New Barclaycard Visa: Now better?

Barclaycard discontinues the for many years successful and repeatedly rewarded Barclaycard New Visa. Its successor is simply called Barclaycard Visa and is elegantly black. But…

Attention: considerable change of conditions!

Old and new card in a comparison

| You can see the pictures of my own cards, because I use them myself and report of my own experiences. This is more authentic … |  Barclaycard Visa New applicable since 2nd of August 2018 ► ✅ |

Barclaycard New Visa Barclaycard New Visa(only available for existing customers) |

| The most important differences | ||

| Foreign currency fee (foreign transaction fee) |

0.00 % of the transaction | 1.99 % of the transaction |

| Direct debit | 2–10 % of the credit card balance | 2–100 % of the credit card balance |

| Minimum installment | 3.5 % of the credit card balance, but at least Euros 50 | 2 % of the credit card balance, but at least Euros 15 |

| Full payer option (no loan interest applies) |

• Transfer • one-time immediate debit |

• Transfer • one-time immediate debit • direct debit |

| Partner card (possible for persons from 16 years) |

free of charge up to 3 cards |

€ 10 |

| Fortunately, this remains unchanged | ||

| Annual fee | permanently free of charge! | |

| Withdrawing cash | worldwide free of charge! Anyways, Barclaycard does not charge any fee, but there is a direct fee of supplying ATMs in some countries. |

|

| Interest-free term of payment | up to 59 days! | |

| maximum credit line | € 10,000 | |

| Can the credit line be increased through deposits? | Yes, up to a maximum of € 20,000 can be “charged”. | |

| Card application | ||

| Requirements | Residence in Germany, at least 18 years old and good to very good creditworthiness | |

| Apply for the credit card: |  www.barclaycard.de |

Cannot be applied for anymore. |

| This table was created in the night of the condition change to the best of my knowledge and belief. If you note further changes, then please use the comments feature for the supplements. Many thanks! | ||

What happens to the existing customers?

There is a existing customer protection!

That means for you: Being owner of the Barclaycard New Visa, you will continue to receive conditions that apply until the 1st of August 2018. At the expiring of the card, you again receive a Barclaycard New Visa with the usual conditions.

But if you like the conditions of the new Barclaycard Visa better, then you can switch the product. For this purpose, you call the customer service of the bank and ask for the change. The switch will take place at the next billing run, but needs a lead time of about three weeks. You do not need to rush!

Important to know: Already built credit lines will fully remain and there is no new creditworthiness check! You are already a customer and only switch the product.

By the way: You can assume that the Barclaycard New Visa will be continued as a condition model for the next years up to decades. Nowadays, there are still Barclaycard-customers that have the condition models of the 1990s. This, of cause, makes only little sense, because they still have an annual card fee, as well as a withdrawal fee.

The current condition change will be pleasing for some people, but not for others.

It is good for everyone …

… because you can keep things as they were, or switch, if you like the new conditions better.

Outstandingly done, Barclaycard. This is also a reason why Barclaycard is one of our constantly observed banks! The interaction with us costumers has been proven well through many years!

The new snag of the Barclaycard Visa

… and how to avoid it smartly!

At the Barclaycard New Visa, you can let the credit card balance be directly debited by Barclaycard up to the last cent at the due date. Many of our frequent readers have chosen this option.

By this, one is sure that the quite expensive credit card interest is never ever charged. This is currently 18.38 %.

What’s good for the customer, is suboptimal for the bank.

The customer has a free credit card with a fee-free cash withdrawal around the globe and a safety that he/she does not pay interest. Everything is free of charge for him/her!

Therefore, Barclaycard only earns through the card transaction fees that the payment receiver of the credit card payment has to pay. This fee has been considerably lowered by the EU-law 2 years ago. As a consequence, many bonus programs, such as Miles&More, have been cancelled.

Changers or new customer of the Barclaycard Visa can still use the credit card completely free of charge, but a little more commitment is required.

Two strategies on how to remain interest-free in the future

-

Immediate direct debit

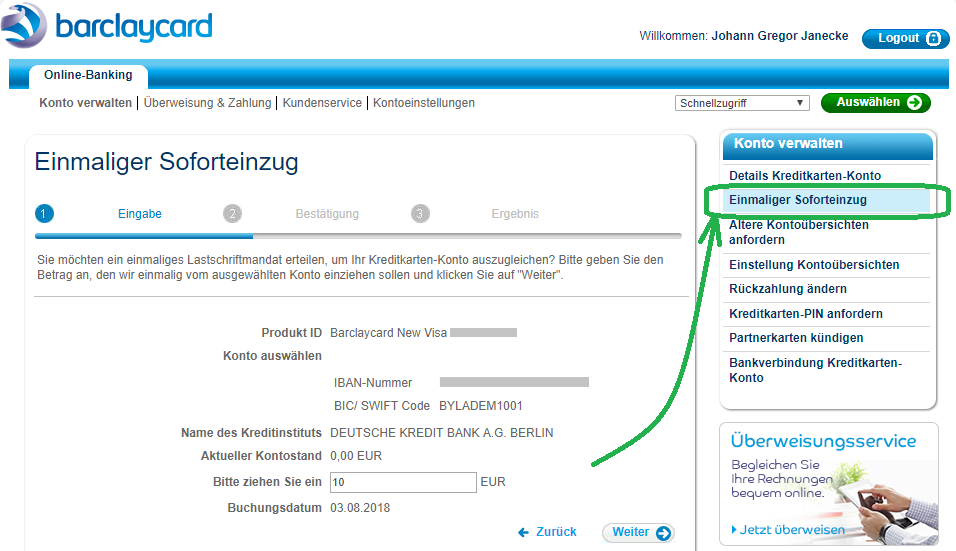

You log into the online banking to Konto verwalten (manage account) and choose the einmaliger Soforteinzug (one-time immediate direct debit) at least 2 days before the due date .

By doing so, you trigger a direct debit of exactly the amount that you enter. You can enter any amount up to the full credit card balance. You can settle the account completely through this feature, so that no interest applies. You cannot recharge the card through this option.

If you decide for this option, it is recommendable to take a note in the agenda as a reminder. If the money arrives only one day late, the interest is charged retroactively from the debit date. This is the less beautiful side and we, being smart bank customers, want to avoid it as good as possible.

-

Standing order

In contrast to the Gebührenfrei Mastercard Gold, the Barclaycard permits to have balance in the credit card account. This is a big advantage and therefore, you can set a monthly standing order in the amount of your average credit card transactions.

This way, you cannot go into the red having average expenses (the balance must be completely paid at the due date in order to keep the interest-free feature), so it is recommended to keep a safety buffer in the credit card account.

One can keep a maximum balance of Euros 20,000. The balance currently does not receive interest.

Why did the bank include this “hurdle”?

Of course, we do not know that, but apparently it is that one counts on less attentive people.

Automatically, the installment in the amount of at least Euros 50 is debited monthly. In percentages, one can set up the direct debit between 3,5 and 10 per cent of the balance. So never 100 per cent, unless you spend less than Euros 50 per month. 😉

One can assume that new customers of the Barclaycard Visa can slip easier into the revolving-loan. And it could only be for some days, because one made the transfer too late.

Then, the interest applies for the term from the transaction. This is an interesting profit-lever for the bank.

No worsening without improving!

On the other side, there is no foreign transaction fee anymore at the Barclaycard Visa. The 1.99 per cent of the card transactions and the withdrawing of cash were a long-time point of critique and was the reason that the card was mainly used in Germany and within the Euro-area.

However, it is paticularly interesting for the credit card provider that the customers use the card outside the European Union, because the fees that the payment receiver has to pay are considerably higher in other countries.

If you use the Barclaycard e.g. in the USA, Barclaycard earns 5-times as much as for payments within the EU.

So that customers use the credit card preferably on journeys, the abolishment of the foreign transaction fee is a smart strategic decision! Especially because most credit cards charge that fee.

In fact, I am a little wondered that it took them so long for abolishing the foreign transaction fee. In an interaction with many committed readers of our special portal, we were obviously able to convince the DKB of implementing this advantage already last year. The report on that.

Advantages of the Barclaycard Visa

- Free Visa Card

There are no annual fees and at a smart use neither other costs apply! - Free withdrawing of cash

Barclaycard does not charge you any fees for withdrawing cash – worldwide! - No foreign currency fee

The foreign transaction fee is 0 per cent and therefore, all card transactions and withdrawals in countries with other currencies are free of charge! - 5-star-security

Protection at card abuse, 24-hours-emergency-hotline, emergency service on journeys, Internet shipping protection, online customer service - Fast and simple online application

Ready for an application or switch?

Nightly video message for our people:

Alternatives to the Barclaycard Visa

Questions? New findings?

Please use the comments feature to supplement and to enhance the article. Experiences of our smart readers are especially helpful for new readers, who join us on a daily basis. A heartly thanks for your committment! Questions are welcome!

Many thanks!

A big thank you to those, who share our article and forward it to acquaintances. The goal of the nightly elaboration was giving you and other smart bank customer the immediate security of the new Barclaycard features …

… and perhaps someone decides to change the conditions or apply for the card as a former non-customers due to this article. You are welcome to share this with me too through the comments feature. A heartly thanks for that. 🙏

Hi, first – thanks for your advices! Now question – I just applied for Barclaycard New Visa via your link here and my application was rejected. I have Schufa index above 90% with 1 year and 4 months bank history in Germany, my income is above German average. Could it be the fact that I recently change my job and also moved to new address – it means I have only 1 month of history in both of this criteria. I am from Slovakia. As Barclaycard is now rejected (also for next 6 months), are there any other similar options? I do not want to create a new bank account, I want to avoid any fees and ideally have automatic 100% direct debit payment of the credit card loan.

From an objective point of view: I can never know why your card application did not work out. I do not sit at Barclaycard’s and have no access to customer data.

Basically, there are a few “hard” rejection factors, and otherwise it means collecting credit points. Depending on the provider, different points are awarded to different facts. If you do not reach the required total score, Barclaycard does not want to enter into a contract with you.

Hi,

First of all, thank you for all the advice we can find on this website.

I am currently considering whether to apply for the Barclaycard Visa or the Santander 1plus card.

By comparing the conditions of these 2 cards, I have not understood if it is possible, with Santander 1plus card, to set up an automatic repayment of all credit card expenses from my bank account, without having the interests charged.

This option is not possible anymore with the newest Barclaycard, if I understood correctly, but it has to be done manually on time in order to avoid interests.

Is it the same with Santander 1plus card?

Regarding this point, the experiences from our community members vary. With some, it works with the automatic deduction, with some not. There seems to be room for individual discretion. The bank will endeavor to have you do the transfer, in the experience that sooner or later interest will be earned on the revolving loan. Like with the new Barclaycard Visa, too.