TransferWise: Transfer in Real Time

As a sequel to the article “TransferWise as a current account alternative”, I have implemented and documented a transfer from my TransferWise-account to the DKB-account for our frequent readers.

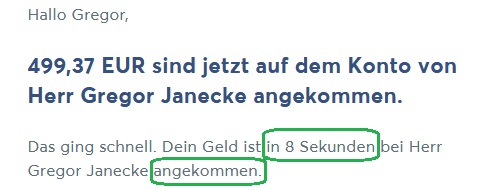

I received an e-mail immediately after sending the transfer:

What previously took 3 days is now done in only 8 seconds! Thanks 🙂

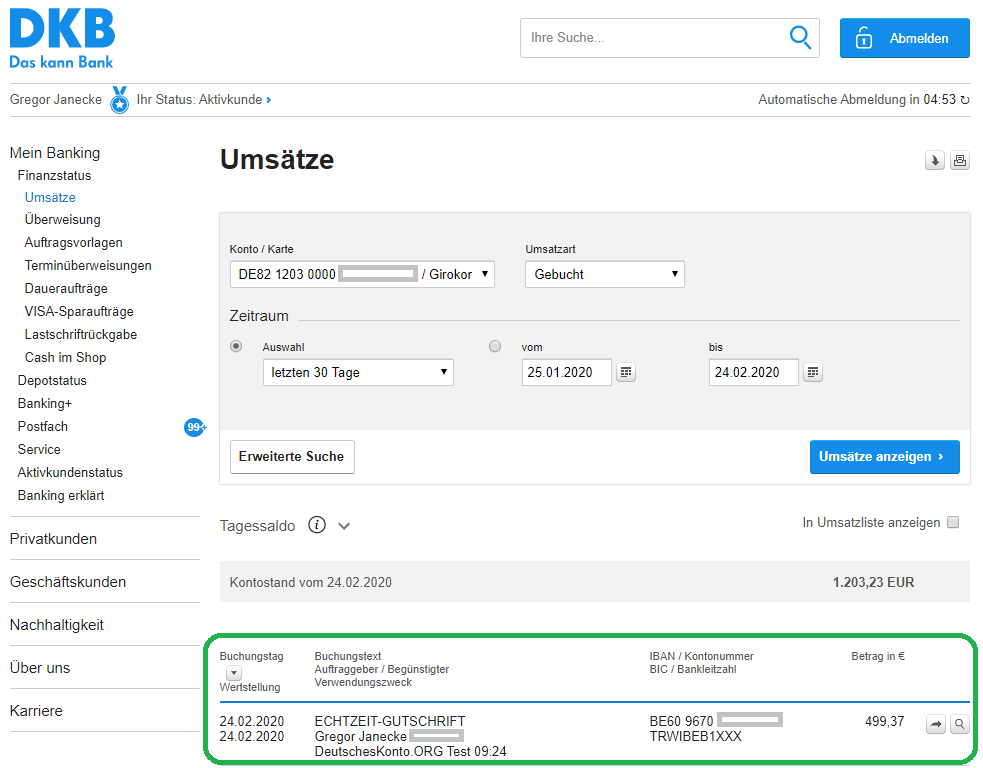

Of course, I logged into the DKB right away:

The real time credit note of TransferWise was immediately visible in the DKB-account. Excellent!

Before we take a look at the transfer steps, our new readers can find the advantages of TransferWise in five bullet points:

- free account management

- free Mastercard

- free cash withdrawals (up to € 238 per month)

- free holding of different currencies (multi currency account)

- easy and free online account opening.

TransferWise-transfer step-by-step

After the login into an existing account, you get to this page (activity and account overview):

Click on the green button to start a transfer.

Every transfer is a real time transfer!

Choose amount

You can transfer from the account balance – you have additional methods for the immediate recharge of the TransferWise-account at your disposal. Someone of our community has asked this question.

Yes, I know: For some people, fees in combination with a current account are a “no-go”. TransferWise is not an option for them.

Everyone else should please note the amount of logistics that have to interact to even be able to offer national and international payments. Moreover, there are absolutely no fixed costs (no account management fees, no fees for the Mastercard) and you also have a German-speaking customer service by e-mail and phone on top of the app and online banking. All that without charges!

A little transfer fee, but otherwise no fixed costs

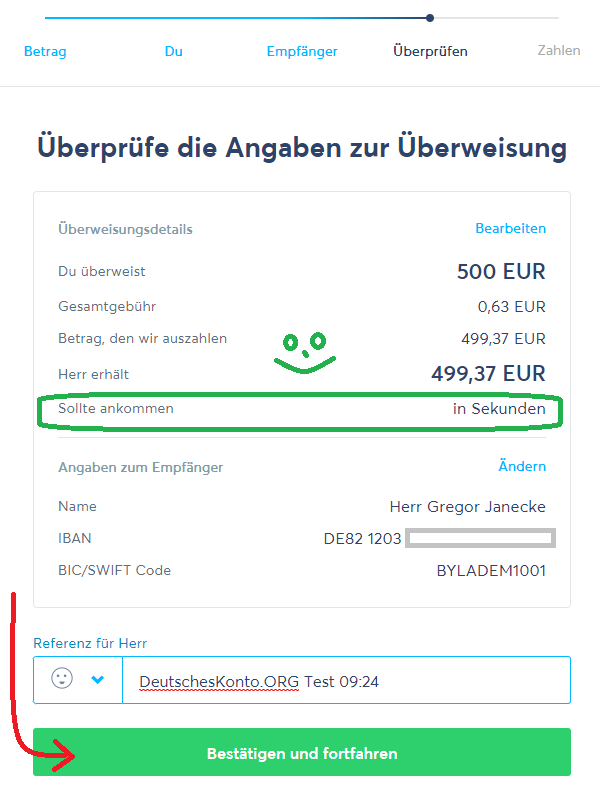

Fees only apply, if you make outgoing transfers or internal transfers in other currencies. At transfers within the SEPA-system, it is Euros 0.63 per transfer. Incoming transfers or direct debit notes are free of charge.

Please note that the 63 cents have to be added to the outgoing amount, if the exact amount of e.g. Euros 500 should arrive at the recipient.

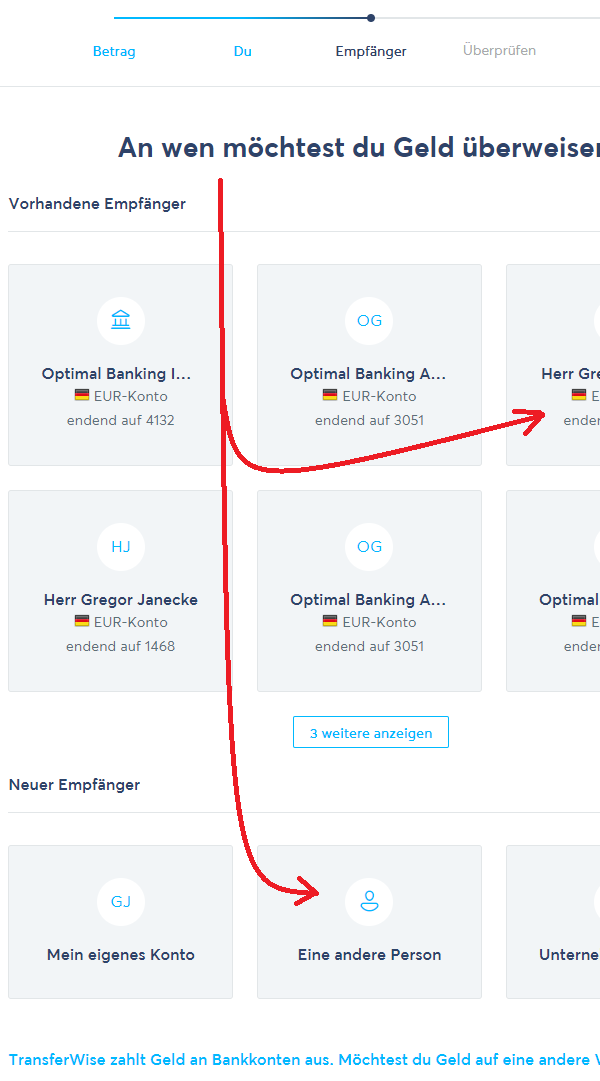

Choose the recipient

You either set up a new recipient or you can choose from a saved one of the previous transfers.

Is this correct?

You can add a purpose here, e.g. a bill number.

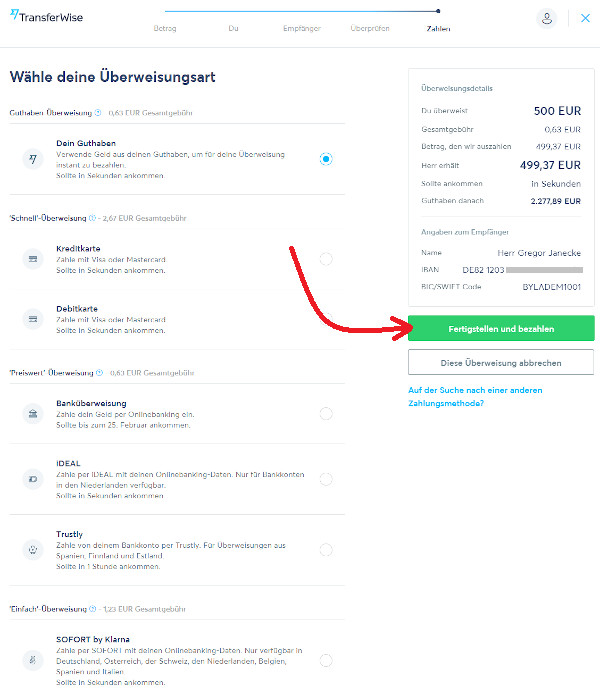

Implement payment

The transfer is implemented with this last click – you can change the payment method for the last time.

Payment is on its way

You will see this picture only briefly, because the real-time transfer only requires a few seconds.

Immediate credit note at the recipient

I have logged into the DKB-account immediately and you can see: The transfer has already been credited!

Summary

Transfers within the SEPA-area are always implemented by TransferWise without a surcharge as a real time transfer. If the recipients bank can also credit the money as fast – which most banks can – then the payment is finished within a few seconds.

What a huge progress compared to former times!

However, TransferWise charges 63 cents for each transfer. There are no fees for the account management or the account service. Incoming transfers are also free of charge. Likewise, there are no transaction fees for card payments.

Comforting certainty: If you do not use the account, there are no fees either.

Do you already have a TransferWise-account?

As always, I am glad to read your experiences and tips in the comments feature.

If not already done, I recommend to open this account. You can read about the further background on why we emphasize the recommendation soon in our Sunday mail.

TransferWise offers an interesting package as a whole ► https://transferwise.com/de/borderless/ ✅

» Step-by-step instruction on the account opening.

How to use TransferWise on top of that:

- TransferWise for international payments

- Transfer of a purchase price payment for real estate abroad

- Comparison of DKB and TransferWise –or are they supplementing each other perfectly?

Leave a Reply