Why TransferWise for international transfers?

As you might know, being a regular reader, I have legal foreign accounts since years, not just because of journeys, but also because of business partners in other currency areas.

For the money transfer, I preferably use TransferWise. When I was in London some days ago, I visited the company – as so often with the camera – so that you can get an insight for yourself:

2. Start your international transfer (enter information)

3. Perform a domestic transfer to the regional TransferWise-account

4. Wait for the notification that your money has arrived safe at the receiver.

An international transfer can be so easy and safe!

1. What I particularly estimate in TransferWise:

-

Cent-exact credit entry at the receiver

At international transfers, one has been repeatedly surprised with how much the correspondent banks have chanelled off in fees.

Of course, I have experiences with other money transfer providers. But there was the problem again and again that the incoming transfer amount differed a tiny bit from the transfer amount. Even one single cent caused that a bill was not paid accurately.

With TransferWise, my transfers always arrived up to the last cent.

-

Avoiding “incoming” or “outgoing” international transfers

If you deal with US-banks or have an account in the USA yourself, then you know that US-banks have the particularity of charging very high fees for the international transfer traffic. Everything between US$ 15 to 100 is possible, even if the payment is implemented in US-Dollars.

At my TransferWise-payments, this fee was never charged, because the TransferWise-transfer is regarded different due to the regional account. In the USA, the payment is implemented through the ACH-system.

This alone has saved me several hundred Euros in the past years!

-

Saving of the transfer data

Of course, at the first time, one has to enter all data for the international transfer. At the next transaction, the placing of the payment is very quick and comfortable, because I just click on the saved data from the past in the menu of TransferWise.

Super-practical and with the transfer-template of our German banks only little comparable!

-

Cheap, fast and safe

For me, being a long-time TransferWise-customer, it is almost a matter of course that TransferWise offers me a super-exchange rate, transparent and comprehensible fees and credits the payment in the receiver account quickly, as well as informing me about that through an e-mail.

2. Note on two important articles

According to the experience with 7 or more money transfer providers since the founding of this special portal, I have decided to got with TransferWise.

We will accompany TransferWise permanently for our readers and report about it from time to time.

TransferWise is “our” special provider for international transfers!

Even if my first article about TransferWise was created already in the year 2013, I still like to recommend it for reading, because it explains its functioning in details ► International transfer with TransferWise.

If you are one of our German-speaking American readers, then I recommend the ► Instruction of Susanne, in order to transfer money at favourable conditions from the USA or Canada to Germany.

3. Why TransferWise is cheaper than banks!

-

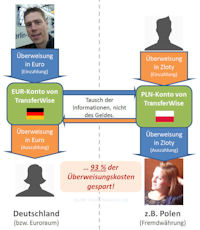

At TransferWise, not the money leaves the country, but the information about the desired payment.

-

Transfers only take place in the according currency area (most often as free domestic transfers).

-

Always the “true” exchange rate is used – not like at many other providers a worse exchange rate, wherein a lot of fees are hidden.

-

TransferWise also has fees. But transparent and comprehensible. A transfer of Euros 500 to the USA costs e.g. Euros 2.50. This is 0.5 per cent of the transfer amount. The minimum fee for this route are at Euros 2. Pleasently cheap?

€ 2.50 fees for a €-500-transfer to the USA

-

… and please remember that no “incoming”-fee in the USA for this credit entry will ever apply!

-

Account management fees or the like do not apply either. You can use TransferWise once or regularly. No matter how, fees only apply at international transfers. And these are transparent and cheap just like mentioned above.

Perhaps you want to set up your TransferWise-account already today?

Questions on TransferWise?

My team and I would be pleased to help other smart bank customers to explore TransferWise and to take the advantages into the own banking life.

Depending on how long you assist our Program for building asset (German language), it can be that you have the desire to open the TransferWise-account faster as you may think today. 😉

Leave a Reply