Opening: Bank Account in Germany

Even if the world is constantly growing together, it is currently still difficult for German banks to implement a meaningful credit assessment of applicants from abroad.

Both top banks of our special portal (DKB and Comdirect) issue by default a Visa credit card with outstanding conditions; therefore, a credit assessment is indispensable. For our readers abroad, we have found a simple way to open a free bank account in Germany via the Internet.

The idea of a free Savings Account in Germany

When opening a savings account, German banks have an easier time because you earn money for the bank. You do not (yet) get a Visa credit card. You can consign money in the German bank, but cannot use a credit limit. Therefore, there is no credit assessment.

If you are a serious customer, you can later obtain a complete current account with credit card in a simplified procedure and, if desired, also a securities account (not available for US-citizens). Please, continue reading for more information.

Complete Current Account with Visa credit card in the 2nd Step

Successful Application for a Savings Account

We recommend the savings account at the Comdirect, because the Comdirect is one of the best banks of Germany, the account application can be made online from abroad, as well as the realistic chance to obtain later a current account, credit card and securities account.

The savings account at the Comdirect is called “Tagesgeld Plus” and has the following features:

- market interest rates depending on the level of interest in Germany

- 4 times a year, you will be credited interest rates

- money is available at any time, no notice periods!

- money is secured through the German deposit insurance system

- there is no minimum deposit amount

- the account management is free of charge

Info about the Savings Account of the bank: www.comdirect.de/tagesgeld

Account Opening is possible from Germany and other countries

Requirements to successfully open an account:

- You must be able to broadly understand and speak the German language, as the contract language is German. Moreover, also the Online-Banking is only available in German language.

- You must be able to provide the identification of the customer (legitimating), which is required by German law. Find more details below.

Account Application in 2 Steps:

-

Online-Kontoantrag

You fill out the application form online for opening the bank account “Tagesgeld Plus“.

If you already have an address in Germany or if you are currently staying in Germany, then please use this application form: www.comdirect.de/tagesgeld (Online-form).

If you are abroad, then please use this link and click through the following path:

- Für Personen, die nicht länger als 180 Tage in Deutschland leben (Persons, who do not live longer than 180 days in Germany)

- Eröffnungsunterlagen (documents for the account opening)

- Tagesgeld Plus

- für Neukunden (for new customers)

- here, you have to decide between Einzelkonto (individual account and Gemeinschaftskonto (joint account, if you want to open a bank account together with somebody else – e.g. married couples take advantage of this option)

-

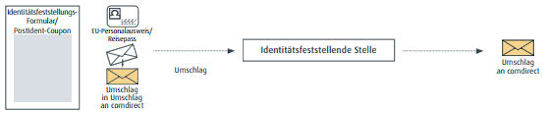

Identification of the person

You have to identify yourself as a customer. The German law requests this from bank customers. If you are currently in Germany, then you can use the free PostIdent-procedure.

If you are not in Germany, you may choose to visit Germany and do the PostIdent here or take care of the identification with a notary in your home country. For this purpose, you may use the last page of the account application form.

You will have to bear the costs of the notary. Due to the fact that there are different legal systems, notarial confirmations will not be accepted from all countries. However, if you live within the European Union (e.g. in Poland, Spain, Italy or Great Britain), then you won´t encounter any problems.

Account openings from North and South America (from Canada to the USA and Brazil) as well as in Australia are common and valid too. For countries in Africa and Asia, it is better to consult the bank about if and which types of notarial confirmations are accepted.

When applying from abroad, please add the following documents in copy to the confirmation of the notary on page 6 of the application:

- Proof of your residential address (e.g. gas, electricity or telecommunication bill)

- Copy of your ID card or passport

Finding the correct form to open an account from abroad is not that easy. Please use the following link: Comdirect-forms.

The possibilities to confirm the identification are well explained in the application for account opening. However, they are only available in German language.

Tax Exemption in Germany

In Germany, capital yields (interest on the savings account) are taxed. However, this only applies to people, who have their residence in Germany. As a foreigner, you do not have to pay this tax.

Interest income and Tax compliance

If you have your residence within the European Union, then the Comdirect is obliged, according to the EU-Savings Directive, to report your interest income to the Federal Central Tax Authority in Germany. From there, an annual report will be sent to the tax authority in your EU country of residence.

This directive was resolved to promote the tax compliance and it only applies to the European Union. A later extension to OECD-countries is currently under discussion.

Using the bank account “Tagesgeld Plus“

Money transfers

The account “Tagesgeld Plus“(Call money Plus) of Comdirect is a pure savings account. It is in frame for the flexible consignation of money. You cannot make money transfers with this account, but remittance transfers to your own current account at your bank.

The money transfers between your (foreign) bank and the Comdirect are always free of charge, if they take place in Euro within the SEPA-area. Otherwise, the Comdirect offers really low fees for foreign transfers.

Cash Deposits and Withdrawals

Whenever you are in Germany, you can deposit or withdrawal cash free of charge into/from your Comdirect savings account at any branch office of the Commerzbank (this is the second biggest German private bank).

You should pre-arrange a cash withdrawal of amounts beyond Euros 2,000 with the customer service of the Comdirect 3 days beforehand, in order to have your money ready in the branch office.

For a cash deposit or withdrawal, you should take your ID card or passport with you, as well as the bank account number.

Deposits and withdrawals can be done free of charge through around 1,000 branch offices of the Commerzbank. The Commerzbank owns 80% of the Comdirect shares.

Online-Banking

You will get a free access to the Online-Banking of the Comdirect bank. This way, you will always be able to access your bank account.

Security of the Money

Your money is safe at the Comdirect, as it is a German Internet bank that has specialized itself on online customers in the fields of current account and money investment. The Comdirect does not deal in abroad credits.

It earns money through the fees of securities trading, the interchange at credit card payments and the interest spreads between money deposits of customers and financing in Germany.

Additionally, the Comdirect takes part in the German deposit protection system that guarantees a statutory Euros 100,000 per customers and per account. Moreover, the bank is a member in the protection fund of the “Bundesverband deutscher Banken” (Association of German Banks) in a private-law manner. This way, each bank account is secured into millions of Euros.

Summary

The opening of a savings account at the Comdirect in Germany is quite simple, as a credit assessment will not be necessary. The account opening is possible from Germany as well as from other countries.

In any case, the account is free of charge.

“Apply now for Tagesgeld Plus”

Here you will find the link for an account opening from abroad: Comdirect-Forms.

Prospects to further services of the bank

As soon as you have managed to carry out your identification from abroad and have received all access data from the bank, you should transfer a little money to your new bank account. You can also perform regular deposits, in order for the bank to see that you are serious about your German bank account.

There are also people, who have transferred higher amounts, because they know that their money is safer with a German bank in Germany as in their home country.

The application for a Visa credit card would be a future step …

Current Account + Visa Credit Card …

Some time later – but at least 6 months – you should ask the bank, if the opening of a current account would be possible. Tell the bank that you have made great experiences with the bank and that you want to use it more in the future. As the bank already knows you, your prospects are good.

You will possibly not get a high credit limit, as German banks decide on it depending on your work income. However, you will get a Prepaid Visa Credit Card. With this credit card, you can take advantage of all the mentioned benefits on the following page: 7 secrets to use the Comdirect Visa credit card optimally.

If you consign securities (shares, funds) in the Comdirect, you can get a credit loan on these … this, however, is an interesting topic for another article.

Here you can find the link to the highly recommendable savings account: www.comdirect.de/tagesgeld.

What questions do you have?

Further articles about German banks:

Images: sashpictures/Bankkarte und manipulateur/Geldkoffer (beide fotolia.com)

I am a student at one of the branches of Wurzburg university in Iran and due to my job position I have to come to Germany frequently and I need a Bank account there. I want to know, is it possible for me to open an online account?

Yes, you’ll be able to get a bank account in Germany. But I would recommend to go to a bank branch – maybe near Würzburg – to open an account and explain its purpose in person.

Every branch bank offers online access to its checking accounts, so you can use it comfortably from Iran.

You will hardly get a bank account at a direct bank like those introduced in the article above, because the process of opening the account would be more complicated. There are still EU sanctions against Iran … so banks need to put more effort into working with Iranian citizens. This conflicts with the very standardized proceedings of direct banks.

dear sir or madam, i need to open a account in saving account but i have latvia visa can open it here please advice me

Are you a Latvian or did you “bought” a Latvian visa with the opportunity to travel in Schengen-Area? So are you able to travel for account opening to Germany? You speak some German for understanding the bank?

In next month we will create a report about saving accounts in Germany. That could be interesting for you. Visit our website again, please.

Greetings – I am working on my residency within Germany and wish to open a savings account. I also would like to transfer funds to another bank. Can the German bank to bank transfer be done? This would be from the tagesgeld savings to the konto account. Also, what is the current interest rate? Thanks und danke..

If you have a residency in Germany, you can use our saving calculator: https://www.deutscheskonto.org/en/account/savings/tagesgeld/comparison/

If you usually outside from Germany, you can open the saving account (Tagesgeld PLUS) at Comdirect Bank … we working at a new article about this topic. Sadly the interests on Comdirect are not the best.

But the current account at the Comdirect Bank is great and for free. And the fees for transfer funds to UK are low for a bank!

Hi,

I am a Nigerian I.T specialist, I frequently come to the EU on business visa and will be coming also next week for a week and some days and also my boss has an appointment at the commerz bank at the Frankfurt airport on our arrival. I want to know if its possible I open a bank account during this period and what step I need to take. Thanks

We can’t answer for the Commerzbank, because that is not one of “our banks”. But if you there you can try it on your own.

It depends what do you want do with an account in Germany … to find a perfect account for you.

For example that account https://www.deutscheskonto.org/en/account/online/ very easy to open. It could be the best option for some people, but sure not for all.

Thanks for the reply.

i really dont mind giving your recommended banks a try but i think a read comments on this forum about other people not being able to open account with the a fore mentioned but in any case can you put me through

Hi Tanja, this is a great website, thank you for helping people.

I am a Sudanese national and living in Sudan, Africa. I want to apply to study for Masters in Germany, if I am accepted in the University, the German Embassy here requires me to deposit a certain amount in a German bank account in my name so they can give me a student visa.

With regards to your “two banks”, you mention that DKB no longer opens accounts for non-EU, and comdirect requires an applicant to understand German, which I do not.

Any advice on what I can do.

Many many thanks,

You need a blocked account (German: Sperrkonto) for you studies?

The “Deutsche Bank” is the best option for this. Google for “Deutsche Bank blocked account” and you will find all information … i wish you a wonderful time in Germany!

Good day Tanja

Thank you for this website. Please advise whether South African citizens can open bank accounts in Germany. Mainly for transfers into the account as investment / savings.

I look forward to your soonest feedback.

Kind regards

Sorry, we aren’t consultants and we don’t ask for honorarium. But you can use all information from our special web portal. That is not for nothing, but it is for free.

Dear Tanja,

Thank you for providing such an informative site.

I am an Australian citizen wishing to open a savings account in Germany. I visit Germany every year for between 30-50 days at a time. I have tried twice with DKB (2012/2013) & was rejected (I assume due to lack of credit history).

My reasons for the account are as follows;

– I will be moving to Germany in 6 months, residing in Germany for one year to study German. My 15 year old daughter will be coming with me & studying for one year in secondary school (she already speaks moderate German).

– I am planning to purchase an apartment in Berlin to reside in during our stay & as a long term investment.

– I will need to begin transferring funds now to arrange for this all to take place in a timely fashion.

I am looking to establish a savings account now that will allow me to transfer funds from Australia & withdraw when I am in Germany. I don’t need a credit visa, a debit card or visa is just fine. Ideally the account will help me to create a credit history so that I may apply for a transaction account/rental property while looking for a place to buy & be able to pay school fees for my daughter before we arrive. Are you able to recommend a bank or account suitable to start with that could lead into an account with credit history later on down the track? I will not be traveling to Germany again before our move in 6 months so I would need to apply from Australia.

I only have limited German at this stage but I can understand enough to complete an application form.

Your time & reply is greatly appreciated, thank you.

Hi Christina

The account at Comdirect is similar to DKB. It is possible to open this account without Visa Card or with Visa Prepaid Card. There is also a saving account and the incoming international wire transfers are cheaper.

Here are information for account opening: https://www.deutscheskonto.org/en/comdirect-opening-current-account/

Do you want use this bank?

Hello Tanja,

Thank you for your speedy reply! It seems this account is fee-frei and not shufa-frei which in the long term is fantastic, but in the short term may not qualify me to open the account due to limited credit history. Do you know if the application form allows me to provide further information as to why I want the account & to request only a prepaid visa? I am happy to try to open this account using the ID form with notarial confirmation, I will let you know if it is successful or otherwise. Thank you once again for your wonderful help.

The question of the credit card / prepaid card will be charged in the application form.

Fantastic website.

I am a South African citizen living in South Africa, but hold British Nationality as a British Citizen as well, with a British EU passport. I work for a German company as their regional Manager in SA. My company re-imburses certain expenses on a monthly basis that I incur while traveling around Africa. This re-imbursement does not form part of my monthly salary but paid direct via international transfer into my SA bank account. I would like to open a German bank account for these amounts to be deposited into so I can use the money while traveling in Europe on business.

Am I legally allowed to open and account in Germany ?

Which type of account and what bank would you recommend ?

I really only want an ATM debit card to use in Europe and not a credit card.

Look forward your advice

Of course, it is legally allowed to open bank accounts for foreign people in Germany. If you are here (during a trip), it will be easy to opening. Because you are here and can speak with banks direct, can show your passport and sign documents.

An account opening online – for a Non-German (speaking) people – is a large challenge. We are looking for a good solution yet. Sadly, I have no better answer at this moment.

Dear Sir:

I am from iran and living in malaysia. Recently, I received an admission for a master program and I applied for the visa. My visa is approved. But, embassy is requesting for a Block account. But, Germany banks do not open Block Account for Iranians. Do you have any recommendation for my case about how I can open a block account?

Thank you very much

Most people go to Deutsche Bank with block account. Sadly we have no article how it works. We hope we can find a guest author for this topic, because we as Germans can’t open this account from abroad. It would be very good, if one can explain that who went this way.

Hello, I tried to open a blocked account on Deutsche Bank since 14 July and all my documents were complete. But there was no reply and explained to me that there are a lot of customers, you need to be wait. I think Deutsche Bank’s service hasn’t no responsibility. Also I searched another banks and can’t find opening student’s blocked account section on bank’s website (Commerzbank, Postbank, Citibank). Maybe I didn’t find it, can you help me to find some links?

We have a lot of customers

Hello,

I’m a German citizen, currently not residing in Germany, but who continues to actively use a long standing with the ‘Raiffeisenbank, Bad Abbach’. I would however like to open an account for my father in Germany. My father is a South African citizen, residing in South Africa. I was informed by my bank that as they are a ‘regional bank’, (for people living in the area), it would not be possible to open and account for my father with them. What do you suggest? I am returning to Germany for 3 weeks tomorrow and if possible would like to open an account for my father, (at another bank?), in this time. Would also really appreciate a ‘run down’ of all documentation I would need to complete the application on his behalf.

Thank you!

Thank you!

If your father can speak German and if there is a justified interest from the perspective of the bank to opening a bank account, he can open it by himself at the Comdirect (see article above) from South Africa.

Another option is a joint account at the DKB: https://www.deutscheskonto.org/en/open-dkb-joint-account/

At an account opening with residence abroad (outside Austria/Switzerland), one German citizen must necessarily be an account holder. The second person may have a different nationality. You would then be both eligible for the account usage.

You can also open a DKB individual account and authorize your father.

In both cases, he will get his own access to online banking and his own bank cards.

The opening of an individual account only for your father (non-German citizen, non-German residence) is not possible at this bank.

Please note that we cannot give you information on local banks, because we are a portal that has specialized in direct banks.

Good luck!

great Website. Thanks for all the information.

I am an indian and have recently moved to germany. I am a house wife and currently out of job. I want to open a bank account so that i can transfer funds from my previous job. I tried opening a DKB account. However, they had rejected my application because i am unemployed at the moment. Can you please suggest if comdirect would accept my application or if i should apply with any other bank.

Thank you!

Yes, that’s correct. Unemployment is not a good point to apply for a giro account with credit line and credit card, no matter which bank!

There are two possibilities:

a) You apply for a joint account with your husband. Make sure that you are listed as the second account owner … you have equal rights regarding the use, but when checking the account application, the banks tend to concentrate more on the first person!

b) You open an account with a provider that does not perform a credit check: https://www.deutscheskonto.org/en/account/current/opening/ (Here you’ll definitely get an account, but the conditions will be different!)