Euros 30,000 overdraft facility on the free current account without salary transfer ✓

In this article, we share with you a strategy of how to get a current account with a connected credit line of Euros 30,000 or more.

It provenly works!

Of course, not for everyone. You need a regular income; however, this does not have to be transferred to the bank. An electronic proof is enough. You also have to be at peace with the Schufa.

Starting point for this article was a three-part reader’s-feedback by Vicent, which was sent to me via WhatsApp. Part 1:

Many, many thanks. I love such feedback, as it makes us advance together!

If you wonder, where he got my mobile number from … He is an active participant of our ► Achiever-training since quite some time.

In this program, we train how to build the creditworthiness in different modules!

Building the creditworthiness is possible with above-average high credit lines – please do not use it for consumption expenditures – Hand in hand. For this, please listen to the audio feedback number 3 at the end of the article.

In which cases is the strategy meaningful?

For example:

- If you want to open a new current account (at a top bank) anyway.

- If you want to set up a high credit line in order to be financially flexible.

- If your professional status could change in your life (e.g. from employee to self-employed person or sabbatical year).

- If you want to increase your creditworthiness (e.g. to get better financing interest rates when acquiring real estate in the future).

- If you enjoy taking advantage of bank products.

In which cases one should not implement this strategy?

- If you are financially at the very beginning and do not feel comfortable. Perhaps you want to start with our coaching program to get a helpful “account system for building asset”?

- If you currently do not have a regular income from work and/or have to “clean up” you Schufa-data first. In these cases, the strategy won’t work and you can save yourself the work of application. The start with our account system would be a good idea in this case too!

- You do not use online banking with your salary current account (because this is where we get the electronical proof of salary).

Good news: One can also submit the proof of salary by mail.

Oh yes, if you already have a current account at the ING-DiBa, then you cannot apply for the credit line before the opening of the current account. Nevertheless: The idea can be recommended to others through sharing this article!

Instruction:

Set up the credit line before the current account!

Here you can listen to the original tip:

Way of proceeding: step-by-step

-

1. Apply online for the credit line

The credit line works like an overdraft facility.

That means: It only costs interest, if one uses it. And also limited to the duration and amount of the use.

One can get flexibly into and out of the credit line at any time. Besides the monthly payment of interest (if one currently uses it, which is not obligatory), it does not oblige you to anything.

Free of charge, except in the time, when you use it!

The credit line is higher, in contrast to the overdraft facility. In order to get the maximum possible (and recommended by us) Euros 25,000, you only need a surplus of Euros 121.46 in the expenditure account (this is the monthly interest payment at the maximum use of the amount and time) and a good Schufa-rating.

You can apply online for the credit line through this link ► https://www.ing-diba.de/lp/rahmenkredit

Here you can find a ► comprehensive instruction for this matter.

-

2. Allow “peeking” into your salary account

Within the application procedure, there is the comfortable option of allowing the ING-DiBa an one-time access to your salary account in an automized electronical procedure. Give permission to the query and enter your access data. This procedure is really safe. It is also used in the area of account switching service.

The bank computer of the ING-DiBa will notice your salary transfer with ease and will also see that you live financially within an ordinary limit. By querying the Schufa-scores, the bank further checks your status.

In many cases, the “Go” will then take place. Currently, you only need to print or let sent the contract of the credit line, sign it and send it back to the bank. Perhaps in the future, this paperwork-step won’t apply anymore.

If you currently do not have online banking at your current account with salary transfer or do not want to grant the ING-DiBa access to your online current account, then just submit a paper copy of the last salary slip. This is also possible.

-

It is important that you apply for the credit line before the current account

In this article, it is about getting an extraordinary high credit line with as little effort as possible, without having to arrange to transfer the salary to another bank!

In the end, you would lose the credit line/overdraft facility at the other bank, if applicable …

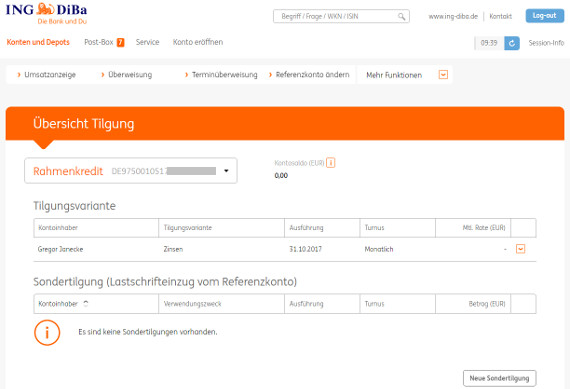

Please make yourself familiar with the online banking and the transfer options of the credit line.

-

3. Wait a little …

… and gather your first experiences with the online banking of the ING-DiBa. For example, you could arrange to get paid money from the credit line account and deposit it again. This is how you will note how well you deal with the bank procedures.

-

4. Apply for the current account with overdraft facility

If you are completely satisfied with the ING-DiBa, then nothing should hold you back from taking a current account too. Right?

If you like, you can let the bank acquire you as a current account customer through one of its cross-selling advertisements. The bank can take it internally as a success and a stronger customer relationship.

At the same time, also your internal ranking (your creditworthiness) at the ING-DiBa will improve. We deal with this subject more in detail within our Achiever-training.

Of course, you can use the online form for opening the current account anytime you want ► https://www.ing-diba.de/lp/girokonto

You can also receive the new customer bonus, if you apply for the credit line first (without bonus) and then the current account. The bonus applies to the opening of the first current account, independently whether you already use other products of the bank!

Just go there using this link ► https://www.ing-diba.de/lp/girokonto and tick in the online form that you are already a customer. This way, you save yourself the further legitimating!If you have already proven your income with the application for the credit line, then you do not need to submit proof of salary again and you do not have to arrange to transfer your salary to the current account of the ING-DiBa!

If you want to apply for the maximum overdraft facility limit, then enter the three-times amount of your monthly net income – the maximum is Euros 10,000. The ING-DiBa grants overdraft facilities “only” up to Euros 10,000.

Big income earners can therefore get a total credit line (credit line + overdraft facility) of Euros 35,000 completely without a salary transfer at the ING-DiBa.

For our article head line, I have deliberately chosen Euros 30,000, because you “only” need an income of Euros 1,666.67 to get it!

Please note that only the “payment amount” can be determined at the automatic account reading of the bank computer. Sometimes there are small differences between the net income and the payment amount, for example at subsequent salary calculations or savings contracts in the area of capital-forming benefits. However, you do not have to worry about that, because the bank also knows about that!

You made it, done!

What do you get at the end of implementation?

You have created – from nothing– a credit line perhaps of about Euros 30,000 without changing anything of your already consisting accounts.

This credit line can outstandingly assist you in transition phases of your life or take short financial bottlenecks. However, please note that you do not spend the credit line money for consumption expenditures. In the long run, this would not be good and hardly complies with the mindset of our smart banking community.

Moreover, the credit line should have a positive impact on your creditworthiness building, as well as on your Schufa-rating. We have reported about that already several times, the last time was here.

For this matter, listen to the last audio:

The participant of our Achiever-training has opened the DKB current account as recommended in the program. Perhaps this is important as a supplementing information to the audio in order to understand the context. Within the further course of time, he applied for and was granted the credit line.

Ready to start with step 1?

“Start-button for the smart credit line”

Feedbacks and questions

I am glad to receive your feedback and questions to the implementation of the strategy through the comments feature. Of course, also reports of success. These should be a drive for other readers, who want to follow our example. Even if you are not participating in the Achiever-training!

It should be super-meaningful for a huge number of people to set up such a credit line. Even if you currently do not think that you may need it in the future. First of all, it is very probable that your creditworthiness will improve, and second is that life circumstances always change and one would be glad later on, if one would have set up a smart credit line in good times.

Please also see the two case examples from the article Set up a strategic credit line… because once set up, the credit line of the ING-DiBa will remain unaudited also in bad times!

Credit line will remain for eternity!

Oh yes, more about the free current account of the ING-DiBa can be found here ► ING-DiBa: cash & cards in an overview.

Video to the article for our fans on YouTube (English subtitles):

Apply for the current account opening ► https://www.ing-diba.de/lp/girokonto

Many, many thanks to Vincent, who shared his ideas and audio-experiences with us and you through his audio-message. We would be pleased to receive more!

Leave a Reply