International transfers for real estates (purchasing/selling)

Due to my activities in America, I am frequently asked on how to transfer higher amounts at best cheaply and safe or how to get them back from abroad to Germany.

The background of my question is often the purchase or sale of real estate abroad, business or emigration. But sometimes also a special car, which could also cost a higher amount.

The author of the article on site in Florida, USA.

My recommendation up to now: TransferWise!

I have already reported about Transferwise quite often. It is my favourite provider for international transfers.

In the past years, I have tested Transferwise in comparison to old and new money-transfer-services, such as Azimo, Currencyfair, Moneygram, Paypal, Skrill as well as in comparison to different banks.

In the overall rating, TransferWise was always by far the leader and in almost every case also in the exchange rate. Also by far!

TransferWise: permanent test winner!

Unpleasant weaknesses of other providers were that the transfer amount was not received to the exact cent amount, that the queries hindered or partially postponed the transfer up to days, that one had to deposit on an account first before the payment could be ordered, that there were additional fees and that further fees were “hidden” in the exchange rate.

After many tests and years of experience, my recommendation is: TransferWise can be used up to a transfer amount of Euros 10,000 for every country, to the USA and Canada even up to Euros 20,000.

Higher amounts through TransferWise?

In contrast to the fee listings of many banks, the fee structure at TransferWise is super easy. Concerning my research countries USA and Canada, it is 0.5 per cent of the transfer amount, but at least Euros 2 per transfer.

That means:

Can you transfer the purchase amount of a real estate abroad with TransferWise?

How would that look like at the purchase price of a real estate?

Euros 5,000 in fees for an international transfer? Are you insane?

I will proof to you that TransferWise is the cheapest way!

How does the fee listing of a bank look like?

Let’s take as an example the cheapest direct bank Comdirect, which has been the test winner most of the time for international transfers in the group of the banks:

Source: price listing Comdirect Bank AG

An international transfer to millions costs up to a maximum of Euros 51.90?

According to the price listing, yes!

This is even the reason, why some customers of the savings bank and Volksbank open an account at the Comdirect, in order to make cheap international transfers.

This is no wrong decision, because just this alone is much better. But there is even a better way and, above all, cheaper!

The exchange rate is the decisive factor!

Let’s see what the million transfer costs, when we include the exchange rate.

The challenge of the comparison is that one can see the exchange rate at TransferWise before the transfer and the transfer is implemented guaranteed at this rate and at the bank transfer, the rate is only revealed after the implementation.

Banks justify this by saying that they have no influence on the rate and the calculation is implemented using a daily average rate. Anyway, these are the answers to my telephone query. However, the banks are right. The Comdirect uses the service and rates of the Commerzbank for international transfers. This is why the calculation of the implementation is received hours later or on the next banking day.

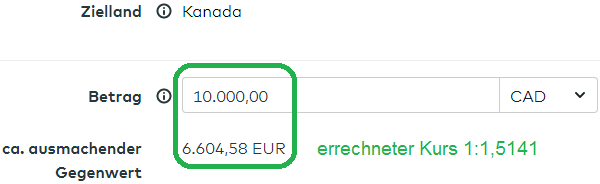

One can use a little trick, if using online banking. You login and enter the transfer amount and the preview is shown:

Screenshot of the transfer mask “Ausland” (abroad) in the online banking of the Comdirect

As so often in my articles, I work with real data and rates and have made a true transfer for my latest land purchase in Canada, from which the rates for the following calculation originate.

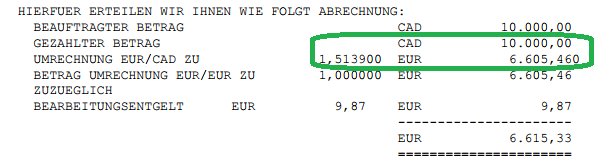

So, the calculation of the transfer resulted in a divergent (real) rate, which turned out to be a little unfavourable:

Section of the currency calculation of the Comdirect Bank AG

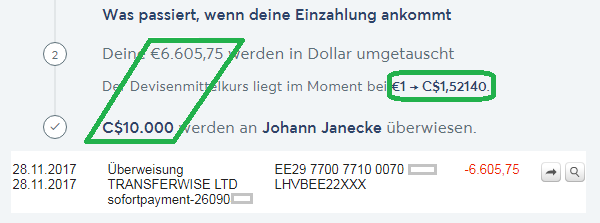

TransferWise has implemented my transfer using the previously shown rate (rate guarantee). Moreover, the 0.5 per cent fee are included in the rate at this view. One can see that it is exactly the same amount that was debited from my private current account (DKB):

Screenshot of TransferWise and the DKB as the emitting bank. Tranfer amounts, which are processed through TransferWise, can come from any German bank account. For this purpose, I like to use the feature “Sofort-Überweisung” (immediate transfer). This is super fast and free of charge.

What differnece does the second position after the point make?

At the purchase price payment of a real estate abroad or similarly high payments, the second position after the point makes a huge difference, as we will now see here.

Let’s calculate our example with the real exchange rates determined from the test:

| Comdirect | Euros 1,000,000 × 1.5141 | = Dollars 1,514,100 |

| TransferWise | Euros 1,000,000 × 1.5214 | = Dollars 1,521,400 |

| Difference: | Dollars 7,300! | |

So we can ignore the “cheap” Euros 51.90 for an international transfer in the amount of millions at a real difference caused by the exchange rate, can we?

Note!

Who transfers to the abroad in a foreign currency has to include all cost parts.

We are often distracted by cheap transfer fees, where especially Western Union is masterful.

The biggest gain or loss results from the exchange rate!

In any case at transfers from Euros 1,000.

Savings bank / Volksbank – an alternative?

I take this point deliberately, although we normally only rarely deal with the savings banks and Volksbank on this special portal.

Surprisingly very many people that I was able to get acquainted with and have bought or were at least interested in buying real estate, lots, land, companies abroad, were customers of a savings bank or Volksbank.

I have often heard that the transfer between Germany and the USA or Canada is so expensive. For example for the maintenance costs or also viceversa the income from rent.

The “cherry top”, however, should be the payment of a real estate deal. Just for this purpose, I visited a savings bank branch office, where one wanted to give me a complicated-looking form. Due to the non existing account, I have turned it down.

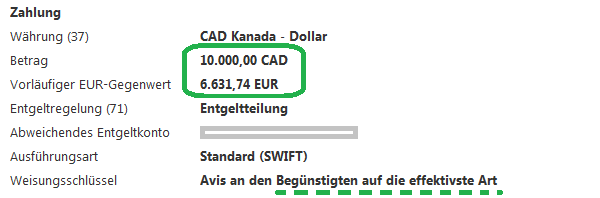

I was able to do the transfer from a Volksbank account timely parallel to the transfer of TransferWise and Comdirect. Here you can see the screenshot:

Screenshot of the transfer of the Volksbank to Canada. Quite more expensive …

Partial payment in a comparison

Let’s assume that you want to make a partial payment or just find out, which transfer way is the cheapest. A good idea is to transfer the same amount timely parallel – for example Dollar 10,000, just as I did for this article.

Result on the German side:

However, this is only one side of the coin!

Usually, there is a fee for incoming international transfers in the USA, as well as in Canada! At my Canadian bank, it is Dollar 25 per transfer!

Transaction view of the account in Canada:

There is still good news:Tie at the velocity. Every transfer way took 2 days until the credit entry. Unfortunately, at the bank transfers, Dollar 25 were debited. Not at TransferWise!

So we have to add the fee deduction in the receiving country to our comparison tabel in order to get to the true result.

Total comparison:

Is it a coincidence or is there a system behind it?

Exchange rates constantly change. One can even speculate on them. This is called Forex-Trading. This should not be the subject of this article. But is it a coincidence that TransferWise is in the leading position and would it be possible that the Comdirect or the Volksbank would have the best rate next time?

We have asked ourselves the same question and have made in total three transfers on different days with the test winner and the second placed Comdirect.

See the rates here:

| 1st transfer (28th of November) | 2nd transfer (6th of December) | 3rd transfer (8th of December) | |

| TransferWise | 1.5214 | 1.51090 | 1.51190 |

| Comdirect | 1.5141 | 1.50610 | 1.50920 (this rate is worse too, but no longer comparable, as it took the Comdirect 3 days for the implementation of the transfer!) |

| Result: | TransferWise was cheaper in all 3 cases and is therefore the better choice for international transfers! | ||

Why is that so?

This is no coincidence. It is determined by the system.

TransferWise was founded to make international transfers easy and cheaper. For this purpose, a pool-system was created. How this exactly works and why the system is obviously cheaper than classic bank transfers, is explained in these two articles:

- TransferWise: Revolutionary concept

- Cheap, safe and comfortable: TransferWise for international transfers

Interview with Anna from TransferWise

For those, who do not yet use TransferWise, it is a good idea to take a peek into this video:

2. Start your international transfer (enter information)

3. Make a domestic transfer to the regional TransferWise account

4. Wait for the notification that your money has safely arrived at the receiver.

Why I love to use TransferWise?

That TransferWise is also the cheapest option for international transfers of high amounts (e.g. real estate purchase abroad), has been shown by this article.

But TransferWise is also super comfortable

… especially, if one has to make international transfers frequently. A once set up payment receiver remains saved and already at the next transfer, one only needs a few clicks to start a new transfer to the abroad.

TransferWise is mobile-friendly and available as an app. Very practical.

► TransferWise.com

One can e.g. – if currently a good rate is shown – order a transfer through the Smartphone app. Then you have 48 hours to transfer the money in Euros to the TransferWise account.

I prefer to do this through the immediate transfer. There are further possibilities, such as the SEPA-transfer, direct debit (up to Euros 2,500) or partially even debiting from the bank card (up to Euros 2,500).

At the immediate transfer, the transfer procedure is initiated immediately. If you transfer to the TransferWise account, you receive an e-mail as soon as your money has been received. Just recently, I was surprised that a transfer that I made from Switzerland arrived at the TransferWise account only 80 minutes later.

An international transfer initiated at TransferWise, but at which the deposit has not yet been booked, can still be cancelled free of charge, for example, because you noticed a mistake in retrospect. This is a big advantage compared to a bank transfer after the TAN-entering!

Instruction for you: brief transfer sequence

-

Create a user account at TransferWise

If you do not yet have a user account at TransferWise, then you can create it here ► TransferWise.com. (It is free of charge in any case.)

-

Start the international transfer

For this, enter the desired amount,

- that you want to send or

- that should arrive.

You can do this here right now:

TransferWise transfers always exactly to the cent! (Many money transfer providers cannot do this.)

Follow the menu, it guides you step-by-step through the single points, such as the entering of the receiver data. You only have to do this once. This is particularly comfortable, if you regularly want to transfer to your own bank account abroad.

-

Make the deposit

There are different possibilities to deposit the Euro amount to the TransferWise account. Most frequently, the normal domestic transfer is chosen. I prefer to use the immediate transfer.

As soon as the money has arrived, you receive an e-mail notification. Then the money is “exchanged”.

-

Payment to the account abroad

Within 1–2 days, the amount is credited to the bank account abroad. You receive information about this through an e-mail. With this, the procedure is concluded.

Perhaps you want to set up your TransferWise-account already today?

Questions about TransferWise or international transfers generally

Is it worthwhile to open TransferWise just for one transfer?

This entirely depends on the transfer amount. Let’s assume that you buy or sell a house abroad and want to transfer the amount. There can easily be a difference of several thousand Euros!

What we did not say above in the article … At a payment of one million, the loss would have been a 5-digit-amount, if the payment would have been made through the Volksbank.

TransferWise does not mind, if you create a user account only for a one-time-payment.

Do I have to report that at the federal bank?

If the payment is intended to buy or sell a real estate, lot, land, company or the like abroad: Yes, if the amount is higher than Euros 12,500.

This notification has to be made, although it is a SEPA-transfer to the TransferWise account, because it is forwarded from there to the abroad.

A notification does not apply, if it is only an account transfer. By this, one speaks of transferring money to the abroad without having a certain use.

These notifications can be made as “private” by phone, calling the toll-free number 0800-1234-111. There is no cross-connection to the tax authority. The notifications flow into the external trade statistics of the Federal Republic of Germany.

Can I transfer with TransferWise from abroad to Germany?

Yes, this is possible from many countries. However, I myself did not yet test high amounts in this direction.

A good instruction of Susanne on how to transfer from the USA to Germany can be found here: TransferWise USA–Germany.

Further questions? Experiences?

The author on his land in Nova Scotia, Canada.

Please use the comments box to supplement this article for further readers with your question and also with your experiences.

Just like it is a goal for TransferWise to make international transfers easy and cheap, it is the goal of this special portal to develop solutions for and with smart bank customers.

The production of this article was a lot of work and I am glad, if it is of intellectual and financial use for you.

Please recommend it and/or give us a 5-star rating. Many thanks! 🙂

Leave a Reply