Loan rejected? Tips for Try No. 2

Sometimes, people only become aware of our special portal, when they google in the Internet searching for the reason of a loan rejection.

Upfront: You will never find out the true reason, because this is never told. Assumptions do not further help you, because they are an excuse and stick to the status quo (= no loan).

This article is about the solution. 👍

You get tips and background information to increase the probability of a loan approval at the next application!

No. 1: The booster – second borrower

Many loans are granted at the second attempt, if another borrower is added.

Very obvious: The bank has a second person, who is responsible for the repayment of the loan. Both incomes and creditworthinesses are summed up and in many cases, enough “points” for a positive loan application are met.

Requirements of the second person

The second person must:

- be at least 18 years and

- dispose of an own income (job or pension payment).

- A marital status does not have to be stated.

- However, it is a requirement that the second person must live at the same address.

People, who live in a big house, have more choices. 😉

Of course the classic is the life-partner or spouse.

However, one can also apply for a loan together with the full-aged child, mother, father, grandmother, grandfather, subtenant or the neighbour. If you won’t use the money together, then think well who you are going to add and above all, if you are asked to become the second borrower!

Tip: 2 borrowers ► double the number of persons ► double the chances!

No. 2: State additional income

Often forgotten in the loan application: income of a sideline job.

However, there are some requirements that these can be recognized as such:

- Easiest is the proof through a salary slip.

- If this is not possible, then through a bank statement. It must be clearly visible that it is the account of the employer.

- The payments must be traceable over a period of three months.

Sideline jobs with cash payments are not accepted in the income calculation. Exceptions are eventual jobs wherein tips are part of the income, e.g. in the gastronomy. However, this varies from bank to bank.

No. 3: Choose a longer term

The longer a loan, the longer the borrower pays interest and the longer the bank earns money. This is why some people choose the shortest term possible. This means at the same time that they have to pay a high installment … so that the bank earns less too. Well, and then the desired loan is rejected…

Do it differently, do it smart!

Choose a long term. This way, your monthly installments will be much smaller and the smaller the installment, the bigger the chance on a loan approval.

If you do not want the bank to earn too good for a too long period, then just make a special repayment from time to time.

Example of a short term, high installments and long term, small installments:

| common financing | smart-bank-customer-financing | |

| Loan amount | Euros 10,000 | |

| applied for term | 3 years (36 months) |

7 years (84 months) |

| actual term | 3 years (36 months) |

|

| monthly installment | Euros 294.00 (loan installment) | Euros 135.41 (loan installment) Euros 158.59 (savings rate or special repayment) |

| Probability of a loan approval | averagely good | much higher (!) |

| Apply for the loan online | ||

| ► Apply for the installment loan at the ING-DiBa | ||

More about this strategy can be found here ► financing plan for the installment loan.

No. 4: Apply through a loan comparison

If you apply for a loan at only one bank, even if it is so good, the risk is much bigger that you are without a loan at the end, than if you prove your chances at several banks at the same time!

Apply at more than one bank at a time, but …

be careful: Who applies for a loan at several banks at the same time on his own, you trigger a backfire. At every application, you agree to the Schufa-clause, often without really understanding of what happens in the background of this data bank.

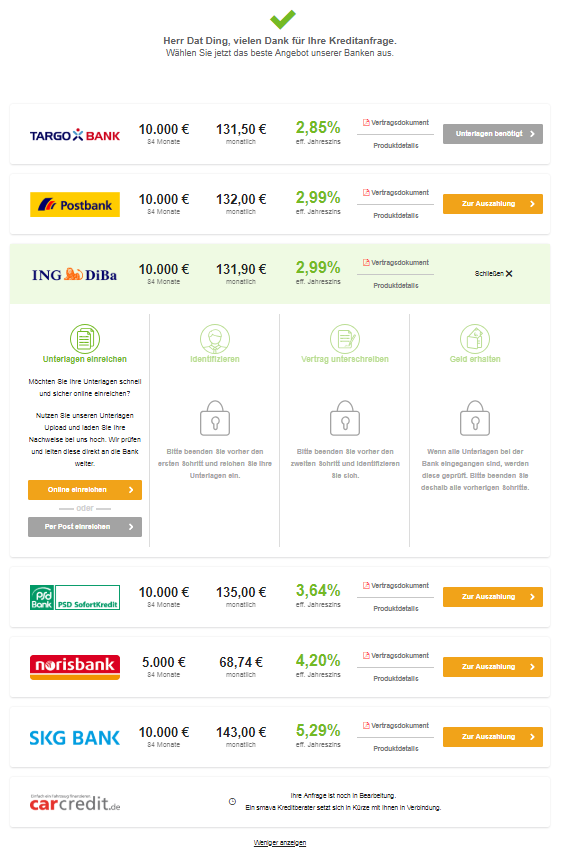

This is different, if you go through the ► loan comparison of Smava, because all banks that do not fit to your profile disappear from the selection due to an internal checklist.

After entering your personal data, most often, only a small list of potential banks remains, where an application really is worth the trouble.

Start the ► comparison with your personal data now!

Support from the Smava-team

Moreover, one can expect help from Smava, because it is interested in the occurrence of the loan contract being an online loan mediator.

If the loan contract does not occur, then everything was free of charge for you. If you get the loan, Smava receives a remuneration for the mediation from the loan-providing bank. Very smart. Both are in it together. At best, you start your second attempt through ► www.smava.de.

No. 5: Change the type of loan

As already mentioned at Tip 3, the amount of the installment has great influence on the loan approval or loan rejection.

Normally, a loan works like this that you take an amount X and repay it within several years up to zero. Amortization and interest are included in the installment!

Nevertheless, there is also a loan type in which you only pay the interest and not automatically amortize. This has the advantage that the monthly installments are extremely low!

The repayment is up to you. From immediately up to infinitely, everything is possible.

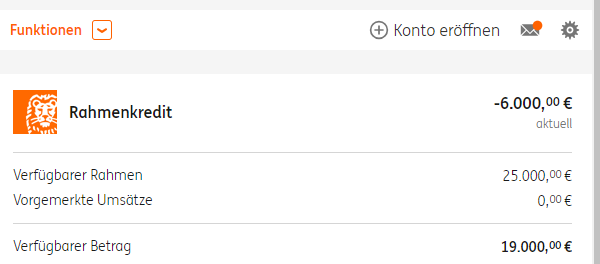

The loan type is called credit line, call credit or simply flexible credit line. I myself have applied for such a credit line in the amount of Euros 25,000 and have received it. I have documented it in this article. Currently, I use it with Euros 6,000:

I could retrieve another Euros 19,000 anytime I want. I could also repay the Euros 6,000 anytime or only a fraction of it. If I do not do anything, only the interest of currently Euros 29.15 monthly is debited. ► Apply for the credit line of the ING-DiBa » .

€ 29.15 for € 6,000 credit line – who can’t afford that?

For me personally, the credit line is a great alternative of the installment loan. Moreover, the offer of the ING-DiBa is the absolutely fairest on the market since years.

FAQ: Do you have to choose € 25,000?

No. At the second attempt, only take the amount that you really need. An increase of the loan amount is possible at any time and works pretty well, as this experience from our community shows:

A heartly thanks to our great smart-bank-customer-community! Further exchange of experiences and tips are welcome through the comments feature at the end of the article. 🙂

Questions? Ideas?

Please use the comments feature at the end of the page. We are a smart community!

Further articles around the same subject:

- Experiences of the credit line of the ING-DiBa

- Differences between the installment loan and the credit line

- Fast application of a short term loan online

- Loan > without < bank!

Video to the article (German voice):

Illustrations: Money – pixelfreund (fotolia.com)

Leave a Reply