USA

The United States of America are not only a popular country for special journeys, but a destination for emigrants since long.

Inhaltsverzeichnis

| Currency | 1 Dollar = 100 Cent |

|---|---|

| Abbreviation | USD, US$, $ |

| Exchange rate (26.07.2024) | 1 EUR = 1.0873 USD 1 USD = 0.9198 EUR |

If you want to join the American dream, only for a few days or maybe forever, then this page should be important for you.

A visit or permanent stay in America is always closely linked to finance … and finance is our specialty.

I have compiled the most important information about banks and bank accounts for you. If anything is missing, please contact us via the comments box at the bottom of this page.

Currency calculator

=

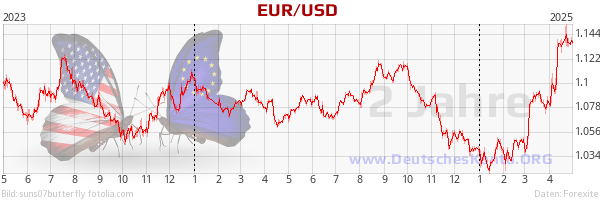

Development of the exchange rate over a period of two years

Development over a period of two years. This serves for your visualization of the development of both currencies to each other.

Paying and currency exchange

Card payments

The USA is the homeland of credit cards. You can pay almost anything and almost anywhere with credit cards. Sometimes you even have to pay with credit card, because no other payment options are available anymore or it is more laborious to use other means of payment.

Valuable tips in this article.

Homeland of the credit card

For example, it is customary to pay directly at the petrol pump with the credit card. If you do not have a credit card or your card is not accepted – which occasionally happens with European prepaid credit cards – then go to the petrol station attendant and pay in advance.

If you have a German or European credit card that deals with the Euro currency, then foreign currency charges apply to each card payment. Banks call this the foreign transaction fee. The fee is a percentage of the payment, usually between 1.5 to 2%.

Over time, this sums up to a lot of money and that is why I suggest two solutions in order to avoid these fees:

- Create an account/credit card at one of the few providers that waive this fee. Here you can find an overview about this: credit cards without foreign transaction fee.

or - You have an account at the DKB or Comdirect. Both banks waive the fee at the cash withdrawal, which is also free of charge. Therefore, you pay with cash that you previously withdrew at the ATM free of charge.

AMEX, Visa-, Master- and Maestro-Card = yes, V Pay Card = no

In contrast to the V Pay Card, the Maestro Card is widely accepted in the USA. Both card models are often successors of the former EC card.

The MaestroCard uses the MasterCard system, which is the same around the globe. The V Pay Card is from Visa, not from Visa International, but from Visa Europe … and is therefore not accepted in the USA.

Cash at the ATM

You can provide yourself with the first cash in US-dollar already at the airport. It does not matter, which ATM you use, as your account holding bank determines the exchange rate.

In the USA, the cash machine is called ATM. This is short for „automatic teller machine“. ATMs are widely represented throughout the whole country. You will see the first at the airport and others can be operated comfortably from the car.

In the USA, there are “drive through”-banks. You can drive directly to the bank teller or the ATM and do not have to get out of your car. American convenient, right?

The exchange rate is always determined by the bank that manages your card account. The ATM charges your account with the withdrawn amount in US-dollar. You can see the following on the bank statement:

- the withdrawn amount in USD

- the exchange rate,

- the conversion amount in EUR.

Usually, ATMs in the United States charge a service fee for the withdrawal. There are only very few at which the withdrawal is free of charge. Usually, the fee is US$ 3.

Tips to avoid fees

Also in this case, I have two suggestions for you:

- The DKB and Comdirect advertise both with a worldwide supply of cash free of charge. To ensure that this promise is fulfilled, both banks refund the foreign fees on request. How this exactly works, please read here in German:

- Gebührenerstattung bei der DKB (refund of charges at the DKB)

- Gebührenerstattung bei der Comdirect (refund of charges at the Comdirect)

Unfortunately, both banks can not perform the refund automatically, because the fee is added to the withdrawn amount and is not charged to the account separately, as usual.

- Another option is the creditworthiness independent SparCard of the Deutsche Bank. With it, all your cash withdrawals from the ATMs of the Bank of America (partner bank) are free of charge. Please note

- the daily, weekly and monthly Abhebelimits (limit of withdrawals),

- that the Bank of America is widespread in the USA, but not represented in all states.

However, I have a solution for this too: Set up several SparCards to use the multiple of the limit of withdrawals. Technically predefined by the bank, one can create a maximum of 19 SparCards per person.

Here, you can drive directly to the covered and lighted ATM and banking machine. Convenient, isn‘t it? This is the Bank of America in Winnemucca, Nevada.

Traveller´s cheques

Traveller’s cheques of American Express – the AMEX Traveler’s Cheques – are widely accepted as means of payment in the USA, however, not by every merchant, but rather larger company chains, petrol stations and good hotels.

Traveller’s cheques have two interesting advantages:

- You will be reimbursed to 100% at loss. Cash is completely lost.

- You can buy the cheques previously to your journey … at best, choose a time, when the Euro is strong against the US-dollar. Because of the currency fluctuations of recent years, you could consider the 1% purchase fee as “peanuts”.

Tip: Buy the traveller´s cheques on days with favourable rates!

However, American Express traveler’s cheques can no longer be purchased from any bank in Germany. Ask your bank. Alternatively, you can buy them at the Reisebank or as a DKB-customer through online banking. At the DKB, you can also order US-dollars in cash and for a transportation fee, it will be delivered to your home address (or to another address).

I like to redeem traveller´s cheques at supermarkets, like Walmart or 7 Eleven, as well as petrol stations, like Shell. Advantage: You receive the change in cash, thus, you obtain small change in US-dollars.

Exchange offices

I did not notice any exchange offices in the USA, as we know them in Europe.

Experiences and Recommendations

You know: the United States of America are considered as the land of opportunity. This also applies to the choice of the payment method. At best, you decide for one that meets your needs for comfort, safety and (fee) thriftiness.

My personal favourite method: Withdraw cash from the ATM and pay in cash.

I have tested all presented payment methods by myself. Additionally, I have even bought a Visa card in US-dollars, but I have preferred to pay with cash on my US travels (which I have withdrawn previously free of charge from the ATM using my DKB Visa credit card).

Caution money through credit cards

For the deposit of cautions (car rental, hotel), a credit card is highly recommended. Depositing it in cash is inconvenient and not welcome. Additionally, the credit card saves resources, because the caution only means that a part of your credit limit is blocked.

If you wish, you are welcome to add your experiences and tips to this article. The box for this is at the end of the page.

Entry in the USA

Travel documents, Visa requirements, Duration of stay

There are special Internet sites that deal with the subject of entry to the USA, so just briefly: to enter the USA as a German, Austrian or Swiss citizen, you must have an “electronic system for travel authorization” (ESTA). This should be applied for at least three days before departure. You can do this by yourself in the internet or your travel agent – usually paying a corresponding fee – will take care of it.

By the way, ESTA is not a visa, because we do not need a visa for the United States out of tourism or business reasons that take less than 90 days. However, if you plan to get a job in the USA, such as Work&Travel, then you must apply for a visa beforehand.

The check-in at US flights takes longer than usual, because travellers are asked to detail their travel plans and their luggage. Americans call it “Security”. Your passport must have an integrated chip, otherwise the entry is rejected.

Declaration of cash

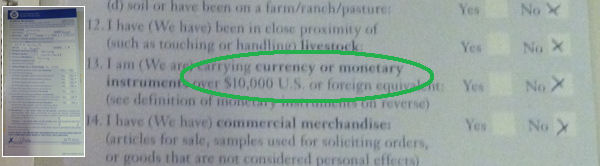

You can take cash or cash equivalent means of payment to the USA in an unlimited amount. However, the authorities want to be informed from the total sum of Euros 10,000 (declaration at the German customs when leaving) or US$ 10,000 or more (declaration at the U.S. Customs and Border Protection).

You can obtain the form at the German airport customs office or download it at zoll.de. On the plane, you receive a general entry form. If you check that you bring cash of more than US$ 10,000, you will be prompted by the entry-officer to declare the origin, owner and purpose on a separate form.

up to USD 10,000 are free from declaration

By the way, traveller’s cheques are included, but credit card balances not.

Question 13 on the entry form, which you receive on the plane … respond honestly!

Opening of bank accounts

Opening of a bank account in the USA

The opening of a bank account in the USA is quite easy. I spoke with about two dozens of banks about the account opening, the conditions and the possibilities of usage (information gathering on the spot).

In summary, one can say that a current account (Checking) at the national banks is rather subject to charge or requires special conditions, e.g. a minimum account balance must be met in order to get it free of charge. At local banks, the account is often free a priori.

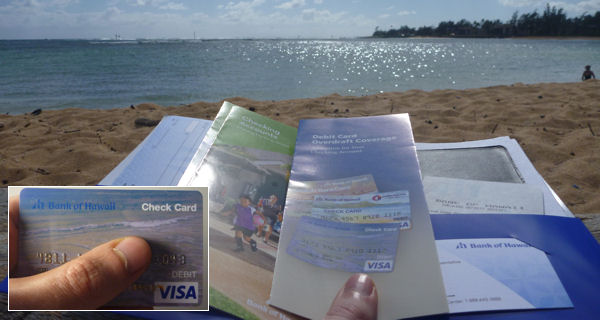

The first cash withdrawal (free of charge) with my ATM card that was issued immediately upon account opening.

Basically, an account is opened in person at a branch office upon presentation of a passport. The account opening with legitimating through the Internet or the post office is not common in the USA. This could be different with credit cards.

Most banks require an address within the United States for the sending of bank cards and possibly further mail, e.g. bank statements. However, one can insist on online bank statements only. Moreover, this is also cheaper.

Since there is no register of residence in the USA, it does not matter whether you actually live at the stated address. At individual houses, your name does not even have to be on the letter box. The post will be delivered, if street and house number exist. Otherwise, it will be sent back to the sender.

Therefore, you can use the address of a reliable friend or an address service with mail forwarding with clear conscience.

At the cards for the account, one usually distinguishes between

- ATM Card,

- Debit Card,

- Credit Card

unterschieden.

With the ATM card, you can withdraw cash at the (bank-owned) ATM-network and use the banking functions of the ATMs.

The debit card works very much like the Girocards in Germany. Payments are directly charged on the current account. In order to be able to use the card, funds must be on the current account.

The debit card is not suitable to build your “Credit-History” in the USA. You need a real credit card for this. The credit history is important for you, if you want to build a long life in the USA.

Not every bank provides you immediately with a credit card with credit limit (credit card) being a new arrival in the USA. A certain level of creditworthiness rating is required. However, you can suggest to the bank to consign caution money – for example in a savings account – in the amount of the credit line.

Tip: Get some cheques right away.

Paying by bank cheques is still widespread in the USA – probably because transactions from the own to another bank are outrageously expensive in international comparison.

A good bank will provide you immediately at the account opening with a few personal cheques. You can request for a few more (mostly free of charge) or a chequebook (subject to charge).

During the account opening, all the necessary documents will be prepared for you immediately: Online access, bank cheques and the most important information about the bank, as well as the price listings. Here you can see the documents of my account opening on Hawaii. The Visa credit card was even sent per post to Germany, as it had to be produced first. Duration: 2 weeks.

Opening of a bank account in Germany from the USA

Until the 06/30/2014, every American citizen with knowledge of the German language was able to apply for a free DKB account and it was almost always approved.

Currently, the account opening from the United States only works, if you have a German, Austrian or Swiss passport. Thus, the DKB account is still the best choice for all emigrants, abroad students, expats or long term travellers! The legitimating takes place via Video call and the cards and access data will be sent by airmail to the USA.

An account opening at the Comdirect may also be requested. Also this bank works with video calls. At PayCenter, an account opening is even possible without a creditworthiness check, but a visit to Germany must be performed, as the legitimating can only be done via PostIdent.

Use the internal search function of this special portal to find more information about account opening possibilities.

International transactions

Bank transactions between Europe and the USA are relatively expensive. Maybe this will change as a result of the TTIP-agreement? Here you can find two frequently viewed tests:

- USA-Überweisung: Comdirect = Testsieger! (USA-transactions: Comdirect = Test winner!)

- USA-Überweisung mit TransferWise (USA-transactions with TransferWise)

Website: www.transferwise.com

I personally became a fan of TransferWise, because this specialist splits the international bank transfers into two national transfers and thus, saves fees significantly. At least at transfers of up to USD 10,000.

Outgoing transactions from the USA are even more expensive at most banks (see price listings) than incoming international transfers. For a transaction, one can even pay USD 50 … and as bank cheques are free or very cheap, I have developed and tested the idea of how to transfer money by cheque to Germany. If you are interested, please check out this article in German: Wiederentdeckt: altes System – neue Idee (rediscovered: old system – new idea).

If you want to stay with a bank transfer, it is recommended to transfer from Germany already in US-dollars. A reader reported that the BEN-option (meaning the recipient in the USA shall bear all costs of the transfer) is the best option, because it does not matter if SHARE or BEN, the fees for international money entry is always the same. However, in Germany, the fee for the bank transfer did not apply.

The author during the card test in the wintry New York.

If you want to test it, I would be grateful for your feedback!

Tips and supplements

I invite you to complement this page with your experiences and tips. The comments box is available for you at the end of the page. The benefit for everyone increases, the more people get involved and contribute with their knowledge. I thank you a lot!

Leave a Reply