Apply a 2nd Visa card at the DKB

A Visa credit card is a basic feature when applying and opening the free current account DKB Cash.

If you want to take advantage of all the outstanding product details of the bank, then it is useful to work with two Visa credit cards. Why this is useful and how you can get a second DKB Visa Card, you will learn on this page.

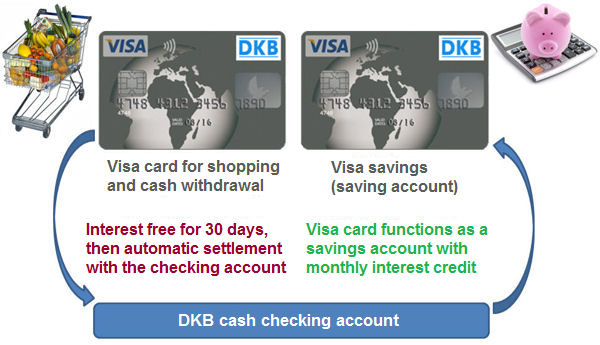

DKB Visa Card offers two opposing options:

- Savings Account with a monthly interest payment at the current interest rate

- Billing Account for credit card transactions and cash withdrawals (interest-free lending credit up to one month)

Problem:

If you have credit on your Visa credit card, then it reduces at the time of the usage of the credit card. So you do not get interest for the consumed credit.

However, if you do not have credit on the credit card, then you get an interest-free lending credit at the DKB until the next billing – which is one month at most. The DKB never charges debit interest on the credit card.

Solution:

Use two Visa credit cards of the DKB – one for paying cashless and for withdrawing cash, the other one as a current account – as the following illustration shows:

… with 2 Visa credit cards, you can use/take advantage of the excellent conditions at the DKB!

Applying for the 2nd Visa Credit Card

The application is quick and easy for already existing and used bank accounts. If you are not yet a customer of the DKB, you should use this link www.dkb.de and apply for the bank account DKB Cash.

After some months, you can visit our special portal again and follow the instructions on how to apply successfully for a second Visa credit card.

You have to understand that the bank has to pay fees, even if the Visa credit cards and the worldwide cash withdrawals are free of charge for you. Therefore, the chances to obtain a second Visa credit card are best, if the bank can see that you really also use the first one. Does it make sense now?

Application Process in 4 Steps

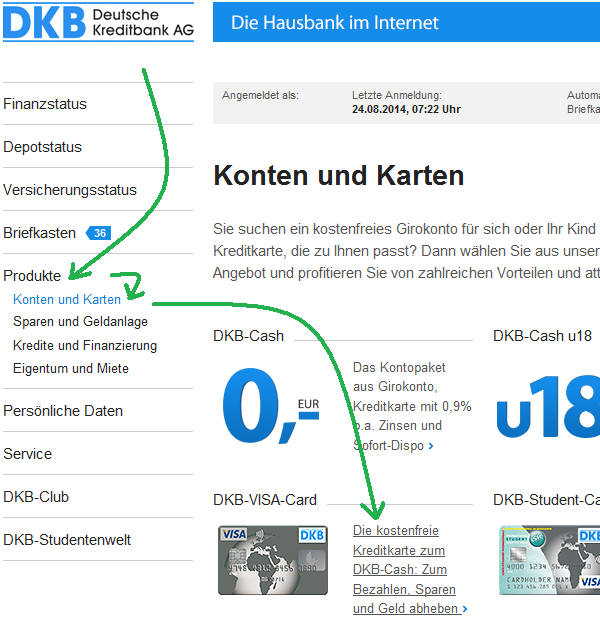

1. Login as a customer on dkb.de

Log into the online-banking of the DKB and click on the left navigation bar on „Produkte“, then the submenu „Konten und Karten“ will open. Clicking on it, a new page will load. Now click on the describing text next to the DKB Visa credit card, just like the arrows indicate in the illustration.

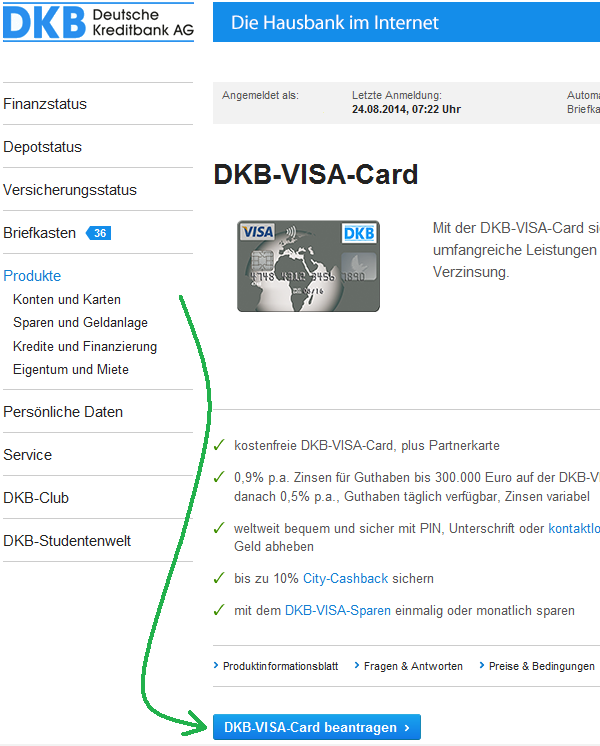

2. Go to „DKB-VISA-Card beantragen“

Overview page that shows the general benefits and conditions of the DKB Visa Card. Click on the button „DKB-VISA-Card beantragen“.

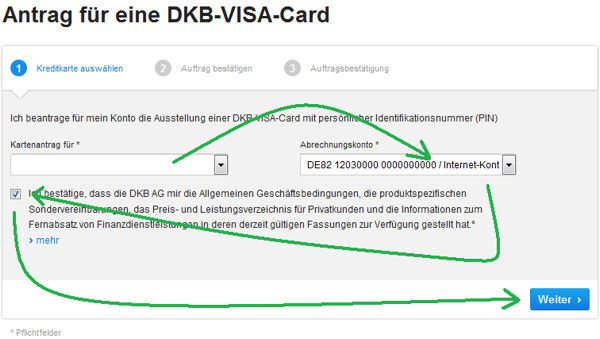

3. Assigning Account Holder and Account

On this page you select the person for whom you request the second Visa credit card. If you are not the holder of a joint account, then this will always be your name and your current account. At joint accounts, you will find a selection in the menu.

Click on the check mark to be able to advance to the next page and click on „Weiter“.

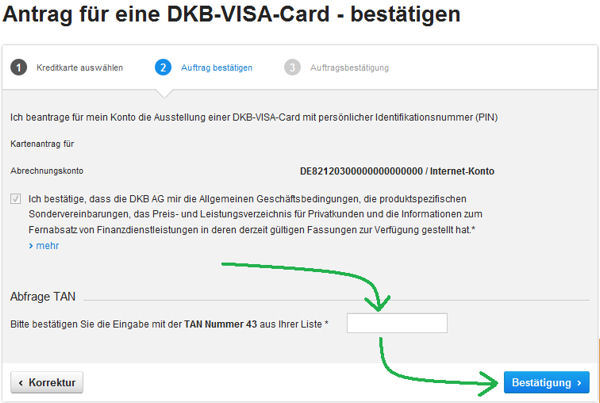

4. Confirmation with TAN

Confirm your application request by entering a TAN.

What now?

Within a few days, the DKB will make a decision on issuing a second DKB Visa Card. As the DKB knows about this smart strategy too that more and more customers take advantage through a second Visa Card, the probability is very high that your new Visa credit card will be approved and issued.

Finally, it is also in the interest of the bank that its customers are satisfied and use the DKB increasingly as their main bank. One feature of a main bank is that the customers use more than one product, so e.g. a Savings Account and Credit Card.

It can take up to two weeks until you receive the credit card, as it has to be manufactured individually.

Individual Credit Limit of the Credit Cards

Usually, the second Visa credit card is provided with an additional, but small credit limit, e.g. 100 or 500 Euros. The credit limits can be distributed by you individually on all existing credit cards.

Therefore, if you do not want to use your additional Visa credit card as a savings account, but as a credit card abroad or as a separate payment card for the Internet usage (as the fraud risk is higher on the Internet), you can customize the credit limits based on your requirements.

Example:

- 2.000 Euros for Visa Card 1 (everyday use within Germany)

- 1.000 Euros for Visa Card 2 (usage when traveling abroad or on the Internet)

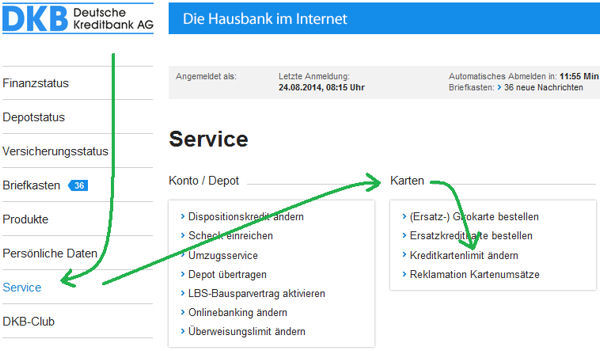

How to Change the Credit Card Limits (Credit Limit)

You can find the online application for changing the credit card limits on the left navigation bar under the menu item „Service“, „Karten“ and then „Kreditkartenlimit ändern“. Alternatively, you can send a message to the customer support. From my experience, it can be useful to change the credit limit of two credit cards at the same time in order to prevent any misunderstandings.

This is how you can increase or lower the credit limit …

If the possibilities at the DKB please you and you are not a customer yet, then follow our recommendation and apply now for this great account with Visa credit card at the DKB: www.dkb.de.

Therefore, the usage of two Visa credit cards at the DKB is really meaningful in order to take advantage of all the benefits!

Further helpful sites for the best DKB-usage:

Images: Eisenhans & Jakub Krechowicz (beide fotolia.com)

Hi,

I´ve just opened my DKB account.

I pretend to use this account for daily use and also for savings.

As you advise, I´ll now use for some months the first VISA card and then request the second one.

Although, I would like you to clarify me how the monthly interest credit is calculated? For example if I´ve 10000€ in this VISA card (dedicated for savings), what would be the interest after the first month?

Thanks,

Joao

Hi,

the current interest rate is 0,6% and will be changed to 0,4% starting Oct 1.

Just for clarification, depending which way of writing you are used to: in the anglo-american writing style it would be 0.6% resp. 0.4%

Thank you for your feedback.

That means:

– Deposit of 10000€ in the Visa card (saving account)

– Considering a rate of 0,4%;

– I will be credit with 40€ after the first month.

Is this correct?

The interest rate is per annum. So 0.4% is €40 per annum on €10k. Not per month as the previous post asked to clarify. Monthly, it would be €3.33.