Commerzbank: Account opening, yes or no?

For some people, the Commerzbank can be the best choice for opening a current account and possibly other banking services too. Therefore, we are presenting here the most important facts that you should know before opening an account.

At the end of the page, you will see some alternatives, so that you can make your own personal decision on a sound basis!

1. Be careful, when a bank pays you money for opening an account!

Whenever someone offers you money – this also includes a bonus or a premium – so that you buy a product, be particularly critical. Even if it is a free current account at first sight, as in the case of the Commerzbank!

Nobody gives away anything!?

The following thoughts come into mind of critical observers:

- If it was the best current account in Germany, then the Commerzbank would not have to pay money for an account opening …

- A bank does not give away money. It will try to get it back through (hidden) fees …

Exactly these ideas are correct!

But! There is another reason that many people do not know: banks often have very ambitious goals in terms of attracting new customers. In order to achieve this, they are sometimes or occasionally willing to pay high advertising premiums. These are paid from the marketing budget and must therefore not be covered (immediately) by the new customer.

By this, you can profit from the bank as a new customer when you take advantage of the offer … especially if you thought of opening an account at that bank anyway.

The truth is: there is no best current account!

There is only a current account that fits best to your requirements. Depending on your needs, several current accounts can fit you optimally.

Sometimes, none may fit to 100%. In these cases, people often have two or three current accounts. Due to the high number of free current accounts in Germany, this is not a problem. 🙂

2. Glance at the conditions of the Commerzbank

Please take a look at this checklist to find out how well the current account of the Commerzbank really suits you:

- Permanently no account management fees

Caution: Only applies to monthly incoming transfers of at least Euros 700. If the amount is below that limit, Euros 9.90 per month will be charged. As it does not have to be a salary payment, the minimum incoming transfer can be made from another bank. - Free online banking and banking app

Although you can do your banking online, you can additionally use the numerous branch offices of the Commerzbank. A transfer on a paper form is as cheap as an online bank transfer: Euros 0. - No fees for transfers

This applies to all transfers in Euros in Germany or to any other SEPA-country. The classic international transfers or transfers in foreign currencies are subject to charge. - Free cash deposits and withdrawals

You can use the ATMS or the staff at the counters in any German Commerzbank branch office for cash deposits and withdrawals. This service is free of charge. Using the EC-card (debit card), you can withdraw cash free of charge at about 7,000 ATMS of partner banks (Cashgroup) in Germany. - Free bank card

The Commerzbank Girocard, often called “EC-card” (debit card) is included free of charge in the current account. With this card, you can withdraw cash or make cashless payments.

If you agree with these points, then, of course, there is nothing to stop, if you take a start balance at the account opening or possibly additional bonuses. Here you can find the link: www.girokonto.commerzbank.de.

3. The big advantage of the Commerzbank

… are the numerous branch offices in Germany!

I know that not everyone appreciates bank branch offices and I myself must admit that I mainly use the machines of the branch offices outside the opening hours (to not become a victim of a sales pitch). 😉

Deposit machines and banking terminals in the branch offices

That I love the deposit machines of the Commerzbank, I have shown in this article about the direct bank subsidiary Comdirect in a video clip: How to deposit cash.

However, not all people are like me, and secondly, a branch office can make sense, if

- one has a problem and a personal clarification seems more appropriate than through a call centre,

- one wants to deposit cash,

- one wants to withdraw larger amounts of cash,

- one wants to have a bank safe / security box,

- one prefers personal advice.

Not every branch office looks so modern like this “flagship” branch office in Berlin. However, the Commerzbank has a program to modernize its branch offices gradually.

Although opening an account in the branch office is possible, I would prefer the online account opening. Why? You will find out in the next section.

4. The opening of a current account

As mentioned above, I prefer the online account opening! If you now decide to open an account, you can completely open it within 5 to 10 minutes. The production of your EC-card starts and you will receive all welcome documents in a few days by mail.

You neither had to get an appointment in the branch office, nor schedule additional time nor had travel expenses … isn’t such a modern way of opening an account brilliant? Okay, or at least very pleasant. 😉

Start the online account opening

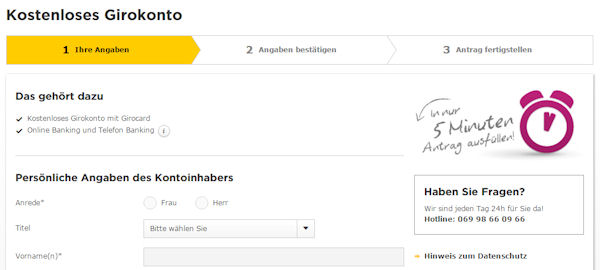

Go to the information page of the current account ► www.girokonto.commerzbank.de and click on the yellow button “Jetzt Girokonto eröffnen“ (open current account now) to access the application form:

If you have a question about filling the application of the account opening, you can find help by phone every day of the year, also on weekends.

Please note that the current account can only be opened online with a place of residence (registered address) in Germany. If you are a German expatriate or currently abroad, but have an address in Germany and can pick up the mail later or forward it, then it will work in most cases.

If you do not live in Germany, but are interested in opening a bank account in Germany, then please take a look at this page: Open a current account in Germany.

Legitimating

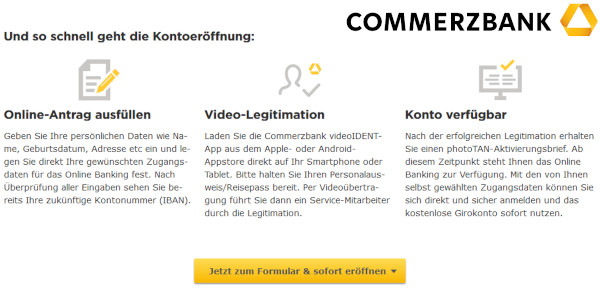

After filling the online application form completely, you will be asked to legitimate yourself. This means that the bank will check your personal data through an ID-card or passport. This is required by law.

There are two possibilities:

- Legitimating through an employee of the Post

For this, you print the PostIdent-coupon or download it on your Smartphone and go with it to any post branch office in Germany. The post staff will write down the details of your identity document. Then, you confirm the correctness with your signature and the document is sent free of postage to the Commerzbank. - Legitimating via video chat

In this modern identification procedure, you hold your identity document in front of a web cam, so that the identification staff can read it. He/she will check the security features through the web cam and take photos of you and the identification document provided by you.

How the legitimating via video chat works:

Account opening completed!

5. Variants of the current account

5.1 Start-Konto (start account) for young people

Actually, it is the same bank account as described above with the only difference that the account management is free of charge without deposits. From a monthly deposit of Euros 300 and good creditworthiness, one also gets a free Visa Card.

The Start-Konto is for young people between 18 and 30 years, if they are still in a training, students or in an internship. Proof is required!

Here you can find further information and the account opening: www.startkonto.commerzbank.de

5.2 Business Account

In Germany, private accounts are – as seen above – often available without a monthly fee and no extra costs for bookings on the account. However, the situation is different for business accounts (also known as commercial accounts). There are usually fees for the account management and all transactions. Also at the Commerzbank.

At the Commerzbank, one can open business accounts for

- self-employed and freelancers without entry in the commercial register

- companies with entry in the commercial register (e.g. UG, GmbH, Aktiengesellschaft, e.K.).

Opening an account in a non-German legal form, e.g. Ltd. or LLC, can only be done through a branch office. All German legal forms and individual entrepreneurs with the company headquarter in Germany can apply for a business account online.

Find further information and the account opening here: www.geschaeftskonto.commerzbank.de

6. Further banking services

6.1 Instalment loan

The instalment loan – often just called loan – is in great demand at the Commerzbank. This has a reason too: the Commerzbank has a very modern application way for loans of private persons.

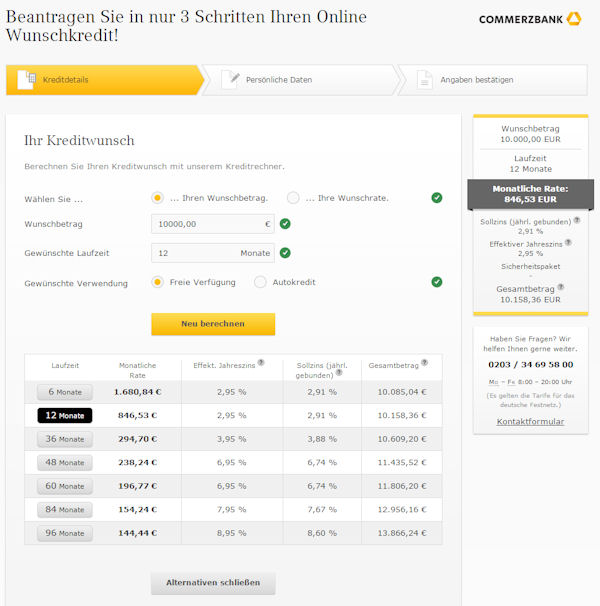

First, one selects the amount of the loan and in how many monthly instalments one wants to pay it back. The interest rate and the monthly payments are immediately displayed. Clever bank customers like to change the duration in order to calculate the best interest rate or a well payable monthly rate.

The Commerzbank aids future borrowers by the button “Alternativen anzeigen” (show alternatives). By clicking on it, different durations, the interest rate, the monthly rate and the total burden are displayed. A nice comparison!

Calculation tool for the appropriate loan. Very easy to use. On the right, the phone number of a hotline is shown, which helps to fill the online application.

Once you have decided on a variant, the application process is similar to the one of the current account. In this case too, the legitimating is required by law. This can also be done via video chat and has the advantage that the loan is paid very quickly. In the best case, already after 3 to 4 days.

Money-back-guarantee in a loan?

If you are not satisfied with the loan (for whatever reason) or you no longer need the money, one can return the loan within the first 30 days free of charge and interest. You simply transfer the entire loan amount back to the bank account of the Commerzbank. Case settled! Great, isn’t it?

You can read further information and the loan application here: www.ratenkredit.commerzbank.de

6.2 Financing of construction

One cannot only get “small” loans at the Commerzbank, but finance real estate from the empty lot to the multi-story residential and commercial building. Different purposes are financed from the initial construction, purchase of an existing property, renovation and modernization work, up to the (expansion) construction of your own plans.

Interestingly, one can apply for the construction financing even with large amounts from the online application to the payout completely without branch office (only online). Who needs advice or help when filling the online application, can take advantage of the hotline.

Further information and the entry form for interest calculation here:www.baufinanzierung.commerzbank.de

Preliminary conclusion

The Commerzbank is the second largest private bank of Germany. It provides banking services for nearly all purposes. On this page, we have reported briefly on the most frequently used features of the current accounts and business account and about loan and real estate financing.

The big advantage of the bank is the combination of branch office and online portal!

Nowadays, many people become customers of the bank through an online application, but to clarify issues or problems, they visit the branch office. This is good and legitimate!

As seen on this map, the Commerzbank operates almost everywhere on earth. The information about account, card and loan on this page, however, refer to the German market.

Alternatives to the Commerzbank

-

Deutsche Bank

The Deutsche Bank is the largest German private bank and the classical competition of the Commerzbank. From the perspective of the customer, the offerings for private customers are similar. Larger service differences can be found in the comparisons to the two following direct banks.

-

DKB (Deutsche Kreditbank)

The DKB wins most customers through its free current account, because it always includes a true Visa Card. With the Visa Card, one can withdraw cash free of charge around the globe (also free of charge in foreign currencies). This internet current account is very popular in Germany.

-

Onlinekonto of PayCenter

Perhaps this is somehow an unusual offer: PayCenter is a provider, where you have to pay fees for the account management and account usage. This circumstance has an important background: the provider earns good money since years. It does not matter whether you use the account or not. That gives you two important securities:

- your account won’t be cancelled, if you use it “too much” or “too little”.

- account and provider remain permanently in this form (= virtually a guarantee of existence for the account).

The account opening is possible with a place of residence in Germany or abroad. There is no creditworthiness check. No Schufa query. No Schufa entry. The account can be used as a business account (corporate account). Soon, the online banking will be available in English too. The account opening is possible within 2 minutes: See all information.

-

N26 bank

The latest account on the market is the free current account, which has been specifically developed for the Smartphone use. Unlike the Commerzbank, an online account opening is possible from several other European countries. The bank card is sent from Germany to other countries.

The account of N26 is often opened as a secondary account. If you have a few minutes, you should definitely take a look at the conditions and the purposes of use: N26 – the most modern current account of Europe.

What do you think of the Commerzbank? Are you already a customer?

The comments box is activated for smart bank customers in order to share their experiences. Many thanks for reading this page until the end. 🙂

Pictures: Commerzbank AG

Hello,

Currently I’m using the Giro Card Maestro in Commerzbank and it’s very difficult to buy online tickets / booking hotel (Airbnb) or flight.

So if I want to open a debit VISA / Mastercard card, what is the fee and is there any requirement for this?

I only live in Germany for next 3 months.

Also, my colleague will come to Germany every 6 months to work for BOSCH, so I want to know which one is suitable for us. Most of us are using English only.

Thank you so much 🙂

Hello,

you will probably not have much luck with finding a German bank willing to open an account for only a 3 months duration.

I fear the most viable option might be the one to use the card from your country. Sorry 🙁

Hello,

can we have overdraft limit in commerzbank and what will be the charges.

Hello,

everybody who opens up an account online will be assigned a local branch. The people in that branch are the ones responsible for an overdraft agreement. Good luck!

Hello,

I am British citizen living in the UK and I will be starting a PhD in Germany in September. As a student, I am interested in the StartKonto account. Am I able to set up this account online from the UK using the video verification service like the GiroKonto account?

That could be possible, if you use your new physical address in Germany. The Commerzbank don’t send post and cards outside Germany for new clients.

Hey,

I have been charged today 300 Euros which as been taken from my account. I got salary today. I earn 1200 euros and this bank charged me for 1/4 of my salary.

It is my 2nd month in Germany and 2nd month in this bank. I used to work in a bank in Poland but I’ve never heard of charges that would be that high, even for messing up SEPA transfers or having an overdue balance on the credit card…

I did 4 transfers from Commerczbank to Polish bank mBank, from account in Euro to account in PLN. Is it possible that the charge comes from these transfers?

Can someone help me please.

Hey,

it would be the best if you make that enquiry directly at the bank branch that is in charge of your account and ask them for the reason. From our perspective, we don’t have the means of knowing the background of this matter and reason for this charge.

Hey,

Thanks for the reply. That is what I did. The charge was an automatic payment towards credit card’s negative balance. It was taken automatically and I was not aware of such functionality, thus the concern.

Have a good day!

How about the credit card at Commerzbank? Is it easy to get? I just opened an account with them, and I would like to have a credit card as well.

“Easy” is of course a relative word, so I can neither say “Yes” or “No” to that. Commerzbank cannot give me any information on another person’s behalf, but recommends a personal discussion of this question in on or their local branches. If you call to arrange such a discussion, you might even have the possibility for an English language service. The granting of a credit card very much depends on the individual circumstances of the account holder, therefore I cannot give a general answer here, sorry.

As a side note:

With DKB, a credit card is standard when you open an account with them: https://www.deutscheskonto.org/en/dkb/

Thanks for your response. Yes, DKB was my first choice, but they rejected twice, they’re too picky, so I went with Commerzbank, which I like so far.

Could someone tell me who much is the maximum withdrawal limit for the Commerzbank debit card for a day or week ?

The standard cash withdrawal limit is 2000 EUR/day and week, i.e. you can withdraw up to 2000 in one day, but then you have already reached your weekly limit as well.

You do have the option to change your limit to 5000 EUR daily and 9500 EUR weekly, but in order to do you, you need to go to a local Commerzbank branch in order to personally sign this request.

How much money can I withdraw when I visit my branch

That depends of the size of the branch. If one announces the required amount at the bank in advance, one can theoretically withdraw a suitcase full of money.

I have a question regarding account management fees. It’s said that I need to have incoming transfer of at least 1200€ per month if I want to have this account for free. But does it have to be one transfer of this amount or it’s a sum of all incoming transfers (e.g. one of 600€ and the other also of 600€)?

No, the amount of 1200 EUR does not have to come in one sum in order to qualify for being free of charge. The 1200 EUR requirement refer to the sum of all monthly incoming transfers.

Hello;

Is it possible to use online banking of CommerzeBank in English?

Thank You

Commerzbank does not offer any English language online-banking.

Actually they do offer an english option to their desktop online website. I use it all the time to pay bills. It is fairly new.

That is a great information 🙂 Thank you very much!

Does a student over 30 years old have account management fee?

I am going to be in Germany for 2 months for an internship at BMW. I want to open a bank account and I am also willing to pay a monthly fee if required. Incoming deposits will be more than €1200 per month. Could you please a bank I can visit which shall be willing to open a bank account for me?

That depends on the service and conditions you would like to get. Bank does not equal bank. Since we are no consultants, but simply an online magazine, we can only recommend for you to surf our site and read about the various possibilities. We wish you a great time in Munich.

Is it 1200 incoming transfer or 1200 balance? In the first case, I only need to earn 1200€ and make Commerzbank my salary account, but I can spend them all. In the second case, I’ll need to have a 1200€ balance in my account to avoid account fee. Please clarify.

Incoming transfer.

Does anyone knows how much time it takes to legitimate the identity for opening a new account using the Deutsche Post?

Many thanks.

3-4 minutes at the local post office. Often, the information is transferred from there to the bank electronically. All very efficient 🙂

Thank you for the reply Gregor.

I must say that in my case it took more than three day… I went to the post office Monday after work and receive an email confirming the opening on Thursday. I could only log in via app on Friday..

I was also assuming it would be faster since at the post office the clerk entered all of my data on a computer but had to wait for some manual confirmation, I guess.

Anyway I got my photoTAN the following Saturday via mail so not so bad 🙂

How long does it usually take for Commerzbank to send you your ATM card? It’s been almost three weeks since I opened my account. I’ve received all other mail from them but I still don’t have my ATM card. And they are extremely unresponsive to my emails/SMS messages.

Oh, that’s definitely too long. It’s best to go to a local branch and ask for help. The Commerzbank is not a direct bank, even if you open the account online. One is assigned to a local branch. These vary a lot re. their customer service, especially with accounts that were opened online. Best of luck for meeting a good person who will help you.

I want to open an account in Commerzbank. Will I be charged if money is transferred in or out of my account abroad? Like if I receive money from an American account or transfer money to India?

Yes, of course. The bank performs a service and charges a corresponding fee. You can find the details in their catalog of prices and services.

Hi, what will happen if a direct debit payment has tried to be taken from a Commerzbank but the funds aren’t available for it to be taken? Will it just be cancelled or will the bank keep taken the payments making you overdrawn? I can’t see any information about this online in English. Thank you

Yes, but there may be a processing fee. The processing is of course more expensive than the fee itself, and that’s why banks don’t like it that way. It should not happen on a regular basis.

Hi Richard,

I’m an expat living and working in Germany. Firstly, I really love this website! Is by far one of the best bank accounts websites in Germany!

Second, I have a 0-€ Konto in Commerzbank. It’s means it’s “free” at least if your salary is there, but I was thinking to switch my salary to DKB after read the reviews and for the visa Card (I have only a EC card from CoBa, really sad after 4 years with them). I’d like DKB as my main account BUT I don’t want to close my CoBa account and I don’t want to pay monthly fees just to be used as a secondary account. Do you know if it’s possible to switch accounts between CoBa accounts (from my 0-€ Konto to Kostenlos Konto for example).

Danke!

Yes, you can change the account model at Commerzbank, but whether you can do this via telephone or need to visit one of the local branches, that I do not know. You will manage :). For the future, wishing you many good experiences with both banks!

Hi,

I tried to activate my online account a few days ago. Today I got a call from customer service, thought it must be the online stuff but the girl was only giving some info about the local branch. She’s talking too fast for me to understand so I asked if possible in English, she said no and hang the phone. I’m not sure what she’s trying to tell me or I would get another call (probably not). Was it part of the process to activate my online account? shall I go to the branch? It could all be done online that’s what I understood?

This is a bit strange, because you don’t have to activate your account or card at Commerzbank. Everything is delivered so that you can start using it straight away. But please remember: This is a local branch bank that offers a free checking account. What does the bank earn? They try to cross-sell, getting people to the store to sell them more products. Since she realized that this would be difficult in your case, she hung up. So you don’t need to worry and you can just use the account. That should work. 🙂 Best of luck!

Hello I would like to open a salary account with Commerzbank, could you please let me know if there are any charges applied and will there be any maintenance fees for the quarter or annually. Basically, will this be a free account?

The account currently has no monthly account management fees, regardless of whether a salary is received or not. Some leading German banks have started to forego fees or introducing better conditions when there is a monthly receipt of money (regardless of whether it is salary or from another source). It will be interesting to see in the coming months, which banks will adopt this model. Internally, the industry seems to have agreed on 700 Euros per month. This is usually covered by a salary account, but it prevents those people from opening accounts who don’t really want to use the account – or otherwise the bank covers their costs through monthly fees.

Personally, I assume that Commerzbank will continue to have attractive offers for attractive customers in the future.

Hello

I live in the US and I want to know if I can open an account at Commerzbank. I have business partners in Germany that bank with Commerzbank in Germany .. it would be great if I would be able to have an account there here in the Us

Please advise!

Commerzbank does not open accounts fpr people living abroad. I a US citizen lives in Germany for a limited time and then goes back to the US, they can get/keep the account.

What about freelancers? Can I apply for Privatkunden Girokonto or I have to go with Geschaftskonto? Income under €2000.

Thanks!

As a freelancer, you can open a private current account – but you can only use it privately. For business use, a business account is required. Commerzbank offers both, so that you have an overview of both accounts with just one login.

Hello,

I currently have a Start Konto, as a PhD student, and a corresponding Maestro debit card. However, this card is not very handy for online shopping (plane tickets in particular) or in some other countries, so the employee I talked to suggested getting a VISA card. However this is a credit card (which I don’t have to pay for additionally as I am a student). Is there an option at Commerzbank to deactivate this credit card they made and obtain a VISA debit card instead, linked to my Start Konto?

Kind regards!

Hi there,

I have my Deutsche Bank account, and I would like to transfer it and apply for a new account in Commerzbank.

Does the Commerzbank facilitate all the transferring information and documents from Deutsche Bank?

My Deutsche Bank is my salary bank account, in that case, does the Commerzbank also disseminate the information to the HR department that I have now an account on their company?

Thank you and have a nice day ahead.

There is a statutory account switching service. Every bank has this (yes, must have). Overall, they are doing pretty well, but with millions of different payees and numbers, manual post-processing can still occur. However, you can see that in the process. Best of luck switching accounts

I am looking for one stop bank depot, credit card, giro, and in the future credit for House. DKB is not a chance since I was rejected even though I have above-average salary. Is Commerzbank bank that can fulfill everything?

Yes, Commerzbank does meet the criteria you mentioned.

Which Banks or ATM Machines in Germany and EU, will allow me to make deposit or withdraw cash, using my Commerzbank ATM Card – without a fee??

Deposits at all Commerzbank deposit machines in Germany. Payouts at all Commerzbank payout machines + machines in the “Cash Group” network in Germany. Please keep in mind that Commerzbank is a German bank. In Europe there are nation states that cannot be compared to the states in the USA. That is why the EU cannot be compared with the USA in terms of banking conditions. You also asked for the lowest Commerzbank card. Commerzbank has higher-quality cards with which you can withdraw money abroad (including other EU countries) free of charge.