Euro Pacific Bank ► Offshore Account

The Euro Pacific Bank is an offshore bank. Offshore accounts are not for everyone. Especially because they are expensive.

Offshore banks live off high fees. They even have to, as they usually do not grant loans. Banks earn best from loans and subsidize about other products, such as free current accounts.

Account can be opened online: https://europacbank.com/#start

Why do people open offshore accounts?

The motives are varied, but can be summarized in 4 main groups:

1. Safety

Do you remember the dramatic images of England (2007), Cyprus (2013) and Greece (2015)? One saw people between fear and hope waiting in gigantic long queues at the banks for hours.

Surely everyone knew that the money would not be sufficient for everybody. With speculation and irresponsible loans, institutions formerly considered as safe run into difficulties and have triggered a bank run.

Amended with 100 % instead of 3.96 % equity!

This cannot happen to an offshore bank, like the Euro Pacific Bank, because:

-

it does not grant loans and does not perform speculations. Their equity ratio is 100 %.

Our Deutsche Bank reached in fiscal year 2014 up to 3.96% after 1.39% in the crisis year 2008. This means that more than 95% of the bank’s balance is externally financed.

This would be impossible at a company outside the banking sector, as bankers regard this as too risky – apparently not regarding themselves. Isn´t that again an obvious case of overconfidence? By the way, more than 90% of car drivers regard themselves as above-average drivers. Purely mathematically, this cannot be, but reveals the difference between internal and external image.

- Even if there is an extreme withdrawal of capital (bank run), the bank does not break down, because all assets of the customer are still fully there.

2. Privacy Policy

In Europe, the USA and the many other developed and emerging countries, the banking secrecy has been abolished or softened to an extend that it is no longer worth the term.

True offshore account = banking secrecy

For generations, the banking secrecy was a firm pillar of confidence. One was able to carry one´s money to the bank, because one was sure that no one knew anything about it. Even if it was known that one was a customer of a determined bank, there was no way to find out the account balance (without a court order due to serious offenses).

This is different today. It started out with the increasing national debt. Some citizens lost their trust in the government and the government even more in its citizens, whether they pay their taxes in the legally required amount?

The consequence was that laws were enacted, which made bank accounts for tax purposes partially transparent.

In Germany, banks transfer the tax of domestic taxpayers directly to the tax authority. The customer receives a certificate, which he/she attaches to the annual tax return.

If one is taxable somewhere in the EU, then the banks of the EU and its associated states report the investment income of the accounts fully automatically once a year to the home state. This should serve the tax honesty: As the citizens know that the tax office already knows about the foreign income, it is indeed better to fully specify this in the Annexe KAP. (Keyword: EU Savings Directive)

Also the legislation of the USA (FACTA) stipulates that foreign banks should report information on the accounts of US citizens to the tax authority IRS annually.

As in Germany, only the capital gains and not the balance is taxed, only the capital gains have been reported, but not the balance. This remained secret at a domestic as well as foreign account.

Data protection for bank customers is removed piece by piece

However, these times have come to an end. From 2017, many banks as never before in the history report the most extensive bank customer information to the home countries. Including their balances! That did not exist even in the much-criticized automatic access to accounts (German: Kontoabrufverfahren).

Search keyword is: OECD agreement for the exchange of bank customer information. More than 50 countries have acceded to this agreement.

It is needless to say that the classic offshore countries do not join such an agreement, as they would thus destroy their financial industry. This often contributes significantly to the prosperity of these small and most often island states.

The privacy at offshore banks is also given towards the home countries of their clientele. This privacy is one of the highest goods in offshore banking and often reason for opening an account at an offshore bank.

How you can still have a clean tax-record, you will learn later in this article!

3. Account for offshore companies

You cannot only open bank accounts abroad, but also found companies. If one does this on any of these islands, we speak of offshore companies.

In some remote countries, one can register more or less easily companies for foreigners. Thanks to various founding agencies, no personal appearance is usually required.

In order to obtain the desired types of freedom (tax, accounting), the company in the corresponding country may usually not develop any economic activity.

Offshore companies are founded – just like offshore accounts – out of different motivations. Often mentioned reasons are:

- International trading transactions

- Online business

- Licenses

- Risk hedging

- Ships

- Assets management

If one wants e.g. to open a current account or securities account in Germany for an offshore company, one will face great difficulties to find a suitable bank.

For some people it simply does not matter, because they have founded the offshore company to operate outside Germany.

Therefore, one needs an account at an offshore bank for the offshore company.

4. Emergency account

There are people living with fear. Whether this is justified or not should not be the issue of this article.

Obviously, the abstract threat situation through partly uncontrolled „criminal hordes“ that penetrated the Schengen has increased the willingness to emigrate from Germany and Austria.

This is especially true for the layer of service providers (which are also welcome in other countries) and of course for people, who can afford it, e.g. retirees, who have worked all their lives and now want to enjoy their well-deserved retirement in safety.

Parked their assets abroad out of precaution!

There are efforts to deposit some of the assets discretely abroad in order to access it in an emergency. An internationally functioning MasterCard of an offshore account facilitates this.

Such prudent plannings are even recommendable, because if someone has privately taken precautions for bad times, then he/she will not have to bother other people.

Following German phrases did not originate by accident, “Take the time, then you will have in time of need”, or, “do not put all your eggs in one basket“. Prudence and planning ahead have always been strengths of our community … and this may also be an emergency account.

Part II: Euro Pacific and Peter Schiff

Before we take a look at the Euro Pacific Bank and its services, let us first examine the environment in order to know where we are getting into.

The US star-economist Peter Schiff

Peter David Schiff, born in 1963, is a well-known economist in the USA.

Due to this fact, he became an economic-policy advisor of the presidential candidate Ron Paul in 2008. He has been proposed for the elections to the US Senate in 2010.

His book, “How an Economy Grows and Why It Crashes”, has come to quite some popularity and was rated by International readers at Amazon.com with an average of 4.5 out of 5 stars. Internationally, it was awarded with the Corine Literature Prize.

Book of the bank-founder Peter D. Schiff at amazon.de – want to take a free peak?

Euro Pacific Capital Inc.

Euro Pacific Capital is the stock market and investment company of Peter Schiff. Its seat is based in Connecticut, USA. Also in Canada, there is a Euro-Pacific company. It advises wealthy clients, mediate stocks, funds and precious metals.

However, one cannot open a bank account at them, because they are no banks. The only real bank at Euro Pacific is the Euro Pacific Bank, based in Kingstown, the capital of the Caribbean island state “St. Vincent and the Grenadines“.

Part III: Euro Pacific Bank Limited

The offerings of offshore banks are partially similar to the usual banking services and partially, they differ greatly. On this general overview page, some important points are particularly highlighted. Others will be dealt with on future detail pages. Please see the penultimate paragraph of this page.

Offshore bank account

The offshore bank account is not comparable with the kind of current account to which probably most of us are used to. The reason for this is that every ingoing and outgoing payment through correspondent banks must run in the SWIFT system, and that is unusually expensive.

In our transfer test in the banking system Germany–USA, the cost of the outgoing transfer was between Euros 7.90 to 14.90, the correspondent bank took another US-Dollars 10 to 20 and the US-bank charged for the incoming international bank transfer also between US-Dollar 20 to 25.

Such fee structures are not suitable for daily payments. Although providers, such as TransferWise make international transfers cheaper, it is unlikely that smaller Caribbean states will soon be connected to such providers.

International transfers are expensive!

According to the current fee listings (2015) of the Euro Pacific Bank, incoming transfers cost Euros 12 / US-Dollar 16 up to Euros 12,500 and outgoing transfers Euros 22 / US-Dollars 30.

For internal bank transfers Euros 5 / US-Dollars 5 are charged.

The monthly account management fee is Euros 3.75 / US-Dollars 5. The MasterCard and its usage are not included.

Due to the fee structure, you can see that an offshore account is more suited for parking money, but not for everyday bank transactions.

This also applies to the MasterCard, since its use is much more expensive than of the in abundance offered free credit cards in Germany. It is nothing more than an emergency card or a credit card for the wealthiest customers, who are willing to bear the cost for an offshore payment.

Bank accounts can be managed in the currencies EUR, USD, CHF, CAD, GBP, AUD, JPY and NZD.

The minimum deposit is US-Dollar 500.

Securities Account

At this point, we will not deal with the offerings in the areas “Brokerage”, stocks, stock options, futures, bonds, Forex (currency trading) and CFDs.

Except: minimum investment US-Dollars 2,500 in order to start.

Moreover, there is the area of investment funds (mutual funds), also with a minimum investment of US-Dollars 2,500.

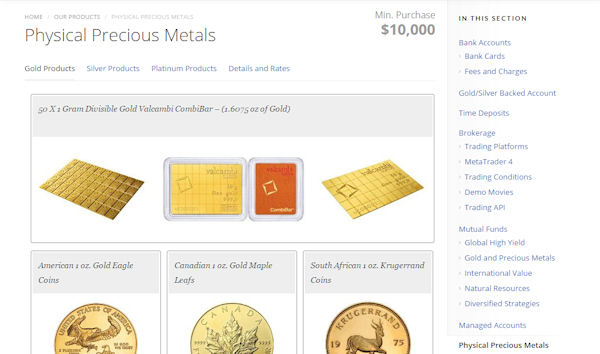

Precious Metals

The area of precious metals is also worth to be dealt with in a separate article. You can purchase physical bullion coins and investment bars of gold, silver, platinum and palladium through your offshore account.

Physically means real: no certificate, no funds, no swap, but a coin or a bar to touch. However, it is unlikely that you touch it personally, because these precious metals will be registered on your name and stored safely.

Buy precious metals and let them be stored safely …

… of course, not on the Caribbean island, but in the safe of Perth Mint. This is the Australian mint for bullion coins, known and appreciated worldwide for their Lunar and Kookaburra series.

The minimum investment amount is US-Dollar 10,000.

Extensive selection of international standard bullion coins and bars

Interesting features

There is the possibility to get issued a debit card that is covered with gold or silver.

Virtually, you set up an emergency account and fill it with gold and silver (long-term inflation protected, which is only diminished by the fees). If the emergency should occur, you can pay the (escape) journey with the credit card or withdraw cash at the ATM. Gold or silver will be sold in the same amount at your offshore bank. If you do not do that, then you are still the owner of the precious metals.

Gold-covered MasterCard!

This could be interesting for some people, who are looking at the stability of our paper currencies rather with sorrow.

Here, the minimum investment is also US-Dollars 500.

Isn´t this a great location for an offshore account? Kingstown, the island´s capital of St. Vincent.

Part IV: Account opening at the Euro Pacific Bank

One can set up private accounts and business accounts. The registration process is practically the same. With a business account (corporate account), additional information of the company will be queried.

At the registration, one can even select German (and other) as the language of the form. Many, but not all fields are translated into German, so that one can fill it out quite well.

Additionally, the planned future use of the account is queried with a PDF questionnaire. This is important so that the bank can offer the corresponding service to the customer.

Also an offshore bank must know the customer who it is dealing with. This is the reason why the following documents must be submitted for the opening:

- Certified copy of the ID-card or passport

- Certified copy of an expenditure account (e.g. electricity bill), a bank statement or a registration certificate (this is for checking the address, because it is typically not included in passports, neither on many national ID-cards; the German ID-card contains the address, if you are registered in Germany; therefore, the certified copy of it or in addition to the passport could be sufficient).

- Bank reference or statement of the same bank, from which you transfer the money to the offshore account

- Signed account contract (contract)

“I will take a look at this bank”

Account opening possible within 24 hours!

An initial deposit must be made in order to confirm it within 30 days (at least US-Dollar/Euros 500).

Important note for US citizens

US citizens cannot become customers of the Euro Pacific Bank Limited, Kingstown. This is a corporate policy decision, which is certainly due to the partially rigid “tracking” of American citizens by the US tax authorities.

Unlike Germany, the income tax liability in the US is linked to the citizenship. Every US-American citizen must pay tax on his/her worldwide earned income in the USA. However, there is a second country that has this particular tax law: Eritrea. But in contrast to Eritrea, the USA has the power to enforce their tax laws internationally.

The USA also does it. Who applies for the account opening of a simple current account in Germany, is always queried and must sign, whether he/she is a US citizen is or taxable in the USA. Some years ago, it was unthinkable that this peculiarity of the US tax authority could be integrated in the account opening applications of banks from other countries.

In order to rule out problems with the USA, US citizens cannot open an account at the Euro Pacific Bank Ltd.

Part V: How to remain fiscally “clean” …

- Income on offshore accounts must be reported to the tax authority in the following year on the annexe KAP of the income tax return.

- Then, the account will no longer be secret; however, the German government cannot access the account.

- To avoid this, you can avoid tax-relevant incomes by maintaining an interest-free offshore account (no interest, thus no report is required)

- Or invest in physical precious metals and only sell it after a holding period of one year (tax-free law).

-

Who conceals income on the offshore account commits tax evasion (criminal offense, paragraph 370 of the tax code (German “Abgabenordnung”). Although this will not be (soon) discovered, you never know life´s circumstances.

Thousands of tax evasion cases have been leaked to the tax office through broken marriages, affairs, and quarrelled business partners and due to the ten-year limitation period, the long arm of the tax law can still catch you afterwards.

When it comes to inheritance, a “black money account” is a bad choice, because the heirs face the challenge of self-denunciation, which they do not have to take the responsibility – if anyone knows of the account; otherwise the former golden offshore account will become a dormant account.

With the increasing national debt, the pursuing pressure on tax-evaders and the dealing with them will become rather harsh. This was shown vividly in the past years.

Plea

Remain “clean”: through non-tax-relevant income or declaration at the tax authority.

Important note

This editorial page cannot substitute an individual tax advisor and legal advice. Please use them as the first source of information! Through our internal area (see below), you can obtain contact to specialized tax consultants and lawyers speaking German and English.

All statements correspond solely to persons taxable in Germany. If you are taxable in another country, please query the local tax law for information.

The tax honesty is important to us. We feel committed to holistic-social tasks. You can do anything that is legally and morally acceptable. You should not get involved with other things. Please also read our tax explanation (Steuer-Erklärung).

Warning: common sense is important!

Not everything that is called “offshore” is serious. As in any sector, there are also grey and black sheep in the offshore business: there are people, who want to take your money, intermediaries that ask for up-front fees, or “banks” that simply are no banks (but would love to take your money).

Someone, who has fallen into the trap of fraudsters in the offshore sector, rarely turns to the police and the border- or even cross-continent-border crime clearance rate is not particularly good. Similarly, there is no state-funded consumer advice for international bank accounts that enjoys a good reputation, at least in Germany.

Not everything that you read in your research on the internet is true. There are people who believe that when something is on the Internet, then it must be true … please always take a look at the imprint of web pages. On web pages that deal with offshore services, you will not always find an imprint.

However, the statements do not have to be intentionally wrong. Perhaps, they are just out-dated. That happens. Please always check the terms and statements directly at the bank.

Nevertheless, do not let this warning stop you from realizing your dream of an offshore account, but be aware at your preparations. Agreed?

Part VI: Summary

The decision, whether you are eligible for an offshore bank account at all or not and if so, at the Euro Pacific Bank, you must take completely by yourself.

However, you can use the following pros and cons to help you take the decision:

|

|

“I will take a look at this bank”

Is it your dream to own an offshore account?

In the internal area of this special web portal, we will continue to report about the Euro Pacific Bank to our regular readers. The free registration is possible here: Registration for the internal area (Anmeldung für den internen Bereich (Auslandskonten)).

If you are concerned, because of the correctness in tax matters, please read our tax explanation (Steuer-Erklärung).

Seat of the Euro Pacific Bank in Kingstown

Seat of the Euro Pacific Bank Limited in Kingstown, the island’s capital. Customer visits are welcome. However, please note that no cash deposits – cash suitcases 😉 – can be accepted. The offshore bank account can be “fed” through bank transfers. Payments are also possible through bank transfers or by MasterCard withdrawals.

Pictures: Amazon, Google Maps, EPB

Leave a Reply