Borderless Account

The Borderless-account is a multi-currency account of our special provider TransferWise. There are no running costs – nor for the Mastercard!

An account opening (https://transferwise.com/en/borderless/) is simple, free of charge and enables a varied use. Ideas and tips are on this page!

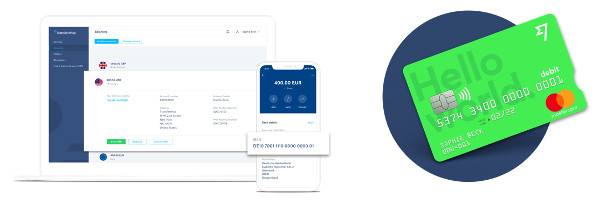

Very practical: Modern account with card and app without monthly fees.

Easy account opening ► https://transferwise.com/en/borderless/ ✅

Options of the use

- Travel-account

Very suitable: You can transfer the budget of the journey to the account and exchange it beforehand into the local currency, depending on the destination. Through the Mastercard, you can pay comfortably and without further costs (no foreign transaction fee) or even withdraw cash (free of charge). The Mastercard is equipped with the contactless-feature, which considerably accelerates the payment procedures in bank-technically “developed” countries. - Current account replacement (emergency solution)

Account opening takes place without Schufa-evaluation (= opening guarantee). Incoming money flow is free of charge, payments with the card too. Withdrawing of cash is free of charge up to about Euros 225 (= £ 200 ). Fees apply for transactions. Direct debits are not possible. - Secondary or reserve account

TransferWise is truly a special provider and although the Borderless-account has some really great features, which German current accounts do not master, in turn, it cannot do some things that German current accounts can do. It is no replacement for a current account, but a meaningful supplement. If the main current account should be blocked some day – for whatever reason – you are at least pretty much capable of action through the TransferWise-account and card. Moreover, you can park your savings for a rainy day here! - Abroad account / foreign currency account

On the part of the juridical area, the Borderless-account is situated in Great Britain and therefore it is a foreign account for most readers. Additionally, you can get an account in the USA, Australia, New Zealand and of course in Great Britain free of charge (!). You can then hold correspondingly dollars or pounds in these accounts. Without an own account number, balances can be held in considerably more currencies. Perhaps also interesting for our readers: Norwegian krone (NOK), Canadian dollar (CAD) and Swiss frank (CHF). - Secret account

Nowadays, hardly any account is secret anymore … but currently, TransferWise does not report any data in the framework of the international bank customer information exchange! It is also interesting that you state a German account number and can send money from it, but this account cannot be garnished. The account management takes place in Great Britain and the national account numbers only conduce the better payment traffic. - Business account

In contrast to the DKB & and the like, the account can be used commercially. The opening is even possible in the name of the company. From GmbH up to foreign legal entities, such as LTD or LLC.

However: The Borderless-account is no miraculous all-in-one solution, but depending on the individual needs, it can be a very nice supplement to the existing current account system.

Experiences

I am already customer of TransferWise since the year 2013. In the first years, I have use the special provider primarily for my international transfers.

Espercially in the first years have I tested TransferWise repeatedly with other money transfer providers … with the result that I now permanently only use TransferWise!

In the year 2017, I flew to London for 2 days in order to take a deeper look into TransferWise for our readers. Really great conversations took place with people of different hierarchy levels.

As a result of the journey, I learned that the decision in favour of TransferWise for me personally was very good and that our public recommendation is correct.

View from the window at TransferWise towards the city of London.

You can trust permanently in TransferWise!

Use in Germany

I have used the Mastercard a lot in Germany in the past months. With the bright, friendly-green and the small bossing – similar to Apple – it just appears comforting. I like to pay with it.

“Hello World” – looks good, doesn’t it? One of my favourite cards in my wallet!

I have not yet used the transfer feature within the Euro-area, because a small fee applies and I have enough current accounts without transfer fees.

But for someone, who has no completely free accounts like me, TransferWise can be a true alternative, especially because no big challenges arise during the account opening.

SEPA-transfer within the Euro-area: Euro 0.80 is charged as a standard fee. Unusual for us, smart bank customers spoiled by Germany, however, as an alternative solution with a fair price. For the sake of completeness: Such a transfer to a US-bank account only costs USD 1 in the USA: This is an extreme saving compared to the USD 25 that are most often charged!

Use on journeys (in the USA)

In the USA, I have only used the Mastercard. I have really loved the contactless feature in combination with the Push-notification. You are at the payment terminal and immediately after “tipping on it”, the Smartphone emits the familiar “beep”. Outstanding!

By the way, this is a true rarity for the US-American cashiers. US-banks are still very far behind compared to us Europeans!

The TransferWise-Mastercard was accepted everywhere, but not at the self-service fuel dispensers at gas stations. However, this applies to almost all foreign credit cards. There, the zip-code is not submitted for the verification. Instead of the PIN-entering, only the zip-code is queried to approve the payment with many US-cards.

The submitting of a deposit for a rental car was no problem despite this “debit-card”. In contrast to presenting a “credit card”, the return flight ticket must be presented.

At the ATM here, I have withdrawn USD 50 as a test. Free of charge! Apparently, the Mastercard can be bend, as seen in the photo.

Foreign currency account

The opening of foreign currency accounts in very many currencies is free of charge. The account management too!

The accounts are not subject to interest. Therefore, no report for the purpose of tax are necessary!

Paying a reasonable fee, you can exchange a currency into another at any time and pretty easy:

Currently available currencies: AED United Arab Emirates, ARS Argentina, AUD Australia, BDT Bangladesh, BGN Bulgaria, BRL Brazil, CAD Canada, CHF Switzerland, CLP Chile, CNY China, CZK Czech Republic, DKK Denmark, EGP Egypt, EUR Euro-area, GBP Great Britain, GEL Georgia, GHS Ghana, HKD Hongkong, HRK Croatia, HUF Hungary, IDR Indonesia, ILS Israel, INR India, JPY Japan, KES Kenia, KRW South Corea, LKR Sri Lanka, MAD Morocco, MXN Mexico, MYR Malaysia, NGN Nigeria, NOK Norway, NPR Nepal, NZD New Zealand, PEN Peru, PHP Philippines, PKR Pakistan, PLN Poland, RON Romania, RUB Russia, SEK Sweden, SGD Singapore, THB Thailand, TRY Turkey, UAH Ucraine, USD USA, VND Vietnam, ZAR South Africa. More will follow!

Money-transfer

The actual origin of TransferWise is the fast, safe and cheap implementation of international transfers. I really like to use this service to recharge my accounts abroad or paying our partners. Even in the scale of real estate purchases abroad have I used TransferWise several times. Great! Thanks!

From mini-transfers up to purchase price payments for real estate abroad: TransferWise is my payment service provider!

Customer service

Like many providers, TransferWise solves customer requests through an extensive FAQ (frequently asked questions and their corresponding answers). In contrast to some other Fintechs, there is an additional e-mail support.

However, I have made the best experiences with the telephone customer service. If there are problems, the telephone would be the best solution option. As the telephone number is deliberately not that easy to find, our readers can find the number here for the German customer service (native speakers) ► +49-522-39473001. Availability: Monday to Friday from 8 am to 7 pm.

Account opening

The account opening is pretty easy. In the first step, you decide, whether you want to create a private or business user account . Only choose business, if you want to open the account in the name of a company.

Initially, you only enter your e-mail address and a password. The user account is now already created.

In the next step, you complete your personal data and make the legitimation. In many cases, it is enough to upload a photo of the ID-card or passport.

The British law stipulates a proof of address by submitting an additional document. Normally you can take a consumption bill (gas, water, energy, Internet). An account statement is valid too!

In the end, the reason is queried. This is due to a provision from the money laundry area and should not be overrated.

Finished and ready for use

Tips on the account opening

If you are not yet sure, whether TransferWise is the right thing for your business, then open a private account first. Make some different test-transfers, order the Mastercard free of charge and talk to the telephone customer service at least once.

If everything is nice (or most of it)? Good experiences? then make the business account opening. You can do this comfortably through the online menu.

One can link a business account to every private account. Then you can quickly switch between the private and business accounts by clicking.

Simple switch between private and commercial use

At the opening of a business account, a private account is automatically opened too.

Private accounts are most often opened without any query. At the opening of business accounts there are sometimes queries by e-mail with the query to upload additional documents (e.g. section of the commercial register). Works well most of the time.

If it should not work out, then it is recommended to take the path of the telephone customer service. They can log into “your case” and can make up a solution together with you very fast. Especially because of the huge number of accepted legal forms and countries, there can be queries at business accounts. But that is okay. German banks usually do not open (free) accounts for companies from other countries.

Are you still missing an information for the account opening?

You are welcome to use the comments feature. The answer will be posted as fast as possible. However, you can already start the procedure of the account opening. The opening and cancellation are easy and free of charge.

a

I probably won’t ever cancel my account. I am very glad to be able to use TransferWise and thankful for the “borderless” service!

Questions / Help?

We can exchange questions and answers about the account opening or about the use through the comments feature. A heartly thanks to our highly-responsive community that provides a very estimated contribution with its answers and experiences!

Since some weeks, a BE-IBAN (stands for Belgium) has been assigned to new account openings. Transfers within the SEPA system are just as quick and cheap (often free of charge) as transfers within Germany.

Today, all existing customers in the Euro-zone have also been assigned a BE-IBAN. The old DE-IBAN is still valid for 6 months. An early change of invoice templates or standing orders is recommended.

TransferWise wrote about another two good news to its existing customers today:

– The setup of direct debits and

– Instant SEPA-transfers are possible with the BE-IBANs.

Hi – are there any options of opening an online joint-account (for myself & my partner)? Thanks!

TransferWise only offers single accounts.