N26: Open the account online from abroad!?

Several hundreds of thousands German citizens and other Europeans live permanently or temporarily in the USA. One does not know the exact number, as there is no resident’s registration office in the USA.

I love this transparent MasterCard!

Moreover, we Germans and other EU-citizens can stay 90 days in the USA with the Visa Waiver Program and after a short stay in Europe, we can return to the USA without a long waiting period. Therefore, there are many German citizens, who live in the USA between three (overwinter) and eleven months.

And of course, there are Europeans (and again many German citizens), who stay in the USA with a Greencard or other types of visa.

Is a German “credit card” meaningful in the USA?

More and more Germans answer this questions with Yes, in many cases!

A brief peek into the situation in the USA

In general, it is customary in the USA to possess several credit cards or debit cards. Points are often accumulated with it or one gets a discount, if one uses the credit card of the shopping chain or airline.

Currently in the USA, many credit cards switched from the pure magnetic-strip-technology to cards with chips (even I got sent a new card of my US bank).

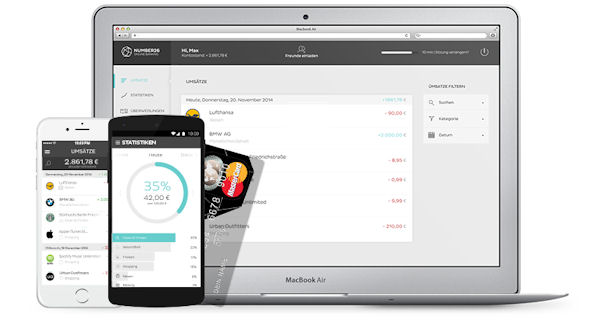

As most often, Germany is leading regarding technology and customer experience – thanks to N26 (former Number26) also in the payment area. If you do not know the free current / checking account yet with also free MasterCard and fee-free cash withdrawals in the whole world, you might want to read this principle article before continuing with the decision on account opening …

1. Why is a German bank account / credit card meaningful in the USA?

On my last research trip, I met Susanne, a tough woman from North Rhine-Westphalia. She just recently moved to the USA to build a new life there.

We talked about the system of debit cards in the USA and how to acquire – virtually earn – a true credit card in the USA.

In the United States, there is also the fear of credit card fraud up to the “theft” of the whole identity in order to plunder credit cards and bank accounts.

A German bank account as well as a German card are not an interesting target for criminals, who are keen on stealing US accounts and cards.

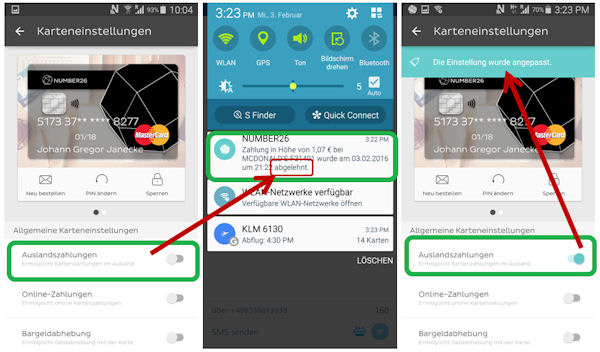

MasterCard is managed through the Smartphone app

Additionally, the MasterCard of Number26 can be blocked and un-blocked any time you want through the Smartphone app. Even partial blockings are possible:

- blocking of the ATM-use

- blocking of the use in online shops

- blocking of the use outside Germany

Whether that works everywhere safely at the partially old payment terminals in the USA will be shown through experience.

1.1 Self-test at the Atlanta Airport

In my self-test – I am writing this article on the flight back from Florida – I have blocked the MasterCard for payments abroad and went to McDonald’s at the Atlanta Airport.

When the card is used for payments, even though it is currently blocked, you immediately receive a push message. If one is the person, who wants to pay, then one can un-block the card within seconds by moving the slide control in the app … and one is able to pay with the card right away. What do you think of this security feature?

There is also a English version of banking app. For myself I prefer the German one 😉

The payment by card was not working, I apologized friendly and asked for “just a second” to move the slide control in the app to the other direction.

The payment worked immediately and the cashier was impressed by what I was doing!

Interestingly, I received a push notification immediately from Number26 that my first payment was declined and afterwards that the second payment worked. Isn’t this a great security feature?

There are people, who only activate the card when they want to go shopping, and then they deactivate it again. They also do that for the cash withdrawal. The feature is only activated in front of the ATM. Therefore, these people can sleep peacefully, without having to fear that their account will be plundered.

You as a customer of Number26 receive a push notification on the Smartphone about every denied as well as successful payment. This is very useful abroad, as one can immediately see how much the payment was in Euros!

Further security features: individually and anytime changeable limits

The function of independently changeable card limits is liked and used mainly by security-conscious people. Changes using the slide control in the app are comfortable and are applied immediately (no waiting time!).

1.2 Account in Euros

Currently, the only currency of the account is Euro, which is quite interesting for some German-Americans. Other currencies, possibly a multi-currency account, are planned. However, Number26 has not yet presented the exact details.

Further currencies are planned.

Those who want to transfer money from Number26 to the USA should use at best the cheap transfer service TransferWise, because TransferWise turns one international transfer into two domestic transfers and one can save significantly on transfer fees by this division.

Thus, in all of my self-tests, no fees for international transfers – which can be $15 to $50 depending on the bank – incurred on the US bank accounts.

For a transfer from the USA to the account at Number26, I would also use TransferWise. So far, my money always went to the other direction. 😉

I guess that I will try this sometime soon. A pure bank transfer from a non-SEPA country to the N26-account is currently not possible. However, this will change too.

1.3 From the perspective of a German citizen in the USA, there are different usage options – find some examples here:

-

Travel account in Euros

One transfers the travel budget once to the new account (one-time transfer costs on the American side) and saves all other fees, when traveling throughout Europe!

Finally, at Number26 no foreign transaction fee applies to Euros and generally to no other currency. If someone lands e.g. in London, one can enjoy the famous British tea without worries of an additional fee on the card settlement (which otherwise applies to US-cards).

No additional fees at foreign currencies

The same applies to cash withdrawals. It does not matter which ATM you use, Number26 does not charge its customers any fees.

With the Number26-Mastercard, one always has the right cash on hand at any travel destination by simply withdrawing it at a local ATM.

Unlike some other providers, there is no exchange rate trap (or financing of the free card through high fees!). All payments and withdrawals in foreign currencies are settled using the official MasterCard exchange rate. Without surcharges!

Withdraw cash free of charge

-

Bank account in Germany

The current account of Number26 is exclusively managed in Germany – in Bavaria. The corporate headquarters and app development are in Berlin. The account-holding systems of the executing partner bank (Wirecard Bank) are in Bavaria.

The balance is subject to the German deposit guarantee system, which secures account balances amounting Euros 100,000 per account holder according to the EU-specifications and refunds within 7 banking days in full, in case the bank goes bankrupt!

Euros 100,000 Deposit Guarantee

For investment, the account is (currently) less appropriate, because there is no interest. However, one at least does not have to declare any income from a foreign account. 😉

Many German expatriates or emigrants still like to have an account in Germany in order to process payments or to receive income through it.

Some even use Number26 to receive their pension payments, because they used to work in Germany and now live abroad.

-

Account for self-employed or property owners

Number26 currently does not offer business accounts, but says officially that one can receive business payments on the account as a freelancer, self-employed or property owner. That is a big difference to the popular, but purely private accounts of the DKB and Comdirect.

-

Payments within the USA

Of course you can use the MasterCard also wonderfully for card payments within the USA. It does not cost anything extra, since there is neither a foreign transaction fee nor other fees and everything is always settled using the official MC-exchange rate. This is particularly interesting for people, who receive their income from the Euro zone.

The only limitation that I noticed during my US-journeys: The ATMs at gas stations regularly ask for the ZIP Code (Postal Code) and this is where the MasterCard of Number26 often fails: at my fuel stops, this applied in half the cases.

However, at the supermarket and even at the reservation and the deposit at hotels and car rentals, Number26 has always provided a good service.

Is recognized as a credit card by cash register systems

Number26 is a top-modern current/checking account, which can be used via Smartphone and online banking. There are no branch offices!

2. How do I apply at Number26?

Unlike the cards of DKB and Comdirect, this is currently not yet completely possible from the USA.

But: This article is primarily addressed to Germans in the USA (although probably many others will be able to learn from this) and there is the possibility of applying through the German address.

Also Susanne made it like this! She is occasionally in Germany, and at last, she was officially registered in the house of her parents. At Number26, no registration information is required for German identity cards or passports, and in the basic version of the account, not even a Schufa-query (credit investigation company) is performed for further verification.

Address in Germany or in one of six other EU-countries is necessary

It is important that the MasterCard can be delivered by mail. It is the only mailing that the bank sends. And whether the card is in the mailbox for a few weeks until you pick it up in Germany, or whether one asks the family to send it to America, as in the case of Susanne, is only a question of private organization.

It is important for Number26 that the card is used, because this is currently the only way for the provider to earn money, through the fees that the payment recipient has to pay at the card payment (not you!).

And Number26 earns through card payments in the USA even many times the amount of within the European Union, because the EU has issued a law to limit credit card fees for merchants!

This means in plain language: you can only apply for Number26, if you have an address in Germany or in another EU country in which Number26 already operates (Article with country list).

If you have emigrated to the USA, it is written on your ID that you have no residential address in Germany. That might cause irritation for the legitimating staff. The legitimating – we will deal with it in short – is performed by a subcontractor called “ID Now”.

It is recommended to use the passport as your identification document, because this does not mention this note. Most often, it only states the city of residence – not the complete address – at the time of applying. The address is entered in the online application form and is only confirmed verbally during the video interview with the identification staff.

In summary: It is important that the mailing arrives in order to get the card safely and actually use it.

3. Account Opening: Step by Step

The process of account opening has slightly changed in the last months (it was optimized by Number26). Our instruction reflects the current process.

3.1 Fill the online application

Go through this link: www.number26.de/account-opening directly to the correct page. Click on „open account now“ and start entering your personal data.

Then login to your e-mail inbox and confirm the receipt of the first e-mail by clicking on the according button.

Congratulations! Your e-mail address is now verified.

Now, the verification of the person follows. This is easiest through a video conversation with an employee of ID Now. You can do that with your computer directly in your browser or via the Smartphone app. Just as you like!

It is more convenient for most with the computer, but with the Smartphone, you actually have the possibility of opening a bank account on the road.

Due to the current high rush, one sometimes has to wait some minutes for an available identification staff member. Identifications can be made every day (including Saturday and Sunday) between 8 am – 24 pm (CET Berlin Time).

Video identification is also possible on the weekend!

In the video call, the data of the person is checked. Additionally, you will be asked to hold your ID-document in front of the camera and tilt it a little several times so that the authenticity features are recognizable.

Moreover, a photo of the ID-document and of you is taken.

Who does not want or cannot do it may choose the PostIdent-procedure for legitimating through any German post office. Both methods are free of charge for us customers.

3.2 Documentation of Susanne’s account opening

Thankfully, I was permitted to observe the account opening of Susanne and we have also taken a video, so we can show you here exclusively how your own account opening will look like.

Click with the mouse on the preview image to start the video:

Altogether, the account opening of Susanne took 15 minutes (including waiting time for the identification staff member) … and then the account was opened!

Very easy account opening!

Susanne was visibly surprised how easy it is to open a bank account in Germany through the Internet. Mainly because she was given her new account number immediately after the identification.

The access data for online banking or for the app is set by you during the account opening process.

Account usage is immediately possible!

With the “Moneybeam” feature, one can transfer within second from one Number26-customer to another. If I would have “beamed” money from my account to Susanne’s, then she would have been able to dispose of it immediately …

Her parents will send her new card to the USA and she makes a deposit (bank transfer) from her previous (paid!) bank in Germany.

I dearly wish her joy using the new account and the card of Number26 in the USA … and with a little luck, we will hear again of her user experience on our special portal!

“Start the account opening now”

Q&A: Frequently asked questions

a) What are the requirements for account opening?

Very few:

- You need to be at least 18 years old and have a valid ID-card or passport,

- You need a modern Smartphone (Android-version 4.3 or newer),

- You need an address in Germany or in one of the other already activated EU-countries, so that your MasterCard can be delivered to you,

- You will need about 8 to 15 minutes to complete the whole account opening (including the legitimating, as seen in the video).

Question: What about the minimum deposit or minimum cash flow?

There are no such conditions at Number26. The account and card are unconditionally free of charge! No matter how much money you deposit or transfer monthly.

Number26 is, of course, pleased if you use the card frequently. However, you are not bound to do so. There are many people, who use Number26 as a secondary account, e.g. for journeys.

b) Are there hidden fees?

No! This would not fit the image of Number26 and the huge transparency in the Social Media.

Number26 currently earns money, when you pay with the card (the fee for the transaction that must be paid by the merchant – not by you) and through the account deposits, as there is namely no interest on the current account.

c) Is the withdrawing of cash really free of charge?

Yes! Number26 does not charge you any fees for cash withdrawals. Thus, about 99 % of all ATMs are free of charge for you.

In Germany, there are some savings banks that do no longer adhere to the usual billing practices and charge foreign customers a direct fee. Also in the USA and Thailand, one knows about these direct fees. Number26 has no influence on that.

d) How can I deposit money at Number26?

Number26 has no branch offices. Not in Germany, nor anywhere else in the world. Instead, Number26 has established excellent cooperations, so that one can deposit cash on the account free of charge at more than 6,000 supermarket checkouts in Germany. The best known supermarkets are Real, Rewe and Penny.

The simplest way is of course the bank transfer from another account, which could be e.g. the salary and pension payment. When using it as a secondary or travel account, it is meaningful to make manual transfers or even a standing order from the main current account.

You have an enormous freedom to use Number26 within Germany and abroad, as you do not have to pay attention to the fees! Since 2015, Number26 accompanies me on every USA-trip.

“Start the account opening now”

Further questions about the account opening or use?

Do you have further questions about the account opening from the USA or the account usage? Please use the comments box for your questions. Posting experiences and tips is also welcome, especially if they help other interested parties. Thank you very much!

Frequently read articles about N26:

When and from where did you open your N26-account?

I am personally interested to know, whether other people have opened their accounts at Number26 also for journeys or extended stays abroad … please use the comments box for your feedback. Thank you 🙂

Hey Gregor, how does the “deposit at hotels and car rentals, Number26 has always provided a good service” work?

I mean – let’s say hotel take deposit 200 USD that will be lifted when you check out. Are those money shown in your statement as if you paid it and after a few days they are “refunded” to your account?

I am asking because classic debit and credit cards and bank accounts has “hold section” (or how to call it). So if hotel tak security deposit, some money are on hold and they are released after Check-out. I am wondering how does it work with number26.

Thanks!

That is a very good question! The deposit bookings I’ve only seen in the app as 0.92 €, which is exactly 1 USD. I have encountered such deposits so far solely in the US, at Alamo car rentals and at gas stations.

It seems, the deposit is not shown in full amount. The 0.92 € were payed back to the account the same day or up to 9 days later.

Perhaps you would like to test this yourself and give us your feedback here? Or perhaps other readers have experience in this area? Thanks for the interesting question 🙂

Hi Roman. From a technical point of view when you pay with a card, the hotel will perform an “authorization” transaction on a certain amount of money (let’s call this “transaction A”). This will lock the money for later.

https://en.wikipedia.org/wiki/Authorization_hold

When you check out, two things can happen.

1-The hotel confirms “transaction A” and the previously authorized amount settles.

With numbers it will be like this:

– You have a balance of $1000

– When you book online, the hotel authorizes $200

The balance is still $1000, of which $800 will show as “available funds” ($200 are locked by “transaction A”).

– You check out, the hotel settles the $200 “transaction A”, balance will be $800 and available funds will be $800.

OR

2-The hotel submits another transaction (“transaction B”), which will be authorized and settled immediately. At the same time the hotel may either cancel or leave alone “transaction A”. Whatever the cases, “transaction A” will elapse after a certain amount of time, the “reserved” money will be unlocked and it will become available to you once again for other purchases.

With numbers it will be like this:

– You have a balance of $1000

– When you book online, the hotel authorizes $200

The balance is still $1000, of which $800 will show as “available funds”.

-You check out, the hotel authorizes and settles $200 as “transaction B”.

At this point balance will be $800 ($1000-200 Transaction B), of which $600 will show as “available funds” (because “transaction A” has not elapsed yet).

– Once “transaction A” elapses, balance will be $800 and available funds will be $800.

This is in essence the reason why you should have at least twice the money on the account to pay for the hotel.

The same holds true for prepaid cards.

In a scenario where the hotel authorizes $200 (to cover for minibar fees for instance) and later settles the bill for $150, you will need to wait for the $50 to become available again.

All of this happens regardless of the bank you have the card with.

I forgot: you can also replace “When you book online” with “When you check-in and the hotel clerk asks for your card”.

How can I transfer money from my bank account to Number 26 card, within Europe? Thank you for fast answer.

I prefer TransferWise for international money tranfer. Maybe it is a good solution you, too 🙂

Thank you !

Hey Gregor, I’m brazilian living in Brazil. I have addreesses in Germany and Italy. What do you suggest on it? Thank you

Hi Ric.

Yes, that might work. Please keep in mind that we have currently suspended our recommendation for opening an account at Number26.

Hi! It is still suspended the “recommendation” to open an account at Number26? ist

Yes, that’s correct: Our assessment is still the same … though of course, it’s eventually in your own (everybody’s own) responsibility if you prefer to act or not act on that 🙂

Hello, I am Lithuanian but live in USA. Also I have a friend who live in Germany. Can I use his address to receive N26 MasterCard? Will German mailman deliver mail if name on mail and mailbox don’t match? Thanks.

Hi George,

technically, that should be possible. If you use “Your Name” c/o “Friend’s Name” and the address, that should work.

Later, you should change your actual address online, though.

Hi Gregor!

I’m a Thai citizen living in Thailand, but I have friends in Germany who I can use their addresses for card delivery. Will it be possible to open an account with Number26 in this case? Also, why did I see a few comments up there about your suspension of recommendation to open an account with them? Is there something wrong with them?

Hi Georgie,

currently, we can neither recommend an account opening with Number26 nor make any specific statements about them. You might want to look for an alternative.

Hello,

Is this still valid that you can neither recommend an account opening with Number26 nor make any specific statements about them?

Yes. I don’t recommend this provider.

Hi there, does anyone have any latest experience opening a Number 26 account as a non-EU citizen/resident successfully? My girlfriend is living in Germany and I don’t live in the EU myself but from time to time, I get paid in euros and go to the EU for site projects too. Would I provide her German address being enough for the purpose of opening and maintaining the bank account? Appreciate any response/feedback, many thanks.