Free Schufa-inquiry: Sample Letter

In the first part, we explained why the SCHUFA collects data and that this data is sometimes incorrect. You have also learned about the federal data protection act that grants you free access to the data.

On this page, you will learn how to get your free Schufa-overview and how the overview looks like.

How to get your free Schufa-overview!

The SCHUFA (credit investigation company) offers different chargeable services to access the data. However, the Federal Data Protection Act (Bundesdatenschutzgesetz, short BDSG) entitles in § 34 everyone to one free inquiry per year.

Step 1: Printing and filling of the sample letter

Download here!

You can download a sample letter in English or German, which we have already prepared as a PDF document. After printing the document, you can fill the date, your name and address as well as the information on your birth date and place of birth.

Important: Do not forget to sign at the bottom of the page.

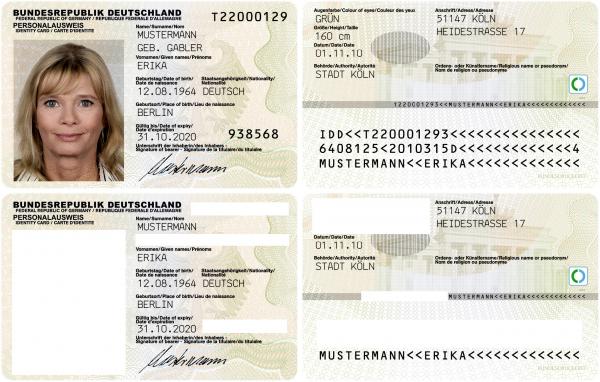

Step 2: Copying your ID-card or passport

Attached to your inquiry, you must send either a copy of your German ID-card or your passport and a registration certificate to the Schufa. This is necessary in order for the SCHUFA to verify your identity, because an unauthorized stranger shall not receive such detailed information about you.

In the copy of your ID, your name, full address, date of birth and place of birth has to be readable. Other information, such as your photo, information on your height or colour of your eyes can be made unreadable.

Step 3: Submitting

Insert the signed inquiry and a copy of your German ID-card (or passport and your registration certificate) in an envelope, stick a stamp on it and send it to:

SCHUFA Holding AG Postfach 10 25 66 44725 Bochum Germany

The answer of the Schufa

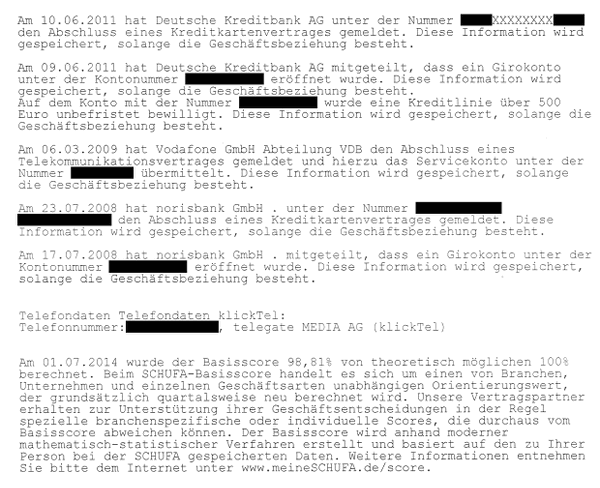

You will have to wait several days or a few weeks until you get an answer. The letter of the SCHUFA will contain

- a cover letter with information on how to report incorrect information

- a list of your reported account information, credit data, telephone contracts…that is stored at the SCHUFA

- a list of the transmitted probability values from the SCHUFA to companies of the last 12 months

- information on the SCHUFA and on the meaning of stored data

In this example, companies have transmitted data about the customer to the SCHUFA. Check for yourself, whether all entries are correct! At the end of the list, you can find the base score.

Bonus: The meaning of the base score (Basisscore)

The base score is part of the SCHUFA data. The scores express, how likely it is for the SCHUFA that you will pay a loan on time. In the mentioned example, the base score is 98.81%. This is a very good value. The SCHUFA distinguishes six levels of risk:

- > 97,5 %

- very low risk

- 95 % – 97,5 %

- low to comprehensible risk

- 90 % – 95 %

- satisfactory to increased risk

- 80 % – 90 %

- significantly increased risk to high risk

- 50 % – 80 %

- very high risk

- < 50 %

- critical risk

The base score is a guide value for you as a customer. However, the SCHUFA does not only provide companies with a single value, but determines different values depending on the industry. This is understandable, as the prospects of reliably paying a mobile phone bill or paying a house loan of several hundred thousand Euros may be different.

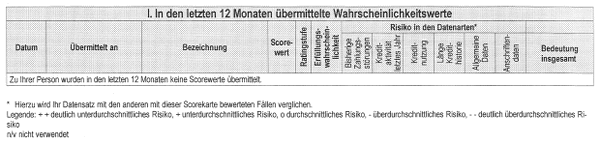

Transferred Values

The SCHUFA also lists the data that has been transferred to companies within the last 12 months. In my self test, no data was transferred, so the table remains empty.

Related articles:

Images: Bundesrepublik Deutschland, Bundesministerium des Innern (ID-card), SCHUFA

I have just moved to Canada should I put my old German address on the letter or is that for the postal address where to send the report? if German address how should I include my postal address??

Thank you for a very helpful article!!

Yes, SCHUFA will need both your old and new address, if you have just moved. The old address is needed in order to identify you/your data correctly and the new address is needed to send you a reply.

You could compose an own letter based on our sample letter where you include both addresses, indicating which one is the previous and which one the current address.

If you would prefer to use a pre-made request form, you can use the one provided by SCHUFA. Click on the British flag for an English form or the German flag for a German form right below the line “Bestellformular: Datenübersicht nach § 34 Bundesdatenschutzgesetz” at the following SCHUFA page (sorry, they don’t want direct links to the PDF). You would put your current address into the section “personal data” and your previous address into the section “additional information”.

David, note that you do not have to provide your bank account data for the free SCHUFA-inquiry! Just ignore the “alternative” box in their form but don’t forget to sign the form above the “alternative” box though.

How long does it usually take to receive the SCHUFA free report and for how long is it valid? I am planning to move for my own apartment in 3 months, should I ask for a report now?

It may take some weeks to get the free SCHUFA report. But there is nothing like a period that the report is “valid”. This report is for your information only, so that you know which information is collected and exchanged about you. Usually you should not show this report to anyone else, because it often contains more personal data then others need to know about you. You do not need this report, if you do not want to know what information SCHUFA has and transmits about you.

When signing certain contracts in Germany, e.g. when opening a bank account or applying for a loan, renting an apartment, … you are often required to agree that the company (i.e. bank, landlord, …) may contact SCHUFA and ask SCHUFA about your credit worthiness. This is often to be found in the smallprint of the contract. Also, the company may send some information about you to the SCHUFA (e.g. if you don’t pay the loan back). The communication between SCHUFA and the company then happens quickly and without any help from you.

I hope that helps.

is there anyway to delete the negative report I have in the Schufa?

I took a credit of 1000 euro and struggled to pay it back. anyway now its fully paid back to the bank. however my name is in the Schufa.

Data is only stored for a limited time. For example, data about credits is usually deleted after three to four years.

Usually you can’t get correct data deleted earlier. SCHUFA’s business wouldn’t work if that was possible.

But you can have incorrect data deleted and incomplete data completed (e.g. if a bank failed to note that you payed a credit back) more quickly. In that case, you can try contacting the company that caused the error (e.g. your bank) or SCHUFA directly.

Hi I am very confused about my schufa score.

I got a girokonto since 2014.10.24 with norisbank

I also have an account with ING Diba since 2015.06.19

At the same time I also asked for credit which I didn’t get.

My score is at 88.1% I have had a regular income since for soon 18 moths. All is paid on time always money on the account,

Should I get a line of credit (or overdraft) so I can prove that I am “worthy” Would it imporove or should I wait?

SCHUFA does not explain how they calculate the score, so it’s hard to say why your score is relatively low right now. It may be because they’ve only had data about you for less than two years and it will get better as time goes by.

When you were completely new to SCHUFA, your score may have simply reflected their experience with people who have entered their database at the same age as you and live in the same area.

I think, the general impression is that you do not “train” your credit score with SCHUFA deliberately as with some credit card companies especially from the English speaking world, where the creditworthiness improves with every credit taken and paid back on time.

Nevertheless, having a line of credit on the checking account may improve the score a little indeed, but asking for a credit and getting it denied could also lower the score. I wouldn’t bother with it too much if you don’t need it now. If you want to ask your bank for a line of credit, then asking the bank where you receive your regular income is probably better than asking for a line of credit on an account that you do not use regularly.

I’d be interested to read other people’s experiences concerning this!