Free Current Account in Germany

Since 2014, bank customers have to use the IBAN (International Bank Account Number) for any bank transfers within the SEPA-countries. Even if the bank account numbers have become longer, there are some advantages.

Thanks to SEPA, the German bank account of the DKB can be used by all EU-citizens within the EURO-zone (blue marked countries) as a main bank. Direct way to the bank: www.dkb.de (German website).

A key advantage of the EURO-zone is that it makes virtually no difference anymore, whether you have your current account (but also savings account or credit card account) in your home country or in another EU-country.

However, the costs that a bank customer has to pay vary a lot. In many countries, there are a bunch of fees for the use of a bank account or a credit card.

But this is different at Deutsche Bank (DKB). It offers a totally free current account, also with a free VISA credit card. In Germany, it is well known and popular as the „main bank on the web”.

Very Good News!

Every citizen of the European Union with basic German language knowledge and sufficient credit can open this bank account. EU citizens do not need to visit Germany to open a bank account. The bank account can be opened via Internet and post service.

The legally required identification of the person can be made through a local bank, a lawyer or notary.

Details about the German Bank Account of the DKB

- Free account maintenance

- Free bank transfers

- Free credit card (Visa Card)

- Free cash withdrawals from all Visa ATMs around the world!

- Bank account in Euros

- Bank transfers in other currencies are possible

- And on request:

- Overdraft facility with low interest rates

- Savings account with monthly interest payment and immediate availability of money

- Securities account with low order fees on German stock exchanges

- Account for Minors with Prepaid Visa Card

DKB as a Salary Account

With the SEPA implementation and the obligation to use the IBAN for bank transfers instead of the national account number, you have the right to use the DKB bank account as a salary account.

Every employer and every governmental payments office (e.g. for retirement) will be able without any problems to transfer money to your new bank account at the DKB. A SEPA bank transfer costs exactly the same as a national bank transfer and is just as quick. A bank transfer takes up to one day maximum. This is regulated by law!

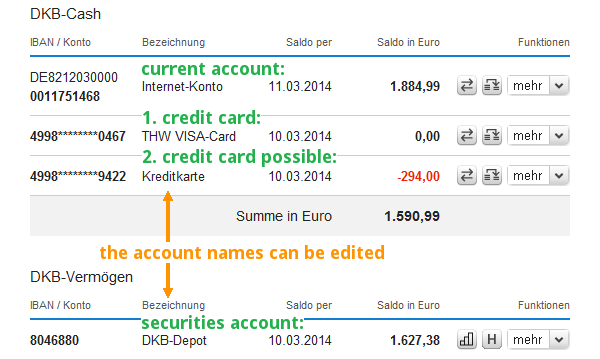

That is how your bank account can look like after logging into the Internet-Banking-System: a current account, one or two credit cards, optimally a securities account.

Also regular withdrawals, such as rent or mortgage payments, can be realized through the German bank account.

You can transfer money to your home country, or set up standing orders. All bank transfers within the EURO-zone will be free of charge at the DKB.

If you use the bank account as a salary account, at the DKB you will get an overdraft credit granted very easily. The limit of credit is a maximum of three times the amount of the monthly salary payment. The credit interest is relatively low in Germany.

You need cash?

Nothing easier than that! With the free Visa Card, you may go to any ATM with the Visa symbol and you will receive cash free of charge. You can continue to use the same ATM as before, but you do not pay any cent for it!

Withdrawals at the ATM are always free of charge, regardless of the currency. If a local ATM-fee is charged, like it is e.g. in the USA, then this will be refunded at your request by the DKB!

These Conditions are Great!

Consider this: On any trip worldwide, you can withdraw cash free of charge. This also applies to withdrawals in foreign currencies, for example, in the United States. DKB does not charge cash withdrawals in countries with different currencies!

DKB as an Additional Bank Account

Of course, you do not have to close your existing bank account. You can keep it and use the bank account in Germany as a secondary account for different purposes. For example, as a:

- Travel account (because the cash withdrawals are everywhere free of charge)

- Savings account (because Germany is one of the safest countries for savings deposits)

- Securities account (because you can trade through the DKB-Depot at very fair conditions on the German stock exchanges)

You can add your own ideas about the use of the bank account to this page. Please use the comments box at the bottom of the page.

Bank Account Opening at the DKB

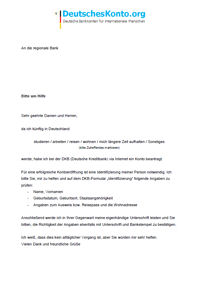

Sample letter to submit at the local bank.

⇒ free Download

The account opening consists of 3 steps:

- Fill out the online application on this page:: www.dkb.de/ausland/.

- When submitting a residence outside Germany, DKB will contact you within three days and discuss with you how you can verify your identity.

For all EU countries, we recommend the authentication of your identity through a local bank. For your convenience, you are welcome to print our service letter and take it with you.

- You will receive several letters with the bank account data and access information as well as bank cards.

From then on, you can enjoy the many benefits of a bank account in Germany!

“Apply for a German Bank Account Now”

… the world´s most attractive bank account!

Do you need assistance? Please write us on our German support site.

Websites that may also help you:

- 10 Reasons for a bank account in Germany

- DKB account opening from all countries (Overview for identification, german)

- The 11 most important functions about DKB Visa Card

imagery: euro zone: Glentamara

Hello, thank you so much for your website! It is very informative and useful for many people. It contains so much great information. The videos are also very clear and useful. Thank you.

I am currently doing volunteer and also paid work for a european Non-governmental organisation in Europe. I have to travel a lot for my job and have no permanent address, except for in the US. But almost all of my time is spent in Europe. I am an EU citizen (Italy) and passport holder (Italy). I speak no German and can only understand very little and simple conversational German. I am trying to learn more now! 😀

May I ask you, What is my best strategy for setting up a simple european accountt for receiving checks and using ATMs while I am staying and working in Europe?

Thank you so much. Danke.

Thank you for your friendly words.

Maybe it is a good idea to open a checking account in Italy. Sadly this is a special website for German bank accounts … so we aren’t able to give you an advice which bank in Italy is the best for your plans.

All online banking in Germany is in German, except Deutsche Bank. Sadly this bank is not the best advice for your plans, that is the DKB. But for this wonderful bank you have to speak and understand German.

Thank you for the reply and advice. For my work, I am always traveling and I am never in Italy and I cannot find any bank where I can apply online. I am comfortable with using a German website for online banking. My German is okay for this, but not good enough to speak German to open the account. I thought maybe I could do online to save time and German banks seem very good.

Thank you again for great website.

You can try it. Here is the link to ⇒ apply DKB account with Visa Card for free. (it is of course in German, but online).

Thank you Tanja for all the advise. I will give it a try. I can let you know if I success if you are interested to know the result.

Do you think I can try WebID with my European passport? Will I have to speak Deutsch on webcam? This will be difficult for me, although I am confident to read German and use online banking tools.

Thank you again for the great site. Tanja, you are doing a great service for all Europeans! Danke!

Currently in the WebID procedure, only German and Austrian ID cards or passports are accepted. Over time, more countries will be added. WebID is still quite new.

The languages for legitimating at WebID are German and English.

I am, of course, interested in the outcome of your account application. The question is, why should the bank open an account for you? Banks want to earn money from their customers. Since the DKB account is completely free, the bank can only earn, if you:

Since you do not live or work in Germany, the bank will be very careful when providing you with a large line of credit.

If you find an answer to the question, then your chances for account opening will increase.

Alternatively, you can look for another bank that earns money with bank charges. In this case, an account opening might be easier, because thebank earns money regardless of whether the account is used or not. One should not forget that every account costs the bank every month money. Just the account opening costs at your German direct bank are estimated internally with Euros 100 up to 200.

Thank you again. I understand better now how you explained everything from the banks point of view. I plan to leave some funds on deposit in the account like a savings account, so maybe this will help me so that the bank is interested?

I will try to open account soon and let you know result. I am in Italy now, so I cannot try. But if I go back to Germany soon, I will try.

Thank you.

We guess that is a good way and wish you much success!

Is it possible VAT registered company from Bulgaria to open bank account in DKB?

That is sadly not possible. DKB business accounts are possible only for few industries in Germany. The DKB is a mainly bank for personal accounts.

If you are able to speak German, maybe this account could be interesting for you: https://www.deutscheskonto.org/de/online-konto/

Thanks for the clear answer.

Hello,

thank you very much for the information, it is really helpful. I have one more question, I have already opened my account in DKB, and now I have to transfer money from my Brazilian account to my DKB account, but I am not sure what is the account number I have to inform my Brazilian bank, so than they can send the money, do you think you could help me with that? Thank you, Marina

The account number is called IBAN. Maybe you can find that with this picture easier in your DKB online banking:

Enjoy your new bank account!

Thank you very much for your reply, I could find it easly. 🙂

Hi Marina,

I’m also from Brazil and I’m searching on how to open a bank account in Europe. But I live here in Brazil. Could you open the account living here or are you living in Germany?

Thanks

Hi Fernando, I am Brazilian an I was able to open a bank account in Germany with norisbank (I tried both N26 and comdirect without success). You will need to visit a German post office and have an address in Germany where they send the letters with opening materials. After that you sign up for online poxbox and everything can be done on their website. You only need to fill the application and visit the post office for PostIdent where they verify your identity using your passport. Be careful to check whether your name in the application matches the name in your passport (as entered by the post office employee in a form that you sign, they are not familiar with Brazilian names, so double check if they got it right). You will receive 6 letters: Welcome, Online-PIN, Telephone-PIN, a TAN-Block (numbers for transaction confirmation), Girocard and the Girocard-PIN. The whole process took less than two weeks.

Hi Marcelo,

Many thanks for this great help. The Norisbank account is free of charge, but has to be applied for online. Here is the link: http://www.norisbank.de/produkte/top-girokonto.html

Hi, I am a resident in West Germany, Currently with another bank but looking to swap to DKB due to it not charging over the odds just for having an account.

I speak little German but use Google Chrome so it all turns to english anyway.

I’ve completed it all and have to now go to the Deutsche Posy AG to verify myself and my wife, Can someone please tell me how you go about paying money (cash) into the account if it has no branches in West germany please?

Also what exactly do you receive after you have been verified and accepted by DKB if your opening a joint account?

Thanks so much for the information on this page.

Regards,

Bryan

You have the possibility to deposit cash free of charge at 14 branch offices of the bank using cash-in machines (cash deposit machines): https://www.deutscheskonto.org/de/dkb/bargeld-einzahlen/

Usually, the money is deposited by bank transfer to the DKB account. Either as a salary payment or a money transfer from another account. Cash deposits through other banks are possible too, but relatively expensive. The fees are imposed by the other bank.

I want to apologize, as I did not quite understand your question about the joint account. However, I am sending you our two articles about joint accounts:

https://www.deutscheskonto.org/en/dkb/joint-account/

https://www.deutscheskonto.org/en/open-dkb-joint-account/

Ok Thanks very much! 🙂

So if i live in Paderborn, North rhine-westphalia , what would be the best option in depositing money? or does it just involve a lot of driving ? haha

Regards,

Bryan

Near Paderborn is no DKB ATM for depsiting money. Make a transfer to DKB account with another bank. That is cheaper …

Ok no problem,

Thank you for your help,

Bryan

I am UK based and do not speak German. I wish to open your account so that I can have EU bank account for when in europe on business or holiday. How can I open this account without being able to read or speak German/

thanks

Anthony

The only possibility we know to open a German current account without any knowledge of the German language, is at the Deutsche Bank.

The Internet banking of the Deutsche Bank is also available in English. That does otherwise not exist in Germany.

However, the account opening is only possible in a branch office of the bank. It is advisable to make an appointment to open an account, so that someone, who speaks English, will be available for you.

Anthony,

Yes it is possible.

However you will need Google Chrome, there is an online guide in English on how to set up an account. Just when you receive an email after online completion, send themas many scanned documents to prove your pay and German address then a week later should be accepted.

Hope this helps.

I am a permanent resident of Austria… I have a friend who is an American citizen but who happens to be visiting me here in Austria… She is from Los Angeles. California and has a savings account at the Bank of America in California. She has a ATM card from her bank, she was told that she can access her money all over Europe… she tried her ATM card at the Austrian teller machines and this did not work… She called her branch bank in America to let them know this, as she needs access to her funds. They told her that since it is a savings account she may have to go to Germany to a Deutche Bank to use their ATM as the are a partner bank of Bank of America… So the question becomes first, is this true.. second, can she access her SAVINGS account through the Deutche Bank ATM portal… Third, does she need to open a an account at this type of bank to have her money transferred.. Is there anyone she can talk to here, if it is in fact true about the partnership with Bank of America? Thank you for your time… we are quite stumped over this…

PS: LA is a very good place, i like it 🙂

Hi, I tried to apply for an account with DKB but was rejected. I am self employed (for 22 years), own home, debt free. But, I am Greek, and we have bank capital controls… Could that be the reason for the rejection? What can I do? I have items for sale (not on ebay) that I could sell to provide funds for the account, because now I can’t even pay my iCloud subscription…

Thanks,

Dimitris

You live in Greece and have stated your Greek address and you do not have a German ID-card? These are the reasons for the rejection!

In this article https://www.deutscheskonto.org/en/dkb-foreigners/, we explain the new “policy” of the DKB. Currently, it does not open accounts for foreigners abroad.

Except for Austria and Switzerland, as these countries are part of the German-speaking area.

An alternative is Number26 https://www.deutscheskonto.org/en/n26-account-facts/ – but here as well, an address in Germany or Austria is required.

However, this is only required for the delivery of the MasterCard (you do not have to be registered there)!

This provider https://www.deutscheskonto.org/en/account/online/ sends the MasterCard (charging extra shipping costs) to Greece. However, the legitimating is only possible at the Deutsche Post.

Does that help you?

Thank you Tanja for your reply,

I have a friend living in Germany who will forward the mail to me, so I will consider Number26, or wait for a trip to Germany so I can visit a Deutsche Post…

Thanks, Dimitris

I hope this message finds you well .

I want to know the procedures to do a blocked account for me at your respected bank online as I am in Egypt and I need to open the account for my study at Germany .a student account

Kindly , inform me with all details the requirements and procedures and i dont speak german so please how can i open the account and manage it using English ( the site is all in german )

Sorry, we don’t make blocked accounts.

Hello,

Congratulations for the article.

I’m Portuguese travelling the world while working online. Can I open an account in DBK?

I saw that after April 2014 they stop opening accounts for foreigners, this is still correct?

Thanks !

Yes, sadly. We looking for new solutions.

Dear Tanja,

I am Italian and working for an Italian company while moving in Germany for a few days each year for business purposes. During my stay, am living in an apartment maintained by my company. During a stay earlier in 2015, I opened an account in DKB using the address of my apartment and a phone bill on my name coming in this address. I transferred my money there and using DKB as my main bank account.

I would like to ask you the following: If I change the address and report my Italian one, may I have any issue with maintaining my account?

Also I have not applied for tax exemption (since the application is asking for your registered address which is the Italian one and not the German). I don’t have any issue with double taxation but must I apply anyway (or is this is only in my discretion) and if yes, again may i have an issue with maintaining my account in case I report a different address as my registered one?

Than you in advance!

By opening an account at the DKB, you have made a great decision. Congratulations!

Despite moving abroad – in your case, Italy, – you can continue to be a customer of the DKB and to use the account and the credit card.

You can update your address automatically in online banking under “Persönliche Daten” (personal data).

This way, you will automatically receive the new bank cards to the abroad after their expiry.

If you have used the DKB as a salary account and now no more salary payments are transferred, then probably the limit on the credit card and on the current account will be reduced. You know that you can increase the limit of the Visa credit card through deposits. Therefore, this is not a problem.

If you are (no longer) subject to income tax in Germany, you can submit this through a form to the bank. You can find instructions here in German language:

https://www.deutscheskonto.org/de/dkb/steuerauslaender – consequently, you will get 100% of the interest credited to your account. The automatic tax deduction will be eliminated.

… and please keep your DKB account, as you never know for what it can still be useful. Moreover, it won´t become easier to apply for one in

the future.

Hallo, ich würde gern ein Konto eröffen, da ich im November 4 Monate durch Südamerika reise und die Bedingungen, gebührenfrei Geld abzuheben sich super anhören. Ich bin Deutsche, wohne aber schon seit Ewigkeiten im Ausland, die letzten Jahre in Italien, nun seit Juni in Frankreich und habe keinen deutschen Ausweis (nur einen deutschen Pass). Kann ich trotzdem so ein Konto eröffnen? Ich bräuchte keine Überziehungsmöglichkeit, möchte einfach Geld darauf überweisen und es dann während der Reise Stück für Stück abheben. Danke im voraus für Ihre Rückantwort..

The formal requirements for an account opening at the DKB have been fulfilled, so that you can start immediately with the account application. With the German Passport, you can complete the statutory legitimating via video chat. This is especially convenient from abroad.

Please note that the DKB Visa credit card always has a credit line, although this is initially very low for account holders with a residence abroad. That is the reason, why the DKB carries out a creditworthiness check at every account opening. Therefore, only 60 to 65 per cent of account applications actually succeed in the account opening.

At the following link, I present three important tips that increase the likelihood of opening an account: https://www.deutscheskonto.org/en/account-opening-dkb/

It is a pity when the DKB is only used for free cash withdrawals – as the bank can be so much more – but it works!

Oh yes, here is the German-speaking area of this special portal: https://www.deutscheskonto.org/de/