How does banking in Germany work?

… and how to optimally use different bank offerings in combination! This is exactly what we will explain to our readers at home and abroad in an understandable manner.

Contents

In Germany, there are banks with branch offices and online banking, as well as so-called direct banks (Direktbanken). These do not have branch offices. Account use and communication takes place only by phone or online.

Since many years, the trend remains that people open a free secondary account at a direct bank (e.g. because they get a free credit card (Kreditkarte)) or completely switch from a branch bank to a direct bank.

Trend towards online banking

Interesting is the division of German banks by owners. So, who owns the bank?

1. Which banks (bank groups) are there?

1.1 Savings banks (Sparkassen)

German savings banks are usually owned by the cities and villages. Formerly, each city had its own savings bank. Over the past 20 years, many savings banks have merged due to the competitive situation.

Although the savings banks have been losing customers since years, they are still among the best-known banks. Often, the accounts are opened, because the savings bank is “on the spot”. Later, when one has to deal with more finances, then there is often a change to another bank that is more cost-effective or offers better services.

There are several hundred different savings banks. They belong to the “public banks”.

1.2 Volksbanken / Raiffeisenbanken (cooperative banks)

This is the next best-known bank organization in Germany. VR-banks – their abbreviation – are cooperative banks (Genossenschaftsbanken). They are organized similar to associations and are owned by their members. Members may only purchase very few shares of the bank, so that no single person is enabled to have too much influence on the business of the bank.

Just like the savings banks, the Volksbanken have to deal with a loss of customers. Although they have many branch offices, they can often not keep up with the price and service of the modern direct banks.

In Germany, there are several hundred different VR-banks. They belong to the “cooperative banks”.

1.3 Private banks

The largest and most famous is the Deutsche Bank. The Deutsche Bank is regularly involved in scandals: there are investigations, raids and court cases. However, it still has a huge customer base. Especially immigrants from abroad prefer – presumably because of the name – the Deutsche Bank.

The fees at the Deutsche Bank are rather expensive, but it offers, in contrast to the second largest German private bank, the Commerzbank, account openings in the branch office also in English language and the online banking is also completely bilingual: English and German.

Moreover, there are quite a lot of medium and small private banks in Germany. The private banks are owned by its shareholders. One may buy shares of these banks at the stock market and one also gets the financial share in the case of success (or failure) of the bank.

1.4 Foreign Banks

On the German market, some foreign banks are actively advertised for customers in German language. In the simplest case, the bank is licensed in another EU-country and serves customers directly via online banking and phone (e.g. the private bank from Latvia) or it has its own branch offices in Germany.

The branch offices were most often purchased in the course of a takeover. So, the Spanish Santander Bank has some in Germany.

Moreover, some direct banks with their headquarters in Germany are owned by foreigners. The best known are ING-DiBa and the Consorsbank. These were formerly German banks that were sold to the abroad.

1.5 Direct banks

Direct banks can have different ownership structures in Germany. In the intensively observed banks by our editorial, it looks like this:

- DKB – public direct bank: DKB is owned by the Bayerische Landesbank and finally also by the German state of Bavaria.

- Comdirect – private direct bank: the Comdirect Bank is owned to more than 80 percent by the Commerzbank. Other company shares are owned by investors, who bought bank shares on the stock market.

- Number26 – Start-Up from Berlin: international investors have given money to establish this bank. Whether it will go to the stock market later on, only time will tell.

2. The current account – the personal money central

The current account (Girokonto) is a personal bank account for daily payments. It is common in Germany to receive salary payments (Gehaltszahlungen) once a month by bank transfer to the current account.

From there, transfers (Überweisungen) for rent, electricity, telephone can be deducted – either by bank transfer or standing order (Dauerauftrag).

A standing order is a transfer, which is executed in the same amount on a regular basis. This is meaningful, for example, for rental payments! Once set up at the bank, one can save the individual transfer each month.

In Germany, debiting (called debit orders) is popular. One e.g. gives a permission to the telephone company to debit the phone bill monthly from the current account. With this, one can save the transfer and the supplier receives the money on time.

Another popular function is the scheduled transfer (Terminüberweisung). The scheduled transfer differs from the normal transfer only in the point that an execution date is set in the future. This is meaningful, if you have a payment period and do not want to pay neither too early nor too late. One simply enters the transfer and let it be implemented on a special “date”. This saves interest and nerves. 😉

These systems already exist since many years. They have proven themselves to be very efficient. At the direct banks that we present on this portal, all transfers, scheduled transfers, standing orders and debit orders in Euros are free of charge!

2.1 Cards to the current account

Usually, a bank card is linked to a current account. This is often called “Girocard”. Depending on the card provider, other terms can be used.

The current account of Number26 can be managed via computer or via app through the Smartphone. There is also a free MasterCard and a Maestro Card included.

Direct banks like to issue credit cards of the type Visa or MasterCard, because they earn through the higher card payment fees (Gebühren) as through the payment by Girocard. The fee is a maximum of 0.3 per cent of the sale’s price (EU-law) and are borne by the payee (= the payment in Euros is always free of charge for you).

There is also the possibility to obtain credit cards without a current account. You can find out more here: Credit cards in Germany.

2.2 Requirements, account opening and online banking

Almost every German citizen over 18 years has one or more current accounts. Since there is a variety of free current accounts, it is easy to open such a bank account.

The account opening (Kontoeröffnung) takes place either in person in the bank branch office (e.g. savings bank, Volksbank, Deutsche Bank) or at direct banks online with legitimating (Legitimation) by the German post (PostIdent) or via a video camera.

It is statutory that the personal data must be clearly proven at any account opening, for minors (in Germany under 18 years) also the personal data of the parents. Not all banks offer a current account for minors.

Bank account possible for children

At the Comdirect Bank, children from the age of 7 can get a free current account with Giro Card and Visa Card, as well as online banking. At the DKB, an account opening is possible from birth. There is a Visa Card, but no online banking for the child.

Online banking is considered very secure in Germany, because the technical systems are very well developed. Most damage is caused by incorrect or careless use by the user. However, many bank customers were compensated generously by their banks in the past. But not always! You should definitely familiarize yourself with the safety rules of your bank.

Most German citizens use online banking. Only the elderly generation still largely prefers to go to a branch office to submit transfers in a form. This is generally associated with costs due to the processing.

Online banking is available at almost all banks only in German language. One of the few exceptions is Number26. There, the account opening, online banking and customer service (Kundenservice) is completely available in English, besides German of course. Additionally, this bank account can be opened particularly easy from abroad. You can find details here: A new era of account openings.

3. Cash

Cash (Bargeld) plays a major role in Germany. Still more than half of all operations are carried out with coins and notes. One can say that the Germans love cash!

Although, there are always discussions in order to limit the cash or even to ban it completely, but it currently looks like that cash will remain active in Germany for a long time.

Many people value the variety of options in the selection of a new current account, to withdraw cash free of charge from the account. This is most often only possible free of charge at their own branch offices or at partner banks of branch banks outside of business hours.

The modern direct banks often have requirement models in which cash withdrawals are free of charge using the credit card within Germany and abroad. DKB and Number26 have the most customer-friendly conditions.

Combined deposit and withdrawal machine. Following bills are accepted: 5, 10, 20, 50 and at some machines also Euros 100 bills. Depending on the machine or card, Euros 500 to Euros 2,000 can be withdrawn per day.

At this machine, you even can deposit coins.

Only few people think of the depositing of cash to the account, because the salary or pension payment (Rentenzahlung) is normally transferred directly to the current account. Government welfares are also directly transferred to the bank account.

Besides a few deposit machines (Einzahlungautomaten), one is working on the concept of depositing cash through the cash register systems of supermarkets. Again, Number26 is the pioneer of this development.

4. Savings accounts

All forms of savings accounts (savings book, call money account, fixed deposit) are especially popular in Germany, because most Germans do not want to take any risks with investments. One can never lose money in a savings account … only purchasing power in relation to inflation, however, that is often mentally hidden.

In the year 2000, the DiBa, was still a German bank at that time, established a modern online savings account. It was called “Extra-Konto” (extra account). Nowadays, it can be opened at most banks under the name “Call money” (Tagesgeld).

It is a bank account, to which one can transfer money from any bank; reverse transfers are only possible to one’s own current account (reference account). With this, the payments were inhibited, as otherwise with a current account. Finally, such online savings accounts are free of charge and formerly many banks in Germany charged fees for transfers.

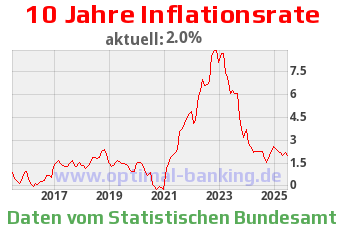

Reverse transfers were and still are possible in any amount and every day. Balance in the account received a very good interest. The call money accounts (Tagesgeldkonten) are always very popular, although the interest rates are low due to the interest rate policy of the European Central Bank (ECB).

Further details about savings accounts can be found here: Savings accounts in Germany.

4.1 Capital Gains Tax

Capital gains (Kapitalerträge) are in Germany subject to taxation (steuerpflichtig). The tax rate (Steuersatz) is 25 per cent.

However, the calculation is a bit complicated, because two other types of taxes are applicable on the capital gains tax (Kapitalertragssteuer). These are:

- solidarity surcharge in the amount of 5.5 per cent

- church tax of 8 to 9 per cent, depending on the federal state.

Please do not get shocked! The tax burden is not 39.5 per cent, because the tax rates are not added, but the additional taxes are gathered only on the amount of tax of the capital gains tax.

Example: Someone receives Euros 1,000 interest on his/her savings account. Now the calculation looks like this:

Euros 1,000 • 25% capital gains tax = Euros 250 Euros 250 capital gains tax • 5.5% solidarity surcharge • 9% church tax = Euros 36.25

Overall tax burden = Euros 286.25 or 28.625 per cent.

Simplified calculation:

Interest income (or other income, such as dividends from shares) • 25% capital gains tax • 1.375% solidarity surcharge (5.5% of 25%) • 2.25% church tax (9% of 25%) = 28.625% total tax.

Exemption order:

Capital gains are not taxed from the first Euro. For single persons, Euros 801 interest income is tax free each year, Euros 1,602 for married couples. In order for the bank to not pay any tax on this amount, one fills an exemption order (Freistellungsauftrag), which is provided by the bank.

One can choose the untaxed amount by oneself, so that one can distribute the exemption amount (Freibetrag) to multiple banks. Just be aware to not exceed the total of the statutory exemption limit.

Germany is no high-tax country anymore!

Capital gains in Germany are not taxed higher than that (exception: special cases). With the payment of the tax, everything is “settled” and therefore the tax is also called “settlement tax”.

If you neither belong to the Catholic nor the Protestant Church, then there is no church tax. This has to be specified at the bank when opening an account with interest or a securities account (Wertpapierdepot).

Automated tax deduction method

In Germany, banks are obliged to calculate the tax and forward it automated to the tax authorities. The account holder automatically receives a tax certificate (Steuerbescheinigung) of the tax payment in the following year.

The figures from the tax certificate are reported by the account holder to the tax authorities in the annual income tax declaration. An “”information couple” arises there. That truly is German efficiency in tax matters. 😉

Tax-free account at a place of residence abroad

If someone has a bank account in Germany, but does not live in Germany and therefore is not taxable in Germany, then he/she is exempt from paying the tax. In order to avoid an automatic tax deduction, one must notify the bank of his. The technical term for this is “non-resident tax payer”.

German banks have special forms for that, if the data has not already been made in the course of the account opening.

4.2 Deposit Guarantee

Balance in the bank is safe in Germany. The law stipulates that each customer will get back 100 percent of his/her money, if a bank reports insolvency. This applies up to the maximum refund amount of Euros 100,000 per person per bank (joint accounts (Gemeinschaftskonten): Euros 200,000).

The refund takes place within 7 banking days!

Some banks have set up private security institutions and have an even higher insurance than legally required.

At the bankruptcy of the Noa Bank in 2010, all customers were compensated within a few days up to the amount of deposit guarantee (Einlagensicherung). This took place in an automated process: The amount of compensation was paid to the consigned current account (reference account). The account holder received a confirmation by mail.

Not only is the balance on savings accounts, but also on the current account covered by the deposit guarantee.

Please note that the deposit guarantee only applies to accounts in Euros or other currencies of the European Union. Foreign currency accounts (Fremdwährungskonten), e.g. in US-Dollars, are not subject to the deposit guarantee in Germany!

5. Loan

The opening of a bank account is easier than getting a loan (Kredit). Of course: At a bank or savings account, you deposit money in the bank, and at a loan, you receive money from the bank. And the bank wants to get this money back plus the interest.

While banks increasingly accept an abroad place of residence (Wohnsitz) at the account opening, it is different in the granting of loans. Herein, one puts great importance to a place of residence in Germany.

Additionally, the income situation will be examined in detail and whether one already has debt. Existing debts are not a problem for a new loan, if one always pays the interest of the old loan on time and has enough money left to live.

Creditworthiness check / Credit History

A bank may request information about whether everything is fine in the financial life of the applicant so far at one of the creditworthiness agencies in Germany. The largest and best known is the Schufa.

At the Schufa, mostly the current accounts, credit cards and loans are reported. The Schufa calculates a score value from which one can learn how likely it is that one is meeting his/her payment obligations on time.

Loan information is stored with the amount and duration at the Schufa.

If a loan is not repaid on time or not at all, then this is recorded as a negative entry in the Schufa. With this note, a new loan is very difficult to get or very expensive (higher interest rate).

According to the German Data Protection Act, everyone has the right to obtain information about the data stored of oneself. We have developed a sample letter for our readers.

Loan comparison

On this page, you will find one of the best credit comparisons of Germany: Loan comparison through calculation tool. The data is adopted from smava.de, which have received press headlines, because they have mediated loans up to Euros 1,000 with 0 per cent interest.

Euros 10,000 are the average loan amount applied for in Germany (without real estate financing) for private clients, as you can read in the article how to successfully apply for a loan.

5.1 Overdraft facility

The overdraft facility (or credit line) refers to a credit line on the current account.

When one opens a new current account at a bank, it is usually managed as a credit account (Guthabenkonto). The account and cards work, if there is enough money on the account.

If the account is empty, you cannot pay with the cards and transfers of direct debits (see Point 2) are cancelled. This can have unpleasant consequences!

To avoid this, it is advisable either to always have enough money on the account or to agree on an overdraft facility with the bank. At most banks, a salary and pension payment is required for the establishment of a credit line. At a good creditworthiness, there is a small overdraft facility at the Comdirect and the DKB without income payment.

German banks grant overdraft facilities up to three times the monthly income payment.

There are also credit lines similar to an overdraft facility – in order to increase the financial flexibility – which are also available as:

-

Credit card loan (Kreditkartenkredit)

You will definitely enjoy reading the article on how Gregor “trained” the free Barclaycard to Euros 9,500!

-

Call loan (Abruf-Kredit)

This is virtually an additional credit line at a specialized bank.

In contrast to an instalment loan (Ratenkredit), in which you get paid the full amount and then pay back month after month, one agrees on a credit line. This can be used at any time.

Deposits and withdrawals are done automatically via online banking. If one is not taking advantage of the credit line, then there is no interest. You can find more information here: Setting up an additional overdraft facility.

Instalment loans are usually cheaper than overdraft facilities or credit card loans. Therefore, it may be useful to organize existing credit lines and merge them in a favourable instalment loan with a repayment plan.

Loans are relatively favourable in Germany, but not everybody gets a loan!

5.2 Construction financing

Even more favourable interest rates are in construction financing (Baufinanzierung), because there is always a security (the property) as a counter value. At construction financing (lots, new construction, renovation, buying an existing property), the financing bank always enters a mortgage in the land register. The property can practically not be sold without having paid the loan.

Construction financing is an individual and consultation-intensive service that cannot be optimally solved through a web portal. However, we have a good connection to an excellent team of consultants for the financing of property with locations in Germany or USA. Simply write us what you need and what you already have, and we will establish the contact.

Bonus: Moving abroad / Cancel account?

In about 99 percent of all German banks, there are no charges for the opening or cancellation of a bank account, neither do fees for inactive accounts apply.

Of course, each bank wants that the opened account remains long and is used frequently. Nevertheless, if you should go (temporarily) abroad, there is no account cancellation required. You only have to leave your new address and possibly update the tax status (see Point 4.1).

For people, who operate internationally, it may be advisable to set up a modern post-box, where one is notified by e-mail, when a letter arrives. One gets a photo of the front and back and then one can decide, whether the letter should be opened, forwarded, destroyed or returned.

B.1 German account number

A German bank account (Bankkonto) can be identified through the IBAN starting with “DE” and then twenty digits follow. Overall, a German IBAN is always 22 characters long. In other countries, the IBAN can be longer (e.g. Poland: 28 characters) or shorter (e.g. Austria: 20 characters).

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| DE | Checksum | National bank code | National account number | ||||||||||||||||||

The national account number as well as the national bank code (BC) are included in the IBAN. For transfers in Germany and within the SEPA-area, stating the IBAN is sufficient. For transfers to other countries, the BIC (sometimes called SWIFT code) is also stated as an international bank code.

Take a look at these detailed pages:

- Current account and banking

- Savings accounts (Savings book/card – Call money – Fixed deposit)

- 6 different credit card types

- 3 possibilities on how to obtain a loan in Germany

- Who offers free business accounts?

What topics are interesting for you personally? Feel free to ask questions via the comments box at the bottom of this page. Possibly, we will report on “your” topic in detail soon. Thank you for your input and support!

What subjects are personally interesting for you?

Please ask your questions through the comments box at the bottom of this page. Maybe we will discuss “your” subject soon in detail. Thank you for your input and your support!

Pictures: pico + playstuff (both fotolia.com)

Tanja wrote: For people, who operate internationally, it may be advisable to set up a modern post-box, where one is notified by e-mail, when a letter arrives. One gets a photo of the front and back and then one can decide, whether the letter should be opened, forwarded, destroyed or returned.

Could you recommend such a reliable address in Germany? Especially one that you have used. Thanks!

Formerly, we used the Swiss Post Box, which used to offer an address in Bamberg (Bavaria, Germany). There, exactly what you are looking for had been possible in a professional way. Regrettable, the Swiss Post decided last year to cancel this services of all foreign customers who do not have a constant address within Switzerland.

Since we ourselves in Germany don’t require such a service respectively have found individual solutions, we are not able to offer our own experiences. Maybe this guest post by Laura is of help to you: https://www.deutscheskonto.org/en/eburo-post-address-germany/

If a transfer of 8000 euros is made with the right IBAN and the right BIC but the name is wrong will the transfer go through?

Please only post your question once and not with several articles at the same time. After all, this is a web portal for smart banking customers. 🙂

Hi

Dear Gregor,

thank you so much for your complete guideline.

(I am non-European, Iranian citizen) I moved to Germany just yesterday, but I have been living and studying in Italy since 2014.

I work contract starts at 1st September and my net salary will be around 2400 Euro per month, my Bluecard is not ready yet I just applied for, but I think it will be valid for 1 year as my contract is for 1 year.

I am so confused about Germany banking system and I see some mobile banks like N26 and DKB as well as traditional banks like Postbank.

I need and an account to receive my salary and pay bills and debt and use it internationally, especially in Europe, and do my online shopping with that. Also I am looking for a bank account that give me credit (max possible credit, I see some give 15k/year and other 25k and …) also credit to be able to buy car and home and …

Good questions, transparent situation!

If you really want the best, you usually have more than one bank. For the credit line, my top rec-ommendation still applies ► https://www.deutscheskonto.org/en/rahmenkredit/ (ING has a good Giro account as well.

The challenge when opening a top Giro account and a corresponding large credit line is the bank’s credit assessment for you. This is roughly based on 2 pillars:

– current occupational situation, amount of income

– history in Germany.

You will earn only few points regarding the second pillar. So it is possible that it does not work out for the DKB because of this. The ING is a bit more generous with this aspect. Even more generous is N26. But here it looks relatively bleak re. credit line!

Welcome to Germany. I wish you a good time here!

I live, work, and do my taxes in Germany and selling a small property in Croatia (originally from Croatia). I will deposit proceeds from the sale (approx. Euro 40,000) to my German bank account. Do I have any tax obligations in Germany for this?

We are probably not the right specialty portal for tax questions relating to real estate deals abroad. But I can tell you that there are no taxes on transfers in Germany, which is something that is occasionally being asked. However, depending on the bank there is a “custody fee” (Verwahrentgelt) on bank balances. The so-called minus interest rate. Crazy world of finance!