DKB ↝ Withdraw money really free of charge?

Starting point for this article was the question by Achim in the internal area of our community:

If I go e.g. with the DKB Visa credit card to the Sparkasse and withdraw € 100 at the ATM, then no further costs arise? It says that withdrawals with the DKB Visa credit card is free, that means that no costs arise at the DKB, but what about the e.g. € 7.50 that are charged by the Sparkasse for a withdrawal by third-party customers?

The video proof (answer + instruction in German language):

Summary for people, who want to know it fast:

-

Withdrawals with the DKB Visa Card is free of charge

To be accurate, one would have to say that the DKB bears the incurring costs and does not forward them to the customer. This applies to Germany and to most of the countries wordwide. However, there are also countries, such as the USA, Canada, Paraguay and Thailand, where a fee is charged by the operators of the ATMs not from the card-issuing bank, but is directly added to the bill of the customers.

These special cases have nothing to do with a potential current account switch in Germany, so please consider the latter as a marginal note.

-

No foreign transaction fee

Also only little crucial for the current account switch in Germany. When withdrawing cash abroad, the DKB waives on charging the otherwise common foreign transaction fee. The direct bank competitor ING gets 1.75 per cent of the withdrawal amount. This is projected to Euros 1,000 a surcharge of Euros 17.50. You save that amount being a DKB customer!

Regarding the cash-friendliness, you can determine the following:

Although being a direct bank, the DKB is a cash bank!

Being a DKB customer, you can supply yourself as often as you want free of charge with cash. There is no maximum amount of monthly withdrawals, as introduced by the competitor N26.

The only condition that you have to fulfill:

Withdrawals are possible between Euros 50 and 1,000.

The reason for the minimum withdrawal amount of Euros 50 is obvious, when you consider the internal costs of the banks. Of course, there is a charge for a third-party customer when withdrawing at a local bank. This service is not provided free of charge, like someone on our Youtube-channel stated.

For withdrawing the money, the ATM-operating bank in Germany charges on average Euros 1.75. In the end, it has to provide the cash, fill the ATM, generally wait and of course, purchase the ATMs.

That means: Every time you withdraw money from the ATM with the DKB Visa Card, there are costs in the amount of Euros 1.75. The DKB bears them for you. They are not forwarded to you. In order to keep enjoying that and not geting limitations like at other direct banks, I appeal to the rationality of our readers to implement the conditions meaningfully.

For example, I do not withdraw less than Euros 100. On average, it is Euros 300.

Moreover, I pay – depending on the occasion and the personal acceptance of leaving a digital payment trace – with the Visa Card.

The DKB earns through the card payment!

This is not much, but as I am very rarely using the overdraft facility, the bank has not many possibilities to obtain the costs for the account management, withdrawing of cash and availability of the customer service.

Development of the fee-notes at the ATMs of the Sparkasse:

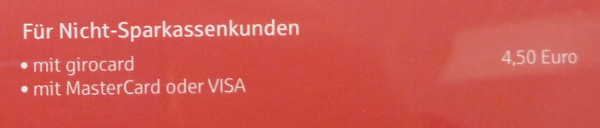

The notes like at the ATMs of my regional Sparkasse were unsettling switch-willing bank customers for years (photo of 2016)

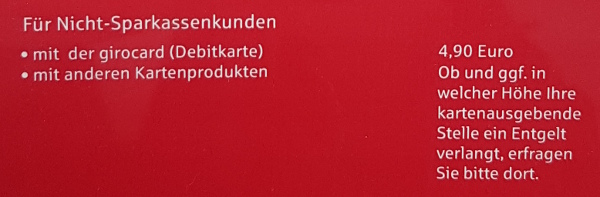

Now it looks a little fairer:

“Please ask your card-issuing company, whether and to which amount you are charged a fee”

The meaningful answer of the DKB is as follows, “We bear all incurring costs automatically. For you, withdrawing at the Sparkasse is free of charge!”

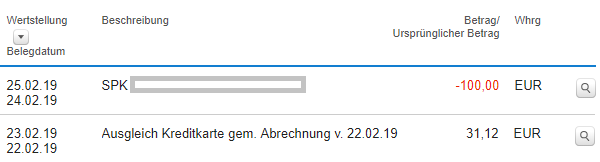

Proof through bank statement (transaction display in the online banking)

You see: No fees were charged for the withdrawal. Only the Euros 100 that I have got in cash from the ATM are debited here. Thank you, DKB!

The money withdrawal was debited, no fees at all. This is how it looks like for me already since the year 2004. Since that time I am a customer of the DKB.

Switch account now to the DKB?

I hope that possible concerns regarding fees for the cash supply are eliminated. If not, then please ask them using the comments feature.

The advantage is that your future ex-bank will still earn money through you, if you have switched the account: every time you come to withdraw cash from the ATM. This could be Euros 7 (4× Euro 1.75) per month and therefore more than perhaps today! Especially because this bank has no more costs from you through account management and customer service!

I recently had the opportunity to have lunch with a department manager of a local bank, who would be even quite happy, if some of his customers would switch to a direct bank (would no longer “burden” his bank office), but nevertheless, there still would be earnings through the ATM use.

Of course, not every one will become a customer at a direct bank, because

- some desire the personal contact at the counter when withdrawing money (a direct bank really cannot offer that)

- not every one gets an account at a direct bank (you need a medium to good creditworthiness).

This means for our old and new readers: You can always apply for a DKB-account and if if works with the account opening, you have many additional advantages!

Who says that you have to cancel the old account (immediately)? Take advantage of both worlds!

Any questions left?

You are welcome to post them through the comments feature at the end of the article. You can also send us your photos of “warning notes” regarding the cash withdrawal at your “home ATM”. A heartly thanks!

Supplementing articles:

- Open DKB bank account with instructions

- DKB: Differences between Visa and Girocard

- DKB Joint Account

Leave a Reply