Overdraft facility (interest and line) in comparison ✅

Experience tells us that people who are considerably in the overdraft, only care little about the interest rate. Perhaps this is one of the reasons, why they use it regularly?

We smart bank customers value the possibility of overdrawing the account to avoid things like return debit notes and the negative consequences of them. Although we should use the overdraft carefully and get the best conditions for any case!

A little market overview + recommendation

Sparkasse Biggest bank in my city. |

DKB Current account of most of our readers. |

ING-DiBa Outstanding supplement for you? |

|

| Loan interest within the overdraft facility line | 11.14 % | 6.90 % | 5.99 % |

| When overdrawing beyond the overdraft facility | 15.64 % | 6.90 % | not possible |

| Amount of the overdraft facility and requirements | |||

| Maximum possible overdraft facility line | 3-times the salary transfer, individual | 3-times the salary transfer, up to € 15,000 | € 2,500 to 25,000 |

| Requirements | current account with incoming salary transfer | salary slip | |

| Account opening and overdraft facility setup | |||

| Time until overdraft facility is set up | 2 months | 5 days | |

| ►►► Start ►►► | Visit the branch office | ► online application | ► online application |

Video message of the author for you

The most beautiful thing!

No matter where you have your actual current account, you can …

apply for an additional overdraft facility immediately, without opening another current account

… and therefore you get double the credit line – or more (!) – at your disposal. And most likely also at a better interest rate.

How the interest rates affect the overdraft facility usage, we will see in a second.

Upfront a summary of the features at the ING-DiBa as a second overdraft facility:

- favorable interest rate of only 5.99 per cent

- credit line between Euros 2,500 and 25,000 possible for application

- discrete and independent from your main bank!

- no current account switch necessary (everything stays as it was)

- no salary transfer necessary

- you only have to proof the income (salary slip, pension certificate)

Simple online application:

Costs at the full utilization of the overdraft facility per month

In the table, a salary of Euros 3,333 and therefore an agreed overdraft facility line of Euros 10,000 is stated. The amount in the left column is calculated as a loan for the full 30 days.

Sparkasse |

DKB |

ING-DiBa |

|

| € 1,000 | € 8.84 | € 5.58 | € 4.68 |

| € 2,500 | € 22.10 | € 13.94 | € 12.15 |

| € 5,000 | € 44.20 | €27.88 | € 24.29 |

| € 10,000 | € 88.41 | € 55.76 | € 48.58 |

| € 15,000 | € 149.32 | € 83.64 | € 72.88 |

| € 20,000 | € 97.17 | ||

The difference between the two direct banks DKB and ING-DiBa is not so big. Both are outstanding banks.

Conspicuous is the difference to the Sparkasse, especially if the account is overdrawn beyond the agreed line. In the comparison, we have stated a toleration of 50 per cent. In practice, it is over much earlier.

With an additional overdraft facility at the ING-DiBa, one does not only double the personal credit line, it is considerably cheaper also in the first use.

Being a customer of the Sparkasse, it is meaningful to get an overdraft facility of the ING-DiBa on top!

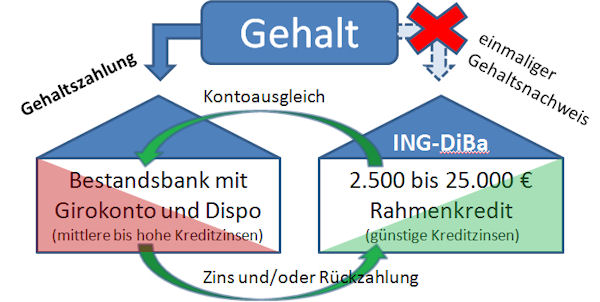

Model first and second overdraft facility

Usually, you have an overdraft facility at your main current account. This is meaningful in order to avoid e.g. return debit notes and their negative consequences. We call this overdraft facility the first overdraft facility.

Independently from the interest rate, it only costs a few Euros, if one is in the red for a few days and with only a few Euros. One does not need a second overdraft facility in this case.

A second overdraft facility is always meaningful, if you

- are regularly or permanently using the overdraft facility

- have to cushion payment overlapses

- need money fast and for a short term

- want to build a strategic credit line

- want to redeem expensive liabilities.

If one is already (since some time) in the red with the first overdraft facility, then the model could look like this:

Application of the 2nd overdraft facility

The application of this additional overdraft facility is pretty easy, because you can make it online. Based on your statements as well as a Schufa-query, a pre-evaluation takes place.

If you get green light, you can print the loan contract, sign it and send it with your current salary slip to the bank. If everything runs according to the plan, then your additional overdraft facility is at your disposal within 5 days.

Apply for what amount?

If you want to take the second (cheap) overdraft facility to redeem your current (expensive) one or you just want to enhance your flexibility, it is recommended to apply with the same amount for the new overdraft facility. You are used to this amount and can handle it. How you can apply for a second overdraft facility (credit line) in the amount of e.g. Euros 5,000, you can see here ► Set up the overdraft facility cleverly.

If you want to set up a strategic credit line, it can be meaningful to apply for the full Euros 25,000 immediately. How to do that and how I myself have got the Euros 25,000, you can see here ► credit line instruction.

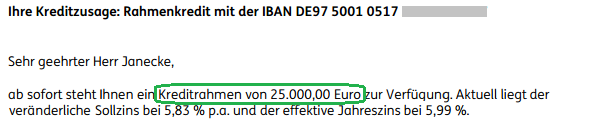

Section of the letter (PDF) with the loan approval

Experiences with the credit line (additional overdraft facility)

Loan approval within only 5 days – by Markus F.

I am glad that I can contribute a little to your program.

I have applied for the credit line on the 21st of April, I have sent the signed loan application on the 24th of April and received the loan approval on the 26th of April.

I have applied online for a five-digit credit line at the ING-Diba.

The application was very easy to be filled. The online check of the transaction of my DKB-current account did not work. Therefore, I have uploaded my last three salary slips.

The approval arrived via e-mail by encrypted pdf-attachment and online in the postbox.

► Read or submit further experiences.

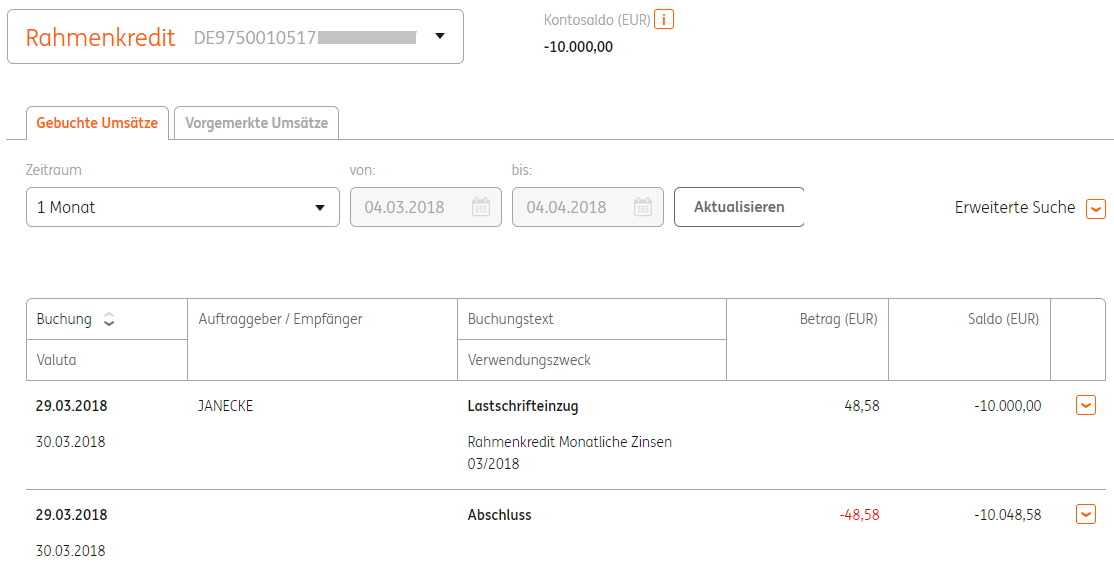

Self-test by Gregor

After I have not used the credit line of the ING-DiBa at all for a whole year, I currently make a long-term test (for a project of which you, being a Sunday-mail reader will hear soon). I am in the credit line with Euros 10,000 and my monthly billing looks like this:

Only the interest is debited from the current account. Nothing more.

A Euros 10,000 loan has only cost me Euros 48.58

That simultaneously means that you have to have at least Euros 48.58 left in your expenditure account (all income minus all expenditures) in order to get a credit line in the amount of Euros 10,000 at your second overdraft facility. Who can’t do that? An average to good creditworthiness is required!

Make yourself more independent from your “main bank” …

In any case, you make yourself more independent from your current main bank by setting up a second overdraft facility, a strategic credit line.

If one e.g. asks for a loan later on and does not get it, one can just use the already available credit line.

Do you plan a current account switch in the medium-term?

You do not necessarily have to switch with your current account to the ING-DiBa. You can freely choose a completely other bank too. But you will already have a line that helps to cushion overlapping payments during the switch.

On top, you do not have to wait for two months until you will be granted a new overdraft facility after the transfer account has been changed!

Moreover, you will be more interesting for banks as a customer with 2-3 good bank account, than having everything at just one bank!

My recommendation: If not yet implemented, set up yourself a 2nd overdraft facility today:

Questions? Supplements?

As always, I am looking forward to your commitment through the comments feature. A heartly thanks for our smart exchange, dear frequent readers. A heartly welcome to new readers!

Leave a Reply