Open the ING-DiBa bank account

Do you play with the thought of opening the free current account at the ING-DiBa, but you do not know all the details yet? Good!

ING-DiBa-account free of charge!

We have created a step-by-step instruction with pictures for you on how to open the account online successfully.

In further articles, we introduce you into a clever use of account and cards. At the end of each page, you have the possibility to ask questions.

Step 1: open the account application form online

Please go through this link ⇒ https://produkte.banking.ing-diba.de/pub/girokonto directly to the online application and start with the filling.

Step 2: filling the online form

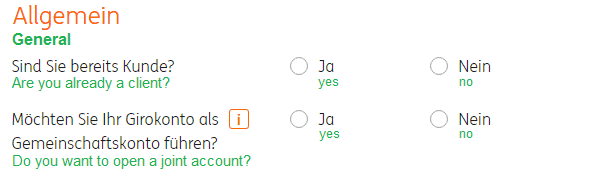

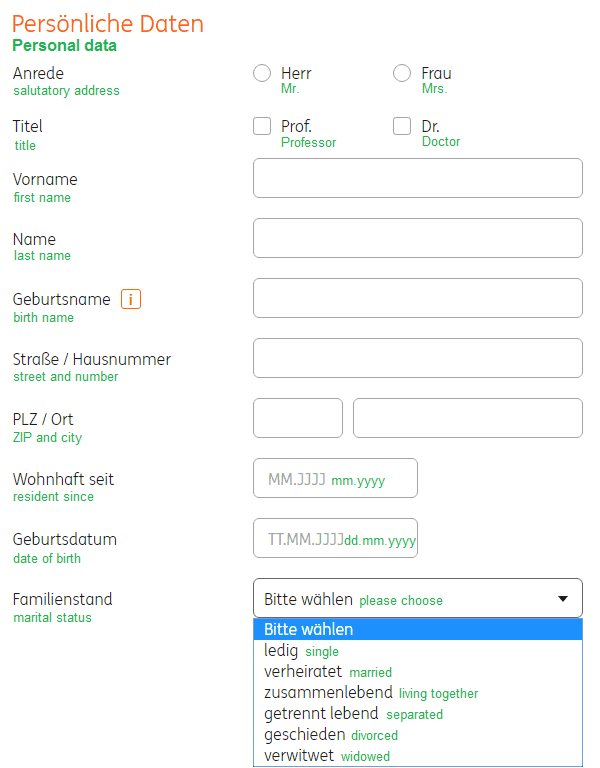

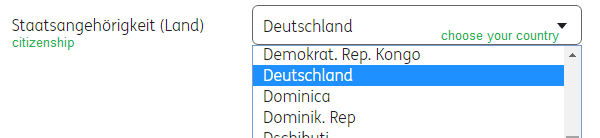

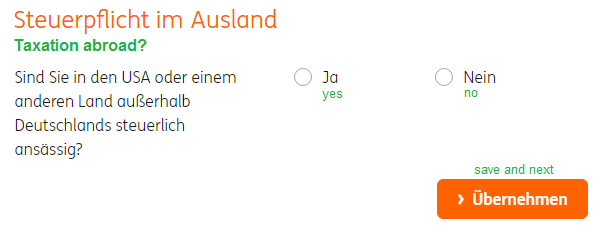

The procedure of account opening is shown to you here picture by picture:

Note on the account opening as a joint account: both account holders must be partners and reside at the same address.

Note at the field birth name: if you have changed your last name in the course of life (e.g. through a marriage), then please state your former family name in this field. If this name stayed the same, then the field remains free.

Please choose your citizenship in German language. As there are about 200 countries, we cannot show all of them translated.

Note on entering the e-mail address: the e-mail address is necessary for the account opening. The bank will inform you for free about services and products, as well as interesting facts about finances. You can refuse to have contact via e-mail anytime.

Please note that the ING-DiBa currently only opens current accounts, if you have a place of residence / address in Germany. Most often, you are taxable in the city, where you live. However, this is not always the case and therefore you can state the tax-country already at the ING-DiBa account opening.

By clicking on “ÜBERNEHMEN” (submit), you go to the next page:

Use our tips for the right filling in the next section.

How to fill the online account application correctly:

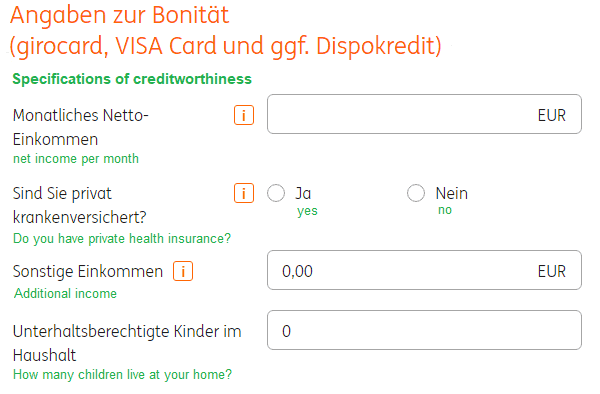

-

Field: monthly net income

The ING-DiBa wants to know, how much money you earn in your job. In the case that you want to apply for a credit line (overdraft facility) on the next page, the bank will ask for a proof of salary anyway. So, it makes sense to take your salary slip and enter the correct amount.

Section from a German standard salary slip.

The ING-DiBa does not accept the following net income: paid children support, Christmas bonus, vacation pay, expenses, other one-time payments.

-

Field: health insurance

More than 90 per cent of German people have a statutory health insurance. If this also applies to you, then choose “Nein” (no).

People with private health insurances are often officers, judges, soldiers, employees with a very high income, some self employed persons and partially also foreigners, who are visiting Germany.

-

Field: other income

Please enter all further income (cashflow) that you receive per month. This could be e.g. salary of a sideline job or rent income, also payments from private supplementary pensions. Income that you do not receive each month (e.g. yearly dividend payments) is converted into a monthly amount. Income from federal child support is not entered here.

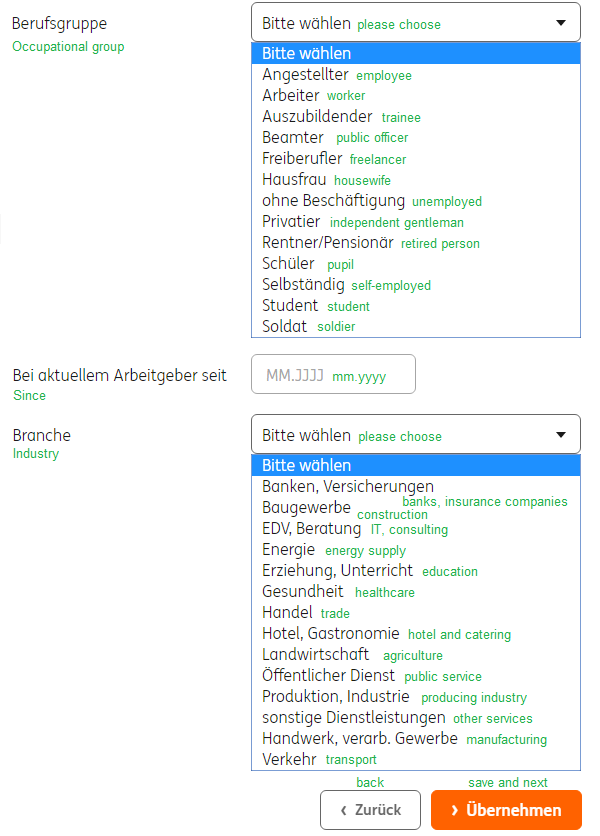

If you are currently unemployed, then it would be a good idea to open the account at a later point of time. This is the “lowest” position at the creditworthiness check.

The bank is often interested in how long you are already having this professional status. For this, a field for the date opens.

At some professional groups, the ING-DiBa is interested in a further division. These are statistical statements that do not affect at all or almost do not affect the creditworthiness assessment.

By clicking “Übernehmen” (submit) you go to the next page:

You can find explanations of the statements in the following paragraphs.

-

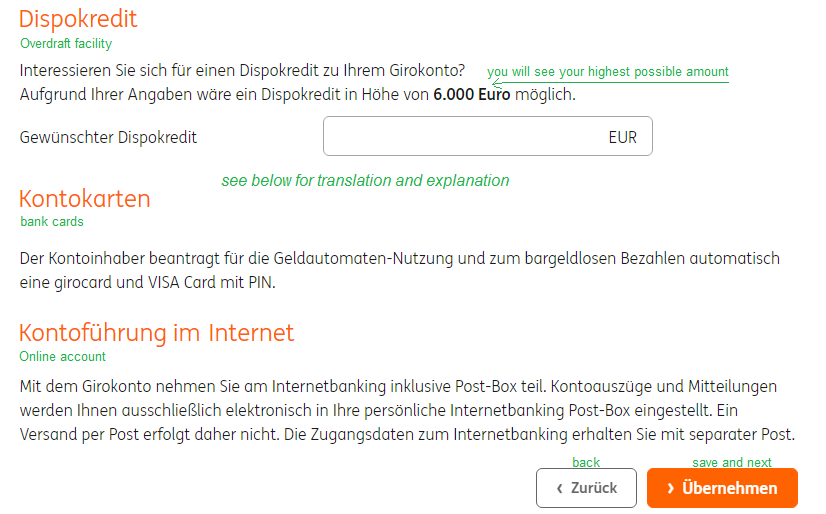

Overdraft facility

The ING-DiBa offers you to set up an overdraft facility immediately with the account opening. By this, one means the amount up to where you can go into the red. At the same time, it is the credit line on the Visa Card.

Due to the statement on the first pages, the bank calculates the maximum possible amount and shows it to you in bold letters.

You can take this amount and enter it into to field below. If you are satisfied with a lower overdraft facility (e.g. Euros 500), then you state this amount there.

If you do not want to have a credit line, then do not enter anything into this field.

-

Cards to the account

With the online account opening, you automatically receive two cards:

- 1 Girocard

- 1 Visa Card.

Both cards are completely free of charge for you. You can read later on this page, how to use them optimally: Cash and cards in an overview.

-

Account management on the Internet

With the online account opening, you agree to manage the account exclusively online. Bank statements are send to the electronic mailbox. You receive the access data by normal mail.

You can also take advantage of the phone customer service.

By clicking on “Übernehmen” (submit), you go to the next page:

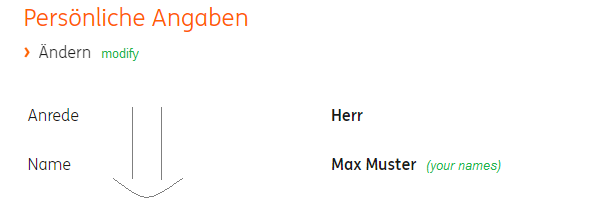

Please check on the next page, whether your statements were submitted or taken on correctly:

… if you notice a mistake, please click on “ändern” (modify), to correct the entered data.

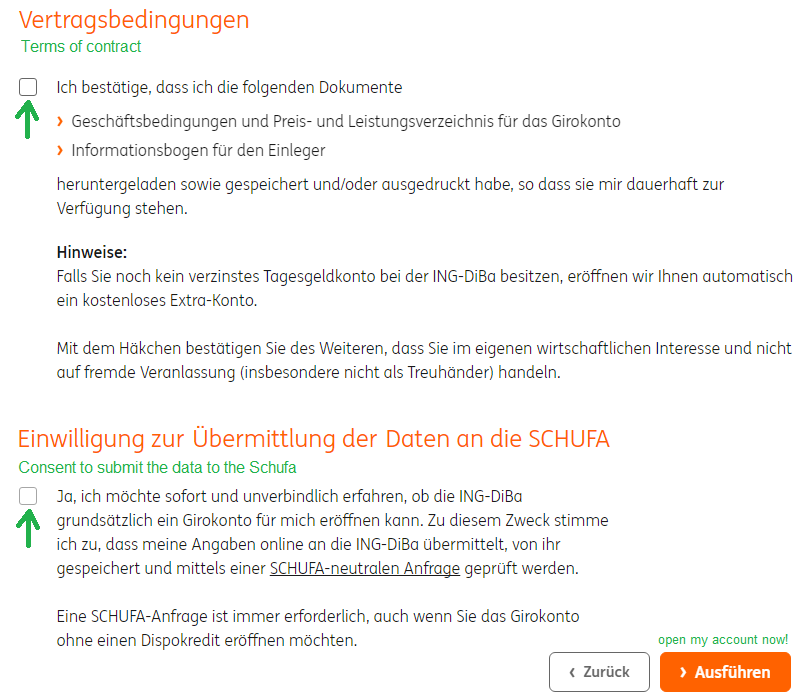

Consequently, you can agree to the terms and conditions of the bank. Please tick the box. Otherwise, no account can be opened for you.

Both boxes must be ticked to open the account!

-

Explanation of the first tick

By ticking the first box, you confirm that you have the price-performance listing for the current account (you can open and download the documents by clicking on the terms and conditions), as well as the statutory “Einlegerbogen für Anleger” (depositor’s form for investors).

With the current account, a savings account is automatically opened – called Extra-Konto at the ING-DiBa. On the savings account, there is interest on balance, but not on the current account. Rebookings are possible anytime and free of charge in the online banking and are booked immediately.

Moreover, you confirm by ticking that you open the account for yourself (not for otheres).

-

Explanation of the second tick

In Germany, it is common that current accounts and credit cards are recorded at a central office. This is the Schufa, Germany’s biggest information office for creditworthiness assessments. If you want to open a current account at a German bank, then you have to agree to the Schufa-clause.

The ING-DiBa will query your creditworthiness electronically at the Schufa. If no major negative is recorded about you (e.g. bankruptcy), then the account will be opened immediately after the legitimating in most cases.

The query at the Schufa takes place creditworthiness-neutrally. That means that you do not have any disadvantages through this. With the account opening, the Schufa notes that you have a current account at the ING-DiBa and how high the credit line is.

Through your data, you can ask for a free query at the Schufa. We show you here how this works: sample letter for Schufa-query.

If you want to open the account, then you must agree to the terms and conditions and tick the box.

By clicking on “Ausführen” (implement) you go to the next page:

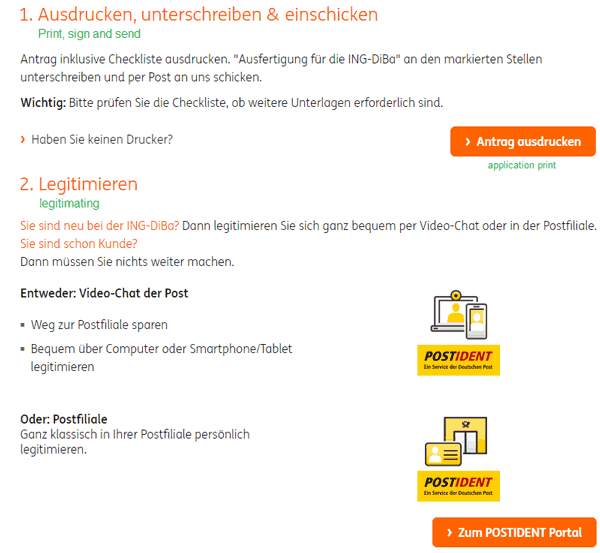

Now you can print the application. The first page is an instruction, on how it continues: sign and send it by mail to the ING-DiBa.

Now you can print the application. The first page is an instruction, on how it continues: sign and send it by mail to the ING-DiBa.

If you do not have a printer, then you can let the application documents be sent free of charge by mail to you.

Now, you only have to make the statutory legitimating: then visit a branch office of the German post with the PostIdent-Coupon (see graph) taking with you your ID-card or passport. This has the advantage that one can send the signed application documents at once free of charge.

Alternatively, you can use the modern video-legitimating procedure. Herein, you hold you ID document in front of the video camera

Done!

If you have reached this point, then you are done!

In the following days, you will receive several letters of the bank by mail. Account number, access data, cards and PINs.

“Open the account at the ING-DiBa now

… free current account in Germany!

Questions on the ING-DiBa-account opening?

My team and I would be glad to help you with your account opening. Please ask your questions on this subject through the comments box at the end of this page. By the way, I myself have a current account at the ING-DiBa since 2008!

Hi my name is Sebastian

I have one question?

I would like to open account in ING DiBa in Deutschland

If I open account hire there’s English version to?

I live in Augsburg and I try to find a filiale from ING but there’s only the Cash points so I’m not really shure how to open account,

Any one from you guys can help me ?

Thank you

Regards:

Sebastian

Hi Sebastian,

ING-DiBa is a direct bank, and as such, they do not have any local branches. Business (including the account opening) is conducted online. You find the link that takes you to the online form in the article above in Step 1.

Since ING-DiBa’s main target group is in the German language speaking group, they do not provide an English language online version. But as you can see in the article above, you can find instructions/translations regarding how to fill out the application. Best of luck! 🙂

Hi, you mention that:

Note on the account opening as a joint account: both account holders must be partners and reside at the same address.

What do you mean by ‘partners’? I have a partner, but we are not married or registered anywhere, do they perform any check on that?

do they ask that both of us have the same anmeldung?

Thank you!

You don’t need to be married to get a joint account, and this status is not checked either. There are constellations where, for example, a child opens a joint account with a parent, or several people in a flat-sharing community do. What is important for a successful joint account opening is that all account owners reside at the same address, as in are officially registered there. On German ID cards, the address is stated on the back, and foreign citizens have a “Meldebestätigung” (proof of residence). Best of luck for the account opening.

Hi Gregor, I just register my address in Germany as move in. Previously I live in another Schengen country as non EU. I just open a new ING-DiBa account online, and state that I live in the German address less than 2 years, so I must provide my previous address in another Schengen country. Then I proof my passport to post office nearby.

My questions are:

– Will I receive the Giro and Visa Card by post after this ID verification step?

– Is there any further clarification from ING Bank, let say about my income/job or residence permit?

– How long does it take to receive the letters containing account number, Giro and Visa cards?

Thanks

Rachel

The mailing of cards is done via the actual account opening by the bank. When you apply for an account opening, the bank checks, whether the account opening is possible, and then the cards are mailed out.

For security reasons, the mail is sent in divided parts. Within two weeks you should get all letters und have an account ready to use. Enjoy discovering your new bank!

Hello,

I have recently moved to Germany from the UK and the ING Bank account seems to fit my needs.

However, having stated that I have only recently moved into my address the form then asks me to inform them of a previous German address. Obviously this is not applicable because I have not previously lived in Germany but it will not let me proceed without filling this section in.

Is it still possible to open an account as someone who has not lived in Germany for very long?

Thanks!

In that special case, your application online might not work the usual way. It is best to contact the bank’s customer service by phone in order to find a solution.

Hi, I’m Samuel Isibor

Please I have been trying to open a self account not a joint account and it’s not working and I just newly be employed to a new company and I am new in Germany and need this account very urgent please tell me what to do thanks.

When you urgently need a Giro account, open a fee-based Giro account without credit check, for example this one ► online account with immediate account opening. This account is bilingual (German/English).

Background: Banks with free Giro accounts perform a credit check before opening an account. If you are new in Germany, your credit “history” is missing some important points. This history, you can build bit by bit. A provider or fee-based accounts without a credit line does not care about the history. That is why you get an account there immediately. It is simply about a different entrepreneurial focus.

Hello,

I have recently moved to Germany, and just completed the Anmeldung a few days ago. Now I’m waiting for my tax ID, and I’m wondering whether the tax ID is required to open an account at ING DiBa or if it would work without it? I would need the bank account as soon as possible, but don’t want my application to get rejected only because of the missing tax ID if it is required. Thanks in advance!

The account opening works without a tax ID, too. The tax ID can be submitted later. Best of luck with the account opening, and welcome to Germany.

Hello,

I am actually having other bank account (sparkasse) but I wanted to open ING diBa bank account as well and deposit some money into it. I am currently employed and the salary is going in my sparkasse bank account.

Is this possible for me to open IngDiba account in this case? What should I fill in the income field when opening Ing diba account since my salary is on other bank?

Thanks.

Hi Sylvester, nice name. In the income field state the numbers from your salary statement. As far as I know, an Ing-Diba account opening does not require that your salary goes into the ING account.

Hi, my husband and I are looking to switch bank accounts and considering ING DiBa. However, he is a freelancer (Freiberufler/Selbstständige) and so gets paid when his invoices are paid, which is normally monthly, but can vary both in frequency and amount. Are we best contacting ING DiBa customer service if we want to apply, or is there a way to complete the online form using yearly turnover (for example)? Thanks for your help 🙂

It’s best to start by completing the online application. If you need assistance, you can additionally call the bank’s customer service. They surely you will be happy to accompany you through the application. Maybe even our translation and presentation of the process will do?

Hi,

I have created a new account, did the Postident verification and sent the application by mail to ING but I didn’t sign it. Is that an issue? Would I need to resend it again?

Thank you

A bank account agreement is only valid if it is signed. This should answer the rest of your question, too. 😉

Hi !! I recently moved to Frankfurt however and will be staying here for 1 yr +. However, I do not get Salary in EURO but I get it in SGD.

So I have no monthly income @ Germany. In that case, I was thinking of using German account for Registration Tax (radio tax) payment and small expenses (Will wire required money from SG account).

Will it be Ok? or a monthly Payment Required?

There does not need to be money coming into the account on a monthly basis. It is al-ways free. The account application asks for the monthly income. Please calculate your salary in EUR. The salary is part of the credit check. Because the account is so good – and free of charge, too – the bank only grants the account to people with a medium to very good credit rating. As a customer, you can choose the bank and as a bank, they can choose the customer. Long live freedom 😉

Hello. A short time ago, I opened an account at the ING DiBa. Today, I received both cards. But I still have my old account at the Sparkasse and I want to transfer my money to the ING account. However, I do not understand how these 2 cards work? Is it one account or two separate? To which account should I transfer the money to? And which card should I use: the Visa or Girocard? Many thanks in advance for your help.

You only have one account at the ING. Both cards always debit directly from this account. The IBAN (account number) is written on the Girocard. It is not written on the Visa Card.

You just transfer the remaining account balance from the Sparkasse to the IBAN.

I generally take the Visa Card, because I can withdraw cash free of charge with it at the ATMs.

Enjoy your new account!

Hi there,

My partner and I have just registered in Berlin this week.

We have come from Australia and wish to open an ING account. We plan to transfer our funds from our Australian bank accounts (Westpac and Commonwealth) to the ING account. Is this a possibility and will it cost any $$?

Do we also have to provide health insurance details as we have yet to get health insurance but have travel insurance…

Also, as we are both currently unemployed, we do have our salaries from Australia. Shall we put that in? Or not put anything in at all?

Looking forward to hearing from you.

Sean

ING does not charge any fees for incoming transfers from abroad. Not even when they arrive in AUD. They will be automatically converted to EUR. For international transfers, I personally use TransferWise.

The issue of health insurance is not particularly crucial for account opening and management. If you have health insurance with foreign protection in Australia, then check a “yes”. If not “no”. In case of doubt, you’d rather check “yes”, because in Germany, health insurance has been mandatory since 2007. You do not have to give the bank any proof. Incidentally, it is the only German bank that I know that has such a question in the application for a checking account.

Wishing you a good arrival in Germany!

Hi. Thanks very much for the very nice tutorial on how to open a ING account.

I have a question: besides the Girokonto and sparen account, is it possible to have a credit account too? I mean, the one when you would pay back the next month or similar.

Thanks

Alberto

This should be the best option for you: ING Rahmenkredit (framework credit). With instructions as well. 🙂 Thanks!

Hi,

Can I use ING DiBa for GmbH?

I want to set up a company/GmbH and I am searching for a faster opening bank account.

Do I need Schufa?

Regards,

ING does not offer business accounts. This here would be the quickeste account opening, or here, the classic way. Best of luck with your business.

Hi Gregor,

I signed up for a ING account yesterday. I also completed the verification process through video. How will I know if my account is approved?

Thanks

That sounds very good! During the next day, you are going to receive the welcome letter per mail. After that, further letters with the cards, PIN’s and access information will follow. Enjoy exploring the new bank!

Hi, I have a joint account with my wife in ING DIBA. Now I want to split that in to two separate accounts. Please let me know the process.thanks.

Open two new single accounts, please. There is no option to split.

Hey,

I am a student from Latinoamerica and I’ve just moved to Germany to study a Master for around 2 years. I would like to know if it’s possible to open the free account (Girokonto 0 comissions)?

Thank you.

Account management is generally free at ING. Enjoy the online account opening!

Hi,

Thanks for the tutorial! I have a question, I’ll start working in Germany on the 1st of November and the company requires that I have a German bank account. I was thinking on doing it with ING-DiBa and, although I know my gross salary, they ask for the net salary which I won’t know until my first payment. Does this number have to be very accurate? Will they check afterwards about it?

Thanks again!

An approximate amount will be just fine. Best of luck with your new work, and in Germany!

Hi from Australia

I am a permanent resident in Australia and have an ING account here in Australia and would like to open an ING-DiBa account in Germany.

I have a Sparda bank account in Germany. Would like to transfer all Euros from Sparda to ING DiBa, for easier transactions to Australia between the ING account.

I am retired.

How can I open an account?

Vielen Dank.

Peter

ING does not open any bank accounts for people who do not have a main residence in Germany. Enjoy your existing account. For international transfers between Australia and Germany, I would use this provider.

Hi, I was wondering if I could open an account while I’m still away from Germany, but plan to land in a few weeks. I have an accommodation already, but if I were to open the account now, there wont be a person to collect the cards for a few weeks. Is it possible for another address to be used for card delivery so that my family can collect it?

You can always try – but personally, I would wait until I am a resident of Germany, because it is a prerequisite for the account opening at ING.

Hello,

I’ve recently moved to Germany and filled in the application. I have received a letter asking for more details around my tax residency, filled those in after a phone consultation with ING-DiBa hotline. This has been about two weeks ago but I still haven’t received any communication back from ING. Does this usually take that long or should I try contacting someone about this and if yes, is there a phone number of english speaking clients?

There is no telephone number for English language customers. However, if you ask in a friendly way, they will probably find somebody to speak English with you.

Hello,

I am Asian, currently I am living and doing PhD study in Czech Republic, because of the collaboration between my department and a German institute I will get my salary from this institute, so I would like to open a German account. However, I do not know which bank services suit me.

I would be grateful if you could help me with this problem.

Thank you very much.

Hong Man

This page is especially for people who need help opening an account at ING. With you, it’s about a general advice. That’s what Christian does in our team. You can apply for that via this page.

Do you know how long it usually takes to receive all the documents about the confirmation of account opening? I have applied and completed the PostIdent almost 2 weeks ago and still haven’t received any letters with a decision or any further correspondence.

Thanks!

Currently, the rush to ING is actually so great that the new-customer letter will arrive after 2-3 weeks. What should one do if other banks always raise their fees again and again? The ING works according to receipt of everything and you can really only get the answer by letter. Please be patient. 🙂

Hello,

Next week I’m moving to München and I will be living to my friend’s house until I will have my own place.The question is if I can open an account without having the address in München and if I can use my home address. I’m from Romania and it will take me a while till I will have my own apartment and I need this account to receive my salary. Thank you for your help.

ING definitely requires an address in Germany. After all, the mail needs to arrive there. I would simply fill out the online application with the address where you are currently available. You can update it later in the online banking system at any time. Best of luck in München!

Hi, I recently opened a Giroaccount. I read about Tagesgeld Sparen account. Does it come together or I need to open separately?

Thanks in advance.

At ING “Tagesgeld” is called “Extra-Konto”. It is a separate savings account and needs to be opened separately. Can be done from the existing Online-Banking.

Hello,

I want to open an account along with depot, do I need to have an unconditional Visa or can I open with a Blaue Karte? I have a unlimited working contract here in Germany.

Thanks

The account can be opened with the Blue Card. Because of the credit check for the Girokonto it makes sense to start the customer relationship via the depot and follow up with the Girokonto. Instructions here ► https://www.deutscheskonto.org/en/ing-guaranteed-account-opening/

Hey there,

So I registered with ING online and tried to do my identification using video chat but it didn”t work out as I have non German passport. So I directly visited a Post Bank where they scanned my passport. My Postident shows my transaction number is already transfered and I can continue with verification.

Is there anything else I am supposed to do?

Thank you!!

Perfect, you’ve done everything right! You welcome letter is probably already on the way via mail. Enjoy using the new bank.

Hello,

I came to Germany on a student visa recently and need a bank account. My Visa is valid till March and I can apply for an extension only by end of January. I will get a resident permit only after the visa extension. Can I still open an account in ING DiBa with a valid visa or will my application be rejected without having a resident permit? I have the Anmeldung, Steuer ID and enrollment certificate from the university. Does ING offer any special Student Account?

I am 30+ years old but I will be receiving more than 700 EUR monthly. Does this mean I still get the account for free?

Thank you in advance.

If you have more than 700 euros a month in the account anyway, you don’t need to worry about a student tariff. The ING is so good precisely because it does not offer a different account for every population group. You can apply for the account at any time if you are resident in Germany. As a student, however, you have a higher probability of opening an account – so you actually do have an advantage. Good luck!

Hi

I have an IngDiba account which I’m very happy with. However I now need to make a payment to the Finanzamt with cash that I have saved. Can I go into any bank and fill out an Überweisung and pay with cash?

Cash can be paid in at any Commerzbank branch via the counter or the ATM. The money is deposited into the account very quickly, so that you can make an online transfer.

Hi! I tried opening 3 bank accounts at once, ConsorsBank, ComDirect and INGDiba. I did the In-Person Post Ident of all three on 25th Jan. I was expecting further communication from the banks, so far I have received none. How much time does it take from the Post Ident procedure to receive a mail from the bank?

Depending on how busy they are, it can take between 1 and 3 weeks until you receive the welcome letter, the cards, access information and PIN in the form of separate mailings via the postal service.

Hello,

I have opened my salary account in ING Diba and done verification process through PostIdent. Can you please tell me what’s the next process. Should I go to Bank for the rest of the process or will everything come by post.

Thank you

You will receive mail/post that explains the further steps.

Hi!

I am a minor international student from Ukraine who is applying for a Preparatory Course in Germany. In autumn, I will need a personal account in Germany to transfer financial means from my blocked account. Due to the COVID-19 travel restrictions, my parents will not be able to accompany me to Germany for this purpose. Is it possible to open a current account for a minor who is not a citizen or a resident of Germany at this bank?

I will also be appointed a German citizen/resident as a guardian by my parents till the age of majority. Could this person accompany me to the bank for opening a bank account?

ING usually does not open such accounts. Your best chance is with the bank your guest family uses and where they are personally known – this means a local bank where you can go and have a personal talk. And yes, for students, such accounts are in many cases free of charge. Best of luck!

Thank you, Richard!

I am a foreign passport holder in Braunschweig. I have filled out the application form but didn’t receive any instruction as to sign anything and send back. I have legitimized myself at the post office. How much time will it take for my IBAN number to arrive?

Up to 2 weeks.

2 weeks to receive the IBAN number? or to receive cards by mail?

All.

Hello,

How do I close ING Diba Tagesgeld Sparen account. I tried calling customer support no answer and then I mailed them, no response yet. It’s been more than 3 weeks. Can you tell me the process of closing the account?

I recommend to write a classic letter to the bank in Frankfurt with the request to close the account, and you need to name an account to which the remaining balance should be transferred. The letter must be signed by hand.

Hey, I’m an international student moving to Germany in a couple months to study for 2 years, and looking at ING DiBa as my banking solution. I have 3 questions:

1. Since I’m not a citizen/permanent resident and I’ve never even visited Germany before, I wouldn’t have a credit history with Schufa (if it matters, I’m Indian). Would that affect my application?

2. Is video verification possible with an Indian passport and the Meldebestätigung? Or do I have to go to the post office?

3. Does ING offer customer service in English?

1. Yes, there is always a credit check when an application is made to open an account. Some people get an account, some don’t. That is their free choice of contract partner.

2. It’s probably best to ask the bank directly, I don’t know.

3. No.