Open a business account in Germany for self-employed: The 5 minutes solution ✔

This article was written due to a request from Hungary. However, the solution could also be interesting for self-employed people in Germany!

Problem: Many self-employed people from abroad have customers in Germany. For the customers, it is often complicated and expensive to make transfers to the abroad.

Moreover, it is also expensive for the self-employed person, when he / she receives transfers in Euros to his/her account in the home country.

The solution: opening a bank account for commercial purposes in Germany.

New problems will arise, but this article will solve them all!

New problem No. 1: If one does not have an address in Germany, many banks do not want to open a bank account.

New problem No. 2: With the DKB and Comdirect, there are excellent providers, who allow a place of residence abroad when opening an account.

However, these are pure private customer banks. If one opens an account there and uses it commercially, there is always a danger of an immediate account cancellation by the bank, as one violates the contractually agreed terms.

Now the solution for you

We have researched a provider, which fits exactly to the solution of the problem and the account opening does not take more than 5 minutes.

This means: you will receive your German account number within a few minutes and you can write it immediately on your invoices and receive payments right away.

Before you open the account, please look at the following details:

- German current account with IBAN and SWIFT-Code

- included in the basic fee:

- 1 MasterCard

- receive 5 payments per month for free

- 1 × withdraw cash (also outside of Germany!)

- Online banking / banking-app

- no address in Germany necessary

- no creditworthiness check

- online account opening within 5 minutes

Go directly to the provider ⇒ www.onlinekonto.de/mainpage.

The details: 1. Immediate account opening

The absolutely brilliant thing about it is that you can open the account immediately – even if it is Sunday night at half past two.

With your online application for account opening, an account number will be immediately generated, which works immediately.

If you want, you could make an immediate transfer to your new account in Germany. Moreover, you can also take the account number and write it on your stationery or on your invoices.

You can receive payments right away!

You will see how the account opening exactly works in the second part of this page.

2. Important to know: Legitimating and complete activation

Also in Germany, there is a Money Laundering Act, which states that the financial institution must know its customers. That is why each account holder must be identified beyond doubt.

Only after the legitimating, you can use the account to its full extend. Until then, however, a limited use is possible. You can receive payments, but cannot make payments. Similarly, the MasterCard can only be ordered after the legitimating.

The legitimating currently takes place through the German post (PostIdent-procedure). You simply visit any branch office of the post in Germany with your ID-card or passport and the Ident-Coupon for the PayCenter online account and ask for the identification.

In the future, there will be a Video-ID process. More on this will be published in further articles.

For most people – just as for the businessman from Hungary, whose request to our editorial led to this article – this is totally okay, because they visit Germany several times a year anyway in order to carry out business meetings and to visit customers.

Invoices can already be paid to your account, which is a big advantage!

3. How to get your money home (abroad)

Now, it is super easy for your customers to pay their bills cent accurate to your German business account, but how do you get your money back home?

Here are two suggestions for you:

- Use TransferWise or another provider, who has specialized on cheap cross-border payments, or

- Simply withdraw the money using your MasterCard in your hometown or anywhere else in the world. The daily limit for cash withdrawals is Euros 5,000!

Possibly, your ATM will not have so many bills, 😉 but your new German MasterCard can do it!

Withdraw up to Euros 5,000 per day with the MasterCard!

Part II: Account opening – Instructions

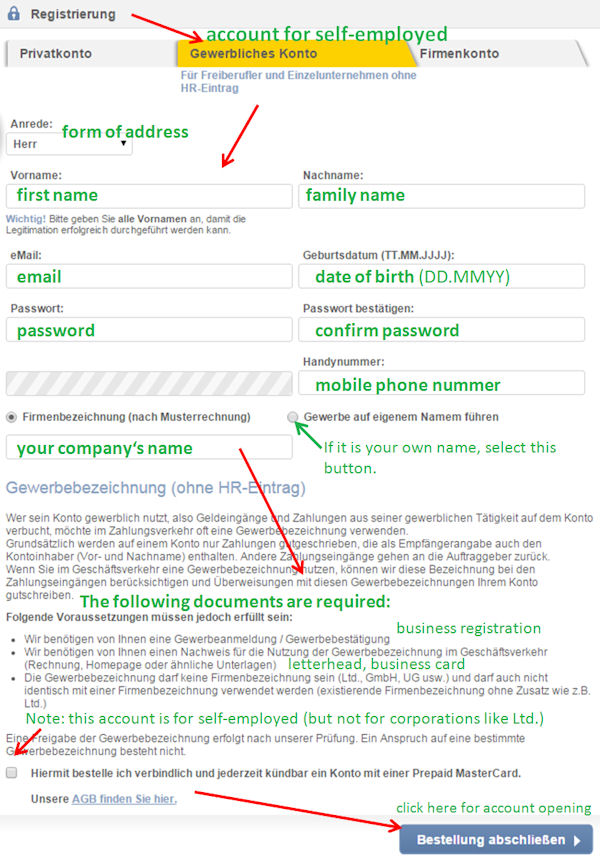

Go directly through this link: www.onlinekonto.de/registration/quick and change in the area „Registrierung“ (registration) from “Privatkonto“ (private account) to “gewerbliches Konto“ (business account). Then you will see the following page and can start filling out the form:

Steps 2 and 3 are the same as at the account opening for private persons. Please take a look here: Confirmation via e-mail and message on the account number.

Congratulations: Your account is opened and ready for use!

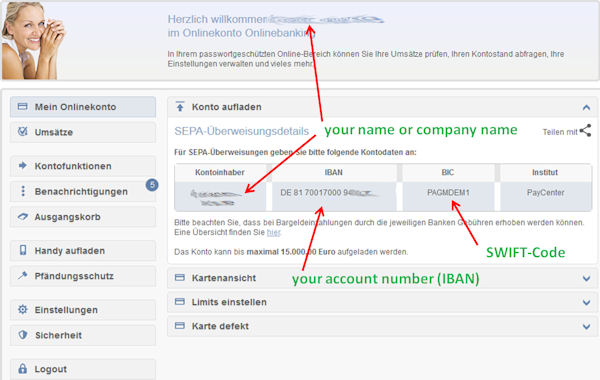

Immediately after the online order and the confirmation of the e-mail address, the account is opened and ready for use. You will see your German bank account number at your first login:

Now you can already receive payments. Your MasterCard can be ordered as soon as you have completed the legitimating (see above).

Note: Private online accounts can also be converted into business accounts at a later date. The account number will stay the same.

Please remember that one must always specify the personal name of the account holder in a private account, for example “Joe Smith”. At this account for business purposes, the account name can also be the company name, for example “Florida Business Consults”.

Basically, the online account of PayCenter can also be opened for legal persons such as GmbH, Ltd, Inc. However, this instruction was specifically developed for the account opening of a business account for self-employed people (without legal entity and no commercial register entry).

“Open the business account online now”

Questions on the account opening or usage?

You can ask questions about the account opening or usage of the online account of PayCenter anytime via the comments feature of this page. Good luck with your new German account!

I almost forgot!

1. You have the option to let your MasterCard get printed with a certain motive. For example with your company logo!

Desired motive / own logo on the credit card is possible!

Simply upload the corresponding graphic to the online banking system.

2. Currently, the account application as well as the online banking is only available in German language. However, we are commuting to the provider that it would be desirable to additionally offer an English version. With our instructions in English, we help to bridge the time as good as possible until the English language versions of the account and banking app are available.

Nevertheless, we are happy and grateful that the account opening for self-employed people (business account) from abroad without an address in Germany became possible.

Addition 2/2017:

-

English language of the account application, as well as the online banking, will be introduced in 2017, one can contact the customer service already in English.

-

Besides the PostIdent-procedure, also the VideoIdent-procedure will be introduced in 2017, so that one can easier open the account online and also complete the statutory legitimating procedure from abroad.

-

Details on the authorization for account opening: the account opening is possible for all people living in Germany (address, place of residence) independently of their nationality. The account opening is also possible for EU-citizens outside Germany, but with a place of residence within the EU. The account cannot be opened for non-EU-citizens outside Germany.

Therefore, the account can also be opened for EU-citizens, who live in Great Britain – but not for US-Americans, unless they have an address in Germany. Everything perfectly clear?

Is it possible account from Russia?

Yes.

What is the process involved for opening a foreign company account?

The same, there is no difference.

Hi,

I am a from Bangladesh. I have a company incorporated in Hong Kong and doing a online service providing business.

I would like to open a corporate bank account so that I can do my business smoothly. Again, I don’t want to go out of Bangladesh for account opening purpose.

Is it possible to open a corporate bank account with all processes will be done by online ?

Please help me out.

regards

Jalal

No.

Im a self employed Non German National (A Pakistani National) residing in Karachi – Pakistan active since 2002.

I , being a sole-proprietor, had been engaged with International Trading of Hometextiles since 2002 until Pakistani Govt through State Bank of Pakistan closed US Dollar based business accounts which nearly destroyed our business and we are actively searching for solution to this problem.

Note, we are already registered with :

Chamber of Commerce & Industry – Karachi – Pakistan

Pakistan Tax Authorities and File Tax returns regularly

We since then have switched to International Trading where our Spanish customer buy through us (as agents ) from our Chinese & Pakistan based factories.

Here main problem is covering our business interests where we don’t have foreign currency business account to manage international trading of Home-textiles.

We if approved by your company, will be receiving orders in Germany while active through German bank and then place order with suppliers from Asia and Far-east specially China where our business interests & profits will be well secured in Germany -.

Now upon reading : https://www.deutscheskonto.org/en/open-business-account-germany/

we felt that you are telling our story, so now, we are looking for a possibility to open trading business ( mainly Home Textiles ) in Germany. Hope you can assist in this regard.

Due to confidentiality , I can email you about my business name and license information on separate email.

Kindly inform your business email address so I submit for further perusal if possible.

Warm regards

Aziz Ahmed

Please excuse, but our web portal is specialized on German online banks. These are mainly accessible to private customers. Some – as presented here in this article – offer accounts for self-employed persons and freelancers.

We are not the right web portal for larger companies. Moreover, there are no online banks in Germany, which are specialized on this business. Most likely, you will find the account services that you are looking for at major German international commercial banks, just like the Deutsche Bank and the Commerzbank. Good luck!

On some parts of your site, you state it’s illegal for a freelancer to use his personal account for business purposes. On other parts, you state it’s legal. If I understand you correctly. It varies from country to country. Please help!

This has nothing to do with “illegally” in the constitutional sense! However, there are many banks in Germany that offer bank accounts only for individuals. If one opens a private account, but uses it for business purposes, then one violates the contract, which one has concluded with the bank during the account opening. This may result in the cancellation of the account.

This is no problem at the provider PayCenter / Onlinekonto. The account can be used for private and business purposes. Moreover, the account opening is very simple.

Thanks Tanja,

To rephrase my question: what I’m truly interested in, is, what the law says in Germany. Can you use your personal account as a sole trader or not? As this matter differs from country to country.

If individual banks have other special inner regualtions, that’s another matter.

The screenshot says that a German “Gewerbeschein” (= business registration) is required if the account is used for business purposes.

To get a German Gewerbeschein, one must have a German address, must register with the local trade authorities, must pay the local trade tax etc.

That is not really a matter of minutes…

Do you know if they might accept a German VAT number to open the account?

Hi!

The account is being opened immediately with the online application. The account number is immediately at your disposal, and you can receive money on it.

The complete clearing (money transvers, MasterCard) can only be finished, once the contract partner has received all files.

A VAT number does not substitute a business registration/trade license. But not everybody needs to register their business like that – artists for example do not. You might want to discuss your personal details with the customer service.

Hi!

What a wonderful website to find. Thanks for all the info, guys.

Here comes my case: I have a company registered in Brazil. We need a bank account in Europe so we can receive money from clients in different countries of the Euro zone plus UK. A german account would be perfect.

If I understood correctly, after the quick registration, we can receive funds on that account, but cannot transfer those funds abroad, until we physically show up at a bank office in Germany, correct?

We can travel there to make that happen. I’m just wondering what documents we would need when we go, to make sure we are not loosing time and money going there.

Thanks!

Hi!

That depends:

Does the company name simple equal the name of the company owner (e.g. firstname, family name + addition => e.g. Jenny Flower Consulting) or does is it a legal entity with a different legal form (e.g. Flowers Consulting LTDA)?

In the first case, the opening of an account with PayCenter should work. In the second case it only works, if the company is registered with a German commercial/trade register.

Hi,

Great website! I am hoping you can direct me in the right path. I am a canadian citizen who does business on amazon in Europe. In order to receive Euro’s i Need a account based in Europe. I need both a euro and GBP account.

Could you point me in the right direction? Which banks will accept application online? I also need to be able to make wires from this account to my canadian EURO and GBP account.

Thank you

Hi Tim,

The account we’ve presented here works with Amazon and is a Euro account, so other currencies are not offered. A money transfer to Canada is possible via TransferWise. Here, the currency will be converted to CAD.

For what you are looking for, we regrettably cannot provide a solution.

Hi and greeting to everybody, who read here too.

The information, from the part of the page operators as well as possible customers, are now more than 2 years old.

Are there any important changes of this business account for customers abroad? Or any updates or alternatives?

Greetings – Henry –

Many thanks for this question! You receive updates for “smart bank customers” weekly with our Sunday mail. Addmitedly, the Onlinekonto is only rarely mentioned. It is a fully developed current account that is constantly operated since years.

The biggest updates in this year will be the introduction of the VideoIdent as a legitimating procedure and expectedly a bilingual Online-Banking (German/English). By the way, both inspired by our request, because a part of our readers is abroad and it would be very helpful for the quick and complete commissioning of the account. 🙂 Thanks for the implementation efforts!

Hello.

I am a small business owner in Turkey. I deal with German companies and Turkish customers. What I would like to is to open a bank account in Germany, and over that account, provide online sales with credit card to my customers in Turkey. And purchase from my suppliers in Germany. Would I be able to do e-commerce if I open a bank account here? If yes, what would be the cost per transection when a customer is buying.

Best

The provider, just like all others in Germany are very hesitant with account openings for small business owners outside of the EU. You can try it, and with a bit of luck it might work.

The first 5 incoming transfers per month will be free of charge, after that it will be 50 Cents per booking.

Hi

Please can you assist. I shall be relocating to Germany within the next year as a sole proprietor, living with my partner who is a native German citizen. I am as a graphic designer and will need to be paid by clients in Germany and abroad. What would I need in order to open this account and would this bank be suitable for my needs? If so can I go ahead and open the account while still in my country of origin being South Africa?

How long after opening the account, am I able to get a Visa Card and a debit card?

Should the account be opened in my personal private capacity and used as such for client payments or opened in my business name which is my name T/A my business name?

I look forward to your response and thanks in advance for any information you can provide.

Excuse me. Did you read the article?

Hi

Yes I did. I was not certain about being able to open it early before my relocation. The rest I think I know, but just wanted to be 100% sure I got the facts correct.

Thanks

You can try an account opening anytime. The start of VideoIdent procedure for an easier legitimization is planned for this autumn.

When you receive the provider’s welcome e-mail, you can use that to reply that you want to move to Germany and would like to open an account in advance. You will get the account number right away. Deposits will be possible immediately, withdrawals only after the legitimization.

Whether the provider is the right one for you, that is something we cannot tell, since we do not offer individual consultancy. This is simply a web portal (like a magazine) for people interested in finances.

Thanks so much for the feedback and advice. It’s much appreciated!

First reply from Tanja is wrong. Paycenter only allow register for German companies. They confirmed me it. You can see also the only one country allowed is “Germany” in ww.onlinekonto.de/registration/quick/showBusinessFull

Do you know other company allowing for open online a EU corporate account in Germany?

When it comes to opening company accounts, there is a gray zone with many providers. Officially, companies abroad are no target group, because this would often attract problem cases. But if one acts smartly, there is a good chance, especially when it’s about a regular self-employed person.

It is different in the case of legal entities. Here, PayCenter insists on an entry in the German commercial register. Companies from abroad can get an entry into the German commercial register as well. With this requirement, PayCenter wants to make sure that the company from abroad is seriously and permanently interested in doing business in Germany.

The conclusion is mixed: Some do get a company account at PayCenter, some don’t. There is no “right” for companies to get an account. The statutory rule is “free choice of contractual partner”. The ones who conduct business properly and act smartly, have the best chances.

I am Pakistani national and resident in Germany with 5 year limited visa (Eu Spouse Visa). I have private account in Commerz Bank and now i tried to open a business account in Commerz bank. I opened my account online and got IBAN and visited bank for ID Verification. Everything was fine but next i got letter from bank that its not possible to open a bank account for you. They did not give any reason in letter.

I visited bank again and asked for reason as such officially they did not give any reason but they guy at branch because you have limited residence permit and as per regulation you can only open one account. So decide you want private account or business account. Can you please guide on this? I want my account with a branch banking service.

Sorry, wrong web portal, our focus are direct banks.