Viabuy Mastercard with account functions

The Viabuy Mastercard® with account functions is definitely not a card for “everyone” – but for some challenges, it is a more ideal solution than you might think at the beginning of this article …

The Viabuy Mastercard is available in two versions: Black and Gold. The conditions and functions of both cards are the same.

On this page, you will learn the features of Viabuy. You will also get some tips and tricks on what special features are available and how you can use them cleverly. Let’s start with an overview of the most important conditions.

Summary of the most important advantages:

- Prepaid credit card with high embossing in a fancy design

- Fee-free charging through transfers

- Kontofunktionen: transfers, incoming payments

- Up to 3 partner cards are possible

- Use as business account is permitted

- Low fee of Euros 1.66 monthly converted from the annual rate

exclusive of the one time fee of Euros 69,90 - Easy online application without need of evidence

- Card delivery within 24 hours.

Go directly to Viabuy: https://www.viabuy.com/

Summary of the most important disadvantages:

- 2.75 % foreign transaction fee at payments in foreign currencies

- Euros 5 fee for cash withdrawals at ATMs.

Why Viabuy can still be very interesting!

As mentioned above, Viabuy is not interesting as a card for anyone. For example, quite some of our smart readers like to travel and often withdraw cash abroad. For this purpose, the DKB simply is the number one choice.

Let’s take a look at the possibilities of use, where Viabuy can be an ideal solution.

-

No creditworthiness check

Since Viabuy works on a credit basis, there is no creditworthiness check. You do not have to fear a rejection of your account opening. No matter how good or bad your creditworthiness is, you will definitely get the Viabuy Mastercard.

Thanks to the sophisticated design in black or gold and high embossing, one cannot visually distinguish the Viabuy Mastercard from a “true” credit card!

-

Account is not entered at the SCHUFA (German credit investigation company)

With the Viabuy Mastercard, you currently receive a German bank account number (IBAN). This bank account is not entered at the SCHUFA or other data services. Only Viabuy, you and the person to whom you pass on your new account number will know about the bank account.

You receive a DE-IBAN

-

Practical protection against account seizures

“Viabuy” is the brand name. The issuer of the cards is the British company PPRO Financial Limited. In practice, account seizures almost never happen to non-British citizens at British providers.

-

Use as business account

Viabuy explicitly allows a business use of the account and the card. Now, compare the converted Euros 1.66 per month for account and card with what business accounts usually cost, if you even get one!

The comparison is somehow disparate, because the account functions at Viabuy are limited to incoming and outgoing transfers. However, these are the most frequently used features of a business account and these already help a lot of self-employed people.

The card can also be issued to legal entities (GmbH, Ltd.) (additional form).

Particularity: You can choose the name of the cardholder of the first card as well as the one of the partner cards freely. You can, for example, get the card issued on your company name or even your nickname! 21 characters are available for your individual name.

Which name would you want on the card?

Note: If you choose a different name already for your first card, then the issuance of the card may be delayed. Of course, Viabuy checks whether rights of others are violated. However, you can see that the issuance on another name is possible on my own card!

-

Business account in Germany or the Euro-area

From our portal experience, we know that there are many small and large business owners abroad, who need a local bank account for an expansion to Germany/Euro-area in order to receive payments from customers. Viabuy is a really interesting option for this purpose!

Viabuy can be applied for from more than 30 European countries and is available in German language, in addition to eight other languages.

Account opening from the European abroad is possible

Moreover, one does not have to travel to Germany to open the account! The account opening takes place 100% online. The identification documents can be submitted online.

-

Use as an emergency account

For cautious people or the ones that want to create a “plan B”, Viabuy can be an interesting option. You get a Mastercard for reasonable costs with which you can withdraw cash or pay cashless around the globe. One cannot recognize that it is only a prepaid card.

You can park a money reserve free of interest (= no income is subject to tax → not report to tax authorities) in the account. In an emergency, you can use the card for withdrawals and payments or even make transfers through the account functions!

Doesn’t Viabuy offer more than one would have thought of the inconspicuous web presence?

What you should know, before you apply for the card!

1. Charging options

The simplest and most of all fee-free option for charging the card and account is the bank transfer. You receive the bank data automatically and immediately after the online application.

Moreover, there is the opportunity to charge with an instant transfer, Giropay, with other credit cards and various other foreign payment providers. However, these are subject to a fee.

A maximum of 3 charges per day and a maximum of 60 per month are possible. Please note this, if you plan to use the account for business. 99 percent of corporate customers, who know this rule, get along with it well.

2. Card activation and advance payment of the fee

As you have probably already read above, the monthly fee for card and account management is converted only Euros 1.66.

Since most costs incur for Viabuy during the provision of the card (order process, card issuing and shipping), the company charges the fees for the first year in advance. In the price list, you can find the advance payment as an “activation fee””. Please note this at your first deposit.

From the 4th year on, the fee is charged annually (Euros 19.90).

3. Credit payments from third-party accounts

Credits from own accounts as well as through numerous charging options are immediately available for further use.

This is different at credit payments from third-party accounts (= current account with a different sender name as your name). These payments are shown as an incoming payment on the online account statement, but you can only use (spend, transfer) it after a waiting period of 14 days at its first incoming payment.

If after those 14 days another payment is transferred from the same third-party account, then it is no longer considered as “third-party” and you can use of it immediately. One needs to know about this rule, so that no conflicts occur.

Tip: If you transfer your salary payment to Viabuy as a new customer, you can speak with the customer service and agree on immediately unblocking the salary also at the first payment.

With Viabuy you can transfer money free of charge and as often as you want to other bank accounts in Germany and the whole SEPA-area (Euro). The online banking is available in several languages.

4. Currency

All Viabuy accounts are managed in EUR. Exception: You apply for the account through the Polish language version – there you can choose between EUR and PLN.

The account opening: Completed within 2 minutes!

Applying for the Viabuy Mastercard is super easy and done within 2 minutes. For this, please go to the website of the provider: https://www.viabuy.com/ and then click on “Get Your Card”.

Now you decide for the black or golden version (the features and conditions are the same). Then enter your contact information and click “Submit”.

You will be informed via e-mail about your account opening and at the same time, you receive your new account number in order to be able to perform the initial deposit.

Card delivery within 24 hours

Your Viabuy Mastercard is sent to you parallel – within 24 hours.

“Apply for Viabuy now”

Questions about Viabuy?

Of course, I have also ordered the Viabuy Mastercard and use it to make own

Our regular readers know and appreciate this sincerity and authenticity. Perhaps, you will even become a recurring reader and enrich this page with your personal experiences, tips and tricks.

For this – and of course, for questions on applying for and the clever use of Viabuy – the comments box at the end of this page is activated.

When one charges the Viabuy account through credit card, almost no information is visible, as seen at the following transfer statement:

For charging, I have used my DKB Visa Card.

Should you do that?

Well, bank transfers are free of charge. Until the money arrives at Viabuy and is fully entered, it takes about one day (you get a free notification via e-mail, as soon as the money has arrived).

When charging through a credit card, the money is immediately available at the Viabuy account. However, this payment method costs 1.75 per cent in fees.

During the transfer, the Viabuy-IBAN and the account holder data is saved in the issuing bank, however, at the deposit via a credit card, this information is not visible.

This is just an intermediate message of my own experiences, while testing our newly added provider. 😉

I read you get a personal IBAN when you register. What country is it from?

From Germany. The IBAN starts with “DE”.

That was my e-mail:

If you use the English language, you will get your e-mail in English. 🙂

I have read some bad reviews on Viabuy and questioning myself if to get one or not. Customer service is poor and I have read aome people lost their money they transfered on the card and dont get no response. How true is that cos thats true thats very bad.

I am glad about your post, thank you!

For more than 15 years I have been watching banks, and in all those years I haven’t found one, where there were no negative opinions and experiences. If one is looking for negative experiences, one finds those – thanks to Google – regarding every financial institution. The question is now what one wants to focus on!

If one believes the review portal “eKomi”, there are significantly more people who have made positive experiences with Viabuy. Here is the current review status of yesterday morning

Objectively, the positive experiences are obviously in the majority.

But I have also heard, that some people were disappointed with Viabuy. Mostly, that has occurred in connection with the card fee. These people had overlooked that the card fee is calculated for three years in advance. Per year, that means inexpensive to customary fees of EUR 29.90 for a prepaid card, which is approximately the Sparkasse level. One should consider that one gets the Viabuy MasterCard without a credit check and super quickly.

The company mainly makes money with the card fee, and not with unreasonable credit fees. Due to the payment in advance for the first three years, one gets a balance deduction of EUR 89.70 all at once. If you have overlooked this condition, you probably get up-set and don’t remember that there will be no more fees for the next three years.

If one doesn’t know this, one might easily feel “ripped off” and tend more to actively “paying back the mean financial institutions” in an online forum than somebody who is grateful for a Schufa-free card with account function that works outstandingly.

I myself use the card as well, so I do not simply write from a theoretical point of view, but can give premium advice to our readers, supported by my own experiences.

How can I load my card on western union?

Can I let my salary be transferred to the card?

Yes, this is possible.

Please note that transfers from own accounts are immediately available – you can only dispose of transfers from third party accounts after a waiting period of 14 days. However, this only applies to the first transfer. After the first time, the third party account is no longer a third party account – but a known account. One should know that in order to avoid misunderstandings.

Alternatively, you can send the salary slip via e-mail to the customer service at the first salary payment, so that the money will be immediately available.

From the 2nd salary transfer, everything will work automatically anyway: immediate credit and immediate use will be possible, because the system will now know this transfer account.

There are many people, who use Viabuy as their salary account.

Is it good for students?

That depends on the personal expectations and user habits of students. We have heard that not all students are the same. 😉

Hi, I’m reading all your comments about Viabuy, honestly I’m new customer and I’m sincerely feel very disapointed about them customer support. They do never reply any email and do not provide any phone number. And that sincerely can make anyone worry especially when they hold a big amount of your money and do not give you any feedback without any reason.

Hi,

Due to the holidays and the New Year, it took Viabuy indeed quite longer than usual to reply to emails. In general, the customer services replies within 24 to 48 hours. For the time being, they do not offer any customer service via phone.

Well we are January 19th 2017, so I do believe that the greeting seasons and holiday are behind us but I still need to wait up to 8 days to get a reply. Let me tell you what is my experience of Viabuy.

At the beginning of December I opened an account and credited it a little bit more than the necessary amount in order to get the Credit Card and everything was fine. I did get the credit card and activate it.

After this I did upgrade my account to IDv2 in order to avoid any limit problem and again everything was fine. After this I provided to one of my client who need to paid me the IBAN released by Viabuy in order for my client to send 5400 Euro to me. At this time the problem started.

I received a message from Viabuy on January 5th saying that considering the sender name was different than mine they needed to held the money during 14 days before to release it. I understood it very clearly and that make sense.

But the same message also was saying : “If you prefer not to wait 14 days […] If the transfer has been made from a third party, for example your employer or a public authority, please reply to this email providing documents that prove the source of your funds. For example […]”

This is what I did exactly, I did provide to them : Bank Receipt, Copy of the Invoice endorsed by my client, Copy of the passport of my client etc … After 9 working days I get finally a reply saying that considering it was my first transfer, they was unable to do anything and need to wait 14 days in order to get the money released into my account.

Now it’s already 14 days, the money still not credited into my account, ViaBuy still do not reply and on my side, I still do not have any idea of what going on and who I have to contact

Hi Nicolas, did you solve the challenge? I have asked Viabuy through my “connection” to take a deeper look at this case and possibly contact you.

Unfortunately, mistakes happen sometimes – also in my case. However, it is important to deal with them professionally.

Many thanks for your smart posting here!

How can I charge money from Italy?

The Viabuy-account can be charged via transfer fee-free. In your case, this is a SEPA-transfer. Anyways, Viabuy does not charge a charging-fee. Whether your bank in Italy charges a transfer fee to Germany or not, we cannot know. SEPA-transfers are free at most German banks.

Additional ways to charge the MasterCard are:

These charging possibilities include fees. You can see them in the online banking before charging. If possible, we recommend the charging through a SEPA-transfer, because it is the only one that is free.

Hi Gregor

I’ve recently applied for viabuy and was under the impression that the first 3 years are free and the charges would only start at the beginning of the 4th. But am I right in believing that the first euros 90 you load on your card are in fact charges for the 3years? If so, when I receive the card and don’t load it will that automatically close the account?

Thanks in advance Dawn

Hi Dawn,

With prepaid credit cards it is customary that the fee is paid in advance, not afterwards. That goes for Viabuy as well.

If somebody wants to cancel an order hey have placed online, they have 14 days time to do that.

The easiest way would be to reply to the welcome e-mail with the sentence: “I hereby cancel my card application. Please cancel the order.” (“Hiermit widerrufe ich meinen Kartenantrag. Bitte stornieren Sie die Bestellung.”)

Please also state your 9-digit card-ID with that.

To simply not react, is not a good option.

After all, you have entered into an agreement, and Viabuy have fulfilled their part, which of cause has caused costs as well.

If you don’t deposit any money and don’t react, you have to take into account that the customary way of debt collection is used. So, do make use of the great consumer legislation and write this short e-mail with your cancellation. You’ll be richer for one experience, and the whole procedure has also been completely free of charge for you!

Of cause, it would be the best if you used the Viabuy MasterCard. After all, there must have been a reason for you taking it on yourself to go through the online procedure. And 29.90 Euro per year for a good prepaid credit card really are okay.

Hi Gregor,

Great website!! Unfortunately, I came across it too late.

I had not realized that I will have to pay 89,70€ fees for this card. I logged in to my online account to see if they 100€ I transferred were received and was very surprised to see that I have only 10,30€ left.

I would like to know if like every other contract in Germany, I have the right to cancel it within 14 days and get my 100€ back. To some people it might not seem much, but to me it is a significant amount.

Thank you in advance for your reply!

Hello,

yes – in Germany, you do have the right to cancel such contracts within the first 14 days. You can do that with a simple e-mail to the customer service, or you can reply to the initial welcome message you had received from Viabuy.

Hey I have me card and want to load the first 90 on it so if I do from what I’m reading here the 90 will be took on me for fees or something so in natural fact after I put the 90 then it will be took and in order to use the card I will need to load more then?

Hi. Yes, exactly. As already said above, it is customary with prepaid cards that the fees are being paid in advance. With Viabuy they are, when you calculate them for a year, a bit better than the average, but for the first three years they have to be paid in advance, and then, starting with the fourth year, once yearly.

This means: Deposit the amount you want to use plus the 89.70 € advance fee for the first three years.

Wishing you great experiences with the use of the card and the account functions!

Hi Gregor and team,

first of all, you have an interesting website. One can find out quite a lot about alternatives to the standard banks.

Now my concrete question:

What or which statements can one see in the vice versa case, so if I pay a bill with VIABUY?

Greetings

Markus

Thank you 🙂 So if one makes a transfer from Viabuy to another bank account?

I will make a test transfer today to one of my accounts and publish a screenshot here.

This is how it looks like, if one sends money – German version – the same structure for you, but in another language 😉

I am thrilled, whether the “Rechnungsnummer” (invoice number) is submitted correctly!

Perhaps I have to do the test again, because I have transferred from my private account and this here is the result (screenshot of my German bank account):

The interesting observations:

I have a second Viabuy-account, on the name “DeutschesKonto.ORG”. Anyways, if one looks at the name on the card and this is also shown on the display at electronic payments.

I will make a test transfer from this account too, to see whether my “real name” is stated in the purpose or the chosen fantasy name.

Hello, I want to know the minimum balance I will get after ordering … I hope it is not debit card? I needed fast money for something reason I want to order.

Sorry, this card is nothing for you. It is a pre-paid MasterCard with online account: you don’t get money – you pay money for using this special viabuy services (look article).

I need to load my viabuy card, however when I went down to my bank they didn’t seem to know anything about the card? I asked for a sepa form to fill in and they told me the minimum for sepa transfer is 10 thousand euro is this correct? I am having difficulty trying to figure out how to load cash into it

The easiest possibility is to top up Viabuy via a bank transfer. Viabuy does not charge any fees for that. Since the bank where I have my giro account does not charge any fees for SEPA transfers, this is completely free of charge for me.

It is a bit more complicated to deposit cash, but I have done that as well.

In order to do that, one needs to find a local bank that accepts the cash and makes the transfer. Again, on the Viabuy side there are no fees for this, but of course the local bank will charge a fee for this service. With me, it lately has been something between 5 and 10 Euro.

It is important to state the 9-digit customer number in the field for the intended purpose, so that the deposit can be allocated/assigned correctly. You can find this number on the card in the lower left corner – at least that’s the case for some countries. For German Viabuy accounts, the intended purpose does not matter, because every customer has their own virtual IBAN for their MasterCard.

Hello,

they state in terms that you cannot receive more then 5 payments from different third party in 90 days, it mean that I cannot receive payments from different people every month?

Best Regards

Hello!

Yes, that is correct – but with an addition: Viabuy makes a difference/distinguishes between money from an own or a third-party-account. Per quarter, five further depositing third-party-accounts can be included. Altogether you’d be having 10 in the second quarter and 20 third-party-account-connections after one year.

Disbursements can be done to an unlimited number of accounts.

With these regulations, Viabuy is being ruled out as a business account for some businesses – while others don’t have a problem with this.

Please kindly explain the word… “No general limits for IDV3 Features”?

Many thanks for this good question!

With IDV3 there is no limitation regarding the loading amount. You could deposit millions on the Viabuy card. With IDV2 it’s 15.000 Euro with IDV1 only 1.000 Euro.

But this is not really complete, because there is still the limit of three loadings per day (60 per month) and max. 50.000 Euro per transfer.

Viabuy is in the core a MasterCard with account function – but not a banking account with MasterCard 🙂

Meaning… It doesn’t matter if am the one loading or someone else paying into my Viabuy mastercard. It’s simply unlimited but for a limit of three loadings per day (60 per month)?

Hello,

This is Rob. I have an issue. I have my card now for more

Than a month and it is not clear to me why I can’t transfer money whenever I want. Most of the time I get the message that I cannot transfer money because of the limit.

I have IDV2. Can you explain to me how I can transfer money to my account in NL via Ideal? Cheers Rob

I want to order this card, i want to receive maybe 15 deposits per month and always from other thirt party account, so total 1500 euro per month, always other poeple.

You said that is not possible in IDV2, is it possible in IDV3 and what is procedure to get this level?

If you want to upgrade your account to IDV3 level, the best thing would be to contact the customer service, so they can tell you, which documents (certified by a lawyer or notary, a tax consultant or a governmental organization) they are going to need from you. Purpose of the required documents will be to e.g. explain the origin of your money. One of the requirements for an IDV3 account is also the yearly use of you card beyond EUR 15,000.

I want to increase my level to level 3.

How can I come into contact with the customer care centre?

Waiting for your reply.

Thanks a lot.

Rob Mom

Only via e-mail.

Hi. I ordered this card and havent loaded it in 14 days, so now they asking me to pay 89eur for 3 years + 40 eur from intrum justitia. Is it legal? What can they do if i do not pay the money? Because they know nothing about me, except the name,number, email and adress, where i do not live anymore. I actually want to cancel the card and i live in Netherlands, is it everything to me under the Dutch law?

Hi!

Yes, it is legal for credit card companies to charge fees, it is even customary. Most people get money for working and pay money, when they use other people’s services or products. This is the completely normal economic cycle.

When somebody does not want to be a customer anymore, writing a regular contract cancellation is recommendable.

To „hide“ because one assumes to be safely abroad, is not a recommendable option.

Hi

Has any experience of using this card to hire a car, assuming that you have sufficient balance, normally a hire company will hold a set amount against your card is that possible with Viabuy?

Hi,

The Viabuy customer service has confirmed to us that that works well. You just need to take care of having enough money deposited in the account, since often there is a security deposit between 250 and 450 EUR or USD blocked in such situations.

Hi,

my wife sent a request for this card, but then she changed her mind and the same day sent an email to the company to cancel it. They answered that all was cancelled twice, and now we have the card in our post! How can we be sure they will not charge us? As you have some connection there, can you help us? I am worried they want their money even if we cancelled in time as they sent this card to us anyway. Thanks for the help.

One advantage of Viabuy is that the card is produced super-quickly and often is even sent out on the same day. They can hardly retrieve it from the mail ;-). You can either send back the card or destroy it.

Hi,

I’ve ordered the card and paid for the in advanced fee. The fee is for three years and after that we have to pay 29.99 euros annually. If I want to use it for only 3 years. How can I cancel it or is it automatically expired without cancellation after 3 years. Thanks

Correct – if one does not cancel, the card is extended automatically for another year. If you want to use the card only for three years, you might want to state that to the customer service (via e-mail) and have that statement filed – so that after three years the card contract expires. That should work.

Hi Gregor,

what does merchant see in transaction log when I make a purchase with this credit card? Car holder name or PPro Finacial Limited? thanks

Hi Pietro. Sorry, but since we are no merchants we don’t have any experience that could answer this question.

PPro customer support replied that merchant see both, which is good as identity proof for some purchases, although PPro has paragraph in T&C that you should not use it as identity proof.

Many thanks for sharing that with us! 🙂

Good day!

Is it possible to cash load card via ATM?

To our knowledge, in Germany you cannot do that.

The general free of charge loading options are by bank transfer and the IBAN assigned to your personal card account. There are also the options of SOFORT Banking, giropay, iDeal or EPS.

In order to find out about how to load the card in your country, please log into your account and choose “Load Card” from the options shown at the top of the page. Then select your country from the list for an overview of your loading options. Once you click on the payment method, you can find loading instructions.

Hi,

I had some doubts and I read all the replys here and… still have doubts.

– So, the name of the owner of the card will appear on deposit statements or the nick name or nothing?

– I can only receive 5 depositos from different sources each month?

Thanks in advance…

Hello i have just moved to Germany so not well informed on certain topics ; one being how would i top up the prepaid card without involving my german bank account in the top up process, any shops that i could use ?

Apart from a bank transfer, you also have the options of SOFORT Banking, giropay, iDeal and EPS.

Depending on which country one is in, one also might have different options on how to load the card. You can find out more about that by logging into your account, select “Load Card” from the options on the top of the page. The next step is selecting your country from the list. You will then be shown your loading options.

ok does anyone know what the other options involve I do not know anything about the other options ?

I want to top up not using my personal bank account .

Hi, I live in Germany, and I got my card yesterday and I want to know please, after I deposit [500 Euro] money into the card, can I withdraw small amounts from ATM in Sparkasse or another ATM whenever I want or can I just pay and shop online or supermarket? Thanks.

Yes, you can withdraw cash from the ATM. That is not exactly inexpensive, but there are people who do that.

So I have a little question: is it possible to have more than 15,000 eur in my VIABUY account? Even though the yearly limit is 15,000 eur, I can have 10,000 eur after 1st year and then the 2nd year I can deposit another 15,000 let’s say and then in total I will have 25,000 eur and yet not exceed the yearly load limit of 15,000 eur. Is this possible? Or the yearly limit is the same with the maximum amount of money that can be stored on the card? Thanks for help.

One can even load more than 1 million Euro onto the card … the actual question ist he legitimization. From 15,000 Euro upwards a higher level of legitimization is required. If one needs more financial leeway, one best contacts the Viabuy customer service.

I basically have 2 questions:

1. Do they charge me any fee when i withdraw money from an ATM?

2. What are the requirements to gain the IDV2 level?

1. Yes, 5 Euro, as stated in the article.

2. For the identity verification, usually a valid official photo ID like a passport or ID card should be enough. Exemptions are IDs that have been issued outside the EU as well as residence permits – here, an additional proof or residence/address is necessary.

Hi Are Sepa transfers from third parties instantly available?

We have made efforts to explain the Viabuy process in our article – please have a look at point 3.

Hello I have received a viabuy mastercard and im living in Ireland. Im wondering how can you load or top up your card if you don’t have a bank account? All the names don’t sound familiar such as Eps,Sofort, iDeal etc here in Ireland, Can you top up your card in a shop? Does it have to be online, and through all those mentioned. If so this is the wrong card for me.

Please log into your Viabuy account (online). There, at the tab “Load Card” you can see all possibilities that are available to your in your country.

Hi, I have received my Viabuy MasterCard with the 2th step (dv2) if I will charge it in 90€ can I withdraw 2000€ even if I have nothing in the Viabuy account?

Hi. You can withdraw an amount up to the amount you’ve charged it with (minus fees). This is the simple and proven concept of prepaid cards.

Hi i have a viabuy card from ireland and now i am currently in Germany, can i use my viabuy german IBan & Bic to arrange a new internet provider to take payment from me every month if i give them these payment details

Unfortunately, direct debit authorizations don’t work. This would be possible with this provider: https://www.deutscheskonto.org/en/open-english-account-germany/ – a legitimization from Ireland via VideoIdent should be possible in October/November onwards. An account opening with legitimization in Germany and in English languages is already possible completely.

Attention: Viabuy changes its terms and conditions on the 1st of October 2017. Here you can find the most important details for you:

On the weekend, it could not be clarified, whether the Euros 69.90 are debited at the card opening or Euros 89.80 (so including the first annual fee). We would be glad to get feedback from you. Thank you!

Hi, can you load the card with bitcoins and the amount transfers in EUR to the card? Does viabuy uses bitcoin address, I read on their site, bitcoin loading is possible. How is the process? Thanks

Hello

if I received Money from SEPA and then I Don’t have enough Documents

Does SEPA transfer take the money back from they came?

Most payments will be credited to the online account automatically after 14 days. All received payments can, if so wished, transferred back to the account that had send them. For any further questions, please contact Viabuy directly, as you might need to state your ID for details.

Hi,

I am looking to rent a car in Naples Italy but the rental companies do not accept Debit Cards or Pre-Paid Credit Cards. Do you know if they will accept my Viabuy card and treat it as a normal Credit Card? How can they tell if it is a Pre-Paid Credit Card?

With the VIABUY Mastercard you can pay like with any other Mastercard card, which in so far includes car rentals. You should ask in advance though, whether the particular car rental accepts PREPAID credit cards. In addition, make sure you have enough balance available on the card.

Hi,

I need to make a SEPA payment using my Viabuy card but the company i am sending the payment to have given me a reference code that I must include on the transfer for the payment to be recognised and routed correctly. I can’t see anywhere in the SEPA payment option where to enter the reference number.

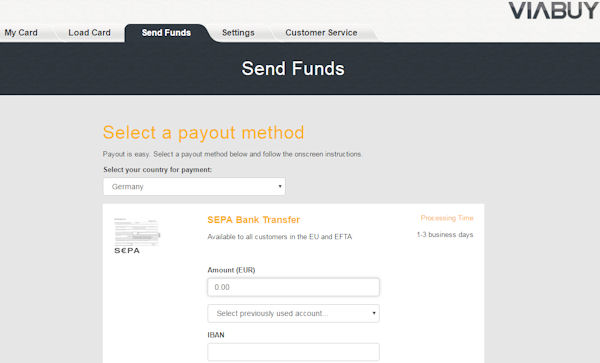

The SEPA Bank TRansfer screen has the following fields:

Amount (EUR)

IBAN

BIC

Beneficiary First Name

Beneficiary Last Name

Payment Purpose

Any advice would be appreciated

Enter the reference code under „payment purpose“. They are simply two different expressions for the same purpose: allocation of the payment.

Brilliant, appreciate your response.

My question

I received my viabuy card and after I failed to activate it with the subscription fee of €90,After 3 months I received a letter forcing me pay a certain amount of €89.80 as a debt or else my the company will take legal actions and the money will have to increase with legal expenses, could you explain to me why this is so?

When you place the order, you enter into a contract for a card (not when you activate the card). If you have ordered according to German law, you can give the card back within 14 days – free of charge and without having to state a reason!

To not activate it and to not get into contact does not work, since these are automated processes. Maybe you would like to contact the customer services via e-mail, in order to find a solution – for example, they might send you a new card (since the first one could not be activated), or you could politely ask how this invoice could happen, despite you having cancelled and never used the card 😉

Good day, I have ordered the card and activated it and I want to deposit 50,000 Euros in it per month, is this possible?

I have a company and I want my monthly income to be included in this card (VIABUY.)

Generally, this is possible. I don’t know if it’s possible for you, because we don’t know each other. The way to a loan is not about getting to know each other personally but via the loan application as linked above

Yes, it is possible. There are some people and companies who do it that way. However, it is advisable to contact Viabuy in advance for such an amount and to announce this one-time amount. Unfortunately, all providers are obliged to be particularly sensitive with such amounts.

Hi, can I add my card to Neteller account and receive payments? Thanks for respond in advance.

Hello! Can I have 2 cards Viabuy with different Iban?

Yes.

Hello

I want to know what it’s the top-up limit for the IDV1.

There is any ID verification for this kind of card? Any papers to support the transactions?

Good evening,

How can I change my PIN code ?

I would like to hear from you please if this is possible.

Sorry, I’ve never heard that it can be changed.

Hello ,if i m in czech and my viabuy was order in romania . How i can add money in my account . Paysafecard are 1000e limit on that.

If i go at a bank with viabuy iban can i added money on my account with transfer bancar at bank? Thanks

Limits IDV1 250 euros and I transferred 300 euros, what should I do?

Hi there, my employer wants to load my card with my wages but they have asked for the bic/swift number. How can I get this? Thank you.

Hi, please someone here can help me ? How can I get a Bank statement of my card please? Because I live in Italy and no way to get it.

Thanks

Hello

I have blocked account in Europe is it possible to open viabuy account

Yes, it would probably have been possible to open an account like this. But it’s a good thing it didn’t happen, because Viabuy no longer exists 😉