How to open a bank account in Germany online (!)

The opening of a bank account in Germany is now easier than ever thanks to N26, if you live in Germany or in one of the selected European countries.

New: modern German bank account can be opened from abroad!

What you will learn in this article:

- How to open the bank account

- What type of account you get

- Which cards you get to the account

- Which services you can use

- From which countries and in which languages the account opening is possible!

For action takers ► here the direct link to the bank https://next.n26.com.

Now let’s work through the important points in reverse order:

5. Countries and languages

When Number26 launched in January 2015, it was officially stated that one could only become a customer of the new bank, if one lived in Germany or Austria.

The account opening, including legitimating via video chat (see point 1), first deposit, card shipping and trying out to made the first payment or cash withdrawal with the new card, could be completed within 48 hours. This was a novelty in the financial sector!

One was able to quickly figure out that Number26 apparently verified the address of the customer by shipping the card per post, otherwise it was returned.

Technically, they have solved the issue by producing the card immediately after filling the brief online form to open an account, and then clicking on the confirmation link in the e-mail.

Card production starts already when confirming the e-mail address

Thus Number26 shortened the time of account opening considerably. The process of legitimating can be performed right after or in the next few days. Depending on the time availability of the customer. However, the card is already on its way.

Number26 does a great deal, so that its customers are delighted, as you can read in further articles on our special portal. This includes the extremely fast opening of the account.

Since passports usually do not state the residential address, you could virtually specify an address of your wish, where you want the card to be delivered.

As far as we can judge, this is legally perfectly fine, because it is defined in the legitimating law that the bank must identify the person beyond doubt.

A customer is identified when his/her name, date of birth and place of birth have been proven. The address is not among this, as it often changes in life – in contrast to the aforementioned data.

First bank account openings with international dimension emerged in “uncontrolled growth”

Some German speaking “first movers” – from mid-2015, when the second language version was introduced, also English speaking people – took advantage of this circumstance and opened their bank account at Number26 through addresses in Germany and Austria.

Only the card had to be delivered. Further mailings are not sent!

Number26 has responded to that! And not in a manner, as one might expect it from a conventional bank (“we will cancel your accounts”), but the other way around!

“If we already have people abroad, who make such efforts to open our account, then we should make it yet easier and work to implement solutions so that the account can be opened from abroad.”

It looks like this fits very well in the growth strategy of the bank with the most modern bank account in Europe.

Here you can see an overview of the countries, from where you can officially apply for the N26 account as well as the planning of languages.

| Country | Language | Link to the country’s page (account opening) | |

|---|---|---|---|

| Germany | German / English | https://number26.de | |

| Ireland | English | https://number26.eu/ie | |

| Italy | English / Italian is still in development and will be offered in the future | https://number26.eu/it | |

| France | English / French is still in development and will be offered in the future | https://number26.eu/fr | |

| Greece | English | https://number26.eu/gr | |

| Austria | German / English | https://number26.de | |

| Switzerland | German, is still in preparation and will first appear in the EUR variant; one is working on foreign currency accounts | ||

| Spain | English / Spanish is still in development and will be offered in the future | https://number26.eu/es | |

| Slovakia | English | https://number26.eu/sk | |

| One can assume that the list of countries will expand in the coming months and years. However, this will happen probably faster in countries where the Euro is the legal currency. We will report about this for our readers on this special portal, and also as soon as foreign currencies are possible for the first time! |

|||

Important to know: It still is a bank account in Germany – with German deposit insurance. Only the application process is now possible from other countries and in other languages.

Likewise, the MasterCard is sent to the countries mentioned in the list. This receives a bank account with a German IBAN starting with DE.

4. Services of Number26

Currently, most services are oriented to the German market. One needs to know that, when wanting to open a bank account in Germany.

However, the corporate directive of Number26 thinks in great measure European, so one can expect that the services that are going well in Germany will be applied little by little to other countries.

A first example would be for the fee-free deposit and withdrawal of cash at more than 6,000 supermarket checkouts. In Germany, this had a very good start, so one will probably also find cooperation partners in Spain, France, Italy or Greece, who are willing to work with Number26.

It starts in Germany and at success, it will be applied in other countries …

What is already available to each customer today are the free cash withdrawals at all MasterCard-enabled ATMs worldwide. You can withdraw cash from your account conveniently and free of charge in your home country or when traveling.

Deposits can be made by bank transfer in Euros. In many EU countries, you can even use Number26 as a salary account. However, this is not a condition for the free account management. There are no requirements for this. The account is always free of charge, no matter, if you use it frequently or not at all.

Overview of frequently used services

- Transfers in Euro

The setup of standing orders, so that payments are executed automatically and regularly, is possible. - Card payments

With the MasterCard, you can pay cashless everywhere in the world, where credit cards are accepted. Big advantage of Number26: Unlike most banks, at payments in another currency, no surcharge applies (foreign transaction fee). Payments in other currencies are converted exactly using the MasterCard exchange rate. - Cash withdrawals

You can withdraw cash free of charge at the worldwide more than 2 million ATMs that accept MasterCard. - Cash deposits

Cash deposits are currently possible free of charge at more than 6,000 supermarket checkouts in Germany (Amounts between Euros 50 and 999 per procedure). - Comprehensive statistics

Number26 shows you your account usage in detailed statistics. This is ideal for people, who keep a household book.

Not official, but reality:

This is no official service, but we know from experience that concerned people from some southern European countries do that: hold the account balances securely in Germany.

Although, there is no interest on the current account yet (no interest income-disclosure to the local tax office either), but it provides a sense of security for many people to have money in a bank account in Germany.

Can you remember the Cyprus crisis in 2013, where account holders have been expropriated on the deposit protection limit of Euros 100,000?

There were similar worries and they always come up again in Greece. Also the fact that one could temporarily not dispose freely of his own account balance.

Bank account in Germany as a backup strategy!

Is it not great having a bank account in Germany, which can be controlled via a Smartphone app or online banking? Additionally, a MasterCard, which offers further options at electronic payments, as well as withdrawing cash?

Note: By the way, there are also people from other European countries, who wish to open an account in Germany precisely for this reason. Why not? Prevention is better than cure. We in Germany know about that. 🙂

Further services will be added in the coming months and years and it is already readable for us observers that Number26 will expand its account with other useful features. We will report about this on our special portal!

3. The cards to the account

As you could read above, the MasterCard goes into production already during the process of account application. With an address in Germany, one usually gets the card within 2 banking days.

Many people like it: partially transparent MasterCard

the comments feature (at the bottom of this page) after how many days you have received your new MasterCard in the mailbox. Thank you!

Card is partially transparent!

The MasterCard – which looks like a real credit card due to the embossing of the account number, name and expiration date – is a debit card. That means that only if you have balance in your account, you can use it. If the account is empty, the card is not working.

Number26 offers since the end of 2015 the possibility of equipping the account with a credit line. In the app, this is called “overdraft facility”. This converts the MasterCard into a true credit card. This is optional and subject to a few other conditions. An article about this is already in preparation. In the basic equipment, right after the account opening, the MasterCard is a debit card.

Likewise end of 2015, a MaestroCard was optionally introduced as an additional card, because MasterCards are not accepted everywhere in Germany. More about that in further articles.

Basic equipment: 1 MasterCard, free of charge!

Besides the MasterCard, a MaestroCard was introduced additionally for the German market on Christmas 2015. Both cards are free of charge. The MasterCard is sent automatically, the MaestroCard can be ordered via the Number26 app. Picture: Number26 GmbH.

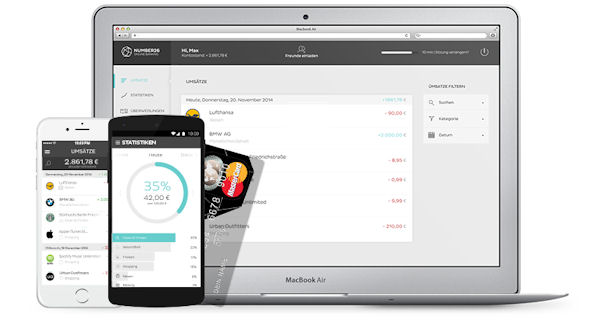

2. Current account with brilliant Smartphone app

Number26 is a real current account with own German account number (IBAN with DE at the beginning).

With this account, one can conduct full payment transactions in the Euro area free of charge. For transfers in any other currency and in other non-Euro countries, the provider TransferWise is recommended.

So you can conveniently transfer money from and to Switzerland, UK, USA and many other countries.

The current account can be managed super easily via the app (Android or iPhone). The banking app of Number26 has already been awarded due to its ease of use and popularity.

Additionally, one can manage the account through online banking on the computer or tablet.

1. Opening of the Number26 bank account

The opening of the account is pretty easy. You can complete the procedure on the Smartphone as well as on the PC. Entering the data could be more convenient on the PC.

However, a Smartphone, in addition to the minimum age of 18 and being a resident in an already “accepted” country, is a requirement for a successful account opening.

Account can be opened on the PC or via a Smartphone.

a) Start the account opening

Go through this link directly to the page of the account opening ► https://number26.eu/en.

(or using the corresponding country link from the table)

Click on the button “Open account now“ and follow the process.

Who is fast can complete the account opening in only 8 minutes! Try and write your feedback through the comments feature.

b) The next steps that follow

- Confirm your e-mail address (card goes into production)

- You immediately get your new German account number. Therefore, you can start the first transfer directly.

- The identification through video chat can be carried out immediately after that or at a later point of time. Please keep you ID-card or passport ready. Alternatively, one can be identified through the post in Germany (PostIdent procedure).

- The card is sent by post to your mailbox. You can activate it through the app and use it right away, if you have already transferred money to the account.

- Done, account and card are now completely opened and ready for use.

“Start the account opening now”

Q&A: Frequently asked questions

What does the account cost?

Nothing! It is a totally free current account – there are also no charges for the cards. Account opening, use and possible cancelation of the account are free of charge.

How safe is the bank account?

a) The technique of the bank as well as of the app is always at the most recent German security level. Outgoing transfers are confirmed in the app by the account holder before the completion. The app is protected by a password. Other more vulnerable systems, like TAN lists or SMS sending of a TAN, do not exist at Number26.

b) The account balances in Germany are subject to the legal deposit insurance in the amount of EUR 100,000 per account. The customer money is always kept separate from the company’s capital of Number26. Should the bank go bankrupt, the account balance will be refunded in full (a maximum of Euros 100,000) within a few days. This is stated by the German Deposit Protection Act (Einlagensicherungsgesetz , EinSiG).

Can I open several accounts?

No. Only one account per person is allowed. The minimum age is 18 years (age of majority in Germany).

Can I use the bank account for business?

Yes, as long as these are self-employed persons and freelancers, whose business is run on their own name.

Please note that the daily transfer limit is Euro 25,000 per day, and that there are also daily limits for card payments and cash withdrawals (overview, German). We hope that the limits will be adjusted to higher amounts soon. However, for 99% of customers, the current limits are enough.

An account opening only on the company name, as in the case of legal persons, is not possible at Number26.

Can I open the bank account, although my language is not yet available?

Yes! However, you must be able to understand and speak English or German sufficiently, because you have to communicate yourself at the legitimating during the video chat. When communicating by e-mail with the bank, you can use Google Translate as a support.

As soon as your language is available, you can change the language of the banking app and online banking under “Einstellungen” or “Settings”. The customer service of Number26 is augmented with foreign language speakers.

And now, we wish you good luck at your account opening, if you did not do it already!

Your new bank account in Germany soon? Or do you already use Number26?

“Start the account opening now”

Any further questions?

Questions about the account and its opening can be made through the comments box. You can also contribute to the development of this page by using this feature. Thank you 🙂

Thematically supplementary articles that are frequently read:

- Overview: Cash and Card from Germany biggest direct bank

- It is possible to open a current account with 2 minutes?

- Trick ► How to get a loan up to € 5,000 within 24 hours!

how can one deposit cash in the account?

From the USA, a transfer with Transferwise is recommended – at least I use this provider for transfers between Germany and the USA.

As it is currently a SEPA account, no transfers are possible from the non-SEPA area (e.g. USA). However, it is possible through Transferwise, as it looks like a national transfer then!

Can one with a Slovakia passport open the account if living in the USA?

The challenge is that Number26 can send the MasterCard to Slovakia, but currently not to the USA. The card to the account is the only mailing that the bank sends you. Therefore, you need an address in one of the aforementioned EU-countries.

Hello Tanja. I am Bulgarian resident but I live and work in Greece for years. My question: it is possible to open number26 account and get Mastercard from Greece? I own EU id card but not passport. It is that acceptable for verification?

Yes, your account opening will be possible.

The card is produced in Germany and then shipped to your Greek address.

Can you please give me feedback on how well it has worked with the account opening and identification through VideoIdent? (using your Bulgarian ID-card)

Many thanks and have fun with your new free bank account 🙂

Sadly its not posible. Only with passport.

From which country did you try to apply for the account?

Some countries still have “ID cards” made of paper, which are considered being not particularly forgery-proof and their security features are hardly testable via web cam.

Passports must comply with the international safety standards and can also be checked by web cam.

The law clearly states that Number26 must identify a person beyond doubt during the account opening.

We generally recommend to use a passport for the legitimating at Number26.

However – according to current feedback – also national ID cards are accepted, if they have modern security features. In this case, it depends a bit on how well the respective country equips its citizens. E.g. Switzerland and Spain have IDs in the modern card format with several testable security features. Italy provides its citizens with a small leaflet with stamp and Greece with a small card made of paper, which is enclosed by a plastic film.

Have try from Greece with my bulgarian ID modern EU plastic card.

I have a German passport but live in Australia. I frequently visit my family in Germany and would like to open an account there to have funds when I visit. Is it possible to open an online account?

Yes it is. It makes sense to use your German family address, because Number26 is not able to send the bank cards to Australia. Good luck and good travel to Germany 🙂

I’m a Filipino businessman, it is possible for me to open a private banking account? and what are the requirements?

Yes, the account opening does not depend on the nationality of the future account holder. However, it is important that the delivery address for the card is in one of the countries stated above (list of countries).

In the course of time, other European countries will be added. An expansion to Asia or to other continents is not currently planned.

I am a spouse of a German national living in the Caribbean. We have children and I would like to open an account and name the children as the beneficiaries. We visit relatives in Germany at least once per year.

1. Can I as a non-German national open an account online? (We have family there so I can register an address).

2. Is putting a non-resident German child as a beneficiary allowed?

1. I am not sure, whether the ID-card / passport of a Caribbean State can be used for the online legitimating. This is due to the fact that the legitimating staff cannot know the security features of ID documents of all 193 countries worldwide!

However, you can give it a try. If it works, congratulations. If not, then you can make the legitimating in a post office branch during your next trip to Germany (PostIdent).

2. The accounts at Number26 can only be opened in one’s own name. The minimum age is 18 years.

Alternative: You can open a DKB-joint account together with your husband and then open a separate account for your child through the online banking – this bank offers its services only in German language.

That’s good to know. Thank you very much.

Hello. I’m student from lebanon and I want to open a bank account in germany online because I am registered in German language school in Aachen (sprechen akademie). How to open a bank account in germany online from lebanon? I’m old 17 years in 10 April 2016. Thank You.

That is not possible. You can open this account if your are in Germany (or some other EU countries – look at the article) and if you are older than 18 years.

Do you have any suggestions on how to open a German account as a Danish citizen with residence in Denmark? DKB and number26 bog give ‘sorry we are currently not offering services in your country’ answers.

Yes, there is one. But sadly not for free: https://www.deutscheskonto.org/en/account/online/

Hello,

I’m a UK national and resident. I want to open an account in Germany. Isn’t possible to do so, if I gives friend’s address in Germany?

Thanks for your help.

Hello!

As long as the mail arrives and you can provide a passport for identity verification, that is not a problem. I had something along those lines working for me as well.

Hello,

First of all, great article! I’m from Singapore and will be working as an intern in Augsburg. I need to open a German bank account for the company to pay my allowance. Will the company be able to pay me through Number26 bank and can I withdraw money from Augsburg? How safe is this bank?

Thank you very much!

You will probably like the Number26 bank account very much. It has a German IBAN and a transfer of the apprentice remuneration will definitely be possible.

You can withdraw cash worldwide fee-free at (almost) any ATM with the bank card. In Augsburg as in Singapore. Only where there are foreign fees at ATMs, charges will incur. This is regularly the case in the USA and Thailand, as well as in Germany at some savings banks (Sparkassen).

Good luck with your new account!

Thanks Gregor! Really appreciate your help.

However, I tried to open an account with Number26 but was turned down by this message:

“Thank you for signing up to our waiting list.

At the moment we are only available in Germany, Austria, France, Spain, Italy, Ireland, Greece and Slovakia . We will keep you up to date and get in touch with you as soon as Number26 is available in your country.”

=(

Use your address in Augsburg, if you arrived here 🙂

Swedish with registered a GbR in Germany. Could be possible a NUMBER26 bank account? Thanks.

As a Swedish citizen, you can use your national ID-card or the passport for the video legitimating. You can have the MasterCard sent to your company address in Germany. An account opening in the name of the GbR is not possible, because Number26 currently only opens accounts for natural persons.

Great!Thanks!

Hello Gregor,

I just opened an account with number26. Can you please tell me what are the limits? What is the balance that i can keep in my account? How much can i take from ATM? It will be very helfull. Thank you. Juan

Hi Juan Antonio!

Currently, the limit for daily withdrawals is 2,500 EUR, and for monthly withdrawals 20,000 EUR. It depends on the ATM, how much exactly it can pay you, but you can withdraw money several times a day.

The monthly limit of what you can pay with your card is 5,000 EUR daily and 20,000 EUR per month. If you, for security reasons, want to keep the daily limits lower, you can adjust them within your app.

There is no real limit of how much you can keep on the account, but the statutory guarantee (as in deposit insurance) is limited to 100,000 EUR.

I hope that helps 🙂

Thanks, Susanne! That is correct. I’d like to add that there currently is a limit for deposits (bank transfers) of 25,000 Euro per day.

Hi Susanne, thank you for your answer. If i have 15,000 euros in my german account today and i want to transfer them to my bank account in Spain, using the SEPA service, can i transfer 15,000 euro once or there is a limit? I need to know this. Thank you for help. Juan

This is possible with Number26.

Hi again, also i need to know if i can use the german account at the full potential without ordering the credit card? Thank you. Juan

Number26 ships the MasterCard automatically after successful account opening.

Also, 🙂 sorry for all this questions :). If i come to germany with my spanish ID, can i open a Number26 account directly in germany or should i register firt on your website? Thanks again for help.

You can open the account with an address in Spain or Germany. It does not matter.

All important information about account opening: https://www.deutscheskonto.org/en/number26/open-bank-account-online/

Hello,

Do you perhaps know if it is possible for a Turkish Citizen to open a Bank account without residency in the EU. Visiting for ID proof purposes wouldn’t be an issue.

Thanks in advance.

KaSa

I highly appreciate your comprehensive elaboration here. However, I must admit that I was and still am a customer of N26 … but I am looking for a new bank.

The conditions worsened too much – and what is a nice app good for, when the customer service is not easily available and does not even get in touch afterwards?

The ING Diba was recommended to me. What do you think of this bank?

The ING-DiBa is Germany´s biggest direct bank! And this due to good reasons ? The customer service is available around the clock and the conditions for the current account are top notch.

Perhaps our step-by-step instructions for the account opening will help you? https://www.deutscheskonto.org/en/ing-diba/open-account/

… and many thanks for your compliment!

Just a note from my recent experience: The embossed card number, name and expiration date on a debit card is a HUGE benefit when traveling. Typically debit cards are “electron”, they have printed and not embossed data. They are not accepted by car renting companies because embossed cards are required as security. Rentals actually hold a carbon print-out of your card as proof the card was present during the transaction, and they use this print-out to charge additional money in case you return with an empty petrol tank, damages, speed tickets etc. But since this debit card is embossed, it is accepted by most car rental companies, as I found out during a recent travel.

Hello. Czech I have no bank account. Can I transfer Czech Post (postal money order) to the bank account Onlinekonto your bank? What was the process? or what are the other options for depositing money from the Czech Republic to Onlinekonto? Thank you

Hello,

I have a bussines in Bulgaria with trade of nitrogen fertilizers.

I have need to create a current account in your bank. Could you support me and my bussines?

I want to start now procedure about create a current account, and open Visa Net Card, like I can give you scan documents – online, and after that I will come in your Branch in Germany.

Can you give me more information about how much time it takes to open an accunt and create VISA NET Card to it.

What are the requirements – like documents, which you wish I to propose.

Hey, hey, we are not a bank but a community of smart banking customers and exchange tips and tricks and publish tutorials online. If you want to open an account, please do this via the respective bank’s website. Best of luck for the account opening as well as your business!

Hi, my son lives in Berlin and he already has an account at N26. We are Colombian citizens and my question is: I travel twice a year to Berlin.

I wanto to know, whether I can open an account at N26, although I live in Peru… to manage different payments.

Currently, you cannot open an account at N26 from South America. N26 plans to start soon in the USA. The bank is already well distributed in Europe.

You can try (!) an account opening, when you are in Germany. We know some people outside Europe, who have a N26-account and work well with it. Of course, the account was applied for with an address in a country, in which N26 is already active. For example Germany, Austria, Ireland or Spain. Good luck!

in such a case, will it work to apply for an N26 account for a person with a Munich address, holding a non-EU passport?

Try it! I don’t decide that.

My friend (he is from France) is now in Africa. If I open an account at N26, order a card and send it to him, can he withdraw a larger amount from the card, if e.g. only Euros 100 are in the account? And what features does this account and card offer him? Thank you.

Hey, hey! Perhaps you should read through the account contract that you conclude when opening an account with the bank?

You are not allowed to make the card or PIN available to other people.

What you intend to do, is legally not allowed.

You always have to open an account for yourself and only use the account yourself.

I am living in Sweden and suppose to apply for a student visa in Germany and the embassy asks me to provide a blocked account at a bank in Germany and a document to evidence it. Is it possible to do it with N26?

Currently, I only know of the “Deutsche Bank” as a provider of blocked accounts. However, the fees are not that attractive. An N26 account could be opened for daily use in the next step.