DKB Broker – basic information

The DKB Broker (securities depot) is not as known as the free current account DKB Cash with worldwide free cash withdrawals using the Visa Card.

We want to change that, because the conditions of the DKB Broker are just as interesting as the current account. On this page, you will find the most important conditions in a summary.

Whether you use the DKB-Broker or not, it is always free of charge.

Subsequently, we will create special pages and instructions to the individual subjects. You are welcome to contribute with your ideas or questions.

⇒ www.dkb.de/privatkunden/broker/

Super-concise conditions

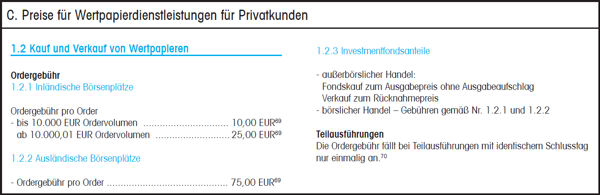

The price-performance listing of the DKB only knows three positions:

-

Purchasing and selling securities at German stock markets

- General sum of Euros 10 for a volume of up to Euros 10,000

- General sum of Euros 25 for a volume beyond

(plus possible third-party costs, where the DKB has no influence on them, such as a stock market or broker fees; at the online trading platform “Tradegate”, there are no additional third-party costs)

-

Purchasing and selling securities at foreign stock markets

- General sum of Euros 75

(possibly additional third-party costs, where the DKB has no influence on them)

- General sum of Euros 75

-

Off-market purchase of fonds shares

- free of charge! (without issue surcharge)

Fees at partial executions

For example, you buy 10,000 securities. The stock market computer decides that you get 2,500 from seller A and 6,500 from seller B. This happens sometimes at the stock market that a purchase order is executed several times (partial execution), until the complete amount of the desired securities has been reached.

At the DKB, you only pay once for it, if all partial purchases took place on one day.

You will not find it more transparent and cheaper at any other bank!

This was the end of the price-performance listing. The DKB has held it consciously clear. Simplicity and transparency is very important for the DKB.

All this is even free of charge:

However, this is not the end of what you can do with the DKB Broker. Here you can find the key points onto which we will take a profound look in the upcoming weeks:

- Free depot management

- Free setup, change and cancelling of limits

- Free comprehensive securities and country information

- Free fonds savings plans

- Free sample depot

If you want to open the DKB Depot, please use this link:

“Yes, I want the DKB Broker …”

Tip 1: Depot transfer to the DKB

A depot transfer to the DKB is always free of charge for you (the DKB bears possible incurring fees for you Clearstream). At domestic depot transfers, always the purchase price is transferred, so that you continue optically and tax-exact at the same point, where you stopped with the old depot.

Tip 2: For German-speaking people living abroad

The DKB Broker can be applied for analogously to DKB Cash (see possibilities of legitimating) comfortably from other countries without a trip to Germany. With the DKB Depot, you can trade exceptionally favourable at German stock markets and as a non-resident tax-payer also most often tax-free!

Questions to the DKB Broker? Please enter them into the comments box.

“Free depot management”

What does this mean exactly?

Let’s assume I have a DKB and DKB Broker account.

Can you please detail the costs of the whole process of purchasing stocks:

1- Putting money on the DKB broker account

2- Purchasing the stocks

3- Keeping them for a while

4- Selling the stocks

5- Retrieving the money out of the DKB broker account

Many thanks!

Hi Alex,

for better overview, I put the answers directly behind your questions:

1- Putting money on the DKB broker account: part of the account management, free of charge

2- Purchasing the stocks: per order of up to 10.000 EUR a 10 EUR fee, per order beyond 10.000 a fee of 25 EUR

3- Keeping them for a while – free of charge

4- Selling the stocks: same as 2-

5- Retrieving the money out of the DKB broker account: part of the account management, free of charge

I hope this helps.

Hello,

If I open a broker account, can I request a professional broker to manage the account or someone that can manage it all?

Hello,

DKB is a direct bank – they do not provide such an option, i.e. the customers manage their accounts themselves.

Having a DKB account and a DKB Depot account, where do I need to transfer money to be used for the stock purchase? Thank you!

The DKB checking account is also the clearing account. In order to buy shares, there needs to be money in this account. However, it does not have to be posted to a sepa-rate clearing account, like it is customary with some other banks.