The future of bank branch offices and how we smart bank customers position ourselves!

Is this even a subject for us smart bank customers?

Yes, because our ideas and thoughts are followed by more and more people. We can see this through our increasing number of subscriptions of our Sunday mail and you can see this through the call numbers of the channel for smart bank customers.

Perhaps some become smart bank customers due to emergency situations, because they did not fall into lethargy, because of

- huge fee increases of current accounts in the past time

- or due to the vast number of branch office closures

but started to look for further solutions and somehow got to us.

A heartly welcome at the smart bank customers!

About the facts

During the research of the subject “Big branch office dying in Germany”, I realized quickly that every newspaper shows different numbers. Often, they are from interview partners or from studies that deal with the future development.

To verify these numbers, it would be meaningful to take a look at the professional position of the informant and the contracting body or find out the financing enterprise of the study. Frankly, this was too much work for me – as I prefer to investigate other bank customer subjects for you that should help us with our accounts. 🙂

Therefore, I have contacted the Deutsche Bundesbank (federal German bank). This is a good idea, because all banks in Germany have an account at the federal bank and moreover, are bound to report important operating figures to the federal bank.

Thanks to the federal bank, we got a terrific overview of the past. The current figures are related to the year 2015:

- There were 1,960 banks in Germany

, 30 less than the year before. The number 30 was created by 25 newcomers and 55 leaving. Among the leaving, there were 26 Volksbanks and 3 savings banks that have pooled themselves. - There were 34,045 branch offices in Germany

, so 1,257 less than the year before. With 498 branch office closures, the savings bank cut back. One can generally say that 1/3 of all branch offices belong to the savings bank, 1/3 to the Volksbank and the remaining 1/3 allocates to all other banks.

How will it go on?

We can assume that the cut back of branch offices will accelerate in the years 2016 and 2017. I use the feature “Google Now”, where the appropriate news are shown for the created profile and this year, there was almost no week in which no article was published that reported on branch office closures and the resentment of the aggrieved customers.

Do we really have to be sad, because of branch office closures?

More than half of German people (51 %, source: federal statistical office for the year 2015) use online banking. At the top, there is Norway with 90 per cent and at the bottom, there is Romania with 5 per cent online customers.

For our readers from the German-speaking abroad: Austria also has 51 per cent. There is no data about Switzerland at the federal statistical office.

What about the quality of the branch offices?

At bank branch offices, I am not surprised that it is only 51 per cent! The mayority of branch offices and bankers is perfect to perform deposits and payments.

However, this is also possible through a deposit and payment machine – and this independently from opening hours all around the clock. Also on weekends. Moreover, such a machine is much cheaper in “maintenance”. It has no need to go on vacations and is only hardly sick or has a defect.

What this machine could also do, but does not yet in Germany, is selling additional products. The bank staff is namely driven to do this in most branch offices. Often with helping – privily skillfully learned “door openers”, which are meant to start sales conversations with the customer.

For example, selling building loan agreements to people, who do not even want to build a house. However, with high building loan amounts, because the contract provision is calculated from this amount!

Current and former bank staff told me und ehemalige Ban of selling numbers, which have to be reached weekly or monthly. If they are not reached continuously, then there will be trouble!

I personally am customer of only one retail bank – and it was really difficult to find a reasonable one, because since I am reporting here on the Internet about bank customer subjects:

- 1 retail bank has cancelled my account

- 1 retail bank has refused to open the account with the note that I am a competitor

- 1 retail bank has reproached me and other banks to be mean.

For people, who sometimes cannot sleep at night, here is a scene from the program “Domian”, that is streamed on WDR at night – A former banker, who cannot look into the mirror anymore and reveals the truth:

We do not need such bad bankers and banks!

Of course, we agree that not all bankers are like that. In the end, most of them are really friendly, when we meet them. Behind the scenes, there is sometimes a big difference, which I was able to learn by myself too. I guess that this is the case in all professional industries.

How does the alternative look like?

For me, it is obvious: building a basic knowledge of money and finances for everyone.

Only the responsible bank customer realizes, whether he/she gets good services, is well counselled and is financially on a good path.

One can compare this with a car repair shop. Someone, who knows about cars and its parts can hardly be scammed. Viceversa – I can see this regularly in my mothers case – the repair shop makes a small fortune … salesmen quickly realize, who they can scam and who not.

Best is to counsel yourself. For example, with according technical literature or like-minded persons, who also want to upgrade themselves financially. Particularly commited readers know our Facebook-MasterMind-Group. More on that subject will be published through our Sunday mail in the coming year.

My favourite book as an introduction!

Click on the cover and you will be forwarded to Amazon

Also for me completely clear: at least one outstanding current account at a direct bank.

It does not matter, whether you like visiting the branch office or not, the conditions of local banks are no competition for the best German direct banks since long. This difference is gaining ground.

The difference of conditions is gaining ground!

This will be continued that through the creditworthiness check of the direct banks (DKB, Comdirect and ING-DiBa) the more thrilling customers from the perspective of the bank are gathered there.

Especially, if the securities depot is also switched after the current account.

There is generally no securities counselling at direct banks, however, one can waive on this easily, if one has learned something in the area of finances and keeps oneself up to date. A good video channel is offered by Kolja Barghoorn: Aktien mit Kopf (intelligent securities investment).

Banks like to sell investment products with high costs

Perhaps they will have less retail-products, such as the certificates filled with hidden or less-obvious fees, but have more first-class shares in the depot. At an investment event of my retail bank, only three different certificates were presented with great effort to the audience. By this, banks earn a lot of money.

At pure shares only through the purchase and sales provision. Of course, this is unadventageous for the bank, if you are not a trader, but hold shares for building asset during tens of years.

In order to balance this loss of income, there is often a annual depot fee at retail banks – this does not apply to direct banks.

If you read our site since some time, then you may know the article Passive income through capital income.

The DAB Bank, which I recommended for the implementation back then, merged with the Consorsbank in the meantime.

Direct securities savings plans without fonds-constructions can be implemented through these depots:

- Comdirect Depot (my recommendation No. 1)

- Consorsbank

- ING-DiBa

- Maxblue

Here an older article by me: pure securities savings have obvious cost advantages compared to fonds and ETFs. Please feel free to write me through the comments feature, if you think that it is time to dedicate time to write a new article about this subject.

How does the future of bank branch offices look like?

For me, there is no personal branch office. If I really need one, then I use one that I like for this purpose and I am poised for paying the foreign fee.

For example, years ago I have made a huge cash deposit through a local branch office and I have paid the fee of Euros 5 gladly for the deposit and the transfer to my direct bank account.

Who is customer of the ING-DiBa can deposit big cash amounts free of charge through the Reisebank. Up to Euros 25,000 per deposit, as reported in this article: Deposit cash from Euros 1,000 free of charge.

I think that there will be more adventure-branch offices, as e.g. by the Deutsche Bank in the Friedrichstraße 181, Berlin. There, you can meet with friends and have a coffee or read a book. This year, I had a great cup of tea there.

In the branch office, you can make more than just bank transactions: Deutsche Bank branch office in the Friedrichstraße 181, Berlin. Photo: Deutsche Bank.

Furthermore, branch office on unthrifty sites are closed . In the best of cases, there will be machines, so that customers can make cash withdrawals as used to. Partially also at self-service terminals, where one can make transfers and other online banking transactions. So, for people, who do not use online banking.

Moreover, I can imagine that banks will be opened in malls. I think that this would be very practical, also for the cost structuring, the employee satisfaction and the customer visits.

There are many people, who become customers of a bank, only because it is on the daily route!

On the countryside, mobile bank-trucks could replace the branch offices, just like the one that I have experienced by the savings bank Neu-Ulm / Illertissen. Such a bank-truck disposes of a counselling office, a counter, a bank statement printer and an ATM.

Every day, this truck stops in 2-3 towns. Such a truck is expensive – however, according to the comment of the savings bank, it is cheaper than the business with immobile branch offices.

The bankers that work here dispose of a truck-drivers license! Photo taken in a small town without permanent bank branch office in the county Neu-Ulm

Apart from some renovation tasks, most branch offices will continue to exist in the coming 5 years just like today. But they will be less in number! Direct banks will definitely grow in number.

What do you think of the development of bank branch offices in Germany?

Please join this discussion through the comments feature at the end of this page, thank you!

Achilles’ heel: free cash withdrawals

Cash plays a huge role for us German people for the daily payment transactions. Some pay almost everything with the card and maybe have cash transactions in the amount of only Euros 20 per month – other people pay almost everything with cash.

Statistics show that 62 % of German people prefer the cash payment:

Therefore, the fee-free withdrawing of cash is a particularly important condition point when choosing the current account.

This is normal for a retail bank at the own ATM. Often as a federal cooperation with partner banks. At direct banks, there is a big scope from “more or less ok” to pratically everywhere – even around the globe“.

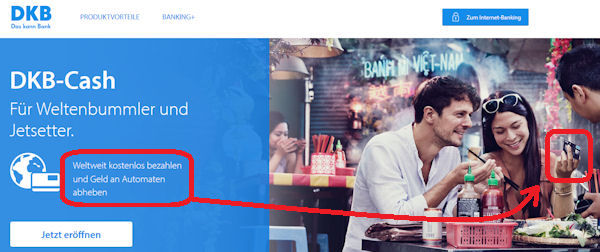

DKB: Paying cashless free of charge around the globe (= no foreign transaction fee at foreign currencies) and withdrawing money at the ATM (= no charge of the withdrawal fee from the side of the DKB). Further information: www.dkb.de

The number of about 55,000 ATMs in Germany is pretty continuous. Some local banks have indeed closed a few, but private providers, such as Cardpoint, Euronet and ICCash, have placed new ones. Depending on the card, one has to be a little cautious at the new providers. Perhaps we will publish a separate article on this subject.

There are sufficient possibilities to get cash. It depends on the fees. With the DKB DKB Visa Card and also at the competitor ING-DiBa, the withdrawal costs are borne by the bank – indepedently from the ATM that you use as a customer.

We smart bank customers know a huge number of ways to get cash free of charge 🙂

As there were a few reprisals from some savings banks and Volksbank towards the owners of direct bank credit cards, they have made further cooperations. Therefore, one can now withdraw cash free of charge:

- at 1,300 Shell-petrol stations (DKB und ING-DiBa)

- at thousands of supermarkets using the Girocard and having a minimum purchase of Euros 20

- in further shops through the generation of a withdrawal slip (DKB)

In the future, we can expect an improvement of cooperations.

The customers of the best direct banks will always find possibilities to get cash easily and free of charge. Anyway, as long as there won’t be a complete cash prohibition. 😉

Preview

Next Sunday, I will show you 5 points that I personally find outstanding at my favourite bank. Are you looking forward to it? Through our Sunday mail, you will be informed automatically.

Further articles on this subject:

- Withdraw cash with the Girocard? [The traps]

- Credit cards without foreign transaction fee

- The new conditions of the DKB in an overview

Leave a Reply