3 secrets for Comdirect-customers

As you perhaps know, being a frequent reader, the Comdirect belongs to one of my favourite banks since years.

Today, I want to share with you three “secrets”, so that you can use the bank more optimized and maybe even like the bank a little more than before.

I found out about the first secret during my visit of the Comdirect-seat in 2012.

1. Comdirect First

How would you feel, if at 90 per cent of your calls to the bank someone would answer immediately and would not have to hold the line for eternal minutes?

This is the most beautiful advantage of the customer service Comdirect First.

The bank itself states that the First-team is particularly well trained, and you can perceive that during the contact through the phone. Callbacks and e-mails – everything works fast and highly professional.

Moreover, one can let the limits of the Girocard, credit card and overdraft facility be set individually. You can prolong the automatic log out to up to 1 hour too. This is very useful, when you get distracted during the online banking.

How do I change to the First-customer service?

Fortunately, there is no additional monthly lump sum, as with other providers, but you can become a First-customer through the use or bank-internal creditworthiness. In our Aufsteiger-Training.de (training for achievers), we train how to become a First-costumer.

The requirements:

- 125 or more securities-trades per half-year in the depot or

- Euros 500,000 or more total wealth in Comdirect-accounts or

- Euros 10,000 or more of monthly incoming money flow in the current account.

The compliance of the requirements is checked every half-year and is then prolonged for another six months.

Note: The current account is free of charge also at a “normal” use without minimum incoming money flow.

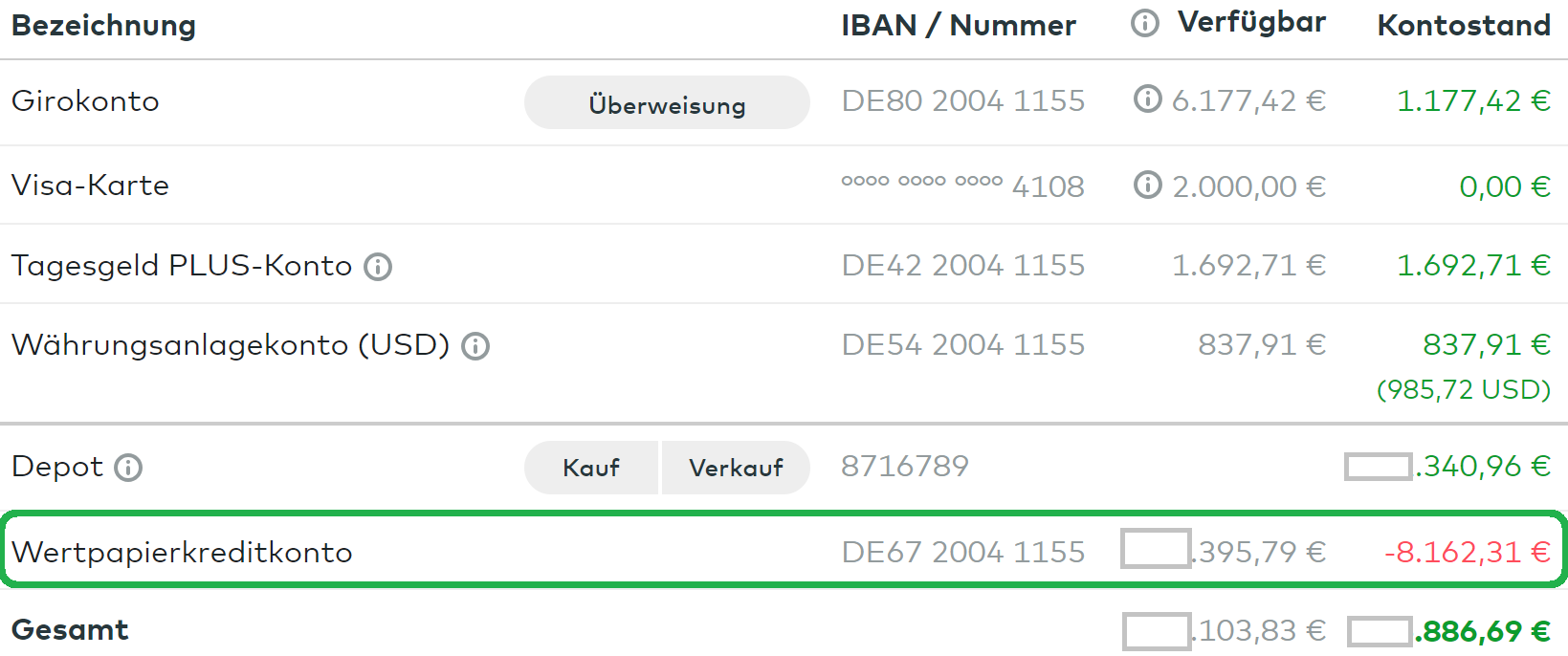

2. Additional overdraft facility through securities assets

The use of the credit line of the securities account is free of charge. Therefore, you can regard this line as a second overdraft facility.

Overdraft facility of more than Euros 100,000 possible!

Who holds a depot in addition to a current account at the Comdirect, builds oneself a better creditworthiness within the bank.

Already at a depot volume of only Euros 3,000, you can apply for a securities loan. The securities loan has the same advantages like an overdraft facility:

- Free setup

- Interest only for the period and the actual used amount

- Available and payable flexibly anytime

- Purpose of the money is completely free!

Additionally to the overdraft facility, there are further advantages:

- Interest rate even more favourable (currently 3.98 %)

- Schufa-free (other banks cannot see this credit line!)

You might possibly think of clever strategies for the implementation … if you want to confer a depot to the Comdirect, then this page will help you ► procedure and tips.

How to apply for the securities loan and further information is worked out for you in an explanation with a step-by-step instruction here ► implement the securities loan brilliantly.

Of course, the requirement is that you are a depot-customer at the Comdirect:

3. Google Pay

Google Pay on my Smartphone

The Comdirect was one of the first and still very few banks that offer Google Pay in Germany. At Google Pay you can pay with the Smartphone instead of cash, Girocald or credit card.

That means for you that you “carry” money without having to carry a wallet. At some sites (e.g. beach), this is very useful, isn’t it?

For amounts below Euros 25, no entering of the PIN or signature is necessary. This simplifies and fastens the payment procedure for many people.

Personal petition: As I am still a little old-fashioned in some things, I would be very grateful, if modern and smart bank customers would share their experiences with Google Pay through the comments feature. Would you be so kind?

Google Pay is a piece of the future already today!

In order to use Google Pay in Germany, you need a current account at one of the participating banks. These are currently the BW-Bank, N26, Commerzbank and of course the Comdirect (which is by far my recommendation!).

Personal video message to the secret-article:

Why?

In contrast to the opening of a current account, there is no creditworthiness check at the opening of a depot.

That means that you do not risk a ejection of the account opening. As soon as you receive the access data to the online banking, you can open a current account by youself with all the already submitted data. The Comdirect will be happy to see a successful “cross-selling”.

Write me, if you choose to do or have already done so. I am looking forward to read about it. Many thanks!

Leave a Reply