Visa Card)

DKB “City Cashback” turns your Visa Card into a real discount card. Just by showing the card you get interesting discounts in lots of German cities, and you don’t even have to use the card to pay for your purchase.

It’s interesting that mainly small, local shops are members of the “City Cashback”. In Augsburg’s “Barium 56” you get cocktails for half the price (no matter if it’s happy hour or not) or at the “Easy Car Wash” in Oldenburg you get a €1.50 discount off of every car wash.

Discover the possibilities for saving near you with the DKB Cashback app.

- iPhone: itunes app-store

- a version for Google Android is still being worked on.

Thanks to the DKB cashback app you find discounts wherever you go …

10. DKB Special (DKB Visa card as an admission ticket)

With DKB Special, your Visa card turns into an admission ticket! The DKB is heavily involved in the promotion of sports, which is probably the reason why tickets are continually given to customers free of charge !

On the day of my research, you could even sign up for tickets for soccer games from the German Soccer League (home game of Hertha BSC Berlin).

Similarly, the DKB Visa card acts as an entrance ticket to the tallest building in Germany, the Berlin Television Tower (368 meters tall!) My report about that is yet to come.

Besides DKB “City Cashback” and “DKB Special,” there is Online-Cashback, which starts directly with online banking. You see, the DKB Visa Card is not only a free credit card, but a complete package with a huge potential for saving and holds a generous amount of entertainment value.

Information is available for DKB customers on the online banking page under DKB Club ⇒ City-Cashback.

11. Easy application

Applying for a DKB Visa card is easy. Go to this page: https://www.dkb.de/privatkunden/dkb-cash/produktinfo/dkb-cash-kreditkarte/index.html and start the application process.

The DKB Visa card is always issued as DKB Cash (internet checking account and Visa card). Sending an application is possible while in or out of the country. If applying from abroad, make sure to check out my tips for legitimization (German).

The only requirement: You have to be fluent in German (contracts and communication with the bank is all in German) and cannot have any negative credit records with the SCHUFA (German protection company for general creditworthiness).

Your income and asset situation doesn’t play a huge role in the application, however, it will of course decide the credit limit on the Visa card and the overdraft on the checking account.

The credit limit can be increased over time, account and card can also be used initially with the positive balance or with small beginning credit limits.

“I never want to be without this card again”

P.S.: If you have anything to add from your own experience, you’re more than welcome to! That’s what this site “lives” on and also benefits other (and especially new) DKB customers/users.

I’m also happy to answer your questions, I’ve been a DKB customer since 2004 and have experienced quite a lot (especially positive).

Very nice article!

I am getting this card, and I live in Sweden.

This is the only card (as far as I know), that you can get without living in Germany, that allows you to pay with card in stores like Aldi and Lidl in Germany.

For supermarkets in Germany, you need a Maestro or V-Pay card, normal Visa and MasterCard can’t be used, because of too high fees for the stores.

I will save a lot of money by avoiding expensive currency conversion fees now, and also I will not need to bring a lot of cash when I’m on holiday in Germany, since I can withdraw cash in ATM machines in Germany, when needed!

I had been a member of DKB and loved it even in Germany. Used it mostly to purchase online but occasionally to withdraw money especially when abroad. However, I exceeded the amount on my account while traveling and hence the credit couldn’t be covered. When I explored that I transferred money immediately (twice as much 3 days later) to cover the outstanding and have a buffer for future. However, DKB set my credit limit to a 100€ and will not increase it. This makes the card useless. I explained why this happend and they discussed it but did not change their mind.This is the other side of DKB – I guess canceling the account and applying new would provide me a much higher credit allowance now it is useless. Do you have any other advice?

To canceling the account and applying a new, that is no solution. The german banks is not stupied.

The solution is: deposit money to the Visa Card. This increases the available frames. Works similar to a prepaid card. But at DKB there is interest on the balance.

Use the card regularly, but don’t overdraw … you can ask later for an increase of the credit limit.

Unable to open account for foreigners :(( It’s only for Germany, Swiss and Austria.

Yes, since 6/30/2014 – our article about that change, exception: you have a german passport. The identification process is then easier. But we are looking for further banks … here is a first alternative: number26.

Is there any interest in banks in Germany with bank charges?

Thanks so much for the information.

I am Chinese and moved to Germany since last year. Tried a couple of times to apply for a German bank account (both DKB and comdirect) and got declined. I just got a comdirect account this month(after tried 2 or 3 times). Now every time I tried to apply the DKB account online, I got the message said “Leider konnten wir Ihrem Wunsch nach einem DKB-Cash im Rahmen unserer automatischen Entscheidung nicht entsprechen.”

So do you have any suggestions for my situation? And will it hurt my SCHUFA score if I apply for a chekcing account? Because I lived in the USA before, over there applying a checking account is OK but applying credit card will affect the credit score.

Thanks,

Did we understand you correctly that you now have a current account at the Comdirect? This is great. In our opinion, the Comdirect is one of the best banks in Germany. Why do you need another current account at the DKB?

Banks in Germany have the freedom to decide whether to start a business relationship with a customer or not. The customer has the same freedom of choice.

As one does not have a personal meeting with the customer service representative, these Internet banks attach great importance on the creditworthiness rating of the SCHUFA (credit investigation company) as well as their own analysis systems.

Of course, no bank discloses their acceptance or rejection criteria in public. These remain a business secret. However, it is obvious that someone, who only recently moved to Germany, has little opportunity to build up a good Schufa rating.

Incidentally, you can request a self-report from the Schufa, in order to know about your personal data. An article on this subject is already in preparation.

If you apply at the same time for the opening of several current accounts, then the bank can see through a request at the Schufa that you recently submitted a request at another bank. How this will be evaluated by the bank, one can only guess …

If you absolutely want to become a customer of the DKB, please try again in one year … you will then probably have more data to be evaluated at the Schufa. Agreed?

Thanks so much for your reply. Yes I just got a comdirect bank, so I don’t need to open a DKB account now.

Just one quick question, in the comdirect website, it sais “Bargeld abheben im Ausland mit Visa-Karte” “kostenlos an allen Geldautomaten mit Visa-Zeichen”. Does that mean if I am in Germany, it’s not free to withdraw money using the visa card? which means the only free way to withdraw cash inside Germany is using the girocard on the Cashgroup ATMs?

Thanks again!

Yes, exactly. In Germany, cash withdrawals with the Girocard are only free of charge at the ATMs of the Cashgroup – not with the Visa card.

Moreover, you can deposit and withdraw cash free of charge at the branch offices of the Commerzbank. The Comdirect Bank has a cooperation agreement about that with the Commerzbank. The Commerzbank is 80 % involved in the Comdirect Bank. The Comdirect is the better bank of those two 🙂

I come from Greece and I am living also in Greece. I have tried to open account (to take DKB VISA) but at the end I received the below comment “Please note that we are opening accounts for customers in Germany, Austria and Swiss”.

Why that?

That means that this bank account is not possible for Greeks in Greece (current).

If you able to speak German you can use this accounts:

Hello,

I got the reply “Leider konnten wir Ihrem Wunsch nach einem DKB-Cash im Rahmen unserer automatischen Entscheidung nicht entsprechen…” when trying to open DKB cash right away after filling the request. I am little confused to be honest, I have friends who do not have a proper jobs (are not officially emplyoed) and they managed to get this card and I am employed since January (officially with proper salary) and have been living in Germany since 2011 (only from 2014 in Berlin) and to be honest I am writing here because I cannot figure out why I am I rejected? They have also asked me if I have permanent (unbefristet) Aufenhaltstitel which I do not yet but I do have permit to live and work here of course, maybe that is the reason? Do you think I should try again is few days? Thank you.

Exactly for such cases, the DKB is currently setting up a “second-chance”-option. As soon as this is done, I will publish an article with instructions to do it.

The background is that the bank’s computer decides whether someone gets an account or not based on various indicators. The banks call this risk assessment … especially, if there is not enough data available, the computers sometimes take not quite favourable decisions.

In the second-chance option, there will be a possibility to write a few sentences about oneself and convey the planned usage of the account.

Submitting a new application with the same data today – or in a few days – will unlikely help you to open an account. You know that if you are doing the same things, you obtain the same results.

If you do not want to wait until the second-chance-option, you should have a look at the Comdirect – also with a free VISA credit card: https://www.deutscheskonto.org/en/comdirect/

The conditions are similar in many points.

Hi,

I am confused about the DKB Visa card when withdrawing money from ATM outside of EU. As I understand from the latest information from DKB itself ‘Bargeldabhebung

am Schalter . 3,0% vom verfügten Betrag, mind. 5,00 EUR

an Geldautomaten im In- und Ausland…kostenfrei’

What is this 3.0%? I believe this is the charge of the exchange fees with a maximum of 5.00 Euro. Withdrawal is free that I understand, but it seems you cannot escape anymore from the foreign currency fees.

What’s the status?

Thank you.

ps: Luckily I managed as a non-German but EU citizen to open a DKB last year. As I have their other credit cards too. Strange that as one EU, it is still so difficult to open accounts in other EU countries.

Good question! This can be explained quickly!

Withdrawing cash with the DKB Visa credit card is free of charge at ATMs. Fees for withdrawals in foreign currencies neither apply (as at many other providers).

The DKB Visa credit card even entitles you to withdraw cash at the counters of other banks. Only in this case, there will be fees of 3%. So do not do that please, unless:

Conclusion: When withdrawing money with the DKB Visa credit card, there is always a free way.

Hi,

I have tried to use my card online to purchase flight tickets, with available credit to cover the cost and more. However, I keep getting asked for a ‘TAN’ when I go through security. It seems that I have to apply in writing and then get it posted to me … is that correct? Otherwise my transaction just seems to get refused – I have tried many times to book these flights n with a foreign airline and its getting frustrating.

Can you help?

At online payments with the Visa credit card, the three digit code, which is stated on the back at the signature field, is often required. This is called CV-code, but not TAN.

You can get a solution fastest when calling the customer service of the DKB. It is available for you all around the clock and its telephone number is also stated on the back of the DKB Visa credit card.

Hello I am a little bit confused with the dbk, I want to know if I can just open account for saving purposes, maybe once in a while I can use it for buying things. But for now I just want to save money. I don’t want any credit limit or bank giving me money as credit, then I end up owing the bank or I go in minus.. So what type of card should I apply for and how do I go about it. Something like a savings account but I can also use it to purchase once in a while. I only want one card, visa card but not credit card included.

Thank you

True, the DKB-product is quite exceptional J and maybe therefore not easy to understand.

What you want to do, works! Here you can find out how:

If you become a customer of the DKB, then two accounts are opened at the same time:

This is done by default. You cannot change that.

Now, it is up to you how you will use the accounts.

Proposal:

Use the credit card account as a savings account. Here, the interest rate is 0.7% and therefore much higher than on the current account (0.1%). If you do not need the card anyway, then keep it safe or cut it.

This way, you are also not tempted to use the credit line. If the DKB account is used as a savings account anyway (Call money https://www.deutscheskonto.org/en/account/savings/#2 ), the automatic credit line is low. However, it will rise automatically, if one uses the DKB account as a salary account.

The credit line of the Visa credit card can autonomously be adjusted under “Service” => “Änderung des Kartenlimits” (changing card limits). If it is higher, the bank must agree, but if you lower it, not. So you can set your credit limit to zero by yourself.

Did that help you?

Hello,

I am an italian student, now studying in Germany. I need to open a german bank account in order to get a job and so on, but I´m quite confused on which bank I should choose, since many of them ask for a proof of address, while I´m now staying at a friend and therefore I don´t have those documents. Would those banks fit for my case?

Thankyou for your help.

The address is important to

a) send you the bank cards

b) carry out a creditworthiness check.

The DKB is a bank that makes a creditworthiness check, because it includes a Visa credit card with credit line (even if the credit line is low at first).

If you currently live with a friend and your name is on the mailbox, then you can state this address.

This bank https://www.deutscheskonto.org/en/number26/ does not make a credit check, because it is a pure credit account. Thus, the account opening is guaranteed to 100%. However, you will also need an address in Germany in order to get sent the Master Card.

Hi, there is one question that hasn’t been addressed (I think) How much does the bank charge for online purchases in another currency, let’s say I buy something from ebay in dollars. Which is the fee? Do they charge a % + a minimum amount? There is no charge at all? Thanks in advance.

This depends on which payment method you choose:

This point is not a strength of the bank. Most customers use the DKB for other things.

Dear Gregor,

I arrived to Germany a couple of weeks ago, because I have started to work here, and I am looking for the best option to open a bank account. With the information that I have read during the last days, I was already pretty sure that I wanted an account in DKB. But today, after I have found your site, I am absolutely convinced about it. There is just a few questions that I would like to ask you, because some points are still not 100% clear for me:

1 – If I understood correctly, I would have two accounts (normal and credit). Can I have all my money always in the credit one? In that case, for all my withdrawals with the credit card (in Germany and also abroad) the money will be taken from the amount I have in my credit account or from the credit limit? (my idea is never using the credit, just have my money there and use it).

2 – Is it free to make money transfers to any other bank account (in euros)? Is it also free for transfers that are not in euros? Are the money transfers made from the money that is in your normal account, or in your credit account?

3 – When you withdraw money in a different currency, the bank doesn’t charge you any fee or hidden amount but, Is the change rate the official one for this day, or they have a little higher rate like some exchange offices do?

Thank you very much.

Best regards,

Jose.

1.) It is a current account and a billing account for the credit card. You only have to transfer money to the credit card, credit line will increase. You can always dispose of your deposited money.

If the credit line is high enough for you (depending on your creditworthiness and usage, it is between Euros 100 to 15,000 at the DKB), it is not necessary to deposit money. Even if the credit card should go into the red, no loan interest will apply. Until the monthly automatically settlement, the credit card transactions are free of interest.

Loan interest can only be on the current account, if not enough money is on it. If enough money is on the current account, then no loan interest will ever be charged. This was your intention, wasn´t it J

2.) Outgoing and ingoing transfers in Euros within the SEPA-area are always free of charge. Outgoing and ingoing transfers in a foreign currency are always subject to charges. Transfers can only take place to or from the current account (DKB Cash).

3.) The charge for ingoing or outgoing transfers in foreign currencies is 0.1% of the amount (at least Euros 12.50 – up to Euros 150). The exchange rates are relatively fair and usual for banks in Germany (no huge surcharges, as known from Paypal, Payoneer etc.)

However, it is often not very easy to get an account at the DKB, if one lives only since recently in Germany. You may have experienced that in the USA, where one has to build a certain credit history. Direct banks that offer all important account features for free, need you to fulfil the strict requirements of the creditworthiness check, even more than a local bank.

Dear Gregor,

Thank you very much for your answer.

– About my first question, my intention was not ever go into red even if there is no interest, use only my money. That’s what my question is about. Imagine I get my account and I deposit 1000 euros in my credit account. Then, using my credit card, I withdraw 100 euros in an ATM in Belgium, I pay 50 euros in a shop in Berlin and I spend 50 euros in an online shop. My question is: now I have 800 euros in my credit account? or now there are -200 euros in my monthly credit line and in the end of the month it will be paid automatically from my 1000 euros?

– About my second question everything is clear, thanks.

– About the third one, I didn’t mean transfers but taking money from an ATM in another currency. For example I am in the USA and I withdraw 200$ from an ATM. DKB doesn’t charge me any fee but, is the change rate the official one for that day? I mean, if the value that day is 1 USD = 0.93 euros, will they use this rate or for example 0.95 euros or similar, like the exchange offices do.

Thank you again and sorry for asking so much, but I like to be sure before I make a decision about banking.

By the way I hope they will allow me to get my account, if I send them my contract and the documents they ask me for.

Best regards,

Jose.

I wish you good luck at the account opening!

Dear Gregor,

Now everything is clear for me. I am going to apply right now for my account. Thank you very much for your useful help, and congratulations for your awesome website.

Best regards,

Jose.

Dear Gregor,

I am a student in Germany and I have a Girokonto Comfort account from Berliner Sparkasse. I only need a free visa card for my online shoppings. Sparkasse visa card is prepaid and also, I have to pay a charge of 3 euros per month. I would like to know, if it’s possible to get a DKB visa card and use it for online shopping without withdrawing money in it and then after shopping, they deduct the money from my main Sparkasse account. Is such a thing possible?

Thank you and best regards,

Negar

This is an interesting question 🙂 I cannot decide that, because I do not work for the DKB, but am an editor. However, I have compiled three important points here that are helpful for a successful account opening at the DKB: https://www.deutscheskonto.org/en/account-opening-dkb/ – good luck!

hellip; and perhaps, you will like the DKB more than the Sparkasse and you will start to use more services of the DKB … by the way, the DKB has a program, which is called Online-Cashback. Unfortunately, the article to this subject is only available in German language.

Dear Gregor,

I recently opened DKB Cash Konto. In next days I shall receive all documents and cards as confirmed by the back. My question is as follows:

I already have a Giro Konto with Postbank which is also my salary account and I want to keep it that way. I do not have credit card with Postbank. I want to use new DKB konto as second account specially because of its credit card which I can widely use to take out cash worldwide and make online purchases. So, do I have to make DKB account as my salary account? Can I increase my credit limit by transferring certain amount of money from post bank to DKB each month? Thanks in advance for your reply!

Congratuations! I am glad that your account opening at the DKB was successful!

If you let your salary payments be transferred to the DKB, you can get a higher credit line on the credit card and on the current account (overdraft facility).

Currently, this works as follows:

After the 1st salary payment, a credit limit of up to double the monthly net income would be possible.

After the 3rd salary payment, up to three times the monthly net income would be possible.

One has to request the increasement. The online form for this can be found within online banking on the left navigation bar at “Service”.

However, you can just leave it as it is and increase the credit line through transfers to the credit card account.

Hi

My family and I shall be moving to Berlin in a few weeks time with my husbands work. We need to get a bank account asap once we get there. We were set on DKB but after reading above, do I understand correctly that this will be difficult after only being there for a few days? We will also we need to obtain a schufa to get an apartment, Any idea when we can do this after we open any bank account please?

Yes, that is right. The DKB offers a real credit card with a line of credit and therefore always checks the credit rating. If an application for an account is successful, though, will only show, once it has been filed :). Good luck.

Here you can read up on our article regarding the Schufa: https://www.deutscheskonto.org/en/schufa-inquiry/

Hello Gregor,

I find very confusing the saving account topic but I am really interested in understanding it better so correct if I am wrong:

Let’s suppose DKB is my salary account. In this case, I receive my salary directly in my current account. You suggest transfering all this money to the saving account (credit card 2) because in the credit card we get 0,7% interest rate. For paying you suggest using only the credit card 1. Then, in the 20 to 22 day of the month the balance is automatically done so that we are not in red in the Credit Card 1.

a) Am I right or is it necessary that we have in the current account the money we have expensed with Credit Card 1 because the balance does not consider Credit Card 2?

Simple example:

Current account: 0€

Credit Card 1: -5€

Credit Card 2: 20€

b)So if we are in red numbers with the credit card 1 it does not matter as long as in the 20-22 day of the month you can provide a positive balance to the bank, and the more money we have in Credit Card 2 the higher interest we receive?

I hope you understand my questions!

Thank you very much!

In your example, after the balance is done, your accounts would look like this:

Current account: -5€ (you pay interest here)

Credit Card 1: 0€

Credit Card 2: 20€ (you get interest here)

You never pay interest for being in the red with the credit card – so being in red with it does not matter. But once the balance is done you now start to pay interest for being in the red on the current account. This is probably not what you want. So it would be advisable to transfer money from your second credit card to your current account, so that you have for example

Current account: 5€

Credit Card 1: -5€ (you do not pay interest here)

Credit Card 2: 15€ (you get interest here)

And when the balance is done that would result in:

Current account: 0€

Credit Card 1: 0€

Credit Card 2: 15€ (you get interest here)

It might be a practical idea for some people not to set up the account so that it transfers all money from the current account in the first place, but so that it always leaves some money on the current account and only transfers everything above a threshold to the savings account.

I hope that helps. You might want to have a look at the article DKB Visa Sparen too.

There are 2 accounts currently

DKB-Cash and DKB-VISA-Tagesgeld.

Are you stating

Option 1: open a Tagesgeld and ask for another visa credit card for the saving or Option 2: open a DKB Cash as it already pays a small interest and use the Visa card for shopping or

Option 3: on top of option 2 ask for another visa credit card and save money in that visa card

Hi Gregor,

I am live and work in Köln and I have a Commerzbank account for my salary. I would like to sign up for a DKB credit card basically for online shopping.

I do not speak fluent german. Do you think I will have issues handling this credit card?

Thanks!

Hi Lucas,

Yes, it’s a good idea to open up a second account besides the Commerzbank one.

The most important basics regarding the use of the DKB Visa Card you should find on this site here. Also, if asked politely, the customer service might be able to come up with some English of their own 😉

Please have another look at point 4 of the article above. This point is important to understand 🙂 Good luck and success with the account opening.

Thanks for your reply!

In my case, I would only need the card for a similar example as this one provided on your website:

“Of course, the DKB account may also be used as a secondary account, so e.g. just for holidays, and otherwise remain unused. However, you should check the credit limit beforehand and if necessary deposit the amount your will need.”

My question is: how much do I need to call the bank services and how much can be simply done online?

Thanks!

You can take care of about 99% online.

Are there any options for US citizens to open a bank account in Germany or get a credit card issued by a German bank when you don’t have a Germany address? I tried to use the DKB-Cash link, which allows you to specify that your country of residence is USA, but then it says the account cannot be opened. I contacted DKB about this and they told me that only citizens of Germany, Austria and Switzerland can open an account.

Of course, that is possible. Maybe you want check is option: https://www.deutscheskonto.org/en/account/online/

Hello Gregor,

I wanted to open an account at DKB bank, and I wanted to know if its possible to cancel getting interest on my account, (don’t want to get any extra money from the bank), PS: I travel a lot, so I will need both cards.

Cheers,

Nacer

The banking account as such does not accumulate interest, and the credit card only does, if you put additional money onto it. In that case though, you can’t opt out of receiving interest.

If you use your DKB account as your regular account for your salary, you will receive a credit line on your banking account, so that you might be able to do without additional money transfers between the two cards.

I am moving next month to Berlin, I don’t have an appointment to register my apartment until the day before I am due to start work. I need to open an account ideally before I start. Can I do this online before I arrive or do I have to make an appointment with the bank once I am there?. I’ve tried calling but my German is not good. I’ve got so little time and trying to work out how I can make things easier. Any advice please.

Thank you.

Dear Gregor.

I have been reading your blog and I have found many answers. However, I want to know if you might have some recomendations for me. This is because I and going to Germany for one month for academic issues and I want to open an account. My country is not elegible for open an account throught online service. Do you have any idea in which I can open an account? I want to save money in other currency.

Dear Daniela,

Do you want to open a giro account or a savings account?

The DKB Visa Card can be used as a giro account or a savings account, but the chances for an account opening are not good, if you don’t live in Germany, Austria or Switzerland.

If you understand German, you can even – in justified cases – open a savings account from abroad at Comdirect Bank. That is called Tagesgeld Plus. But the interest rate is very low.

Generally, the interest rates in Germany are currently very low, so that it is not very worthwhile to open up a savings account.

If you at least have a temporary address in Germany, so that you can receive the banking card (no hotel address or P.O. box), the Viabuy account might be possible. There will be a fee for the opening, but it is completely in the English language.

The MasterCard from <a href="/en/account/online/"Onlinekonto is even mailed to places outside of Europe, but here the fee is even higher. An English language version is currently in the works.

You might have some luck if you simply go into a bank branch … but that is outside our business expertise, since these operate very differently. Our web portal is specialized in the best online banks. It is easier though, to become a customer of one of the best direct banks, if your residence is in Germany instead of abroad.

Good luck!

Hi,

I am a non-EU citizen, and I will stay in Germany for six months with the Erasmus+ scholarship (800 EUR) starting from this September (and then return to my country). I have never lived in Europe before. Do you think I will be able to open a DKB account? I will have an address in Germany shortly, but I probably do not have any record in Schufa. And how about a Comdirect bank account? Should it be easier for me to open such an account over a DKB one?

And another question: What is the current interest charged (once) every month for the use of DKB Visa card?

Thank you in advance!

Hello Author, Many thanks for this blog and for your efforts to write!!!

After reading the blog and question/answers, finally yesterday I opened account at DKB and used the facility of Video Identification to verify myself.

I have Indian Passport. For me the Identification was successful. But when we repeated the same for my Wife’s authentication, surprisingly the Person in Video said video Identification will only work for German Passports and not for other nationals.

But when we told him that we already did my authentication before 10 mins, he checked it back and then did for my wife also. 🙂

So if this happens to someone else, please remember that video identification is possible, you just need to push in some cases 🙂

Thank you for this very helpful feedback 🙂 I wish you many good experience with your new bank!

Hello,

I am an international student in Germany and I am here for 5 years to complete my studies. I want to ask one question I can apply credit card or not. I have account in Deutsche Bank and Commerzbank as well my monthly salary coming in Commerzbank. I will be very thankful if describe something relating for this.

Hi! In general, everybody can apply for the DKB Visa Card and the respective Giro account. How this works we have shown here: https://www.deutscheskonto.org/en/open-dkb-bank-account/

Whether that make sense for you, we cannot judge for you, and the same goes for the question, whether the bank will open the account. This will be decided in the course of the credit check, as it is generally done with German direct banks with a Visa Card credit line. Good luck!

Hi Gregor,

My daughter has recently opened a DKB account for all the reasons outlined here. She travels around Europe a fair bit, and wants an account she can use to withdraw euros in different countries. We have just tried this here in France for the first time at a VISA atm. Strangely, the VISA credit card was declined, but she was able to withdraw cash with the maestro debit card. She has credit in both accounts. Can you think of why this has happened? Will she incur any charges?

Thanks

Hi Richard,

Because DKB takes over the costs for cash withdrawals, they have stipulated a minimum amount of 50 EUR. If you try to withdraw amounts below 50 EUR, it does not work.

Switching to the giro card is not a good idea, because with the giro card the customer pays the withdrawal fee.

The solution is simple: Always withdraw more than 50 EUR.

If there is a different reason, please contact the bank directly. As editorial team we do not have any access to customer or card dates.

What is the minimum balance that they will allow for this type of account? Thank you

The account has a credit line, so the lowest possible account balance is the full use of the individual credit line. How much that credit line is, one can find in the “Finanzübersicht” (financial overview) when you click “Details”.

Another one…. So to get my money in is easy. in the event that I do not want to draw cash from an ATM, but wish to TRANSFER (internationally; I am in South Africa) back to my home country account, is this possible on the online platform?

Thanks 🙂

Yes.

In answer to the question, ” how much money can be withdrawn at a time” DON says “Sie können mit Ihrer DKB-VISA-Card grundsätzlich zwischen 50 und 1.000 Euro oder Gegenwert pro Tag am Geldautomaten im In- und Ausland abheben”. Does this mean that is it mandatory to always withdraw minimum 50 EUR equivalent?

Yes.

Thank you very much for the detailed review 🙂 I looked up this review and immediately went to the portal to open an account.

Unfortunately, I could not open the account. So I called the kontakt/service and asked what was the reason. It was not clear why, but they asked me to fill up a feedback version where I could fill the application and send. After three working days, I receive a letter that my account can not be opened for some reasons which they did not mention.

If I need to know, I had to write them a letter and post.

Utter insane it is.

I guess they deliberately do not want to provide services to foreigners.

Has anyone else had the same experience?

This annoys me every time: When a foreign citizen does not get something in Germany, it is quickly remarked: “This is because I am a foreigner.” But that is rather not smart, and such comments won’t be getting published by us in the future anymore.

Actually it is so, that most people don’t have a clear idea about what a bank’s assessment processes look like. In addition, these can be very different from bank to bank. If you for example go to a Sparkasse, you can get an account easily. But in more than 95% of the cases you have to pay account maintenance fees there and only get an account without credit line or credit card, The bank does not run any risk and earns money with your, whether you use the account or not.

Germany’s best direct banks have a different business model: They offer great bank services free of charge: free account, free credit card, and a credit line with good conditions. These banks only make money/get reimbursed for their expenses, if they gain a customer base with a good credit standing. Via the questions in their online application they try to assess this point, and there are also additional queries at credit check agencies, e.g. Schufa and Infoscore. If somebody does not have a good history with those, important requirements for the account opening are not being met, which by the way is the case with many Germans as well!

In our coaching program we coach, among other factors, regarding how to build a good credit standing. Building a good credit standing in the country, where one lives, is important, for example in case one wants to finance something at a later point, for example a car or home.

Hallo, right now I have my salary account with Targobank and I don’t want to change that now. But I want to open a DKB account for its evrstaile services for using it in abroad. I have two questions:

1) Somewhere I heard that, if I am an active customer of DKB of having a monthly transfer of 700 Euro in the account, then the 1.75% of the fee for card payments in abroad is also free of charge. Just want to verify this information before applying.

2) What will be the credit limit if I don’t fullfill the criteria of not being an active customer?

1) Yes, that’s correct. During the first 12 months, this benefit is granted even without the incoming money. So you have enough time to test the account extensively.

2) The credit line depends on whether you have an incoming salary on that account. Further info here. If one does not want that, one can transfer money onto the DKB Giro account and internally transfer it to the credit card. This also increases the available amount on the Visa Card.

We hope you’ll enjoy exploring DKB!

I have been living in Germany since 6 years now. I earlier had a Sparkasse account and starting of 2018 I changed to DKB. I really enjoy the services of DKB and especially the DKB VISA credit card. But my only problem is my DKB VISA credit card has a limit ho 100€ only. Due to which, I always have to transfer money from current account. I have a permanent job and good salary. I asked them to increase my credit limit but they refuse to do so. What can I do? How can I prove them that I am a reliable customer

Since when have you been receiving your salary on the DKB Giro account?

I have the account since January 2018 and the salary in DKB account I am receiving since February 2018.

That is odd. Maybe the salary payment as such is not recognized automatically. That happens, for example, when the employer does not send a “SALA” code. The best would be if you contact the bank’s customer service. Only the bank can do changes. Best of luck.

I have there a question. So we can withdraw money from Automat by using credit card or giro card of DKB but what about if I have with me for example some cash , and I want to deposit it in Automat. Can I do it by using DKB Visa card or DKB Giro card without any charge?

Secondly, if I use my DKB Visa card or DKB Giro card to buy groceries or use everyday life to buy something in Germany or in EU countries is there would be any charge?

My last question is, if I withdraw cash outside of Germany but in EU countries is there any charge? or any limitation of how much I can take cash?

Thank you so much for your time. I am looking forward to hearing from you 🙂

You can withdraw money from the ATM with the Visa Card only. That’s free of charge. As a direct bank, DKB does not operate local branches and hardly any own ATMs. If you want to deposit more frequently, it would be a good idea to open an account with a branch bank.

Regarding the second question: The use of the Visa Card is free of charge worldwide. Similarly, the withdrawal of cash in Germany, in the EU and in the rest of the world free, as far as DKB fees are concerned. As described in the article above).

I am planning to open up a joint DKB account with my wife, from what I have found we would get two giro cards and two Visa cards. Would it still be possible to add another Visa card to the account for savings??

Yes, a second Visa Card is possible. As a rule, it is issued virtually and is called “Visa Sparen” (Visa Saving). Still, you can use it for internet payments because it has a CV code and everything else you need. The application can be made after the account opening. independently from the online banking. If another physical card is desired, you can also apply for that, even with a custom motive. For this, a one-time fee will be charged.

Hi and thanks for sharing your experiences. I have a question about something you mentioned in your “N26 with MasterCard – it’s for free!” page (https://www.deutscheskonto.org/en/number26). There it says:

In order to remain free of charge [N26], you are not forced to withdraw cash in the foreign currency country first, as with the DKB, because Number26 does not even charge the international service fee when paying with the credit card abroad!

What do you mean with, “as with DKB”, hinting that DKB isn’t free until some special withdrawal is made? There’s no other mention of this anywhere on your site that I could find at least.

Thanks!

As an active customer at the DKB you never pay a foreign service fee. Personally, I prefer DKB.

Hi,

Does DKB visa come with collision and damage insurance?

Regards,

MG

No, it doesn’t.

I have a DKB account since long time.

Back in the days I could see the monthly interest credit in my credit-card account.

Now I can’t see it anymore! did they change something in the last years?

DKB Visa Card never had credit interest.

I have a DKB account and I have read through your comments regarding various transactions. While reading all of them, I was surprised that so little is said about making deposits into the accounts while living abroad (i.e. USA). So, how can I make deposits from USA? Is it through my local bank?

I would appreciate your comments and by the way, I am fluent in German, so that is not an issue.

From the USA, it’s the best to deposit the money by bank transfer to the DKB account. I use the special service provider TransferWise. Another alternative would be to send a check to Berlin. You cannot deposit any cash directly into the DKB account in the USA because the DKB does not have any deposit ATMs in any other country other than Germany.

Hi, I am currently in Athens, Greece. Tried to withdraw cash from several ATMs with Visa sign. All of them say there will be 2.50 charge by the bank owning the ATM. So it seems that DKB Visa is not totally free for cash withdrawals in Euro zone, right?

Hey hey, the DKB does not charge any fees. But you can not hold them responsible for all ATMs worldwide. ATM operators can set their own service and pricing under local laws and agreements. Usually, banks charge additional fees – the DKB does not do it and therefore belongs to a fairly small circle in Germany, as far as that point is concerned!

Hi, I just moved to Germany from the UK and finally opened a DKB account. I read loads of tips on websites such as this one (super useful, so thanks!) but I’m still confused about something.

I took out €150 from an ATM yesterday, looked for Visa sign, put in my DKB card, and saw today that I have a €5,99 charge for taking out my money! Now I just checked my cards, and I used my DKB debit card – but it doesn’t have the Visa sign on it? So how am I meant to get money from my DKB account at a German ATM for free? Do you actually use a credit card to withdraw cash?? In the UK that is the number 1 ‘do not do’ rule as you will be charged so much money, so maybe I misread everything about DKB as I am so used to not using credit cards at ATMs.

So do I withdraw cash using the credit card, and it comes out of the account somehow? Or so I then need to go into internet banking and pay off the credit card?

Dear Sarah, welcome to Germany. Great decision re. DKB. But please allow our country and our banks to have our own rules. With the DKB, the withdrawal using the Visa Card – as clearly described above on this site- is free of charge. Not with the Girocard though. I withdraw cast with the Visa Card and have never been charged a fee for it. It’s as simple as that.

Hello!

I am fairly new at DKB and my German is still very bad (which does not help – but I knew it before. I was just recommended DKB too often so I decided to go for it anyway).

Reading all the information above, I understand the following:

– It is better to use the Visa card to withdraw money at ATMs in Germany, because with the debit one there are fees. And to ensure that this is possible, I have to top up my credit account (as it is now fixed at max. 100 Euros). Right?

– We can however get cash in some shops with the Giro card. There if I look at “details” I see “cash 100 Euros”, although I have much more on that account. Does that mean that my cash withdrawal limit is 100 Euros?

– My Credit line is currently 100 Euros too, but I asked our office to wire my salary to my DKB account in the future (I am now at Sparda West and I want to leave). So the credit line should increase “automatically’. Is that correct?

– And my last question is: does DKB, as N26, can automatically deal with taking over all monthly automatic payments/direct withdrawals by the electricity company, internet, public transport card, etc)? Or do I have to inform each of these companies myself?

In advance, thanks a lot!

Starting 1.1.2020, you will be able to book from us professional advice on the use of our German banks in English. Maybe this is something for you? Because I do not know how I somehow could formulate again or newly, what I have already described above in detail – and also on the almost 100 pages on the DKB here.

Thank you Richard.

Stating that you sauf it all before is totally understandable, but not necessary completely helpful. I read a lot of pages, maybe not 100 but a lot – and even watched your videos. Most of my questions were rather a call for a confirmation that I got your information right. I did not see anything though on an automatic transfer service from one former bank by DKB, such as automatic payments directly debited by companies (e.g. electricity, internet, etc). Maybe you wrote about this but then I did not see it.

So, in case this was already answered and you do not want to repeat – which again I can understand – at least sharing the link to the related post would have been an option.

After all these years with my faithful DKB Visa, I came across an ATM that wanted me to pay 4 EUR as “direktes Kundenentgelt”. Of course I declined the transaction, and found another one that was free. (I understand DKB used to reimburse these charges in the past, but not anymore.)

Since my “official position” is that this practice is a downright robbery (AFAIK, the banks already settle the ATM fees between each other), I was wondering if there’s some sort of a blacklist of banks and ATM networks that exercise this form of robbery?

I think such a list would be of a great value especially for “nomads”, saving time and making it easier to find useful ATMs and root out the usurious ones.

Hello,

Thank you for the wonderful article explaining everything in such detail. After reading this article I got an account at DKB.

According to your point: “5. Saving with an interest rate advantage” , I am supposed to get interest on the money I store on my Visa credit card.

I tried to do that, but it has been over a month now, and I did not receive any interest on the amount in my credit card.

Did this change since the time of writing this article? Or do I need to activate something.

Thanks

Yes, right, the article is already older. Currently, the interest rate is at 0.01%, which basically means no interest. Point 5 can currently be disregarded. 😉 I do hope you’ll enjoy DKB!

I am a recent settler in Berlin and looking to open a bank. As a non eu citizen with a residence permit in Germany and limited German proficiency which bank do you recommend.

Just fyi here is what’s important for me :

– free account that provides an EC card and German IBAN

– free withdrawals at ATM

– free to use the card in other eu countries

– free and immediate money transfers

This would be the ideal of course. What do you recommend?