How to deposit cash with Number26

Direct banking customers finally have possibilities to deposit cash free of charge nationwide thanks to the revolutionary provider Number26!

An idea was implemented that we have proposed in our Petition to the DKB (page in German language). Number26 is the first bank that converts the idea thankfully!

Deposit – step by step:

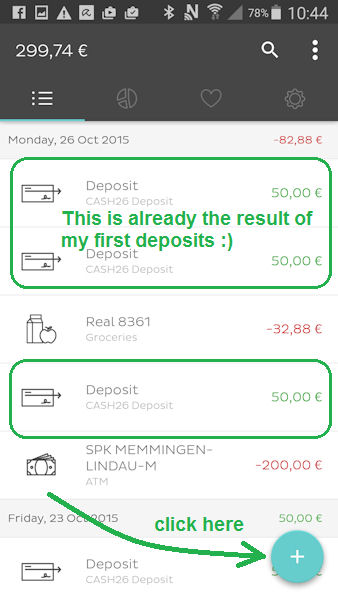

1. You open the N26 app on your Smartphone

1a) At the bottom right, you can find the Plus button.

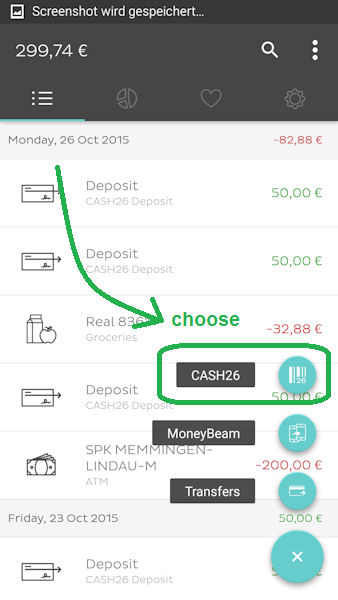

Click on the Plus-button and the following options appear:

1b) Now click on “Cash26“

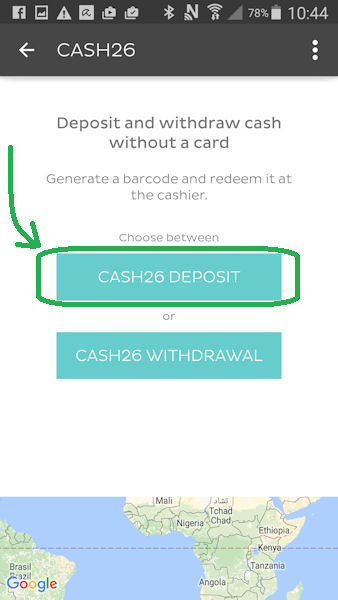

1c) On the next screen, click on the option “Cash26 deposit“

1d) Now you enter the amount that you want to deposit

An amount between Euros 50 and 999 can be deposited using this method.

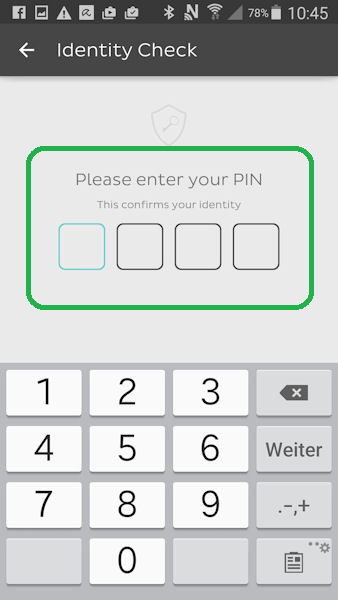

1e) By entering your four-digit PIN, you confirm your deposit order

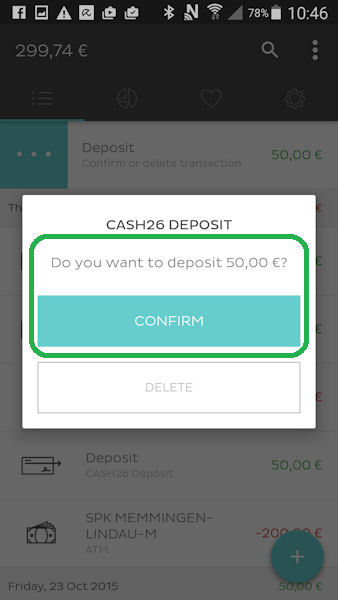

1f) There is another query, which you have to confirm

1g) Then, a bar code will appear

In the bar code, all necessary payment data is included. In order to transfer it to the cash register system, it is only read briefly. Just like at the purchase of a yogurt.

In order to find a deposit option nearby, you can click on the points icon on the top right and then click “nearby branches”.

1h) Showing deposit options nearby

1i) Google map with locations, where cash deposits are possible

A Google map will appear, on which all deposit options are localized. This did not work during my test, but one may assume that it usually works.

The app uses the GPS feature of the Smartphone.

2. Head to the supermarket checkout

As I know that there is a Penny supermarket nearby, I headed to it in order to deposit money. Alternatively, I could have done that in a Real supermarket, but the distance to the Penny supermarket was less.

Take your Smartphone with you; you do not need the MasterCard!

The supermarket manager denied that I can deposit Euros, saying, “This is not possible, I am 100% sure!”, which was eagerly reinforced by a cashier, who joined our conversation.

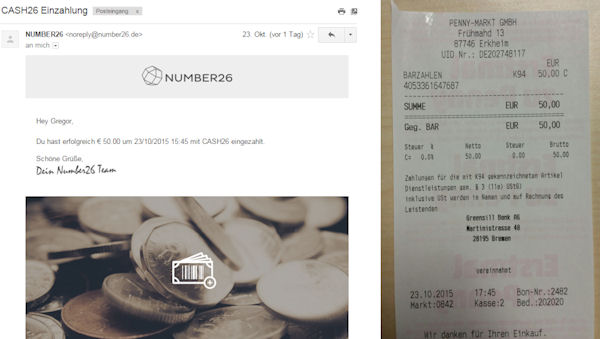

However, when I was allowed to hold the bar code in front of the checkout scanner, the cash register opened and I was able to give her the Euros 50. Then, I received a deposit receipt. When I logging into the Number26 app again, I saw that the deposit has already been credited to the account. Outstanding!

Deposit receipt of the supermarket (on the right) and at the same point of time, Number26 sent me a confirmation e-mail of the successful deposit. Thanks!

Done! This was free of charge. 🙂

Advantages of the cash deposit through Number26

- longer opening hours as with bank branch offices

- deposits are also possible on Saturdays möglich

- no need for a “consultation interview“

(in the proper sense, it is a sales interview – I know people, who always go to the ATM in order to avoid being accosted)

- no additional detours, if one is going shopping anyways

- free deposit of cash

(in the proper sense, it is a sales interview – I know people, who always go to the ATM in order to avoid being accosted)

Of course, there are also disadvantages that I do not want to conceal. Every reader can evaluate the importance for himself/herself personally:

- Minimum deposit of Euros 50

- Maximum deposit of Euros 999

- Little discretion, as you are only rarely alone at the supermarket checkout

Withdrawals are also possible!

By the way, you can also make free withdrawals using the same app and the bar code system. You can “withdraw” at supermarket checkouts between Euros 1 and 300 – at ATMs between Euros 5 and 600.

Account opening only because of the deposit option?

There are numerous people, who

- have their main bank account at a direct bank, but still maintain an account at a bank branch office to be able to make deposits occasionally, and other people who

- have not yet changed to a direct bank, because then they would not have no convenient ways for cash deposits anymore.

This problem was now solved by Number26!

However, is this a reason to open a Number26 account?

Yes, it is one of many. 🙂

Number26 offers a lot of further good reason for an account opening:

- free account management

- free MasterCard

- free cash withdrawals (worldwide)

- no additional fees at currency exchanges

(e.g. credit card payments in foreign currencies of journeys, where other banks charge between 1.75 to 3.50 %) - super-comfortable banking app on the Smartphone

- account opening also possible solely using the Smartphone

“Start the account opening”

But should I open an account at Number26, if I already have a direct bank account?

One may decide this entirely for oneself. If one only opens the account to make deposits free of charge and then transfer the money to one’s real account at the DKB or Comdirect, then this will work. However, is it fair?

Number26 offers a high satisfaction for people, who are starting to deal with the account and use it regularly.

Out of fairness, one has to say that Number26 cannot do everything yet that one is used to from established banks, such as transfers to the abroad (outside the SEPA area) or the opening of joint accounts and authorizations.

But the bank does not have to (implement everything during the first year of existence). Personally, I am thrilled with the fast development of the newcomer bank and its innovative strength. May it bring many great revolutions to the German – later European – bank customers also in the future.

Oh, if I have understood Number26 correctly, then there will also be deposit options abroad in the future. However, I do not know the details yet. If you heard more about it, I would be pleased to read your additions to this article using the comments feature.

Likewise, feel free to post your experiences of depositing cash though Number26 or write direct tips for other readers, for example, about new shop partners. Currently, I am only familiar with the Penny and Real supermarkets.

Many thanks to our active readership!

Frequently read articles about Number26:

- The 6 most awesome features of the N26-MasterCard

- International use of Number26

- Comparison: Number26 better than DKB?

As I am such in a good mood today, I have produced a video for you:

Subscribe to our YouTube channel and experience further practical instructions ✔

Hello,

Thanks for the informative article, however I did not understand if it possible to make the deposit to your CASH26 account using a credit card?

This is wrong or out of date. N26 is now charging a not-inconsiderable 1.5% fee for all Cash26 deposits beyond the first 100€/month, effective 3 May 2016.

https://n26.com/update-to-the-cash26-program-fee-for-cash-deposits/ reads in part:

An example of the charges:

100 Euros deposited in a month = 1,5% x (100-100) = 0 (free)

200 Euros deposited in a month = 1,5% x (200-100) = 1,50 Euro fee

500 Euros deposited in a month = 1,5% x (500-100) = 6,00 Euro fee

1.000 Euros deposited in a month = 1,5% x (1.000-100) = 13,50 Euro fee

Thanks for updated information, but is it still possible to deposit using a credit card and pay the 1.5% fee. Thanks

So is there no way to deposit cash if you have no smart phone? I lost my phone and need to get another one. I need to deposit money in my account in order to get one, but it seems I need one in order to deposit money in my account. 🙁

Hi, I didn’t get it totally, when I create my account, there is an option for free maestro card, and I guess with that card I get an IBAN number, is there any way to transfer electronically from for instance DKB or comdirect account into N26 master card or maestro card? cause if not, I should either pay 1,75% on other credit cards for non-euro purchases, or some deposit charges for N26 account and then charge-free online purchases in non-euro currency (same thing at the end!!)

Agreed, I still don’t understand how one would deposit actual cash from one’s pocket and not from another bank.

Also, will in function it other EC countries?

This particular preference for cash seems to be a German specialty. So far, we have heard nothing about cooperation partners regarding the deposit of cash in other EU countries.

I opened a N26 acct, deposited money, used my card and would like to deposit money back into my account. I hit the plus sign and did not get the info to be able to deposit money. can anyone help me.

Thank you.