Norisbank: Why I would not open a free account …!

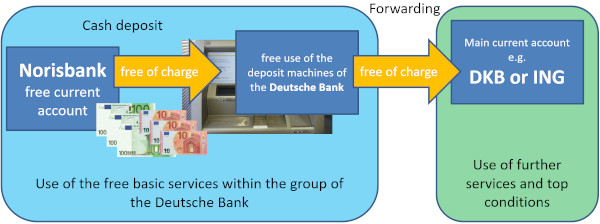

Yes, I know: Some people of our community use the free current account of the Norisbank, in order to deposit cash free of charge through the machines in the branch offices of the Deutsche Bank and then again transfer free of charge to their main current account.

An account opening for this purpose is indeed meaningful, because everything is free of charge for the bank customer and the deposit procedures are unlimited.

The Norisbank is an outstanding bank for this purpose!

Interesting inspiration? Implement now?

Yes, but …

… I opened the article with the statement that I would not open an account at the Norisbank.

Why?

Pretty simple: I do not need the option of depositing cash and I like the other conditions of the DKB (my main current account) and the ING (my reserve account) a lot more.

However, it could be that some of our readers do not even need such outstanding conditions for their account usage. This is why I will explain it in more detail.

I do not think that the Norisbank will survive in its current form!

Admittedly: I observe the Norisbank since at least 2006, the year in which it was taken over by the Deutsche Bank. It did not manage to take the leap into our exclusive list of particularly recommendable banks. Somehow, there was always something in between: conditions too weak and have been tested from time to time; the staff also too “weak”, in order to not say something worse. 😉

There is no prospect for improvement, because the Deutsche Bank has done with the Norisbank exactly what many (self-proclaimed) councellors of a modern bank ask for:

-

Reduced branch offices

In the year 2012, it has even closed all branch offices and since then, it only acts as a direct bank.

-

Fired staff, in order to reduce personnel and administration costs

Since the takeover by the Deutsche Bank, the Norisbank has reduced 84 % of the staff and 71 % of the administration costs. Does this sound nice for the investor, who is already a tormented Deutsche Bank shares owner – or not? Well not so much, because it looks like the …

… Norisbank has saved itself into the ruin!

It has finished the year 2018 with a loss of Euros 12 millions!

The DKB made Euros 301 millions of profit within the same time frame; the ING more than a billion. This perhaps is like comparing apples with pears, but makes its point regarding its future sustainability!

-

Just offer free services and earn the money back-door

You hardly earn any money through a free current account. The customers would have to use further products, such as the credit card or overdraft facility/installment loans. Herein, the hurdles of application are easier to take at other banks and the conditions are just better at the DKB and the like.

The Norisbank could not profit at all from the tendency towards free current accounts. In the past 10 years, it has even lost almost 20 per cent of its customers – even it its current account is free!

Although free of charge, it has lost almost 20 % of customers!

DKB and ING earn a six-digit number of new current accounts every year. Especially since the Sparkasse and Volksbank increase their fees more and more.

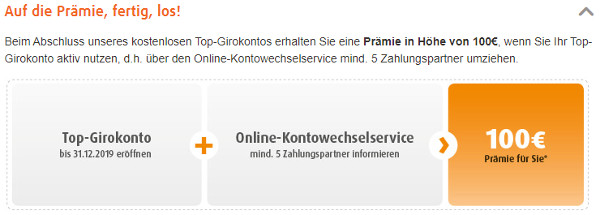

Since some time now, the Norisbank even gives Euros 100 to every new customer, who opens the account and makes 5 transactions with different payment partners. If banks have to pay their new customers money for opening a free account, then this is not a good sign in the long-term.

In principle, the Norisbank wants to acquire customers with this promotion, who use the account permanently. Instead of paying a one-time money bonus, it would be better to improve conditions and services.

Even the DKB had troubles to maintain the service quality in the past two years, but if you put the customers into a comparison to employees, then this looks like a time bomb for the Norisbank:

Bank Amount of customers per employee Norisbank 10,340 N26 3,500 ING 1,879 Comdirect 1,695 DKB 1,028 Source: magazine “Finanz-Szene” issue of October 27, 2019 Even if the N26-bank has encountered very frequently service problems this year, it has 3-times the amount of employees per customer. The Norisbank customer service did not appear negatively, because it rather gave customers away. The customer service is especially contacted by customers that are new at the bank and learn the first steps.

What does the Norisbank provide us with?

The most interesting part really is the free depositing of cash through the machines of the Deutsche Bank.

Smart bank customers transfer the money then fastly to their main bank. The Norisbank cannot make money with that. Then the bankers shout out to the customers, “You only want to take advantage of us”.

My truth is:

The Norisbank does not have a sustainable business model!

It should offer conditions and services similar to the DKB and ING. If you switch to a direct bank, then you would choose one of the best of course – or wouldn’t you?

The Norisbank has a free current account, but the conditions and the service are only average.

The Norisbank only has 46 (!) employees at about 548,000 customers

As the bank apparently lacks committed employees and there is no intention to change that on the part of the Deutsche Bank, the Norisbank will be a side issure at the German bank market also in the coming years.

It is good enough to open a free account for cash transactions and keep it free of charge, but not good enough to use it as a main account or implement important bank services.

What do you think?

I am of course interested in your opinions and experiences on the subject:

- Perhaps you are a happy customer of the Norisbank since years and mainly use cash deposits and payments?

- Perhaps you are looking for a cash-bank?

- Or do you look for a free alternative, if it did not work with the account opening at the DKB or ING?

I am looking forward to the exchange through the comments feature.

At the same time, I do not want to hold anyone back from the account opening. Gather your own experiences with the Norisbank. I would even like it a lot, if more people opened an account at the Norisbank (e.g. as a consequence of condition improvement), because we rather need more than less banks in Germany!

Many providers are a guarantee for good prices and good quality.

Encouragement for the Norisbank

Please make an efford, Norisbank! I will write a new article, as soon as I have come to a new conviction. Until then, it is quite a long way. However, you are still on my observation list and this circle is also exclusive! Good luck!

Further current accounts in discussion:

- Open an account at the DKB or ING?

- DKB in a comparison to the Commerzbank

- Open the DKB-account – Step-by-step instruction

Give the Norisbank a chance and …

Since I came to Germany,2016 I am using Norisbank. I mean, my husband open it for me and even until now that I am working, I still use it. I never have any plan to switch to any bank because I am satisfied with e.g. they able to fulfill my requirements. My banking usage is only for transfer and mostly electronic. All is free of charge, unlike with other bank that I often heard that paying maintenance and even needs to maintain otherwise, they got charge. haha- Man! The bank already has enjoy the money when we are not using it, why they are charging us the customers? Until such time that Norisbank meet my needs and they excel from my expectation so far, I will stay.

Perfect, I am happy that you have had a positive experience and that you are happy with Norisbank. Thank you for the message here!