How to withdraw € 25,000 being a DKB-customer

You won’t find the following in the price and service listing of the bank, but it works. Oliver, participant of our Achiever Training, has tested it some days ago and the photos were also taken by him.

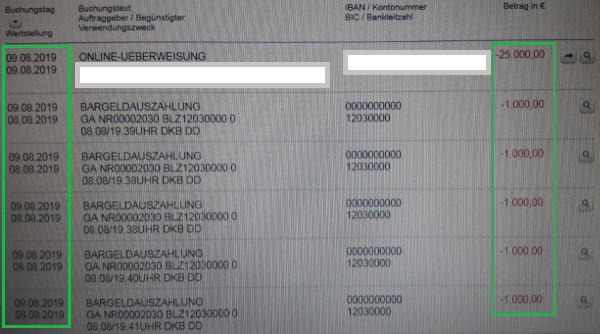

You can see on the bank statement how it works!

How does it work?

Very simple: You call the DKB-customer service in the timeframe from Monday to Friday between 8 am and 6 pm (the customer service is available around the clock, however the increase of the withdrawal limit is bound to a certain daily time ).

You can activate your Girocard for a maximum of Euros 5,000 cash withdrawals. As the timeframe for withdrawals is 5 days, you can withdraw a maximum of Euros 25,000 through the ATM.

Withdraw with the Girocard as an exception

Important to know: The amount to be enabled has to be in the current account at the time of the telephone call!

If you have e.g. Euros 20,000 in the account, then you can enable the card for Euros 20,000.

After the telephone call, you can go to the next ATM and start with the cash withdrawals. As only the fewest ATM pay Euros 5,000 at one fell swoop, it is possible to withdraw several times.

(You are welcome to tell which ATMs pay Euros 5,000 at one fell swoop using the comments feature – probably they are in some branch offices of the Deutsche Bank or Commerzbank.)

Step-by-step instructions

-

Withdrawal amount has to be in the DKB-current account

If this is not the case yet, then transfer the desired amount to the DKB-current account. As soon as the money is available in the current account (as above in the photo), you can continue with Step 2. -

Enable through telephone call

You call +49.30.12030000 and ask for the enabling of the withdrawal of the desired amount using the Girocard. No reason has to be stated! -

Withdraw cash little by little from the ATM

The enabling is active after the call and you can immediately start with the withdrawals.

At withdrawals of up to Euros 5,000 you are done in one day. If you want to withdraw Euros 25,000, you call on Sunday or Monday and withdraw Euros 5,000 on every day of the week.

Done!

As the ATM normally cannot payout bills of 500, the daily rate can look like this.

Are there any fees to pay?

On the part of the DKB – just like we, smart bank customers, are used to for most services from this bank – no fees are charged.

The complete procedure is free of charge, if …

… you use the ATMs of the DKB, just like Oliver did.

If you have no DKB-ATM in your surroundings, you just withdraw using a third party ATM. The fees are shown to you directly on the screen before the withdrawal.

Cheap banks charge Euros 1.90 per withdrawal. This is a fair amount, isn’t it? This fee remains with the paying ATM and does not flow back to the DKB!

Can you withdraw even more money?

Yes!

Standard-card for fee-free cash withdrawals

Being a DKB-customer, you have a Visa Card as a standard. Hereby, the daily limit is at Euros 1,000. You cannot increase it. However, you can apply for another Visa Card and would have therefore 2 × Euros 1,000 per day.

If you extrapolate this to our 5-days-period, then you can add another Euros 10,000 (2 × Euros 1,000 × 5 days) through the Girocard additionally to the withdrawal of the Euros 25,000.

Therefore you can being a DKB-customer:

withdraw Euros 35,000 per week!

If you combine this with a free secondary account, then you are at Euros 70,000 per week! Do you want to extrapolate this to one month?

Do you want to try it?

If this article has been the solution for you on how to withdraw big amounts of cash from a direct bank account, and you can implement this, I would be very glad to read your feedback through the comments feature.

A heartly thanks!

Open the DKB-account?

I just hope you do not only want to open it, because of the great possibilities of cash withdrawing … the DKB has so much more to offer, as our frequent readers know (and report of).

Nevertheless some short information about it: The minimum age for the account opening is 18 years. There is a minors accounts. Moreover, you can open a joint account.

Account, cards, withdrawing cash and most other services are free of charge. In change, the bank expects of the customer to have a good creditworthiness and a regular income.

The bank is flexible regarding the place of residence, if the creditworthiness and income are accordingly well. Account openings from Germany, Austria and Switzerland are the easiest. Due to the fact that the legitimating can take place through VideoIdent, the DKB is also adecuate for German expats.

Further information about the DKB-account ► www.dkb.de/privatkunden/dkb_cash ✅

Leave a Reply