ING-DiBa: Cash & Cards in an overview

The current account of the ING-DiBa is among the three best current accounts of Germany. As well as the other two providers, it currently has a high influx of new customers.

Currently, new customers can rejoice of € 75 initial balance. www.ing-diba.de/neukunde.

Customers of especially savings banks and Volksbanks switch to the ING-DiBa, because these are increasing the account management fees and simultaneously close branch offices.

Account remains free of charge!

The current account of the ING-DiBa is free of charge and will remain free, as well as the cards to the account. Due to the fact that the ING-DiBa offers two cards to the account, we explain to our faithful and new readers, how to use which card optimally. Below the table, you can find an explanation video.

1. Tabular overview: Which card for what purpose?

| Which card should I use for what purpose? Chronology as in the video (see below) |

ING-DiBa Visa Card |

ING-DiBa Girocard |

| Withdraw cash at ING-DiBa-ATMs within Germany at more than 1,200 ATMs, withdrawal limit € 1,000 per day |

free of charge | free of charge |

| Withdraw cash at foreign-ATMs within Germany are more than 58,000 ATMs, in Euro-countries more than 400,000 ATMs, withdrawal limit € 1,000 per day |

free of charge | |

| Withdraw cash at ATMs in the foreign currency abroad e.g. Switzerland, America, Asia, withdrawal limit converted € 1,000 per day |

1.75 % foreign transaction fee | |

| Withdraw cash in the supermarket (e.g. Netto, Penny, Rewe, toom) € 20-200 per transaction |

minimum purchase of € 20 necessary | |

| Withdraw higher cash amounts from € 1,000 must be registered by phone 1 day beforehand from € 5,000 must be registered by phone 3 days beforehand |

free of charge, pick-up with ID-card or passport in a branch office of the Reisebank | |

| Depositing cash € 1,000-5,000 per deposit (up to 50 coins) |

free of charge, presenting the IBAN and ID-card or passport in a branch office of the Reisebank | |

| Credit card payment immediate debiting from the current account |

free of charge in Euros other currencies plus 1.75 % foreign transaction fee |

|

| Debit card payment (formerly: EC-card payment) immediate debiting from the current account |

free of charge in Euros other currencies plus 1.75 % foreign transaction fee |

|

| Personal note: the ING-DiBa offers an outstanding account, if one remains mainly in Germany and in the Euro-area. For journeys or trips to the foreign currency abroad, one can supplement the account with an additional card in order to save the foreign transaction fee. For example with the Gebührenfrei MasterCard Gold(fee-free MasterCard Gold). | ||

Explanation video for you

By the way: you can subscribe to our YouTube channel. 🙂

2. Background information about the bank and account use

The ING-DiBa is a very solid German private customer bank, which was founded in 1965 (at that time with another name) by trade unions, in order to help workers and employees to build asset (economizers). Back then already as a direct bank!

Some years ago, the bank was sold to the successful Dutch financial corporate group ING Groep – this is the reason for the name part “ING“. The “DiBa“ is short for direct bank. In Germany, the ING-DiBa has more than 3,000 employees in its sites Frankfurt am Main, Hannover and Nuremberg.

Besides the current account, there are further bank offerings that one can use separately. By far the most account openings were registered for the Extra-Konto. This is a free call money account.

The opening of a free call money account can be a strategy to become a customer of the bank without creditworthiness check … and later apply for a current account being a registered customer. However, this is only interesting for people with a rather average creditworthiness and who would like to have access to a free direct bank.

A very thrilling product is the Rahmenkredit (credit line). One can also set up an overdraft facility at the IND-DiBa without a current account. How this works and in which case it is meaningful, is described on the following page: Enlarge the financial margin cleverly.

The free current account

The current account of the ING-DiBa is completely free of charge. I myself have it since the year 2008 and have never paid any single Euro for it. I did not use it a lot, since I only set it up as a backup-account back then. If something should happen to my main account, I could switch immediately to the ING-DiBa. Account and card are ready for operation anytime in case of emergency/switch.

Moreover, an overdraft facility in the amount of several thousand Euros is at my disposal. This was set up in three-times the amount of my submitted proof of salary back then. However, I did not transfer my salary payments to this account. Nevertheless, the overdraft facility remains without interruption. This is very meaningful for the backup-use.

ING-DiBa as your main account

The current account of the ING-DiBa can be used as the main account. Besides the fees for the card use/cash withdrawals in the foreign currency aborad, it is great!

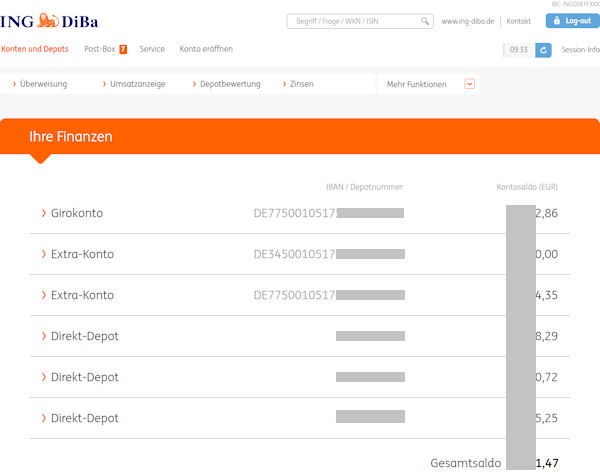

When I log into my account, it looks like that:

On this screenshot, you can notice that it is possible to set up two call money accounts (at the ING-DiBa it is called “Extra-Konto”) in addition to the current account, as well as several securities depots. No account management fees are charged for any of these accounts.

ING-DiBa Visa Card

As a new customer, you automatically get the Visa Card. This should become your new main card, because most stores in Germany and further countries accept the Visa Card as a means of payment.

Moreover, you can withdraw cash free of charge at every ATM within the Euro-area that has the Visa-sign. These will be the most you can see. The search for an ATM of the own bank or cooperating partner is over through the opening of a current account at the ING-DiBa. 🙂

Use as a true credit card?

Yes and no! All card transactions are debited immediately from the current account. Just as ususal at the Girocard. An indebtness with normally high credit card interest is not possible!

Nevertheless, it is regarded as a credit card within Germany and abroad. If you apply for an overdraft facility at account opening or a later point of time, you will also have a credit line on the Visa Card! This is namely the Girokonto-Dispo (current account overdraft facility).

With the Visa Card, one can pay small amounts up to Euros 25 contactless in Germany.

The weekly limit for the Visa Card is at Euros 4,000.

A small drawback at journeys to the foreign currency abroad: At card payments or cash withdrawals in a non-Euro country, a 1.75 % foreign transaction fee applies. This is the fee for the currency exchange. If you do not travel to such countries, then you can skip this point. As a supplement to the ING-DiBa, we list here cards without the foreign transaction fee.

Trip-advice for the USA: in the USA, one is often asked, whether it is a debit or credit card. Always say or choose “credit card“.

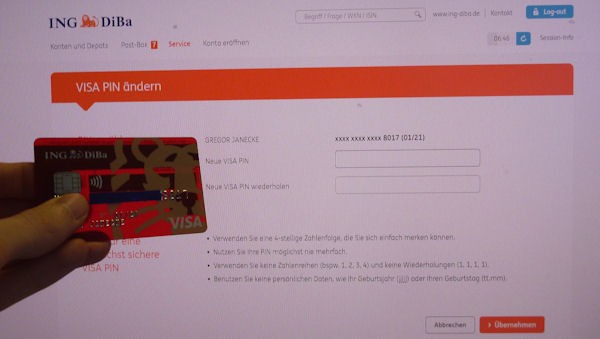

Desired PIN that can be changed anytime free of charge

As a ING-DiBa customer, you can change the PIN of your Visa Card anytime and free of charge. This is easily possible through your online banking:

In contrast to quite a lot of other banks that charge fees, if you forgot your PIN, you can change the PIN at the ING-DiBa, if you cannot remember your old one. You only have to enter the new PIN 2 × and confirm it with a TAN. Very practical!

ING-DiBa Girocard

In Germany, the Girocard – as the former EC-Karte – is particularly popular. If you owned a Sparkassen-Card or a VR-Card, then the Girocard would be the counterpart.

Paying in Euros is free of charge with this card.

In the foreign currency aborad (except Sweden and Romania), the 1.75 % foreign transaction fee (but at least Euro 1) per payment is charged. If you do not pay in Swedish Krona (SEK) or Romanian Leu (RON), it is recommended to use the Visa Card. This does not know the minimum fee of Euro 1.

In some supermarkets (see table further above), you can withdraw cash up to Euros 200 free of charge at the checkout at a minimum purchase of Euros 20.

3. Account opening and a balance of € 75

| Requirements | |

|---|---|

| Minimum age | 18 years Minors can get a savings account or securities depot through the parents. |

| Place of residence | Germany readers from Austria can open their new current account through www.ing-diba.at. There is also the possibility to get the intitial balance of Euros 75. The account management is only free of charge in Austria at a salary or pension payment transfer! Emigration plans? After the account opening, you can change your place of residence to the abroad. The free current account as well as the already granted (!) credit line on the current account (overdraft facility) will remain. There is a separate article on this subject: ING-DiBa for emigrants. |

| Account opening | free of charge + possibly € 75 balance ? www.ing-diba.de |

Euros 75 initial balance

Currently, the ING-DiBa gives a balance in the amount of Euros 75 to every new current account customer, if two salary payments of at least Euros 1,000 are transferred within the first four months. Such offerings already existed in the past. However, it seems that the requirements for the initial balance increase with the time. Do you want to take a look at the requirements? www.ing-diba.de/neukunde.

“Free current account with 2 cards ”

… get my new account now and do not pay any account management fees anymore!

4. Gregor and his accounts

As our regular readers know, I have my main current account at the DKB. The DKB, as well as the ING-DiBa, are among the small circle of the best German direct banks. In some points, the DKB is better, in others the ING-DiBa. In the basic features, both accounts are free of charge and virtually exchangeable.

The DKB is convinced – and I share this opinion –, that its account is so good that one does not have to gain new customers through an initial balance.

Due to the very good and fair conditions, the ING-DiBa would not need to give away a present for the account opening. However, it does so, maybe due to tradition.

Since I know the bank, there are always presents for new customers. Perhaps this is the reason why the ING-DiBa is bigger than the DKB?

There are people, who like to take such bonuses, if one is deciding to get a new current account anyway. Why shouldn`t they?

After the DKB-rejection, become a customer at the ING-DiBa!

Perhaps due to our detailed reporting about the DKB, many readers choose this bank. They have made an outstanding decision.

However, no everyone, who applies on account opening at the DKB, gets the account. The DKB – but also the ING-DiBa – makebefore every account opening a creditworthiness check of the applicant. The Schufa-query and the Schufa-score play an important part in the decision, whether it will come to an account opening or not.

In the past weeks, several readers wrote or posted through the comments feature of our articles that the account opening at the DKB did not work, but they are now happy customers of the ING-DiBa.

This has an important background: the account at the DKB only exists with a credit line. Some people may initially only be granted a small amount, but it is something.

The ING-DiBa has the possibility to open a current account on a credit basis at first. This way, one can get an account at an amazing German direct bank easier and later book the overdraft facility (credit line) as a supplement.

What experiences and ideas do you have?

Please write us about your experiences with the account opening and use of the ING-DiBa through the comments feature. Tips, advices and exchange of smart bank customers for smart bank customers are more than welcome. Many thanks!

Supplementing articles:

- ING-DiBa current account as a completely underestimated option for German emigrants

- Want an additional overdraft facility? ING-DiBa as one of several good providers

- DKB: Also the Giro- and Visa Card free to the account

PS: If you should encounter any problem with your accout – you can reach the ING-DiBa by phone dialing 069.50500105 24 hours a day, also on weekends!

Addendum: Due to the fact that more and more people are interested in opening a current account at the ING-DiBa, I have created an instruction that guides you step-by-step through the account opening procedure.

Hello and thank you for this great article.

After my post on the schufa page and the nice advises by the stuff of this portal, I changed to Ing-Diba as my main account (Not accepted by DKB).

The transition from the older bank was very smooth and with no problems thanks to Ing-Diba change tool (Only little thing, I still don’t know the status of GEZ as I didn’t hear anything back from them).

So far I’m enjoying the possibilities with the Visa card and the freedom it gives me (no more looking for a specific ATM).

The only two limitations I see are

– As mentioned in the article is the 1.75% of foreign currency conversion. In my opinion, if it is lifted, then Ing-Diba can easily beat ComDirect (since the latter’s Girocard is only limited to the cash group).

– The update of the account, every transaction appears only after few days. But I think I’ve somewhere read, that direct banks are going toward updating this strategy for some instant update and notifications (may be the editorial stuff are more informed than me about this point 🙂 )

Super feedback 🙂 thank you for your smart extension!

Dear Gregor,

What fees does ING-Diba charge their account holder for transferring funds of between 20,000 and 40,000 Euros from Singapore to Germany?

Thank you in advance!

Dear Mary,

That is a very good question! Many thanks for that!

ING-DiBa does not have fees for incoming money, not even when it comes from a different country in a foreign currency.

The currency will be exchanged to Euro according to the current exchange rate, which you will see on your bank statement.