ING-DiBa: Depositing money

Depositing money to the current account of the ING-DiBa free of charge is easy, but one has to know how it works … and we present it for you on this page!

Requirements:

- You are holder of a free current account of the ING-DiBa

- You have the ING-DiBa Girocard with you

- You want to deposit an amount between Euros 1,000 and 25,000

- You visit a branch office of the Reisebank AG (partner bank)

- You have your ID-card or passport with you

You can see how the procedure of the cash depositing exactly works by watching this video:

My own depositing

… took place on Saturday, 4th of December 2016, through the branch office of the Reisebank at the airport Frankfurt. Similar to Marie and Lukas in this article.

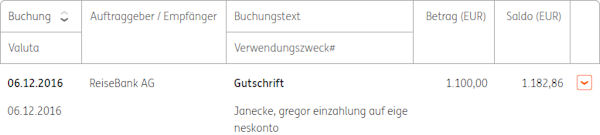

Already on the following Monday, 6th of December 2016, the money was booked on my current account, as you can see in this screenshot:

I have only deposited bills. Coins would have been possible too – anyways, if the total amount is more than Euros 1,000.

Frequently asked questions on the depositing at the ING-DiBa

1. Does one always have to present the Girocard?

Presenting the Girocard is recommended by the bank, because one is virtually identifying oneself as a bank customer and the employee can copy the account number easily from the Girocard for the depositing.

In practice, cash deposits are also accepted, if one states the account number or IBAN someway else.

2. Depositing to a third party account?

The ING-DiBa officially states that deposits through the Reisebank are only free of charge for the account holder or the empowered person or that the ING-DiBa bears the fees for the deposit only for “own” people.

However, we received confirmation by the circle of our smart bank customers that no fees were charged at the deposit to an account at the ING-DiBa, if it is a third party account.

3. Does the bank also accept foreign ID-cards?

In most cases, yes. At best, you take the identification document, which you have used for the account opening at the ING-DiBa.

If you have an ID-card and a passport, then take the passport with you. The passport is the more-valued legitimating document in many issuing countries.

4. Can I deposit my daily takings this way?

Almost in any case no, because the ING-DiBa only offers current accounts exclusively for the private use.

The Deutsche Bank could be interesting for the opening of a business account, because there are possibilities to get it without a monthly account management fee and deposit money through the branch offices. Source: www.deutsche-bank.de.

5. How frequently can I deposit money free of charge?

The ING-DiBa does not know a limit of the number. Theoretically, you can deposit money several times a day.

There are only limits for the amount to be deposited. The bank has set a limit with Euros 1,000 to 25,000, which is meaningful for most customers (e.g. sales revenues of a car) and at the same time profitable for the bank.

6. Is it possible to deposit less than Euros 1,000?

Yes, however, you will have to bear the fees for the deposit yourself.

You then also have the freedom to make the deposit at other banks. For example, at banks that are situated closer to you or charge lower fees. The Reisebank is not popular, because its favourable fees. 😉

Further questions on depositing money at the ING-DiBa?

Please use the comments box at the end of the page. You are welcome to supplement this page with your experiences and advices. Many thanks for your engagement!

Thematically appropriate supplements:

- Branch offices of the Reisebank according to the federal states

- ING-DiBa: Cash & cards in an overview

- ING-DiBa current account as a completely underestimated option for German emigrants

- Alternative: cash deposit through machines of the DKB

Do you want to open an account at the ING-DiBa?

With the ING-DiBa Visa Card, you can withdraw cash free of charge within the Euro-area – independently of the ATM-brand!

Perhaps you want to open a free current account at the ING-DiBa? Then I want to congratulate you to this decision. The ING-DiBa is Germany’s biggest direct bank … and this has a proper reason!

Germany’s biggest direct bank!

Moreover, being a new customers, one often receives a small bonus for opening a current account. Take a look at what is offered at the moment ► www.ing-diba.de.

Do you get a deposit slip after depositing for proof – in the conceivable case that the amount is not booked to the ING-DiBa-account?

Many thanks for this great question!

Yes, you get a deposit slip. Mine looked like this:

Thanks for the information. Can I send money (Euro) from one German bank (işbank) to my ING-DiBa-account freely ? Thanks.

We can only speak for ING-DiBa: Incoming payments in Euro are booked without fee. So, yes!

Can I send money from ING Romania account to ING DiBa (Austria)?

Please keep in mind that we have specialized in smart banking within Germany. In general, for transfers with currency exchange we advise to use TransferWise, because in about 99% of the cases, this is less expensive.

Hi. Does Sparkasse’s atms take charge of withdrawal, or in Germany I can take the money from any ATMs for free with ingdiba girocard?

thanks

Please always do the cash withdrawals via the Visa Card, this is free of charge for ING-DiBa customers. The minimum withdrawal amount is 50 Euro. After all, it needs to be worthwhile for the bank to cover the fees! (With the Girocard, one has to pay the fees oneself).

Thank you. And second question is – I have applied for an overdraft, what is my next steps? Will I receive a letter which I need to sign and sent it back?

When I go to overdraft menu, it says you have already sent the request.

If I need to print out some pages, sign, and send it, I can’t find where is this documents.

Thanks for your help.

Correct, credit agreements (that is a Giro account overdraft) at ING-DiBa need to be signed additionally. Maybe you have already received mail in the meantime? The bank sometimes needs a bit of time to determine how much of an overdraft they are willing to grant. Please ask the bank directly. You will get better information there, because the customer services can have a direct look into your account.

Hallo,

I just opened ING-DiBa Girokonto. I received Girocard and a visa card. I have not added any money to the account so far.

I have few questions:

1. I received PIN for Girocard. Do I have to activate card using this PIN or change PIN before using?

2. How to activate VISA credit card?

3. How to pay back credit borrowed using VISA card?

The cards of ING are already active. You can simply use them – at least if you have agreed on a dispo when opening an account. Otherwise it means: first deposit money. Although the Visa Card is recognized by the payment system as a “credit card”, it works as a “debit card” only, if no dispo has been agreed to with ING. It works only as long as there is a balance on the checking account.

Hello. I have US dollars, what should I do to deposit to the Ing Diba account? which is the best place to exchange it to get better rate?

Hello I would like to ask if where I can deposit cash less than 1K € in Berlin using ING acct without any fee? Thank u

From our community we have received the feedback that it has also worked with less than 1,000 Euros, often free of charge. As a web portal, we follow the official statement of the bank: Free of charge starting with 1,000 Euros via Reisebank.

Meanwhile, ING has their own deposit machines at their standard locations in Frankfurt, Nuremberg and Hanover. Deposits starting with 5 Euros are free of charge here. It’s not possible with less than 5 Euros, because the machines only accept bills. More machines are planned. Exact information has not been published yet.

Hi,

Thank you for making this site, it’s amazingly helpful! 🙂

I have a quick question:

Are you aware of ING having any direct deposit machines in Berlin?

Personally, I only know the ones in Frankfurt. These are right in front of the headquarters at Theodor-Heuss-Allee 2.

Hey!

Can I deposit less than 1,000 Euro to my ING account? If yes, is it possible to do it in the regular ATM machine ?

Thanks!

Have you read the article?

Is there an option to deposit cash using ING DiBa ATMs?

Yes, but only at few ATMs, which are supposed to be at the locations of the bank. I only know the one in Frankfurt, directly in front of the ING office building. Therefore, it’s not a solution nationwide.

Hello,

how do I transfer money from my Girokonto to Visa Card for online shopping?

That is not necessary, because every payment with the ING Visa Card is directly debited from the Girokonto/giro account.

Can I deposit cash into a ING-DiBa account without having a physical card?

No, the ATM needs the Girocard in order to assign the deposit to the respective account.

Hey, I have a question about ING bank too. I have received my cards as giro card and Visa card around two weeks ago. When I put my giro card into an ATM there is no option to see how much I have. So it’s pretty annoying not to know what is your balance is. Also I think I need an ITAN list or Internet banking PIN to use the online banking app which I haven’t received it yet. Should I just change the bank instead of dealing with bunch of annoying stuff because its unnecessarily tough to use this bank properly? The bank has no English language option too.

Are you from the USA? In Germany we have a different banking system. You can only check your account balances at your own bank’s ATMs. If you want to do that, you need to go to one of the ING ATMs. If you have a cell phone, you can open the app and see the account balance immediately. Maybe this is a solution for you?

The ITAN lists are no longer available for new customers. Existing customers still get them as an emergency solution, but that is going to stop as well. You won’t have any practical disadvantage. You would not get an ITAN list from another bank either.

We also have our own language in Germany, and that is used by 99% of all banks. English-language online banking can be found at Deutsche Bank and N26 as an additional option.

Hi, can I also deposit cash at an ing diba europe (for example in spain)? If I have a spanish ing diba account for example in germany, or opposite, a german ing diba cash deposit in spain? Thanks!

No, that doesn’t work.