Withdrawing money in the USA – best option?

In this article, you will find out:

- which credit card has the best currency exchange rate,

- which ATMs you should use and which you should avoid and

- which alternatives exist for withdrawing cash!

Perhaps you want to start with the documentation video of the article?

Comparison: Which bank offers the best exchange rate?

Previous note:Exchange rates – which is indeed implied by the name – fluctuate constantly. At our last test in the USA, the DKB provided the best exchange rate, however, in this test, it offered the worst!

This is one of the reasons, why we perform these tests frequently to get a long-term overview. Depending on the type of use (cash withdrawal, cash-less payment), we include further features to affect the test result, just like the international service fee (foreign currency fee) or the refund of foreign fees.

Despite the worst exchange rate, the DKB turned out to be the second best provider in the comparison, as it refunds the local ATM fees, which occur regularly at cash withdrawals in the USA, to its customers.

Find details further below, but here is the test result:

| Provider | Compounds of a cash withdrawal at the ATM | Link of the provider | |||

|---|---|---|---|---|---|

| Withdrawal amount | +ATM-fee | Exchange rate | = Debit entry from the account Difference to the best provider |

||

| Top provider of this special portal | |||||

Comdirect |

USD 10 | $ 0 | 1.1332 | € 8,82 € +/- 0,00 |

|

DKB |

USD 10 | $ 0 | 1.12434 | € 8,89 € -0,07 |

|

Fidor |

USD 10 | $ 3,50 | 1.131601 | € 11,93 € +3,11 |

|

Number26 |

USD 10 | $ 3,50 | 1.131601 | € 11,93 € +3,11& |

|

Hochrechnung auf eine Abhebesumme von 1.000 US-Dollar:

| Provider | Compounds of a cash withdrawal at the ATM | Link of the provider | |||

|---|---|---|---|---|---|

| Withdrawal amount | +ATM-fee | Exchange rate | = Debit entry from the account Difference to the best provider |

||

Comdirect |

USD 1.000 | $ 0 | 1.1332 | € 882,46 € +/-0,00 |

|

DKB |

USD 1.000 | $ 0 | 1.12434 | € 889,41 € -6,95 |

|

Fidor |

USD 1.000 | $ 3,50 | 1.131601 | € 886,80 € +4,34 |

|

Number26 |

USD 1.000 | $ 3,50 | 1.131601 | € 886,80 € +4,34 |

|

Evaluation of the test

Special feature: As you can see in this photo, the Term Owner Fee did not even incur at the Comdirect and DKB. This saved us from asking for refund. However, the test result still is transferable to the generality.

On the test day, October 9th 2015, the Comdirect Bank had by far the best exchange rate from US-Dollars to Euros.

Test winner: Comdirect (by far!)

At the cash withdrawal, it was able to extend its leading position even further compared to the other Top4 credit cards on our special portal, as it is the only bank together with the DKB in Germany that refunds foreign fees of withdrawals.

How this works in detail is described in the following two instructions:

At the extrapolation to the US$ 1,000 withdrawal, the DKB – despite the refund of the withdrawal fee – fell back to the last position. Here we can see clearly that the decimal places are crucial in larger sums!

The ATM of the PNC Bank

At this ATM of the PNC Bank on 315 N Haddon Ave, in Haddonfield, New Jersey, USA, the withdrawal test took place.

Surprisingly, the ATM of the PNC-Bank in Haddonfield, New Jersey, did not even charge the usual ATM fee at the withdrawals of the Comdirect and DKB.

However, the fee was charged at the withdrawals using the Fidor SmartCard and Number26 MasterCard. I do not know why.

In principle, this simplified our test, as in 99 per cent of ATMs in the USA, there are between US-Dollar 3 to 3.50 withdrawal fees for foreign customers – also for customers of other US banks.

The Comdirect and DKB would have refunded this anyway, but Fidor and Number26 not.

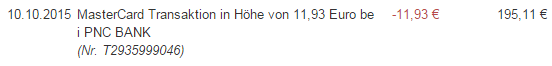

As evidence, we are inserting here the corresponding bank statements, before we proceed with the points 2 and 3:

Comdirect

Everything on one spot: The Comdirect Bank shows the withdrawal amount and the exchange rate in one line within the transaction overview. Comfortable!

DKB

At the DKB, one has to open the details of the transaction in order to see the exchange rate.

Fidor

The Fidor Bank shows the fewest information about the withdrawal. Therefore, one can only see the entry date, but not the withdrawal date. There are no details available. Moreover, the bank explained to me by phone that there is no exchange rate, as the US-bank changes the money … this shows lack of knowledge of the Fidor customer service (which I experienced several times at the account opening). The exchange rate for Fidor customers is directly set by MasterCard. Therefore, it is exactly the same rate as at Number26, which also entrusts MasterCard with the exchange rate.

Number26

In the detailed view of the transaction, Number26 since only recently also shows the exchange rate. The lack of it at previous tests was a point of critic from my (and other people´s) point of view. Many thanks to Number26 that it has extended their information for the benefit of all customers!

Part 2: Which USA-ATMs are recommendable?

Basically, you can use any ATM to withdraw money. You do not have to pay attention to any traps like one can frequently encounter them at Eastern European ATMs and with a slight modification in the UK and Switzerland (misleading information in order to charge you a significantly worse exchange rate).

The USA bank is not interested at all in your exchange rate. It always settles in US-Dollars and entrusts the currency conversion to the main bank of the customer. For you as a customer, it is much more important to have an excellent main bank (or special travel credit card), than the choice of ATM.

99 % of ATMs charge a fee!

Almost all ATMs in the USA charge a withdrawal fee, which is directly added to the withdrawal amount. In most other countries, the withdrawal amount and the withdrawal fee are charged separately from the credit card-issuing bank. Many good German direct banks bear this fee for their clients.

These are the advertising promises, “withdraw cash free of charge abroad“. Except for the Comdirect and DKB, you will find an asterisk that says that one has no influence on possible foreign fees. Therefore in practice, the cash withdrawals in the USA are subject to costs for all bank customers, excluding the Comdirect and DKB.

Usually, Sparkassen, Volksbanken and large as well as small private banks charge their customers with an additional withdrawal fee according to its own price list (for example, 2% of the withdrawal amount, but at least Euros 5.99). Being a customer of such banks make you pay double!

Sparkasse and Volksbank customers pay double!

… unless you can find one of the very rare ATMs that waives on this fee. In Haddon Township, New Jersey, there is such an ATM in a Wawa branch (fast food chain), perhaps to lure people into the store, who then may make further purchases?

By the way, this ATM is operated by the PNC Bank, but in their own branch office, which is situated about one mile away, the usual fee applied using the MasterCards of Fidor and Number26. There was no sign stating, “No Surcharge“.

On this subject, we will publish a separate article on this special portal soon. As a fan (German site), you will be informed proactively about the publication.

Pay attention to the sign, No Surcharge, as you can withdraw cash there without paying the ATM fee. Take advantage and withdraw a higher amount, because there are only few of these ATMs in the USA.

Part 3: Alternatives to ATMs

1. Cash through American Express Traveler´s Cheques

If you travel frequently to the USA and/or became familiar with the exchange rate fluctuations, then the following tip might be especially interesting for you.

There are people, who buy traveler´s cheques in favourable currency phases – when the Euro is high compared to the Dollar.

Although the purchase costs you 1 % fee, the redemption is free of charge!

When paying by cheque for the equivalent of US-Dollar 500, you pay a fee of US-Dollar 5. Eventually also postage costs can be added, if you let the traveler’s cheques be sent to you.

How to transform traveler´s cheques into cash:

You go into a larger store (e.g. Walmart) or a petrol station (e.g. Shell) and pay by cheque. You will receive the change in US-Dollar cash. So you have received cash in US-Dollars free of charge.

Change is your new Cash

You have already paid the 1 % fee for the purchase and hopefully at a better rate and you may have recouped the 1 %.

Compared to a credit card payment, which often includes an foreign transaction fee from 1.75 to 3.00 per cent, you have even saved money buying the traveler’s cheques.

Notes to the banks observed by us:

You can purchase traveler’s cheques via online banking at the Comdirect and DKB. This service is not offered by the Fidor Bank and Number26. However, the latter ones are among the few providers that waive on charging the international service fee.

1. You sign a second time in the presence of the cashier on the traveler´s cheque (green arrow)

2. The cheque is drawn by the teller machine.

3. You receive your purchases and the change in cash (free of charge!)

Further information ► The secret knowledge of Traveler´s Cheque users (article in German language)

2. Pay most often cashless

The USA is a country, where cash is more important in everyday life than here in Germany. Therefore, the strategy of travelling cashless through the USA, only hardly will be doable.

For example, one could not pay any highway or bridge toll, which I passed on my current journey through Delaware, Maryland, Pennsylvania, New Jersey and New York, by credit card. Only cash was accepted (or an e-pass that you do not have as a tourist or business traveller).

At the tool booths, you can only pay cash being a foreigner … however, supermarkets accept paying penny-items by credit card, as an additional test on this special portal will show.

Your strategy could be the following:

Your strategy as a non-customer of the Comdirect or DKB might be that you withdraw a large amount of cash once and then handle it sparingly. Pay predominantly with credit card.

In the USA, you can easily pay small sums by using a European credit card. For another article, I have purchased consecutively four chocolate bars for US-Dollar 0.79 and paid by credit card. So, four times 79 cents with the credit card.

Signs and the accompanying growl of the cashier, “Credit card payments only from Euros 10”, do not exist in the USA. Also the smallest amount is happily accepted using the credit card!

Does it depend on the right credit card?

Yes! In addition to credit cards (Visa and MasterCard, American Express), often but not always, the MaestroCard (at some Girocards) is accepted. The Girocard of V Pay is generally not accepted.

Pay attention, whether your credit card is subject to the foreign transaction fee!

It is strongly recommended to get a credit card for a trip to the USA. If your departure is imminent, then take a look at the MasterCard of Number26. You can receive it within 2 banking days.

This is probably the fastest possible credit card application and delivery: Free credit card: How to get the credit card in only 2 days to your mailbox!

By the way, the MasterCard of Number26 performed best at our test of cashless payments. Article will be published soon!

The MasterCard of Number26 is an ideal means of payment for cashless payments in the USA, as it does not charge the foreign transaction fee and is overall completely free of charge! Here: uncommon photo in the garden of the White House, Washington DC.

Further information ► www.number26.de/en

What will be published in future articles for you:

- Test: Which is the best credit card for cashless payments in the USA?

- Where can I withdraw cash free of charge, if I am not a customer of the Comdirect or DKB?

- Why you cannot pay with a German credit card at Aldi (USA)!

Which credit card do you take with you on a USA-journey?

I am looking forward to read your additions, tips, experiences and questions on the subject, “withdrawing cash in the USA”. The comments box is activated for you!

Thanks for the comparison.

What is the maximum amount per day and per month withdrawals for Comdirect?

Converted about 600 Euro per day.

Also, there are preset transferlimits per day. You can find this under: “Persönlicher Bereich >> Verwaltung >> Überweisungslimits” – and there you can adjust them yourself to fit your needs.