How students can open the DKB account

Being a young person, one usually does not have a lot of experience when opening a bank account.

Especially at current accounts, one can think of some things in order to make a good impression for the bank and to obtain a bank card and Visa credit card with the according credit limit.

Account opening for Students

1. Go to the “Landingpage“ of the DKB-Cash

Please use this link https://www.dkb.de/privatkunden/dkb_cash/ dafür. Hier sehen Sie nochmals die Vorteile des DKB-Kontos. Klicken Sie nun auf „Jetzt DKB-Cash eröffnen“, um in den Antragsprozess einzusteigen.

2. Fill out the boxes

The first boxes are self-explanatory and entering your personal data will be quite easy for you. However, we will explain some field in detail, as our experiences have shown that the data is provided “too cautiously”, which caused in the worst cases, the rejection of the account opening.

-

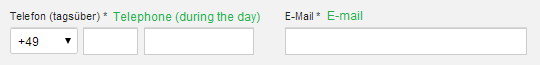

Telephone number

Also telephone numbers abroad may be entered und are used by the bank for any queries.

Please enter the telephone number with which the bank can contact you directly, so at best your mobile phone number. This has the advantage that the customer service of the DKB can contact you directly for any queries regarding the bank account opening. Moreover, it avoids unnecessary letters and your account will be opened faster.

Inquiries by phone are relatively rare at account openings in Germany. However, this happens more often when living abroad. In this case, you could be asked e.g. about the planned use; and the bank can also find out, if the communication in German language is working fine.

As you know, the DKB is a liberal-minded bank. It has customers in all countries of the world (except North Korea). Additionally, an application for an account is possible from abroad.

No promotional calls by the bank!

Your telephone number will be saved at the DKB also after the process of your application. Sometimes, requests via e-mail are easier to be answered by phone call. In such cases, the DKB will call you. There were absolutely no phone calls for promotional purposes during the past 10 years!

-

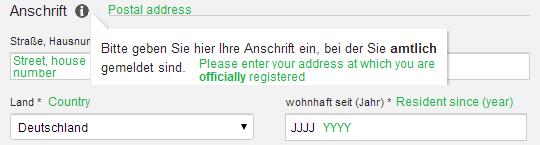

Address

Your address can be in Germany or abroad. A later change is of course possible using online banking and will not be further verified.

Please enter the same address as stated on your ID card or other identity document. This will simplify the legitimacy through the PostIdent as well as the new WebID-procedure.

After your successful account opening, you will get sent your bank card and Visa credit card. In the ID card of the students, often the home address of the parents is stated, as an official change of registration to the place of study did not occur (yet).

Please make sure that your parents receive the mail and that you will get it as soon as possible. Once your have received your login information for the online banking, you can enter the new address there.

The new address will not be further verified by the bank. The DKB does not send any promotional mails. However, you should make sure that the bank always has your current address available.

-

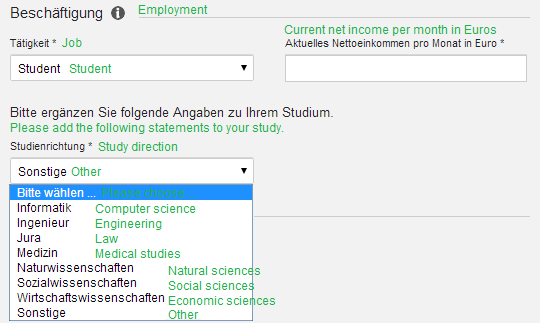

Occupation

Only the field of study is required. It is not necessary to state the name of the university or faculty.

Being a student, of course, you will choose “Student” from the drop down menu. This is obvious. You can also select “Student”, if you are in the transition phase.

This is, if you e.g. want to start with a course, but the details are not decided yet. Or if you have already completed or interrupted your studies and the subsequent use (for example, a new course) is not determined yet.

A certification of study is not required!

For the opening of the DKB account, a certification of study (registration certificate) is normally not necessary!

-

Current net income per month in Euro

It should be at least Euro 500 per month – it is allowed and welcome to sum up all incomes.

This box is very important, as it has a significant impact on the opening of the bank account as well as the initial credit limit. Especially people, who start their first study course and move to another city, have doubts on which number is the right one here.

The right number is the total of all incomes that you receive!This total could be calculated like the following example:

- 184 Euros Child benefit

- 300 Euros Student loans

- 300 Euros Sideline job

- 50 Euros Pocket money

- 20 Euros Support from grandmother

- Total: 854 Euros!

In this calculation, it is all about the incomes, not the expenses.

The child benefit and possibly the family support are usually fixed. New students or students, who are in a reorientation phase, may not have the specific figures of the sideline job and student loan yet.

In such cases, it is meaningful to provide the bank with estimates, as:

- it does not make sense for the bank to open a bank account with credit card for people without income,

- the given information will not be verified with payslips or the like,

- the incomes do not have to flow directly into the bank account.

A proof is generally not required!

Of course, you may use the DKB account also as a salary account – this is especially meaningful, if one wants to have a larger credit line later on. It can also be used as a secondary account or for other purposes, which are presented here.

In order to apply for the DKB account successfully, one should have a disposable income of more then Euro 500 per month.

If you have less money at your disposal, then I recommend applying for the Comdirect current account. At the Comdirect, you have the possibility to waive on the Visa credit card or to obtain a prepaid version. At the DKB-Cash account, there is always a true credit card included; therefore, at least some income is necessary – even if it does not flow into the DKB account.

3. Account opening and credit limit

After you have completed the bank account application process and the identity check and the Schufa-query (credit investigation company) did not show any negative entries, you will receive a welcoming mail with your bank account number and login information for the online banking after a few days.

Overdraft facility, credit limit, credit line, disposal limit = defines how far your can go into the red at the DKB.

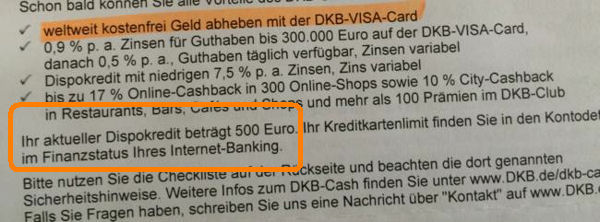

You will be informed about your initial credit limit (= overdraft facility) of the Visa credit card. For many students, it is Euro 500. You have two possibilities to increase it:

- Deposits to the credit card account (your balance is always available for you)

- Transfer the salary payments to the DKB account and apply for a higher limit.

… more about this topic in further articles on this special portal. On this page, it was all about providing a support for students for the application of the DKB account with Visa credit card.

“Yes, I want to have this bank account!”

… simplified credit assessments for students!

Do you have any questions about this topic?

Please use the comments box. We would be glad to help you!

Further articles about the clever usage of the DKB account:

- Open DKB bank account with instructions (English/German) ◄ very helpful!

- 3 Secrets for New Customers of the DKB

- How to apply for a 2nd Visa card at the DKB

Images: Lisa Gerhold · DKB AG

Dear Tanja,

I am in Germany to study at the University for two months – I was awarded a grant from the DAAD. The problem is that the DAAD can pay the grant only to a German bank account, but the banks here won’t open a bank account for less than 6 months. I haven’t tried the DKB or the Comdirekt yet. What do you advise?

Thanks in advance.

Ah, I forgot to say that I am EU citizen, in case that matters.

Yes, it makes hardly sense to open a bank account for only two months. Opening a checking account costs a bank at least 100 EUR. So why should a bank open an account, when you want close it very soon?

Please don’t open an account with this intent at our favorite banks DKB or Comdirect … DKB has already restricted opening accounts for people living outside Germany, because too many people didn’t use the offer sensibly.

I am surprised though, that the money cannot be transferred to your foreign account. Thanks to IBAN and SEPA, it should be possible without problems or additional costs at least within the euro area. That’s what SEPA has been created for.

Proposal:

1. Apply for a good German checking account if and only if you have use for it for a longer time. Compared to some other nations in the European Union, Germany is a paradise for bank customers!

2. Or open only a savings account (e.g. a Tagesgeldkonto) in Germany. You can receive money there as well and have it transferred to your main checking account. A savings account causes less effort for everyone, as there are no checks of creditworthiness and no bank cards. Opening and closing a savings account is simpler and less expensive for the bank than in the case of a checking account. Okay?

Mrs tanja,

I’m Iranian and I would like to apply my student visa but I should to open an account.

The problem is for Iranian there is no way to open an account, is it right or I can open an account?

The DKB generally does not open blocked accounts for students (only normal current accounts). Only few German banks offer blocked accounts. Most are opened at the Deutsche Bank.

Some days ago, I got an advice that the Sparkasse in Aachen opens accounts for Syrian students. Syria, similar to Iran, belongs to the countries for which citizens the account opening is generally a little more difficult.

My question is how does your cheff pay your salary into your dkb account if you own one. What do they have to do.

Thank you

Sorry, I am not sure if I understand right. Do you your own boss (like a freelancer) and want pay a salary into your private DKB account? That make sense that the bank see that you earn money … that is important for the value of credit line.

Hallo Mr Gregor

No I meant, for instance I am a nurse and I want my work to pay my salary into my dbk account, how will they do it. What are the procedures.Because it’s not like going to the bank and deposit my salary in my account right? Since its an online bank

Thank you

It’s easy. You give your DKB-account number (IBAN, BIC) to the personnel department of the hospital. They have banking software and transfer the salary to your DKB-account.

This banking software marks the transfer with the record “SALA”, so the bank can automatically recognize that this is a payment of salary.

Private persons can not mark transfers with “SALA”. For that they need banking software / business account which can do this. The majority of employers in Germany have it.

I recently arrived in Germany, I am a student but I want to open an DKB account with my new German address, otherwise my card and pins will be sent to America first, and it will take me longer to have an available account (I need it asap). What problems will I have for identity validation in case my current address does not match the one in my passport?

Thanks!

In individual cases, there are problems with the post, but most are satisfied, if one states the place of residence orally at non-German passports. However, if you are currently living in Germany, you can prove this with your “Meldebescheinigung” (registration certificate). In Germany, there is the law that you have to register at the town hall (Einwohnermeldeamt (registration office), Bürgerserivce (citizen service)), if you live here.

The DKB Account with Visa credit card always has a credit line (sometimes less, sometimes more). Since you probably do not have a credit history in Germany (not registered by the SCHUFA (credit investigation company)), then this could be the bigger challenge.

Good luck!

I have tried many online banks accounts, but they have all the same problem: the just show the account balance, there is no way to see the actual credit balance.

For example: when I withdraw some money or pay with the girocard, I don’t get to see the movement before it gets actually booked (after 1-3 working days).

Is it possible to see the movements in real time (Sparkasse like) with DKB or comdirect?

Yes, with the DKB this has recently become possible.

Hi Miss Tanja,

I am from Singapore and will be doing my exchange in Cologne for 4.5 months from August. I heard about DKB from a friend who mentioned that opening the student credit card & account will have no charges/fees and i can close it after 6 months. I would like to ask, is there any costs associated with closing the account (Kündigung)?

Thank you very much.

Hi Josiah,

We’d like to ask you to not apply for the DKB account. For an account opening the bank invests about 200 EUR in a new customer (legitimization, banking and credit card, online banking etc.). The bank does that gladly, for customers that want to use the account long-term.

People who open an account and then close it again after a few months, have the potential to make account openings more difficult for other people (increase of non-acceptance quota) and/or worsening of the conditions for all customers. DKB has been among the direct banks with the best conditions for many years, and that should stay this way. But for that it’s important that the customers use their account long-term. Since there are less money earning possibilities for a bank without account administration charges and without yearly fee for the credit card, long-term customer relationships are important.

Dear Tanja,

I am a Brazilian student and I’ll be doing an exchange for 1 year, maybe a little more, in Germany. I had gathered all the documents required to send and open the blocked student account with Deutsche Bank.

But yesterday I saw the option of DKB student card, found really interesting, and now I have some questions:

They also provide the option of blocked account? Can I open this account to apply for the student visa?

Can I, as a foreigner, still with basic knowledge of German, and still in Brazil, open the account?

Or perhaps open the DKB cash (that doesn’t require an address in Germany) and then apply for the DKB student card when I arrive?

Or can I apply for the student card already and put the address of the place that I’ll live, attach the admission letter that I received (I still don’t have a matriculation document)?

And the Passfoto is a copy of the passport page? Or just a regular face photo?

I understand it’s too many questions, but I hope you can help me. I thank you in advance.

Sincerely,

Amanda

Hi, at DKB it is not possible to open up a locked account. An account opening for foreign students is only possible, if one is in Germany (registration card). But an account opening for just one year does not make that much sense, and the bank will probably not agree to this. Instead, there are other providers, which we will introduce in the future.

Hello. We are a EU-foreign family living in Germany. I would like to know which is the best suitable account I could open for my son (17 years old) for which I could get a girocard and maybe later when he is a student a credit card. For now, the parents will transfer him the pocket money on monthly basis. Please let me know which are the best options in opening an account for a student 17th years old. Thanks!

Hello. If you are a DKB customer yourself, you can open for him (without a separate credit check for him) a junior account: https://www.deutscheskonto.org/en/dkb-opening-junior-account/

He will be able to take it over completely when he turns 18 and will then already have a Giro and Visa Card. For young people without their own income that is often the easiest way to get an account with (from my point of view) Germany’s most interesting direct bank.

Hello!

I’ve had my dkb account for a few years now but I would like to close it. I was wondering if you had any tips or useful insights on how to close the account.

Thanks!

Hello!

Please have a look at this link: https://www.deutscheskonto.org/de/dkb/konto-kuendigen/

We have a German sample letter for this purpose there, that you can use for your own message to the bank.

Hello,

I am a PhD student from Iran and I plan to stay and study in Germany for about 4 years (even more if I find a job after I graduate). I receive a monthly salary of about 1500 euros. Is DKB a suitable choice for me? Do they offer their services in English?

Thank you

Hello,

DKB offers neither account opening nor online banking or service in English.

With Onlinekonto customer services in English is possible. The website will be available in English at a later point as well.

Viabuy is available in English completely.

Other than DKB these two others charge a fee – but might because of that be available to foreign students.

Hi and thank you, especially for this great instruction!

I have a problem opening my account. I am a British student and will study in Germany from April.

I found an apartment to rent, but my landlord asks for a German bank account to debit the rent. Therefore, I want to open a German account and … unfortunately a surprise! One has to state a German address to open an account, otherwise, the website sends an error message: “DKB-Konto kann nur für Leute mit Wohnsitz in Deutschland eröffnet werden” (DKB-account can only be opened for people with a place of residence in Germany).

I cannot take the address in Germany, because the address is not yet official and my name is not on the mailbox.

It´s a snake biking its own tail and I do not have a solution for this problem. Do you have an idea?

With best regards,

Rémi

Perhaps the bank system is a little different from the one in England … if one has a good to very good creditworthiness, one can get a free current account with credit card and further great conditions. In order to be able to check the creditworthiness – or known from the English term “Credit History”, the bank needs an address in Germany, where you are actually officially registered.

If you live there since less than 2 years, then the address has to be stated, where you have lived before.

But not every provider checks the creditworthiness that exactly. There are providers that do not do this at all. They proceed according to another business model: they charge a monthly fee and there are also fees for the extras. On the other side, the account opening is very, very fast. One of these providers is Onlinekonto. Perhaps this helps as a transitional solution.

Good luck with your studies in Germany!

I am student doing my masters here, I like to deposit money as savings and also need as a credit card option in case of emergency money. Is DKB student account suitable for it?

If you already have a good credit standing in Germany and some sort of regular income, yes, then you can apply for the DKB account. For students, there is the additional option of a student credit card with “DKB Cash”, and for saving purposes you can open the “Tagesgeld” account.

I just applied the registration yesterday and finished post identify process. but I think i gonna bck to my country,Malaysia already.

is it ok continue to open the account or I have to cancel it? How can i request the cancellation?

If your address in Germany is valid/current long enough for you to receive the paperwork/cards of your new account, then you can let the application process continue and then later simply change your address to you new one.

If you want to canel your application, it is enough to simply send DKB an informal cancellation (please make sure to properly identify your application, so they can find it in their system).

Hi

I will be studying medicine in Germany but would like to set up a bank account before I leave my home country. I’m not sure where I’ll be living permanently in Germany as I still have to find an apartment. Could I still apply for a bank account for students from my home country? or is it better that I apply in Germany?

Recommendation: Apply the bank account when you are in Germany.

Hi, first of all many thanks for this useful site!

About the DKB I wanted to ask, whether I have to cancel my current account, if I deregister from Germany?

Or could I live again in my home country and still have access to the account and card? I am an Erasmus-student and want to keep a German account.

One can keep the DKB-account in spite of moving from Germany. As soon as the time has come, just consign the new address in the online banking. When the cards expire, you get them sent free of charge to the abroad. This is not a problem. This happens again and again.

Dear Tanja,

Hey, I am student from the United States and I will be studying in Germany for 2 years. I am already in germany and have gotten my Meldebestätigung.I have tried to register the DKB online from the link provided by you guys. However, in the end I received this message

” Leider konnten wir Ihrem Wunsch nach einem DKB-Cash im Rahmen unserer automatischen Entscheidung nicht entsprechen. Die notwendigen Voraussetzungen für ein DKB-Cash liegen gemäß Ihren Angaben nicht vor.

Ein zweiter Antragsteller kann sich positiv auf die Entscheidung Ihres Antrages auswirken.”

I am not sure why is this happening and what can I do? I believe I have provided all accurate and sensible answers. The biggest believe for me is my nationality as from Deutsche bank they are unwilling to open a block account for amercian citizens. If so, what else can I do?

Looking forward from your reply.

Cheers,

Martha

Hello Martha,

Since you are from the USA, I assume you are familiar with the expression “credit history”. Debit cards and a debit account you will be able to obtain in Germany without problems.With the DKB account, there is always a credit card included, therefore an account opening works only then, when a certain credit history is available. Several factors have an impact on this: the score value at Schufa, monthly income, residence, and duration of that residence so far.

With the reply, the bank wants to let you know that an account opening with a second person is probably possible (joint account). But this is probably not your plan. Maybe an account opening will work out in 6-12 months (better credit history) … DKB is one of the best German banks and can (unfortunately/fortunately) choose their customers.

A pity that I cannot write anything beyond that, but that’s the way it is.

Hello,

I am a British student who is working for 2 months at a German university as part of the DAAD RISE programme this summer. I was just looking for some advice regarding which banks would be suitable for someone looking to open an account in order to receive a 700 Euro monthly stipend.

Regards,

Ash.

Hello,

I am a foreign student doing a Masters degree in Germany. I already have an account in Deutsche Bank but would like to open another one (preferably at DKB), mostly for the credit card without fees.

Can I have 2 student accounts at the same time? Or would it be better to have a normal account at DKB, as well as keep my student account at DB.

Thanks for your help,

Luis

DKB only has one account model. It is the same for all clients, regardless whether you are a student or not. So you can keep your other account if you want – or not, if DKB suits you better in the long-term. 😉 Best of luck for the account opening!

I am a non-EU citizen (Indonesian to be precise) trying to get an educational loan to cover one of the requirements in the form of a deposit (around 8700 Euros). I do not hold German citizenship nor do I have permanent residence permit. Will I be able to apply a loan?

Here you can find questions and answers regarding loans/credits in Germany

► https://www.deutscheskonto.org/en/loan/

Hello,

I am registered as a student at the University of Freiburg. I need a German bank account for insurance, receiving money monthly from my blocked account, etc., but the banks I have visited require both of my parents to be present since I am under 18. However, they are both in different countries and it is difficult for them to come. Does DKB have an account for minors where the parents do not have to be present in person?

Thank you in advance.

Hi Evelyn, nice, Freiburg is a beautiful city! I hope you enjoying studying there. Ok. As I know with DKB it is possible to open an account for minors. And your parents have to be present – in the Internet. Your parents can open this account online. 😉 Sorry for my tarzan english.

Hi Evelyn,

As Martin has already said: No bank opens accounts for minors (i.e. in Germany younger than 18 years). That is not because of the banks, but due to our laws.

DKB does offer a junior account, but for that your parents need to have an account at DKB as well. You can find more information about that here.

I am trying to order a new credit card via the website as mine will expire in February and I would like to book a couple of things for March or May.

How can I request a new card? do I need to call? Cause my German is still not great I would be happy to do it all online.

Thanks

You can do that online. You can find the instructions here.

Hi All,

I am doing my Masters in Germany and I want to open a current account from DKB. I am an Indian Citizen and have residence permit for 1 year in Germany (will renew every year) and I will be staying here for more than years. Does DKB accept my application and opens account for me?

PS: I heard DKB does business only in German, so will it be a problem for English speaking students or do they reject my application as I don’t speak German?

Thanks & Regards,

Sachin

When opening an account, you do not speak to the bank because all processes are online. Except for legitimization, which is also possible in English. Nevertheless, I do not recommend opening an account if you do not understand the German language. After all, you cannot understand the account contract you are signing, and what do you want to do if there is a problem?

Hi Richard,

Thanks for the information. In this case which Bank do you suggest for me, I am an international student and I need to get my blocked account money transferred to a German Bank account and use it. Can you please suggest?

Thanks & Regards,

Sachin

Deutsche Bank has such accounts.

Thank You.

Hello. I’m a student born in September 2002. I will be studying in Amsterdam (without my parents) I would like to open a student account. Can I do it by myself as I am still under 18? Do I need my parents’ approval?

According to German law, you can only open an bank account when you are at least 18 years old. However, Amsterdam is not Germany. 😉

Hello,

I am a 30 years student from Iran and I would like to open a bank account at DKB. I do not have a job but I have all the money for 1 year of my study and I want to deposit that amount to my account. What should I write as a salary in the form? The fact that I do not have monthly income but I have the money for 1 year living in Germany.

Regards,

Saeedeh Bagheri

The problem with banks in Germany is often that too much or too little money is not so welcome. I would solve it myself in such a way that I would pay myself a “fictitious in-come” according to my planned standard of living. For example, as a student, that could be 1,800 euros. Best of luck!

Hey,

I’m going to Germany in September, and I would like to open an account for DKB bank. and I’m planning to keep it even after going back to my country. it’s big bank with great repetition. the problem is the bank wants Tax number or whatever. I’m going as exchange student and even my country JORDAN, we only use tax number for business only. How can I go around that?. and I have the legal documents and the rest of the “DAAD” financing for the student “861” Euro/m.

If you apply online for an account, the field for the tax ID is not mandatory, so can simply leave it empty.