DKB Changes: Cancel account? Or open it now more than ever!?

The DKB with more than 4.5 million customers – main product is the free current account “DKB Cash” – is the German “bank leader”.

When it changes some decisive conditions, then similar conditions change at other direct banks shortly after. However, they were most often not able to keep pace. Whether this also applies to the current changes, we will report in our Sonntagsmail (Sunday mail).

Go directly to the bank ► www.dkb.de/privatkunden/dkb_cash/index.html ✅

Short retrospective before heading to the future

In the year 2017, the DKB introduced the “Euros-700-threshold”. When someone had more than Euros 700 incoming money flow into the account, he/she was among the privileged clients. This regular incoming money flow does not have to be the salary. A self-transfer from another current account is enough to receive the following advantages:

- no foreign transaction fee, neither at card payments nor at cash withdrawals ⇒ always a cost-free use of the Visa Card on the part of the DKB within Germany and abroad!

Savings compared to the standard account 2.2 % of the transaction in the foreign currency. That would be Euros 22 per Euros 1,000 in foreign currency! - 0.6 per cent points cheaper overdraft facility interest rate ⇒ 6.65 % instead of 7.25 %

This is an equivalent to a saving of Euros 6 per Euros 1,000 of used overdraft facility volume per year. - free supply of an emergency credit card within – most of the time – 48 hours when you are abroad

Standard customers can also use this service, however, they have to bear the costs of Euros 180 themselves.

Also the emergency cash would be possible.

- Participation in Online-Cashback and DKB-Live

Via Online-Cashback, bonuses of more than Euros 3.6 millions have been awarded to customers in the year 2018 and DKB-customers received through “Live” 500,000 free entry tickets for events sponsored by the DKB (mainly sport events). I was on the Berliner Fernsehturm (Berlin television tower) for free through this program in 2014. Standard clients cannot participate in these two offers.

But even if these Euros 700 are not transferred once or generally, the DKB current account as well as the Visa card(s) remain free of charge.

What did other banks make with the Euros 700 threshold?

At first, they waited and observed how the introduction of such a customer selection barrier developed.

For the DKB, it developed very well as very many customers used the bank more than before. Hundred thousands have used the DKB previously rather as a travel account, because everything linked to journeys abroad was free where many other banks have charged fees.

Of course, the DKB has also advertised with it in this context and attracted secondary account clients or travel card clients accordingly.

Even I have introduced the use of the DKB to the community more often on journeys, like here during a journey to Canada:

Nowadays, many use the DKB as their main current account or at least as a secondary account with noteworthy transactions.

Three banks, that we of DeutschesKonto.ORG observe, have tailed with changes – however, the customers have “fewer advantages”:

-

ING: Euros 700 incoming money flow or a monthly fee of Euros 4.90 applies.

Even if further products, such as the securities account or the credit line produce relief, they do not protect from the fees, but a self-transfer (e.g. in an account system) does.

-

Commerzbank: Euros 700 incoming money flow or a montly fee of Euros 9.90 applies.

According to the “Handelsblatt” (trade journal), a cancellation of half of the branch offices is coming soon. So the bank would then only have around 500 branch offices instead of the former 1,000 in Germany.

Whether there is a retreat from the rural areas or several branch offices in big cities are merged, is not clear yet. This means especially for branch office customers: observe or switch to and familiarize with the online use. -

Norisbank: Euros 500 incoming money flow or a monthly fee of Euros 3.90 applies.

The Norisbank is quite remarcable, because it statistically managed to exchange its complete clientele within 10 years. It acquires about 50,000 customers per year and also loses 50,000 customers. According to own statements, it currently has about 500,000 customers. It is a bank for rather low demands. 😉

Okay, that was the current state.

What changes at the DKB?

The changes are for the great mayority of our readers only of little importance or have practically no relevance at all.

However, there was also some hussle and fear in our own community about what might come – this is why we have created this summary and framework article. Thank you so much for your trust and approach!

| until March 31st 2021 | from April 1st 2021 | |

|---|---|---|

| Changes in detail: | ||

| Interest on balance in the DKB Visa Card | 0.01 % | 0.00 % |

| Interest on balance in the DKB Visa call money account | 0.01 % | 0.00 % |

| There will be a new call money account (without Visa Card) from April 1st and it will receive interest on balance. The bank does not state yet how much it will be – in contrast to the changes of existing conditions, it does not have to. If changes of existing conditions will occur, the bank has to inform its customers two months ahead, so that they can decide whether they want to continue the account with the new conditions or cancel it. |

||

| Deposting cash at DKB-machines | free of charge | 1.50 % of the amount, at least € 2.50 and a maximum of € 15 |

| The DKB-machines are provided with cash and deposited money is collected by an external service provider. Money, which has been deposited, is not paid no the next customer. It gets into a different cash box and is checked before it is recirculated. The DKB is charged with fees for this work and now it partially charges its customers, who use this feature. You can find the list of the DKB-deposit machines here. |

||

| Storage fee from Euros 100,000 | – | 0.50 % per year only applies to new accounts! |

| Background: If your account is in the overdraft facility, the bank earns money through you (overdraft interest). If you have balance, the bank loses money through you, which has do to with the negative key interest rate of the European Central Bank. | ||

Was that it?

Almost. Conditions for “receipt-orders” change, e.g. if you give the DKB orders by mail, and checks: lump sum Euros 2.95 per manual processing. However, this does only apply to very few of us.

So, is the DKB a bank where you can still open a free current account?

From my point of view: yes!

And it will remain this way in the future too – in comparison to other banks.

Why?

It is still miles away from its goal of being a bank for 8 million customers and its key to growth is the free current account. Even if other services will (have to) be charged in 1 or 2 years, I assume that the basic services – the current account with Visa Card – will remain without monthly account management fees.

Questions or comments and remarks about the DKB-account?

Are always more than welcome through the comments feature at the end of this page!

Here some popular articles for (new) DKB-customers:

- How to (not) mess up the account opening at the DKB

- Fund-savings with the DKB securities account

- 3 secrets for new DKB-customers

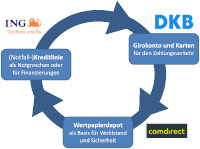

- DKB in comparison with Comdirect

I am trying to close my DKB bank accountant transfer funds to Bank of Ireland. I have tried e- mails and phone calls but none have achieved a workable result

After attempts to unlock my Tan2go account to obtain the necessary forms I am totally unable to do anything

Can you help?

Account closure must be ordered in writing with a signed letter.