Germany: Keep your oldest current account, even if it costs fees!

My first checking account was with Mittelbrandenburgische Sparkasse. I no longer have it today because, once I started earning money, it became subject to fees.

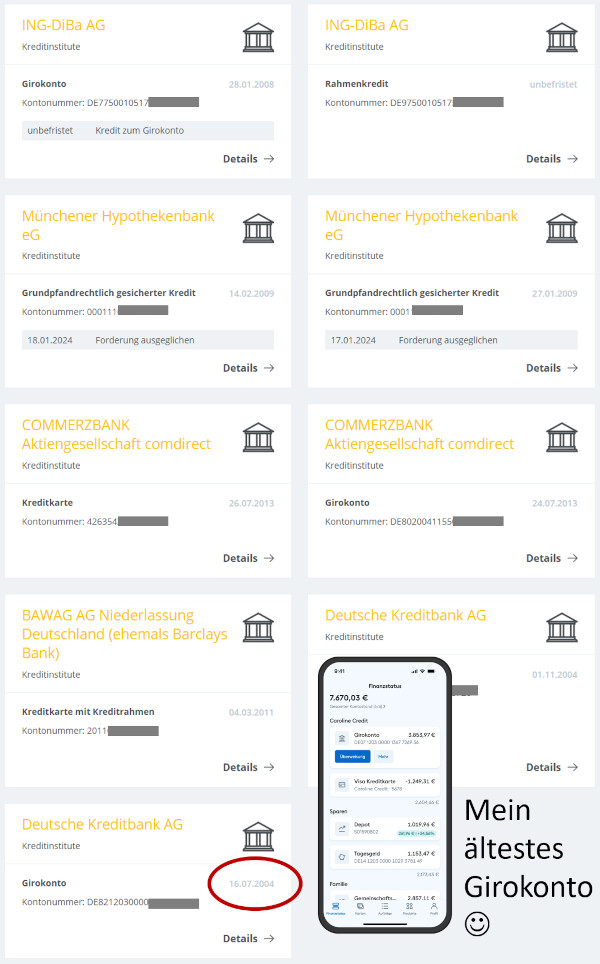

My second checking account is with DKB. Back then, it was absolutely top class! It’s the oldest one I have, opened in 2004. Although there are now many other very good checking accounts, I keep it.

Why?

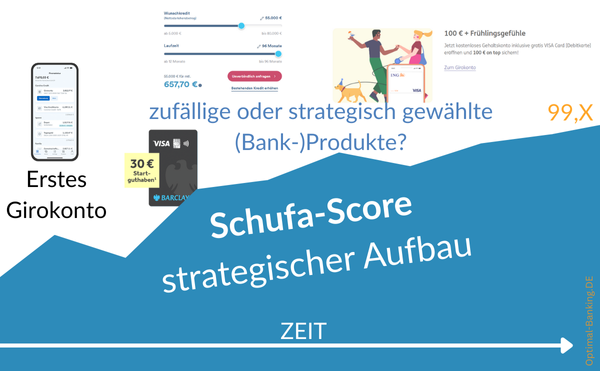

The age of your oldest checking account is an important factor in building or optimizing your own Schufa score.

A cautious approach is recommended

Continuity is an important factor. You should only change checking accounts slowly and carefully.

If your oldest checking account is still with a Sparkasse or Volksbank, keep it for strategic reasons. Even if it costs you money every month!

If necessary, switch to a cheaper account model because you use banking services from other banks more cheaply or for free. But keep the account. Schufa does not show your account model or how many fees you pay.

As a reader of the Sunday mail, you know all the listed and even more banking products I use.

But what you can see is the “credit history”: how long the account has existed, whether and to what extent an overdraft was agreed. The same applies to a credit card. We can discuss overdrafts and credit cards via the comment function. 😊

Screenshots from meineSchufa.de.

If you want to ruin your Schufa score:

Take advantage of every new customer offer for a checking account—be it 6 free months or a soccer ball for the season. Once the privileged period is over, close the account and move on to the next provider.

Soon you’ll be surprised to receive rejection letters from A-class banks when applying to open an online account. No problem, you think, and open new accounts at banks known for subsidized consumer financing. Do this several times, and your “reputation” in the central “file of decency” (= Schufa) is ruined.

Example: Promotional offer for opening a checking account at ING.

Installment loans will only be available to you at significantly higher interest rates, and during a mortgage consultation you’ll be told: Being a tenant has its advantages too. 😉

Yes, long-term customer relationships have been destroyed by advertising slogans like “stinginess is cool” or “I’m not stupid”. Comparison portals have contributed by recommending that you switch electricity, gas, insurance, and financial products every year.

Have we been trained to keep switching?

It’s up to us “smart bank customers” to resist easy temptations and keep an eye on the system, on the bigger picture.

Think about the future

Maybe your current life plan doesn’t include financing one or more properties someday, but it’s a good feeling to be able to do so at any time instead of having to say: Nobody will take me.

In my opinion, it’s important at any age to know your score value and to maintain or strategically build it.

Unfortunately, this isn’t even taught in the most basic way in schools. So the first valuable years go unused.

The first steps to building your score:

-

Know your score

Due to data protection laws, you can find this out for free. Some time ago, we reported on this in this article.

-

Analyze the content

The current score is just a number. But what else does Schufa have on you? Incorrect information—which does happen—should be updated or deleted.

-

Optimize your stored data

If you have too many bank connections in Schufa, you could carefully reduce the less favorable providers. If you have too few reportable banking products registered, consider building strategically. This could be a second checking account, an overdraft, a credit card, or a line of credit.

Again: Step by step is better than making several changes at once without thinking them through.

-

Increase your credit lines

If you’ve been at it for a while and have your strategic banking products, consider increasing your credit lines!

-

Monitor your Schufa file

I’ve been doing this for many years with my own paid access to Schufa. This gives me the security to spot negative changes early and react.

3 questions for discussion via comments:

- What is your current Schufa score?

- Which providers or products are listed in your Schufa?

- Is there anything missing or incorrect in your Schufa?

Further articles you should know:

- Proof: Credit improves Schufa

- Open a Schufa-free current account …?

- Comparison: Wise vs Revolut Account

Leave a Reply