N26 MasterCard for free

Partially-transparent MasterCard

Please look at each presented card feature and discover the huge potential for your (financial) life.

At the end of the page, you can ask your questions that I will answer gladly.

Beforehand: What N26-customers love most:

- absolutely free MasterCard (no annual fee, no hidden costs!)

- all cash withdrawals are free of charge in Germany and abroad

- super-useful banking-app (easy to use and very functional)

Question: Want to order the card within the next 8 minutes (www.number26.eu) or read the article first?

The 6 most awesome features of the card

1. Withdrawing cash free of charge worldwide

Okay, withdrawing cash free of charge is offered by several banks.

However, there is no bank that offers you a credit card account without creditworthiness check (= no Schufa-query / no rejection / virtually with an account opening guarantee) and free cash supply! As an example, the rejection rate of the DKB is about 35 percent.

Withdrawing cash is always free of charge within Germany and abroad!

You can withdraw cash as often as you want and wherever you want free of charge. It only matters that the ATM accepts MasterCards, and so do most ATMs worldwide.

What you should know: Withdrawal limit

You can adjust the withdrawal limits individually within the banking app. Currently, you can withdraw up to Euros 5,000 per day and up to Euros 20,000 per month using the MasterCard of Number26.

Note: Cash is always free of charge!

2. Paying in foreign currencies free of charge (no foreign transaction fee!)

This is only provided by very few credit cards, because banks love to earn through card transactions abroad.

This is disguised by the term foreign transaction fee and costs you up to 3% of the card transaction. At the DKB Visa card known by travellers, this is every time 1.75%.

A quite huge sum is thereby made over the years.

Calming when paying with the card abroad. There are no fees for the international use!

This does not apply to the MasterCard of Number26. It waives completely on this source of income. All transactions in other currencies are converted directly without fees using the MasterCard exchange rate.

Compared with Visa and other banks, the MasterCard rate is not always, but quite often the best! That was also the case at my card test abroad.

Note: Payments abroad are converted free of charge!

3. Control Center with card blocking options

There are credit cards, where it is advisable to notify the bank in advance that you will spend your holidays abroad, as there is a risk that the credit card will be blocked. The background is safety mechanisms to protect you against credit card fraud and therefore they block it at unusual payments.

This is different with this MasterCard. The card blockings out of “security reasons” are in fact quite annoying and it is the declared goal of Number26 to give its customers a surprisingly good user experience.

The credit card can be (partially) blocked and activated again.

You, as the cardholder, are given the opportunity via the Control Center in the banking app and online banking to enable the credit card only for certain areas.

If you are not e.g. abroad, you can deactivate the use abroad. So, a credit card defrauder can never withdraw money from your credit card abroad.

And as soon as you make a trip abroad, you simply activate the feature again.

The blocking and un-blocking of the credit card can be made from one second to the other. Without the customer service. It is easiest to open the app and change the lock-symbol as shown on this page in detail: Blocking and un-blocking of the MasterCard (article in German language).

You have the following option:

- Blocking of payments abroad

- Blocking of payments on the Internet

- Blocking of the usage at ATMs

- Complete blocking of the credit card

With this features, Number26 gives people the greatest possible freedom and personal responsibility.

Note: You decide on the available options!

4. Money Beam – Transfers within seconds

With Money Beam, you can send money to people from your contact list (Smartphone) without having to enter the awkward IBAN. You will now only need seconds for the transfers.

If the payment receiver also has an account at Number26, the money will be transferred immediately. “Beamed” … perhaps with reference to the famous terminology of “Star Trek”?

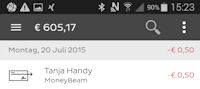

Bank statement of a Money-Beam payment

If the payment receiver is not (yet) at Number26, then it does not matter. He/She gets an invitation to enter his/her account details in order to receive the transfer.

An efficient way to transfer money!

Of course, one can transfer with Number26 also in the conventional way.

Note: Transfers are super-easy and comfortable!

5. Push notifications at each account movement

Information about each account movement in real time

Safety or necessary information? As a cardholder, you receive the push notification in real time (if Internet connection is available) for each account movement to your Smartphone.

Therefore, you can see right away, if money is received. This is useful, if you are waiting for your salary payment or the like …

Of course, you are also informed about any credit card payment. As soon as you have entered the PIN at the checkout, your Smartphone will vibrate. If you did not initiate this payment, you can react quickly through the customer service.

Note: You are always informed actively about your account!

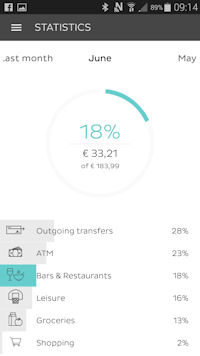

5b. Statistics (bonus)

These evaluations can help to identify potential savings possibilities.

Number26 offers you for free a lot of statistics on your account and spending behaviour.

Each transaction is processed automatically into categories. Of course, you can make adjustments and changes. The graphical assessment can help you to optimize your financial life.

6. True current account included

Different people get the free MasterCard of Number26 out of different reasons. There are people who

- want to have a new current account and choose N26 right away as the most modern current account in Europe with Smartphone component,

- only need a second credit card for Internet purchases or journeys abroad,

- want a start a new financial life and are therefore looking for a new bank that does not investigate at the Schufa,

- just want a prepaid credit card and are looking for a provider, who offers this free of charge.

This MasterCard is for all those people and for even more applications (you can post your additions using the comments box) and on top of that, it offers a true current account with IBAN, transfers, standing orders and bank statements.

There are already people who use Number26 as the main account.

Note: The MasterCard is equipped with a complete current account!

Fortunately: Account opening made easy

There is probably no bank account with a credit card (credit base), which is easier to apply for than Number26.

Currently, the account can be applied for, opened and used in German and English.

Requirements for the account opening

There are only few requirements for the account opening:

- modern Smartphone (because the banking app must work on it)

- shipping address for the MasterCard in Germany, Austria, France, Spain, Italy, Greece, Slovakia or Ireland

(later, other countries will be added) - one must be at least 18 years old.

Once you have filled out the account application online, the video identification process will take place right afterwards. Here, the ID-card or passport is held in front of the camera. Also a photo of you will be taken via the camera.

Alternatively, the proven PostIdent-procedure is offered.

Consecutively, the MasterCard goes immediately into production and will be sent to you. There are cases – for example in my case – in which the card has already arrived the next day in the mailbox.

It only must be activated via the app and it is then ready for use. You can perform a transfer to your new account immediately, because you have already received your account number by e-mail.

Note: account opening possible in 8 minutes!

Number26 advertises with the statement that the account opening can be completely finished within only 8 minutes … and I personally know of someone, who managed this!

“Start the account opening now”

… can you complete it within 8 minutes?

https://number26.de/en (English)

https://number26.de/ (German)

Moreover, I would be happy to answer your questions, because I am a N26-customer since January 2015 and have become a fan. With this, I am one of the first customers of this new provider and was able to make quite some interesting experiences. Answer guaranteed!

Gregor, i wanted to warn other people that today i received an email from number26 notifying me that they block my account effectively and immediately (with my money in it!)

This happens like 27 days after the reception of the card.

They told me that my account would be unlocked only after a proper postIdent verification.

The legitimating is required by law. Did you encounter any problems at the video legitimating?

No. Even after the videoconference i got this confirmation:

“Congratulations Gonzalo,

You’ve already completed Europe’s quickest account opening process. You’ll receive your NUMBER26 MasterCard® 2-3 working days after the verification of your identity. You have already set your PIN for your MasterCard® (more details).

Why not transfer some money into your NUMBER26 account to use it now. Even before your NUMBER26 MasterCard® arrives you can use MoneyBeam and transfer funds.”

Why sent the card and encourage people to transfer funds, if there is the possibility of issues/rejection/etc in the future.

Don’t get me wrong. I’m very happy with the card & the app. (Except the 2 day lag for the tranfers..)

I’m waiting for further contact from Customer Service to solve this out.

Hi Gonzalo,

did you solved the problem with your blocked account anyhow? Or did they told you, why they blocked your account?

Thanks for answer

Hi Zdenek!

I have my account back!,

Seems like it was an issue with the quality of the capture of my passport.

After some delay because of a bug in the ios app that prevented me to do the verification one more time, i can use my number26 account again.

🙂

Hi Gregor, thanks for the time and effort writing this.

Could you explain me the dependency of the smartphone on the sign-up and use of the card?

I’ll be travelling abroad to a non-euro country where I’ll probably not even have internet/data connection on the phone.

I would like to go to a rent-a-car and use the credit card. I know the rent-a-car will request a credit-card with pin authentication.

And, to be honest, my current smartphone is an old model and not in the supported list.

Is there anything that prevents me to use the card without having the supported smartphone, or being offline?

Is there an app-authentication step that *needs* to happen for you to register the account?

I *need* to have the smartphone with me, charged and with network available, when trying to use the card, because I need to confirm the transaction?

Not obvious for me from the description of the steps.

Thank you,

Joao

For the account opening, you need a modern Smartphone, unless you are technically savvy and can follow the idea of Andreas Adler described in his guest article: https://www.deutscheskonto.org/en/number26/without-smartphone/

If you will go travelling and have previously transferred enough money, you can use the MasterCard without the app for cashless payments, or to withdraw money from ATMs.

However, you need the app for transfers, cash deposits, MoneyBeam or even the blocking of the credit card. If you do not plan to do that, then you can take the credit card without Smartphone with you on your trips.

Regarding the issue of acceptance, we do not yet have enough experience to make a 100% safe statement. Although the credit card is embossed (one can feel the card number), it is not a “true” credit card with credit limit, but a debit-MasterCard. Although it has a chip and a PIN, the layman cannot say exactly from the outside, what type of card it is … when I was asked in the USA, whether it is a “credit” or “debit”, I usually said, “credit”. It has always worked perfectly. If needed, you can say, “Sorry, debit”. However, I did not make any security deposits with the card (hotel, car rental). Here, I would be grateful for experiences of other Number26 customers 🙂

I wish you a lot of fun on your journeys!

Hello mate

Thanks for the article. My girlfriend has a account with some other bank that offers Giro card. She is reluctant on opening a joint account with number 26 as she thinks MasterCard is not widely accepted in Germany like Giro card (eg: grocery stores).

Would this be an issue for us to open an account with number 26 and do they offer joint accounts?

There is no joint account at number26.

If one needs a certified true copy of a hard copy bank statement, how do you get this with an online bank such as number26?

Hi Karen,

you can get a statement from Number26 that confirms that you are their customer and that states certain key facts about your account, Excluding your account balance. They can also send you a confirmation, on request, regarding a certain single transactions, e.g. if you have to prove that you have made a particular payment. These confirmations will include the letter head, signature etc., but will be sent to you as a PDF file for you to download and/or print.

They do not send it by regular mail, and this does also not refer to overviews of your regular general bank transactions.

I hope this helps.

Thanks Susanne. So one cannot get a bank statement of the account balance then, whether in hard or soft copy PDF…

Yes, you can get a bank statement, either online or via the app.

I appreciate your prompt and precise answers very much. The immigration office in Germany requires that I have a blocked account; can Number26 offer this? I wish to close my current bank account and transfer all my funds to my Number26 account but my current bank will only do that under instruction from the immigration office, who will only issue a letter to the bank if I can prove Number26 can give me a blocked account.

Number26 don’t offer blocked accounts. The Deutsche Bank have such account.

Hi Gregor, thank you, I already have a blocked account with Deutsche Bank, but am charged about 5 EUR monthly.

Hi could you tell me if it is possible to have your work wages paid into the number26 account?

Hello Nick duke,

yes, you can have your work wages paid into your Number26 account.

Hi,

I do not have my bank card yet and need money from my Number26 acc.

How can I get money without a card?

Here is an instruction for you: https://www.deutscheskonto.org/en/deposit-cash-supermarket/

In how many days you receive the card? I’m waiting almost 20 days! I don’t know if it happens because of holidays but its a long waiting time.

In Germany, it takes on average 2-3 days. For the delivery to the other new countries, we still do not have experiences. In which country do you live?

Even to Greece (currently the farest place possible, 20 days would be too much). Please contact the customer service of Number26 and ask them to send you a new card. Whether this works already automatically through the app, I do not know, because I do not have the app where the card is not yet activated. You can possibly try. Good luck!

Hi,

I see that there is an annual fee of €30 for Credit Cards in Ireland, mentioned on the Price List here – https://number26.eu/wp-content/uploads/2015/07/NNUMBER26-Pricing-List.pdf

But the card has been downgraded to a Debit card.

I know I may be clutching at straws here, but do you know if this charge will be applied? It seems like it must be a mistake.

To reply to myself, it is a stamp duty. But there must be a mistake somewhere.

Here are the fees – http://www.revenue.ie/en/tax/stamp-duty/leaflets/stamp-duty-financial-cards.html

Okay, fine! Thank you 🙂

Hi Gregor, I am a tourist currently staying in Germany. I will stay here until 3rd of May 2016. I have cash and I do not feel safe carrying this around. I have four questions. Your advice is really important.

1. If I want to open my Number26 account in Germany, do I have to buy a smartphone in Germany?

2. I stay with a host family. It is not their official business. Then, is it possible to show my residence proof to your bank?

3. Number26 Master Card will be sent if I deposit some money, correct? Then what would be the minimum amount required?

4. Can Number26 account receive money from overseas?

I will be waiting for your advice, Gregor. Thank you.

Where are your original from?

Enjoy your new german bank account 🙂

Thanks, Gregor. I really appreciate your advice.

I was born in South Korea. Now I’m a citizen of New Zealand. And never used Smartphone in New Zealand. My father living in U.S just gave away his smartphone (T-mobile) to me when I visited him recently. If this can be a problem, please let me know. Thank you. 🙂

Thanks Gregor. I have one more question. I use Ipad. Could Ipad be also a prerequisite instead of Smartphone? (In this case I would buy the cheap old mobile phone.)

I’ll be waiting for your advice. Thank you.

Cool! I think that is fine. How was the account opening for you? Finished?

Thank you. It’s a good news that Ipad can be also a prerequisite. I will use my Ipad. Will open the account soon. I will contact you when I face another challenge in the account opening process. 🙂 Thanks again.

Hi Benedictus,

it is of course true that you can download the app on your ipad and use it for access. But you will not be able to transfer money to another account with the ipad, unless you have it connected to a telephone number where you can receive text messages. This is part of the security system for Number26 – you need to be able to receive text messages to a telephone number that is connected to your app/account, because that is how you receive PINs. In order to go shopping etc., you of course do not need the phone, you can simply pay with your card. I hope that helps.

Hello,

Before opening an account, I want to know does the Number26 also offer credit card option along with mastercard? If yes what is the limit of credit card and what is the rate of interest while returning the money?

Thanks in advance

Greetings,

Puneet

Hello Puneet,

The credit card option with Number26 is exclusively MasterCard. If you pay with this MasterCard, the respective amount is taken out of your Number26 account automatically (and without delay, so no worries about interest rates here). Therefore, the limit of the card depends on the amount you have on your Number26 account.

I hope this helps!

Hello Susanne,

Thanks for your reply!

So the conclusion is hat … It’s a normal bank process with mastercard and the balance you can pay. No credit card.

Still it’s good offer for me … I will let you if I face any challenges while opening the account.

Thanks for your help .

Greetings,

Puneet

Dear Gregor

I really need your information on this issue. I have opened a month ago an account with Number26. My residence and main bank account is in France and I hoped to transfer on N26 my funds, but their operator explained me that for the moment this is just possible to be done in Germany.

Anyway, since I am travelling to London this weekend I would like to charge my new master card and to use it there without costs. Is it possible? Should I use the account details (IBAN, BIC) of my N26 profile? Does that German bank account really exists without any financial mouvements?

Thank you for your answer!

Polina

Hello Polina,

I just wanted to ask how long did it take for you to receive your MasterCard in France?

Best,

Cris

Dear Polina

I do not know your “operator”, but I know our European laws dealing with payments within the EU. Bank transfers from a French current account to a German current account take 0-1 days and may not be more expensive than a national transfer of the bank. This is EU law!

This means for Number26 customers that all transfers in Euros within the SEPA area are free of charge.

Usually, there is no problem to transfer money to the Number26 account. Most do it online with IBAN and BIC. If you use transfer forms made of paper, then you have to take the forms for SEPA payments. Not the one for international transfers!

Taking the Number26 MasterCard with you to the UK is an excellent idea! There is no foreign transaction fee for GBP at Number26. Thus, you will save a lot of money (fees) compared to most bank cards.

Please be careful when withdrawing at the ATM that you do not become a victim of the rip-off trap, which exists in the UK (particularly at the airports and tourist places). How this works, I have shown in an example in Hungary: https://www.deutscheskonto.org/en/withdrawing-money-in-hungary/

I wish you a fast success with the transfer (it is better to do it online than asking in the bank – there are often bankers, who either do not know or want to consciously prevent such migration) and a good time in the UK with many good N26-experiences. You’ll be amazed 🙂

Dear Gregor,

thank you for your kind answer, just great so I’ll try to start the transfers on my N26 mastercard adapting my cards to my “nomadic” way of life.

All the best,

Polina

Cool 🙂 Fine!

Dear Cris

I don’t remember exactly how long it took but it was in max a week.

Best,

Polina

Hi Gregor,

Still couldn’t get how to top up Number26 account if I haven’t got any other bank accounts and only some cash on my hands.

Thank you.

Chipolino

If you are in Germany, you can deposit money into your account at more than 6,000 supermarket cashiers. But from 100 Euro and above per month, fees apply. So, for bigger amounts, this might not be the right solution.

If you have many or high amounts of cash deposits like that, Number26 is not the right bank. That much honesty is allowed!

Hi there, I’d appreciate any insight into this: I am in Germany and would like to pay for groceries or goods cashlessly with my Mastercard or Maestro card; is that possible? Is there a need to activate these?

Thank you,

Karen

Hi Karen.

In Germany, the option to pay with either debit or credit card is becoming more normal, but is far less common than it is in the USA, for example. In some shops you might still only be able to pay cash, especially in smaller shops (a bakery, for example). Then again, many shops might accept debit cards, and other ones accept debit as well as credit cards, though some might only take MasterCard, some only Visa etc. So, it really differs. You will usually find signs at the entrance and/or the cash register that tell you which form of payment is accepted. If not, I’d ask beforehand, to avoid surprises.

When you get your cards from Number26, you activate them online once, and then you’re good to go, as far as activation is concerned.

Hi all,

Has anyone got experience using this card as a security deposit (car rental, hotel etc) in the USA?

Many thanks!

Hi I have a similar question to Carmen – can you rent a car with this card? The car rental companies accept MasterCards (credit Card) as they need to block security deposit on the card but this is a prepaid card, correct? Would they accept it also? thank you

Just tried signing up from Spain which Number26 has been advertising as market it has accessed in December, but now they wrote that they have to wait list me due to them being backed up opening accounts.

Makes no sense their story.

If they were really backed up they could by now give some kind of estimate when the waitlisted people would be contacted.

It sounds more like they have trouble getting permission by Spanish authorities to operate there.

I quote:

“Thanks for your interest in signing up for a new NUMBER26 account!

We’re temporarily backed-up in the opening of new accounts in your country. But we’ve added you to our wait list and will send you another email as soon as we have a further update. We very much appreciate your understanding in the meantime.”

Hi Peter,

Thanks for your info regarding the current situation regarding Number 26 in Spain.

Maybe this is a good occasion for customers as well as non-customers to observe the current developments of Number 26. We ourselves regrettably don’t have any new information regarding this subject.

It looks like the Sepblanc, a Spanish government commission in charge of supervising financial companies has cut the company down in its tracks by instituting a new ruling going into effect March for fintech companies that use videoconferencing as method of identification of customers. They set out all kinds of rigorous requirements.

Unfortunate.

Hello,

I am moving to Germany in June 2016 and in a Need of a bank account – I have a few questions regarding Number26 account:

1. Is there an online Banking System that is accessible from a Computer or do you have to use the Smartphone app for all bank transfers?

2. Can you have more than 1 Card issued for the same account (e.g. for my wife)?

3. Is there english speaking staff at customer Service?

4. What is the processing time of a bank Transfer to other bank account (not within Number26) in days?

Thank you in advance for your help!

Hi Karol,

We do not recommend an account opening with this bank anymore – background information regarding this can be found on the German language part of our website.

Hello,

Thank you very much for your prompt response.

Kind regards,

Karol

Hello. I recently recrived my card (in Germany), but I have one question. Is it totally free of charge? Because once I ordered a ViaBuy Prepaid Card, and I was told that there was no anual fees, and after I received it I was informed that requires a payment of 90€ to start using.

Another question, how I make to charge it? there is some way beside Bank transfer? Is it possible to charge it with a credit card?

Dear Gregor,

I’m Nodirbek, student, studying in Tashkent, Uzbekistan. Fortunately, this summer I’m going to Germany to participate summer school. It’s great chance me to get more academic and social skills 🙂 But I have problems with my Visa electronic credit card because of withdrawing money. More exactly I can only get cash from cash machine 300 $ per month! But still I can use it for any payments, problem is only limeted cash!

I do want to open Nubmer26 account and get master card, then immediately transfer all my money from my Visa card to my new Number26 master card. Then my travel will be really amazing!!!

Is it possible?

Thanks at advance!

Sincerely Nodirbek!

Hello,

I live in Austria and hold a LogitimationKarte but N26

does not recognize that as an Identity document.

They also did not accept my passport cause I am from India.

The guy on Video Call verification said

” we don’t accept passports from India, Pakistan & Australia as they are far away and cannot be verified”

What a joke….

Anyways no more smartbanking….

Maybe this is a option for you: https://www.deutscheskonto.org/en/viabuy/ – this MasterCard and account is not for free. But the service and the legimation is much better. This is no a start-up, it’s an established company with an annual profit. So you can rely on it that it works well in the long term … and you can apply from Austria!

I have heard that N26 has or had some security problems and that the conditions got worse. Is that true?

Yes, we have also heard of the security issues. These are probably fixed.

However, the condition worsened several times in the past 12 months. No so great for us bank customers. We have taken this provider off our recommendation list. Here you can find our Top3-current accounts in Germany: https://www.deutscheskonto.org/en/best-current-account-germany/

Good Morning,

somebody can help me to understand how can I do the download of the incomes (not of the outgoing transfer) ?

Thanks

Antonio

Is it possible to transfer the money from the N26 card to a ReiseBank card?

As far as I know, a bank transfer from card to card is not possible – but from one account to another account should be possible. There is an IBAN to the ReiseBank card, or not?

Do N26 send my statement to my address every month?

No, it’s a modern online bank. The only thing that is sent physically, is the banking card – until they have another solution for that as well 😉

Account movements can be viewed within the app or the online banking.

N26

A friend of mine has the N26 card and received a bank wire transfer from the UK in pounds sterling, and his account rejected the acceptance of the funds because his account with N26 is in Euros.

Doesn´t the N26 bank automatically convert the incoming bank wire transfer currency into the receiver´s Euro account?

Any replies would be welcome

Oops, I have not heard that yet either, but in fact there are a few, very few, banks that do that kind of impractical thing.

A solution and at the same time my recommendation for transfers with currency exchange is ► TransferWise.

Can I open a card with a Greek address in Greece?

Yes.

Could you advise me on how to accept a transfer in USD to my account at N26?

With pleasure: I would transfer the US-Dollars to the N26 account using TransferWise. That is fast, safe and cheap.

Hello gregor,

As you may know, in n26 we can have (sub)accounts, i want to know if we can have separate master card for each one of them.

Hello. Do you get your own account number after the account opening as with every bank? Or it is just a “general account number” and you need a personal code for each payment, which must be entered in the purpose field, so that the money enters an account of a specific recipient.

Everyone gets an own account number. It is a DE-IBAN.

Hello,

I have questions regardind the credit card of N26. Is not it like the credit card with credit limit? As I have a bank account in Deutsche bank, but i want to take a credit card with credit limit from N26 because N26 is fully online and easy to excess anywhere.Is the credit card like “Gebührenfrei MasterCard Gold” of the Advanzia Bank or not?

Hi I want to open an account, but before that I want to ask, if I get a transfer money of about 2000 British pounds to Germany, how much can I take daily and how much is the tax??

Welcome to Germany! There is no transfer limit or transfer tax here.