Open the DKB as a secondary account and use it meaningfully with overdraft facility!

Of course, I am a fan of the DKB and use its account since 2004 as my main bank account. However, there are people, who already have a good bank account and only want to (provisionally) open a secondary account at the DKB and use it. For you, this article has been divided into 3 acts.

Act 1: The account opening

The account opening is a pretty easy job, because the DKB has optimized this procedure since years in a manner that there is the least possibly amount of cancellations and therefore, it gains the highest possible amount of customers.

The DKB now has about 4.5 million customers and it wants to reach 8 million customers in the course of the current target planning.

So let’s help the bank by opening a (secondary) account!

You can find a step-by-step instruction on the account opening here and to what you should pay attention to during the data entry here. As I said before, it really is simple.

Start the procedure:

If you want to peek into the conditions and experiences with the use upfront, then please click here.

Act 2: The account setup with overdraft facility

Some perhaps do not want to have an overdraft facility, because they do not want to encumber themselves with debt at a bank. This is a respectable thought!

However, some banks “work” especially well, if you at least give yourself the possibility of having a debt there. That also applies to the DKB!

You can have a balance of one million Euros in your current account, but without an incoming salary transfer, you do not get a higher creditworthiness of Euros 500! Having such an asset, of course, you do not need it.

Nevertheless, the DKB grants you with a true credit card (in contrast to the main competitor ING), and the DKB Visa Card has its own credit card account separate from the current account. This bears many advantages, as you can read here.

The credit line of the Visa Card is Euros 500 (account openings from abroad Euros 100) as a standard. Your creditworthiness does not matter in this context. It only has to be sufficient to be able to open the account.

Increasing the credit line

Increasing the credit line is easy, but includes a little effort. You arrange to have your salary transferred to the newly opened account at the DKB. After the second incoming salary transfer, you apply for an increase of the credit line. A maximum of 3-times the transferred amount of salary is possible.

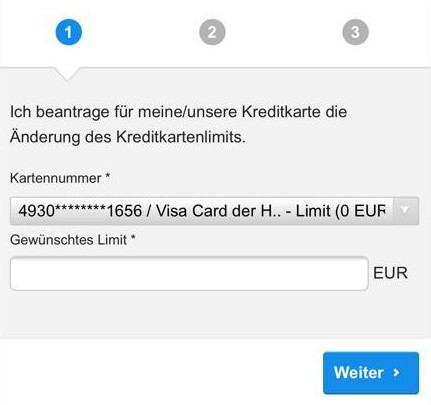

Changing the card limits can comfortably be done through the app, using the tab Service => Limite und Dispo (limits and overdraft facility) => Kartenlimit ändern (change card limit). The path is the same using the online banking on the computer.

Example: If you have a transfer amount (salary payment) of € 2,800, then you enter € 8,400. So 3-times the amount! If this seems to be too much for the DKB, then the bank will suggest you a lower amount. In any case, it is better to try a higher amount first. You can lower it at any time, but increases are always evaluated by the bank.

Act 3: Cancellation of the salary transfer

As soon as your new increased credit line is completely set up, you can change the salary transfer again to where it was transferred before.

The credit line on the Visa Card and the overdraft facility on the current account will remain!

Of course, you can also save yourself from the effort with the temporary salary transfer and use the popular DKB Visa Card only with the credit line of Euros 500. The overdraft facility can be increased by transferring balance to the credit card or by setting up a monthly standing order. You can find an instruction for this here.

However, being part of our smart bank customer community – especially people, who implement our account system – we love to use bank accounts best possible. This also includes several credit lines, especially if they do not cost us anything.

In particular, the current crisis has proven again – as our subscribers to the Sunday mail know – that it is meaningful to get bank products when you do not need them (yet). When you need them, it could be that you are not in the best phase of your own creditworthiness.

This is why I plead to you:

Open your secondary account today at the DKB!

This, of course, is for those readers, who are not yet DKB-customers. If you are a DKB-customer, then you can recommend this article to the people in your circle. A sincere thanks!

The DKB is a bank on which we can count on after the crisis. There is a bunch of candidates that won’t be there for you and our Federal Chancellor said, “We are only at the beginning …“.

How about your personal finances?

Gain an overview, or, if you already work with our net asset statement and the account diagram, update it now.

Complement – where not already done – your bank accounts with first-class products such as the DKB as the secondary account and of course also our proven and free credit line.

What are your ideas?

Participate in the conversations through the comments feature. Perhaps you already know the weekly raffle in the Sunday mail and occasionally, we include your ideas in the corresponding Sunday video.

A hearty thanks for the wonderful commitment of our community!

BTW: About the meaningful use as a secondary account!

Plea to the community: Who can report a little about the meaningful use of the DKB as a secondary account? Travel account? Account for eBay? Account for expenditures in the context with a hobby?

I love reading about the ideas and experiences that are gathered in the comments. A sincere thanks to you!

These are my favourite features of the DKB:

- unconditionally free account management

- free Visa Card + Girocard

- limitless free cash withdrawals within Germany and abroad from a minimum withdrawal amount of Euros 50

- no foreign transaction fee

- comfortable management through online banking and app

- … and perhaps for you ► easy account opening ✅

DKB: The best account with card for me for every day expenditures + journeys abroad. Thank you, DKB!

Which points are your favourites or do you particularly like to use?

Complementing pages:

- Loan at short-term work? Apply here.

- Account opening: Comdirect, DKB or ING?

- Open a secondary account abroad

Leave a Reply