Open account at N26 – yes or no?

149 smart bank customers have participated in our survey about N26 and have reported about their experiences with the bank N26. Thank you very much for everything!

On this page you receive the prepared evaluation.

We hope that it will be a good base for taking your decision, whether you will decide for an account opening – or not. Alternatives will be named accordingly.

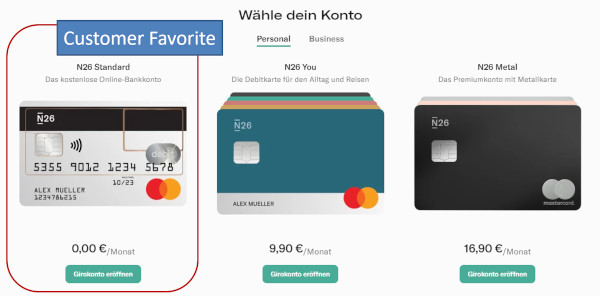

If you have not heard anything about N26 yet: It is Germany’s first Fintech, which received a company evaluation worth billions (business success) and offers a free current account (customer use) as well as several models that are subject to charge:

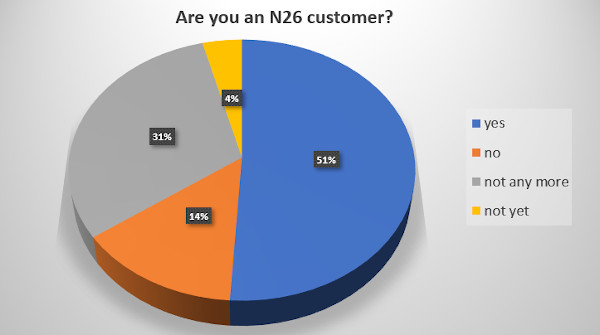

More than every second person is a customer of N26

… not of the total population, but of the survey participants from our smart bank customer community. This is even more than I expected. However, one third has left the bank again – again more than I expected. We will hear about the reasons in the further course of this page.

In our community, there is a minimum potential of 4 per cent and a maximum potential of 18 per cent that could still become customers.

To what part do you belong to and what is your opinion of N26?

Please answer using the comments feature at the end of this page. Hearty thanks!

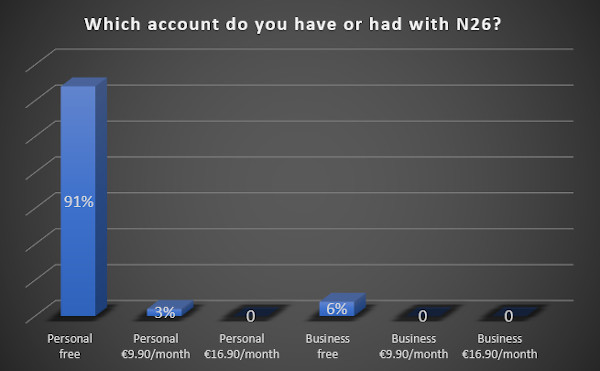

With which account model did you gain experiences?

Fitting to our community, the great mayority (91 per cent) of customers has opened a free private account at N26, another 6 per cent a free business account.

Only 3 per cent have directly paid for bank services. Do you think that the investers of N26, such as the Allianz and several Venture-Capital-Fonds, were happy about that?

Well, their profit is created through additional product sales (Allianz) or a higher price when reselling the share certificates (Venture-Capital-Fonds). Could there soon be a IPO (flotation) on the horizon?

Main reasons, why the account has not been opened

- Bad image in the press

This is very interesting, because the trust in the press has diminished continuously in the past years. Almost everyone knows the term “LÜGENPRESSE” (lying press). The word refers to the deliberately false illustration of facts in the political area. Our readers seem to trust a lot in the reporting of the press about banks.

Where does the trend towards bad reviews in the press come from?

Is it envy that has been cultivated since about two or three generations? Is there a jealousy of N26’s success? In the end, N26 has adquired about 5 million customers according to own statements. 5 million in 5 years. This is extremely good!

In the press, of course, there is some doubt about what is called customers and whether there are a lot of clients that only exist on paper among them.

The contact between the press and the “press department” of N26 – which obviously has been partially implemented by a freelancer – does not seem to be the best either, as one can hear in the background. However, our portal has never received an answer of queries through the press channel.

So that the press has something to report about, it has to disclose something worth writing about the customer numbers. And this was the case. Mainly negatively. This is not unusual.

Negative things “sell” best in the press.

For example, that the legitimatings were so weak – sometimes people were able to open a bank account just by uploading a photo of the identification document – that a whole bunch of fraudsters opened the N26 accounts. As a consequence, high-priced products were offered on eBay, the buyers transferred to the N26-account and have never ever received the product.

There have been repeatedly reports about security risks or about customers, who have been missing money from the account and that N26 has failed to take care of these cases, were incompetent or very slow. One could read in the press reports: ony when the affected customers turned to the press.

Over all, N26 seemed to only take care of a problem, when the pressure was big enough. Even if the pressure came from the banking supervision, which almost always only acts behind doors, completely office-like. However, it became known that one had to use more pressure at N26 as normally with other banks.

You could summarize it as follows:

Account openings did not happen, because the interested person was afraid that the bank will not help when encountering a problem!

This coincides with statements by people, who have or had an account at N26 and complained about the customer service. Moreover, there is no (more) phone customer service in four of the six account models!

There is only the chat-dialogue with the customer service for customers of the free account. Some customers do well with it, others would like to speak to a real person, for example, if it is about complex circumstances.

Another point of critisism was that the customer service was not entirely competent or has made promises that were not kept.

Further reasons, why no account was opened at N26

- There are already many good accounts, such are offered by the DKB, ING or Comdirect, Revolut or TransferWise. The added value of N26 is too low and you would have an additional entry in the Schufa.

- N26 does not offer a Girocard – in Germany, you can have the Maestro-Card optionally added to the Mastercard, but it is not accepted everywhere, where the Girocards are accepted.

- already very satisfied with the existing bank system or created account system

- no real-time transfers possible

- dubious image (see press reports + other customer experiences)

- low trust in Fintechs.

Why customers cancelled the N26-account

- conditions have worsened since its beginnings in several phases.

- bad experiences with the customer service

- lost trust (presumably through press reports or own experiences)

- Schufa-entry (this was a surprise for some; N26 was Schufa-free in the first years)

- did not like to be adressed with the informal “you” for banking operations

- focussed on other banks, account has simply no longer been used.

What should happen, so that you would open the account as a new customer?

4 per cent of the survey participants has stated that they have “not yet” opened the account at N26, and one could assume with confidence that the account openings will take place as soon as some things have been cleared. This and if the points mentioned above have not discouraged them from doing so.

We will soon deal with the requirements for a “pleasant account opening”, but first the list of desired features:

- Sofort-transfer (immediate transfer, at best free of charge or cheap)

- a “true” credit card (N26 currently only offers debit Mastercards, of which every card use is immediately debited from the current account)

- unlimited cash-withdrawals

- possibility of an account opening for minors

- further information (perhaps this article has helped you, you are welcome to recommend it to others).

How should you be, as a customers, if you want to open the account?

The bank is what it is. Of course, it is subject to continuous changes, even stronger and it seems to change more often than other current account holding banks. However, it is by far easier to change yourself than a bank.

But who wants to change himself/herself for a bank?

Okay, some see an opportunity of growth or leaving the “comfort zone”. Not everyone wants that or at least not as a surprise. So therefore we take a look into the following list of features of how a satisfied N26-customer should look like:

- You are an “onliner”. You love to make payments fast, free of charge and easily. You manage your finances online and if you have a question or a problem, you prefer the immediate chat feature. You do not need a voice contact and you absolutely hate to listen to the muzak during the phone waiting line.

- You love to pay with the card and look forward to automatic evaluation possibilities that give you a better overview of your finances. A few cost-free cash withdrawals per month are enough for you, if you even need them at all.

- You would like to combine the account/Mastercard with an insurance package. This is possible paying a surcharge and also having a telephone customer service (however, almost no one from our community did that).

- You like the hierarchie-free communication and feel well communicating in an informal way with the bank.

- You have at least one very good (reserve) account.

Suggestion:

If you still have space in your account system, then try N26. Even if most of this article has been written about the less nice sides – the heaviest opinion was because of the press response – it also has to have a whole bunch of satisfied customers, otherwise N26 would not have that outstandingly huge growth (about the same as the DKB and ING together)!

Has this page helped you to take a decision about whether you open an account at the N26 – or not?

Please leave a comment at the end of this page and please recommend our community of smart bank customers. Thank you!

A hearty thanks to the participants of the survey and the many letters!

Soon about another bank? You can participate through our Sunday mail.

Frequently commented articles of the community:

- N26 – Transition to a better banking?

- Postbank in Germany: Account opening good or bad?

- € 100 bonus for an

account openingaccount use

Leave a Reply