Withdraw money in Canada

As you know from our last Sunday mail, we were on a research trip to Canada. In order to make things easier for you on your next trip, I share our experiences regarding withdrawals in this article with you.

I know that some of our regular readers have already been in Canada … so I would be happy to read your numerous comments and additions.

1. My cards for withdrawing money

I went to Canada with these credit cards.

On the trip to Canada, I took all three cards from our article, “The 3 best checking accounts of Germany”.

I used the DKB Visa Card and the Comdirect Visa Card, where the Comdirect as well as the DKB once had the better conversion rate. From my years of experience, I know that this often alternates and therefore does not really matter.

I have not used the Visa Card of the ING-DiBa, because it is my backup account that I have equipped with a huge overdraft facility in the event that the first two accounts are simultaneously not available.

No foreign transaction fee at cash withdrawals (DKB/Comdirect)

Additionally, the ING-DiBa charges a foreign transaction fee of 1.75 per cent of the withdrawal amount. The DKB and Comdirect do not charge this fee for cash withdrawals, which is why those two cards are much cheaper.

This point should be highly interesting for our readers, who are customers at the Volksbanken, Raiffeisenbanken (cooperative banks) and Sparkassen (savings banks). These regularly charge an additional withdrawal fee (our banks do not do this) and the foreign transaction fee. Therefore, two fees!

2. Where can I withdraw money free of charge?

Canada is a country similar to the USA, where the “direct customer fee” at cash withdrawals has become common. That means that the ATM will charge you, for example, $3 for the withdrawal.

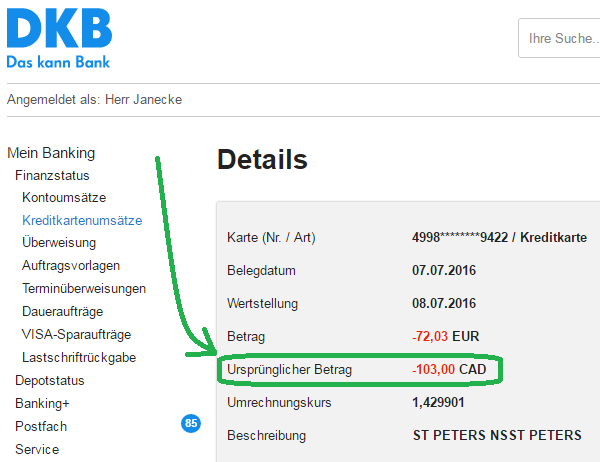

On the credit card statement, you will find then $103 instead of $100, which were actually given by the ATM.

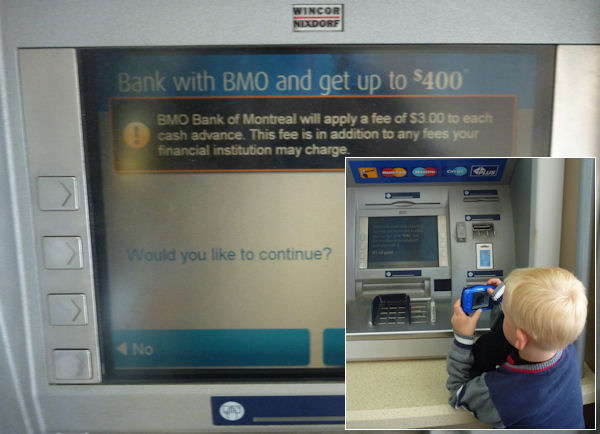

But do not worry: Each ATM shows this on the menu and you can still cancel the withdrawal process, if you do not want to pay this withdrawal fee. This is fair and transparent.

If you see a fee notice, “ATM fee”, you can still cancel the withdrawal and look for another (fee-free) ATM.

Pay attention to the “direct customer fee” (ATM fee)

Let’s suppose that you would have overlooked the note and would have withdrawn the exemplary $100, then your detailed credit card statement at the DKB would look like this.

2.1 Which ATMs do not charge the ATM fee?

In order to find out, which banks charge such a fee and which not, I visited many banks, where I talked to the people and have tested the withdrawal myself – usually only up to the fee note.

The self-testing is an advantage, because not all the information is always correct. This is not a Canadian peculiarity. I have experienced this already in the USA and, of course, at banks in Germany.

For example, I was told at the Bank of Montreal (BMO) that withdrawing with the Visa Card was not possible. In fact, there was no Visa Card logo on the ATM. However, the DKB Visa Card was read without difficulty and I was given the possibility to withdraw money. However, I quit the process at the fee note, as it was our goal to find ATMs, where you can withdraw cash free of charge.

Our little assistant took a photo of the ATM of the Bank of Montreal without the Visa logo. A withdrawal of up to Dollars 400 plus a fee of Dollars 3 was, however, offered by the ATM.

2.2 The result of my research can be found in this table:

| Bank | ATM-Fee | Maximum withdrawal amount |

|---|---|---|

| Scotiabank | Free of charge | Dollars 1.000 |

| TD Canada Trust | Free of charge | Dollars 300 |

| ATM at the gas station | Subject to charge (currently $1,75) |

Not specified |

| DC Bank (in the hotel) | Subject to charge (currently $2,50) |

Not specified |

| Bank of Montreal | Subject to charge (currently $3,00) |

Dollars 400 |

| Royal Bank of Canada | Subject to charge (currently $3,00) |

Dollars 200 |

|

In the column on the right side, you can sometimes read “not specified”, because I realized that such information would be interesting, only when I opened my own bank account in Canada and had to make a minimum deposit of $2,000 in order to get the free account management. For people, who regularly travel to Canada or plan to visit in the future, it might actually make sense to open an account in this country. You can read how that worked with me in this article on our sister web-portal: account opening in Canada (article in German). |

||

2.3 Recommendation: Withdraw money through the Scotiabank

To withdraw cash in Canada, I recommend the ATMs of the Scotiabank, because they

- are free of charge

Thus, the cash withdrawal for our readers with DKB or Comdirect Visa Card is completely free, as both banks waive on an own withdrawal fee in Canada and do not charge a foreign transaction fee at cash withdrawals! - permit the highest withdrawal amount with $1,000

This is especially interesting for people, who need more cash and therefore, do not want to drive from one ATM to another, especially due to the fact that the number of fee-free ATMs is limited (see table above).

2.4 Alternative?

If you need less cash at once, then the free withdrawals at ATMs of the TD Canada Trust are also a possibility. One should only use the other banks in an emergency. This was the case, when I had to pay a medical bill in cash in a small town. In this town, there was only one branch office of the Royal Bank of Canada. In this case, I was happy to pay the $3 fee (see photo above).

The Royal Bank of Canada has the largest net of branch offices across the country and has a branch in almost every significant town. 😉

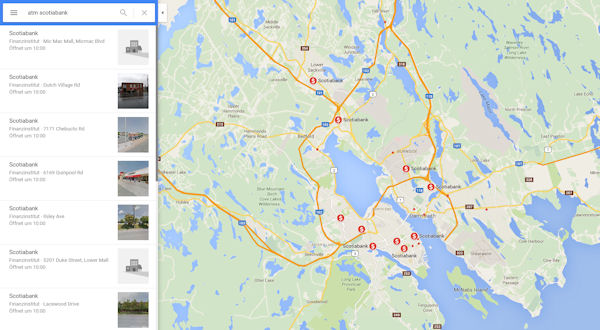

If you want to withdraw free of charge, browse at best maps.google.de and enter “ATM Scotiabank” or “Scotiabank branch” and all nearby possibilities will be displayed.

ATM search through Google. Simply enter the ATM + bank name and scroll on the map.

3. Particularities at withdrawing cash

It is worth mentioning that ATMs in Canada basically only pay $20 notes. This is, of course, efficient for the banks, because they only need to supply the ATMs with one cash box.

However, this also means for you that you will carry around a thick money pouch, if you withdraw $1,000, as you can see here in the video:

It is worth mentioning that ATMs in Canada basically only pay $20 notes. This is, of course, efficient for the banks, because they only need to supply the ATMs with one cash box.

However, this also means for you that you will carry around a thick money pouch, if you withdraw $1,000, as you can see here in the video:

Do you already know our YouTube channel, on which you can find further videos?

The largest bill in Canada is the Dollars 100 bill. The smallest denomination is Dollars 5.

ATMs of the Royal Bank of Canada may partly also pay CAD 50 bills. However, due to the fees and the low withdrawal amount, this is not meaningful for us.

You can also enter the branch office of the ATM and kindly ask for an exchange into larger bills. The withdrawal with the credit card at the counter is not recommended, because this is no longer free of charge at our German banks!

The branch office density is noticeably well in Canada despite the long distances. One cannot always pay with cash, credit card or check (Canadian Check) with equal acceptance, but at most “points of sale”.

Cash payments are often meaningful!

So it is up to you which way of payment you choose. Currently, it is often meaningful to withdraw cash, because most German credit cards charge a foreign transaction fee for card payments in Canada.

Here you can find our overview of cards without foreign transaction fee.

According to the responses to our latest blogpost in German language, I am very confident that the DKB will abolish their foreign transaction fee this year.

4. In conclusion

… I would like to encourage you – also if you prefer to pay with card – to withdraw cash at least once in Canada, because the bills are different from our Euro bills in interesting ways.

They are composed differently (difficult to describe, but somehow smoother to slippery). Moreover, they have integrated these tactile dots of Braille and are transparent to about one-eighth!

I personally like these notes of the Bank of Canada very well!

At spot 1. you can feel the Braille and at the spots 2a. and 2b. the bills are transparent.

Questions and additions?

The comments box at the end of the article is activated for your questions and your additions, tips, and updates are also welcome. I look forward to your commitment, thank you!

Thank you very much for this great guide. Unfortunatlly, Ing-Diba is not planning to demolish the 1,75%. Otherwise, it would have been a real competitor for DKB specially that it has more than 7 millions clients.

Thank you for your feedback 🙂 Yes, that is right. I spoke with ING-DiBa for some days, they have no plans to delete this foreign transaction fee. Sadly!

Thanks for the helpful guide! I will certainly look for the Scotiabank ATMs thanks to you! 🙂

Hi Gregor, thanks for good information. I am currently living in Vancouver, Canada. TD Trust charges 3 CAD ATM fee when one used DKB. Therefore, only Scotiabank doesn’t charge any fee to DKB.

Additionally, HSBC charged only 2CAD ATM fee. Could you tell me your comparison between DKB and Comdirect, which one has a better rate?

Depends on your experience, when I go back to Germany next year, I would consider to apply Comdirect Visa card.

Thanks.

Exchange rates tend to constantly fluctuate ;-), sometimes one bank is ahead, sometimes the other. Both banks are great.

Just went to TD Canada Trust, they charge $3 for ATM fee. However, if you have TD Bank USA it seems the fee is waived

Yes, that’s right. Thank you!